SoundHound AI (SOUN) has been a major talking point in 2025 thanks to its cutting-edge voice recognition and conversational AI technology. Despite this, SOUN stock is still down about 40% year-to-date, reflecting the volatility that often comes with early-stage AI innovators. Even so, there are several compelling reasons investors may want to keep this stock on their radar. Here are three key factors that could position SoundHound AI as a long-term winner.

TipRanks Black Friday Sale

1. Strong Revenue Growth Ahead

In Q3 2025, SoundHound reported revenue of $42 million, up 68% year-over-year, driven by strong enterprise adoption and new customer wins across automotive, healthcare, financial services, and consumer sectors. The result also beat analyst expectations of $40.5 million.

The company also raised its full-year guidance to $165–$180 million, up from $160–$178 million. While SoundHound has not yet turned profitable, its strong revenue growth and upwardly revised guidance indicate significant long-term potential. The revision reflects growing interest in SoundHound’s products and an expanding lineup of solutions.

2. Wall Street Support

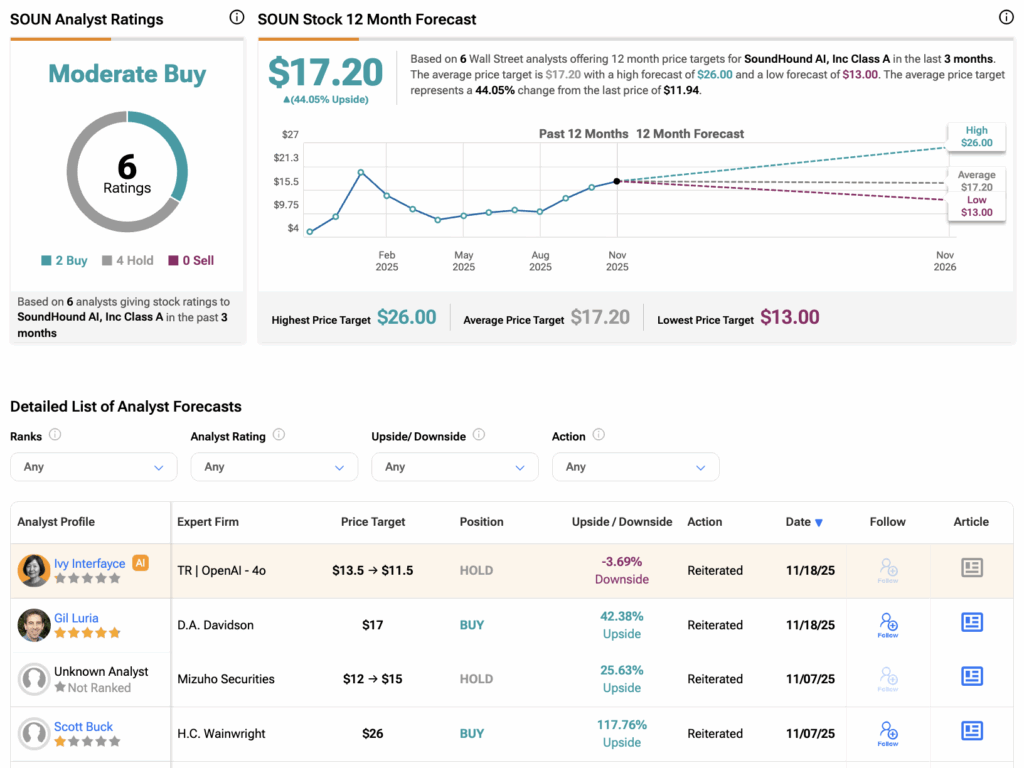

Wall Street analysts’ moderately positive outlook on SOUN provides another reason for investors to be optimistic about the stock.

H.C. Wainwright’s analyst Scott Buck has the highest price target for SOUN at $26, implying an upside of over 120% from the current level. Buck believes the company is moving toward profitability, with improving margins and a clear path to positive EBITDA. He expects that as more industries adopt SoundHound’s voice AI technology, the company will scale operations, boost revenue, and steadily approach profitability.

Meanwhile, five-star analyst Gil Luria of D.A. Davidson remains bullish on SoundHound, highlighting the company’s large addressable market and consistent execution of its growth strategy. Luria acknowledged that big tech remains competitive but noted that SoundHound stands out thanks to stronger platform performance and higher benchmarks.

3. The Power of Data

Another reason to bet on SOUN stock is the company’s data power. One of the company’s most valuable assets is its data. With over 1 billion voice queries processed each month, SoundHound keeps improving its Polaris AI model. Earlier this year, management noted that its voice recognition slightly outperformed competitors’ models.

In the AI world, data is key. With two decades of real-world user interactions, SoundHound could be reaching a turning point. This strong data foundation may drive long-term growth, making SOUN stock an attractive play for long-term investors.

What Is the Price Target for SOUN?

According to TipRanks, SOUN stock has received a Moderate Buy consensus rating, with two Buys and four Holds assigned in the last three months. The average SoundHound stock price target is $17.20, suggesting a potential upside of 44% from the current level.