Today we’ll hear from top investor, Jed Ellerbroek from Argent Capital, about what he sees as 10 must-own stock names tied to the AI revolution to be position for the future.

Even after huge gains in AI stocks, productivity gains from advanced chips and AI tools could drive another phase of growth in 2026.

That’s the view of veteran investor Jed Ellerbroek of Argent Capital.

Ellerbroek sees the AI boom not just as a tech story, but as a productivity story. U.S. companies spend roughly US$15 trillion a year on salaries versus about US$1 trillion on semiconductors.

As AI automates workflows, more of that economic output could shift toward machines and software. The result: strong growth opportunities for the companies powering this transformation.

His approach looks beyond any single layer. While semiconductors are central, he’s bullish across the AI stack. That includes chips that drive computing, the cloud platforms that scale workloads, software that automates processes, and the data centers that host it all. In our latest Ticker Take video on YouTube, Ellerbroek highlighted 10 names he considers “enduring businesses” positioned to benefit from AI’s next phase.

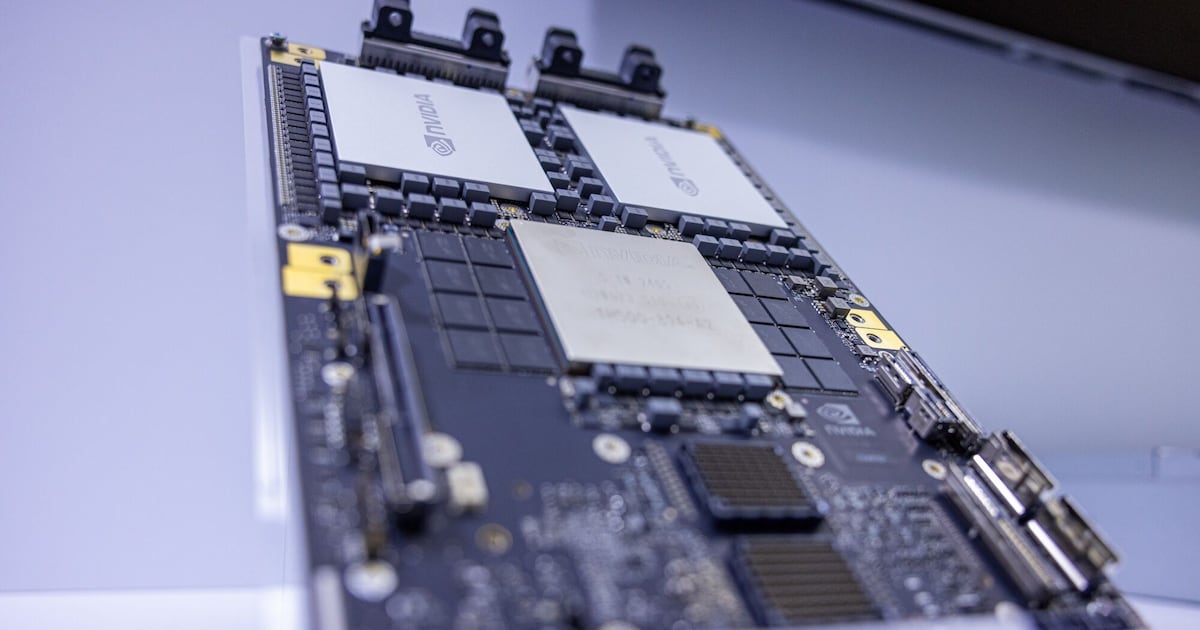

Nvidia (NVDA)

The face of AI computing, with GPU demand still outpacing supply.

Applied Materials (AMAT)

Makes the machines that produce advanced chips, with strong long-term growth.

Broadcom (AVGO)

Chips, networking tech, and software that support cloud and AI infrastructure.

Amazon (AMZN)

AWS is one of the world’s biggest chip buyers, scaling AI workloads globally.

Alphabet (GOOG)

Generates strong cash flow across search, YouTube, and cloud, enhanced by AI features.

Microsoft (MSFT)

Enterprise AI leader with broad adoption and strong analyst support.

Meta (META)

AI investments and a strong ad platform position it for long-term growth.

ServiceNow (NOW)

Workflow automation software that helps businesses leverage AI for productivity.

Tyler Technologies (TYL)

Public sector software with steady growth as government systems modernize.

Apollo Global Management (APO)

Investment firm with exposure to multiple industries, including data centers supporting AI infrastructure.

The ticker take?

Investors have debated whether AI stocks have run too far, too fast. Jed Ellerbroek offers a different perspective: the AI boom is still in its early stages. Productivity gains from chips, cloud platforms, software, and data infrastructure could continue to drive growth. The companies enabling this transformation are positioned to play a defining role in the years ahead.

Jon Erlichman is a BNN Bloomberg contributor and the host of Ticker Take on YouTube.