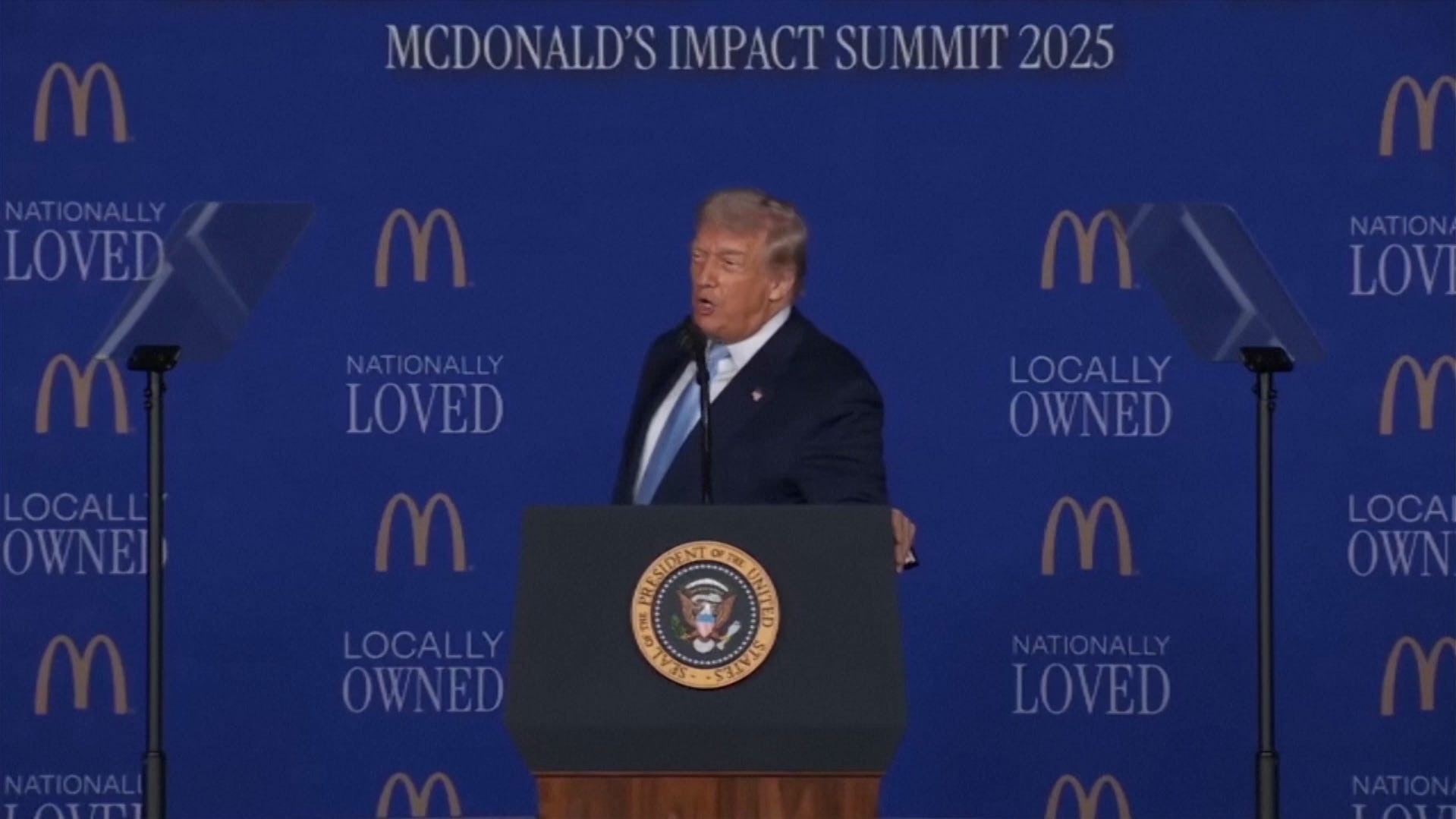

Trump speaks about affordability at McDonald’s forum

President Trump joked that he was the “first former McDonald’s fry cook” to become president.

Inflation eased its grip on the American consumer in November, with prices rising 2.7% from a year earlier, the Labor Department said in a Dec. 18 report.

The annual inflation rate had crept as high as 3% in September. The slightly lower rate for November reflected smaller price increases for gasoline and new vehicles, among other items.

Core inflation, which excludes volatile food and energy items and is watched closely by the Federal Reserve, came in at 2.6% in November – the lowest rate since 2021.

Many forecasters had projected the upward march of inflation would continue, under pressure from President Donald Trump‘s campaign of import tariffs. One consensus forecast put the overall inflation rate for November at 3.1%, nearly half a point higher than the reported figure.

“The market can hardly believe their eyes,” said Chris Rupkey, chief economist at FWDBONDS. “Where is the tariff inflation?”

Stocks rose at the opening bell on Dec. 18 in response to the unexpectedly rosy inflation report.

Just as interesting, perhaps, was what the Bureau of Labor Statistics did not say: What happened to consumer prices in October.

There will be no inflation report for October, owing to the nation’s longest-ever government shutdown, leaving a permanent one-month gap in the historical record.

Some analysts questioned the accuracy of the November inflation data. The shutdown began on Oct. 1 and ended on Nov. 12. That gap, coupled with the late-November Thanksgiving holiday, left the government limited time to collect data on prices.

“It’s just one month of data, and distortions can’t be ruled out,” said Seema Shah, chief global strategist at Principal Asset Management.

That data lapse also means the Labor Department could not report any month-to-month changes in consumer prices for November. In a normal month, economists count on monthly price fluctuations to provide signals on the direction of the economy.

Here’s what we do know: Inflation had crept steadily up in the months since President Donald Trump launched a slate of aggressive import tariffs, which raised consumer prices through the summer and fall.

The annual inflation rate stood at 2.3% in April, its lowest ebb since early 2021. The index rose to 3% in September, its highest mark since January.

Tariffs have fed inflation in 2025

The difference, economists say, is tariffs. Import taxes have added roughly 0.7 percentage points to the inflation rate in 2025 through September, according to a November paper published by the National Bureau of Economic Research.

Retailers have passed along some tariff costs to their customers, pushing up prices in some categories even as price increases in other areas, such as rent and gas, have cooled.

How will inflation affect interest rates?

A downward inflation trend would ease the job of the Federal Reserve, whose leaders must decide whether to continue lowering interest rates at their next meeting, in January 2026.

The Fed typically raises interest rates to tamp down inflation, and lowers them to stimulate the job market. In recent months, both metrics seemed headed in the wrong direction.

The November inflation report “is welcome news for both consumers and the Federal Reserve, which have been grappling with renewed inflation pressures since inflation picked back up this summer,” said Stephen Kates, a financial analyst at Bankrate.

The latest jobs report showed that unemployment rose to 4.6% in November, the highest rate since September 2021.

The Fed’s inflation target is an annual rate of 2%, sufficiently low that consumers don’t really notice it. The Consumer Price Index was approaching that 2% goal when Trump unveiled his tariffs, whereupon the index surged higher.

“Bringing inflation back to the Federal Reserve’s 2% target remains a long process, one that the Fed now projects may not be achieved until as late as 2028,” Kates said.

A 3% inflation rate is problematic, economists say, but it falls far short of an inflation crisis. It’s more of a “frustration” to American consumers, said Bill Adams, chief economist of Comerica Bank. “You see deep unhappiness over it.”

Many recent projections have suggested the inflation rate will remain in the 3% range through the early months of 2026. Jerome Powell, the Fed chair, said in a Dec. 10 press conference that he expects tariffs to add another “couple tenths” to the inflation rate next year.

Other observers are more optimistic.

“The tariff bump is over, and the trend of lower prices is back on track,” said Jamie Cox, managing partner for Harris Financial Group. “Consumers will see the benefits of lower prices right around the corner in 2026.”

(This story was updated to add new information.)