This year, while we’re all together, I’m thinking of bringing it up – maybe selfishly – but as a conversation to make sure their plans work for them… and us

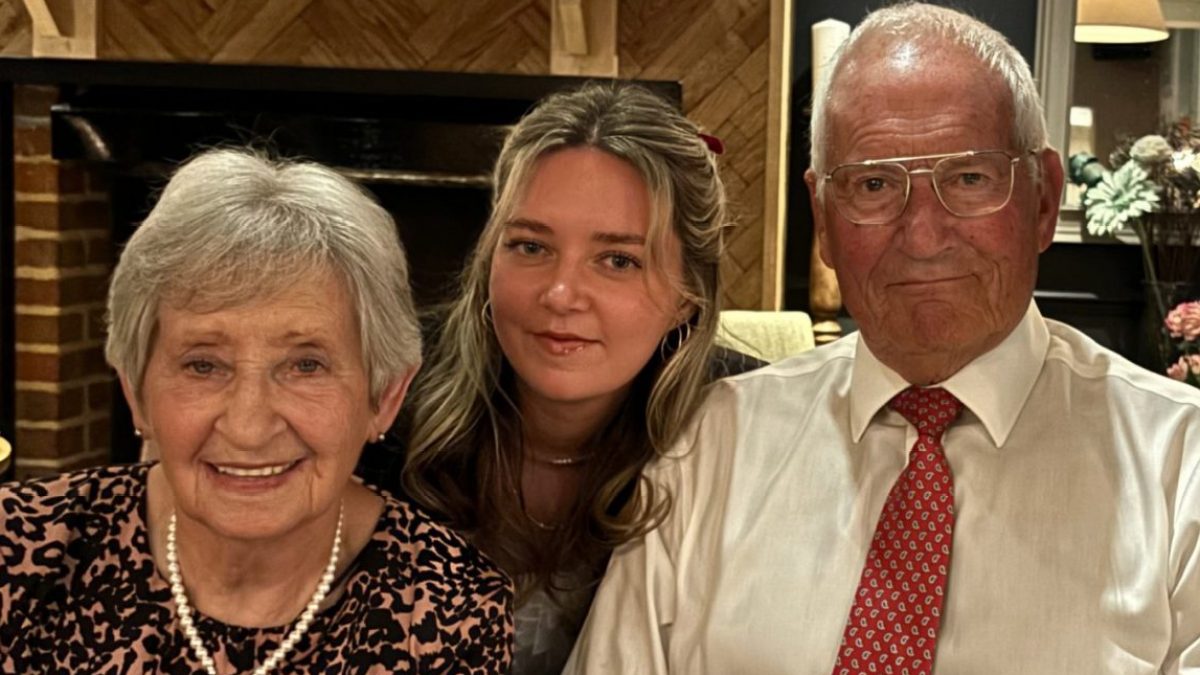

Christmas is almost here, and I can already picture my grandparents’ house, where we have celebrated pretty much every year since I was born.

There’ll be roast potatoes spilling on to the floor with the dogs rushing to hoover them up, freshly baked mince pies disappearing before anyone can claim them and my grandad in his usual chair, quietly supervising everything and pretending he isn’t counting the seconds until he can get back to his crossword.

My parents and my uncle will be bustling around, my brother making terrible jokes that somehow make everyone laugh, and I will be somewhere in between enjoying it all – but this year I will also quietly be thinking about money.

New FeatureIn ShortQuick Stories. Same trusted journalism.

In 2025, our family suffered much loss and hardship, something that has served as a reminder that, as difficult as it can be, we should start planning for the future, including deciding what to do with our finances.

Grandad has always dealt with the money side of things, but he doesn’t know everything.

He has a generous defined benefit (DB) pension, so my grandparents are doing okay, but as they get older – and after the year our family has had – it feels urgent that we, or at least they, start thinking about how the coming years pan out.

Since I started this job, he has started asking me questions now and again about pensions – mainly – always gently, as if testing the waters.

He once asked how to apply for pension credit, even though he clearly does not qualify. Another time he asked whether the amount he gets from his pension each year is a lot compared to others.

I answer carefully because my professional knowledge is not just information but a kind of power, the sort of power that makes you think about legacies and planning and, unavoidably, inheritance.

This year, I have been thinking that Christmas, with everyone together at my grandparents’, might be the right moment to bring some of these conversations up.

It does feel bold, maybe even wrong. I was brought up to never discuss “money, religion or politics”, with my mum particularly hot on this. Especially at the table. And especially on Christmas Day.

In a family born Catholic, where tradition still lingers even though we no longer go to church, nothing controversial is allowed on this sacred day.

The rules are simple – we laugh together, we eat the delicious meal Gran prepares, we exchange presents, we enjoy ourselves and leave anything potentially divisive until tomorrow or next week or never.

And yet I keep coming back to it. Everyone is older now. We have had a hard year, and losses that just remind me that none of us are getting younger.

Sitting around that table feels like a rare opportunity, a moment when we are all together, to talk honestly and make sure nothing slips through the cracks.

I know my grandparents have money to give, and I know my grandad buys a paper every morning, so he has probably seen stories about Britain’s most-hated tax, maybe even one of my own pieces.

But I also know that some things can be easy to miss, like the seven-year rule. This is the one that says if you give gifts or money to someone and survive for seven years after, it will not count towards inheritance tax (IHT).

It seems simple enough in theory, but timing it correctly can make a big difference, and knowing when and how to plan is not always obvious.

Changing rules also mean that unspent pensions – which at the moment can usually be inherited completely tax-free if someone dies before age 75 – will fall under the IHT net as of April 2027, meaning people need to be even more mindful of their estate.

So, this Christmas, while we are all together, I am thinking I might gently bring it up. Not in a way that feels transactional or stressful, but as a conversation about making sure nothing is left to chance, that their plans work for them and for us.

I will answer questions when they come up, I will make suggestions if it seems appropriate, and I will try to read the room (I can imagine my parents will try and shut me down pretty quickly).

I want them to feel supported and informed, not under pressure, and I want to respect the rules of the day while also making the most of a rare chance to discuss something important.

And I know my grandparents – and everyone else who will be benefiting from their cash one day – will appreciate my intervention.

It’s a strange place to be in. On one hand, I am a money reporter, writing about these things all the time, analytically and without emotion.

On the other hand, this is family, and love complicates everything. Talking about IHT and the seven-year rule feels like ambition and betrayal rolled into one.

The roast, the mince pies, the small golden rules of family life – all of that still matters.

But I also cannot stop thinking that this Christmas might be the moment to start a conversation that will matter for years to come.