Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

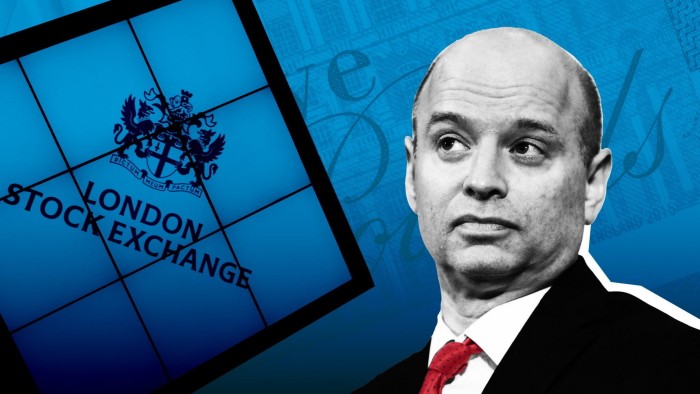

Forcing UK pension funds to invest in British stocks is “unnecessary” and tax breaks should instead be used to encourage domestic investment in public markets, the London Stock Exchange Group’s chief executive has said.

The UK is struggling to attract companies to its main stock market, with fundraising from new listings falling to a 30-year low. It is also grappling with a string of businesses seeking to float or move their listings to the US, leading the government, regulators and investors to fret about the City of London’s attractiveness.

Westminster is seeking to reform pension rules to encourage large pools of capital to invest in domestic equities. Rachel Reeves, the UK chancellor, has sought to force pension funds to invest in UK companies, a move seen as highly contentious by investors.

“We are not pushing for mandation,” LSEG chief David Schwimmer said as the group reported its earnings on Thursday. “It’s very important to take a look at the fact that the pension funds get about £49bn a year in tax incentives,” he added.

Making those tax benefits conditional on pension funds putting a minimum percentage of their assets into UK investments “would seem to be very, very reasonable”, Schwimmer said.

LSEG makes most of its revenues from its data and analytics business, which involves selling access to financial data to customers, including banks, brokers and asset managers. It grew into a financial data giant following its $27bn purchase of data group Refinitiv in 2019.

Despite this, the London Stock Exchange remains at the heart of the City and is a barometer for the health of the UK’s capital markets.

“We work both with potential listings and also we work very closely with the companies that are already listed here in terms of different events, different services that we provide to them,” Schwimmer said, defending LSEG’s commitment to initial public offerings. “The London market has had a number of very positive, healthy reforms over the last few years,” he said, adding that multiple companies were lining up to float in London soon.

Business bank Shawbrook is planning to list in the UK, while insurer CFC is also weighing an IPO, the Financial Times has previously reported.

This week, Wise shareholders voted to shift the fintech’s primary listing from London to New York, becoming the latest company to do so.

Revenues at LSEG rose 7.8 per cent to £4.49bn in the first six months of the year, exceeding analysts’ expectations. The company made just £205mn from its equities division over the same period, or 4.6 per cent of its overall revenues.

LSEG also announced a £1bn share buyback on Thursday. Its shares fell about 4 per cent in morning trading.