Canadian households saw their wages grow faster than inflation, but those gains failed to keep up with essentials. That was the take from RBC in its 2026 outlook, noting the cost of food and housing continues to outpace incomes. The bank sees inflation pressures moderating further this year, but warns affordability pressures aren’t going away anytime soon.

Canadian Wages Outpace Inflation, But Fell Behind Essentials

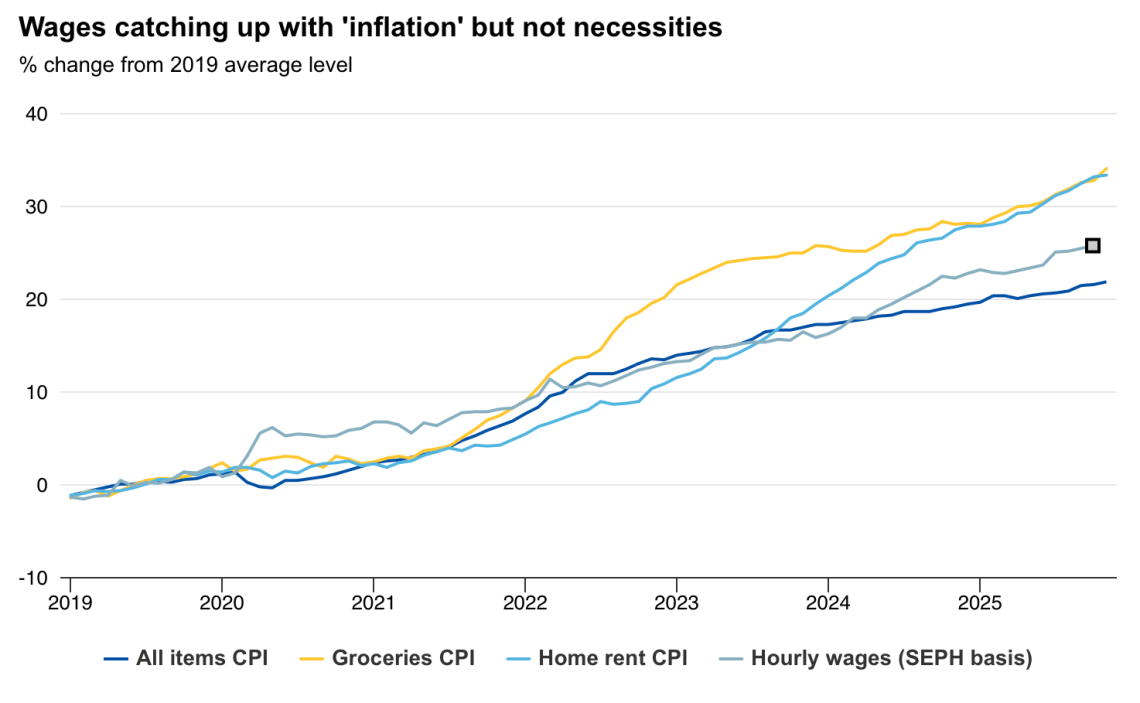

Canada’s affordability issues aren’t anything new, but the post-pandemic inflation shock amplified the pain. Despite this, wage growth (+25%) has outpaced CPI (+20%) since January 2020, notes the bank’s economists. However, those wages have struggled to keep pace with food and housing, which have both climbed roughly 30% over the same period.

Source: RBC Economics; StatCan.

“For lower-income Canadians, who spend more of their income on food and rent, this type of inflation hurts more,” explains the bank’s economists in its 2026 outlook.

RBC sees inequalities persisting throughout this year, and the pressures widening the gap don’t end there.

Canada’s Affordability Gap Is Widening Even Further

Also on the losing side are households carrying debt, with larger debts amplifying the pain. It’s a well-known problem among pandemic-boom home buyers, who were hit with a triple whammy—peak home prices, renewing at higher rates, and minimal time to chip away at those huge mortgages.

On the flip side, the bank notes that savers have benefited from rising interest rates. This group is more likely to skew towards older households with financial assets and deeper pockets.

“A booming stock market has improved household balance sheets for those with financial assets, and not for those that don’t,” notes the bank. It further added, “Affordability isn’t a one size fits all narrative.”

Affordability is only a problem for those impacted. Who knew?

The bank sees inflation slowing further in 2026. However, it’s important to emphasize that slower price growth is still price growth. It also doesn’t undue the surge in prices, meaning the pandemic-era inflation surge will continue to burden those impacted with little relief in sight.

You Might Also Like