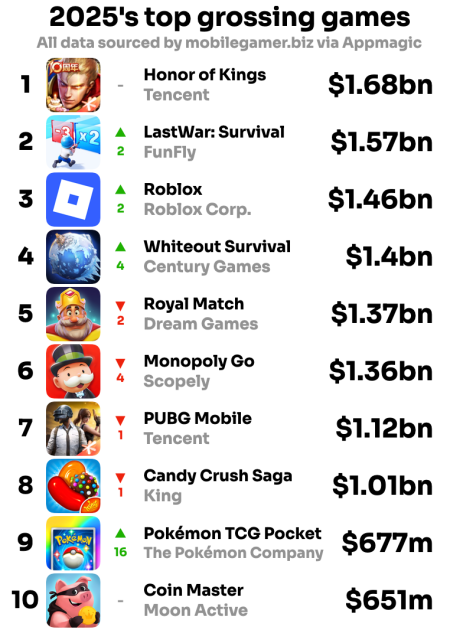

Here are Appmagic’s top grossing charts for 2025.

First, the usual caveats: Appmagic revenue data does not include Apple or Google’s 30%, ad revenue, webshop income or revenue from China’s fragmented Android ecosystem.

Still, these numbers are pretty indicative of the shape and size of things.

In years gone by, Honor of Kings topped these charts by some distance – but 2025 was different, with Last War running it close and six more games racking up over $1bn in 2025.

While it was a closer race than before, Tencent’s monster MOBA stays on top. The $1.68bn Honor of Kings earned in 2025 was practically all from China, with its second biggest market the US, which brought in $8.5m during 2025 – a rounding error. Honor of Kings was actually down year-on-year from earning $1.74bn in 2024, but it remains the one to beat.

FunFly’s Last War had a terrific year – up significantly from 2024’s $1.1bn to $1.57bn, and it’s not even out in China, even though its developer is based there.

The US was Last War’s top market in 2025 with $672m spent, followed by Japan ($294m), South Korea ($153m), Germany ($58m) and Taiwan ($40m). A China launch would inevitably push this to the top of 2026’s charts.

Roblox also grew year-on-year, hitting nearly $1.5bn in 2025 after generating $1.1bn in 2024 (and $900m in 2023), no doubt thanks to the fever surrounding Grow A Garden and Steal A Brainrot this summer. It’s a very ‘western’, English-speaking phenomenon though – its top five markets by revenue are the US ($723m), South Korea ($70m), UK ($66m), Canada ($45m) and Australia ($44m).

Century Games’ Whiteout Survival also had a great year, rising up from generating $936m in 2024 to pass $1.4bn in 2025. And it’s big in China and the US, with $377m and $325m earned in each market respectively. Japan ($201m), South Korea ($156m) and Taiwan ($45m) complete its top five markets for 2025.

Dream Games’ Royal Match declined year-on-year, down to a mere $1.37bn in 2025 compared to 2024’s total of $1.39bn. That might be down to companion game Royal Kingdom stealing its thunder a little with its huge UA budget and wider celebrity ad campaign (Royal Kingdom is down in 35th spot with $246m earned, by the way).

Scopely’s Monopoly Go is also down year-on-year, with the usual caveat that it earns big bucks through its webshop. Its 2025 IAP earnings of $1.36bn are below 2024’s $1.43bn, and it too is very ‘western’ – top 2025 markets for this one are the US ($1.1bn), the UK ($48m), France ($46m), Canada ($35m) and Germany ($31m).

China represents most of PUBG Mobile’s earnings, though it does fine in the US, too. It grew fractionally year-on-year but would have been higher were it not for a real loss of earnings momentum at the end of 2025 – it was regularly earning over $100m a month until that drop-off.

King’s Candy Crush Saga has been steady all year, racking up IAP earnings of $75-90m every month. It is up a little on 2024’s total of $980m and passed the $1bn barrier for the first time. Candy’s market split shows the US way out on top with $576m generated in 2025, followed by the UK ($54m), Canada ($37m), Germany ($37m) and Australia ($23m).

There’s quite a drop in earnings from Candy in eighth to Pokémon TCG Pocket in ninth, which rode its huge launch momentum through to the middle of 2025. It has dropped off badly in recent months; its 2025 peak was in March, when it earned $94m, but towards the end of 2025 it was racking up just under $40m in an average month. It’s mostly dependent on players in Japan and the US.

Moon Active’s Coin Master completes the top ten, having dropped to around $650m earned in 2025 from its 2024 total of $697m. This is its third straight year of IAP revenue decline, but it’s still a good $100m-ish ahead of Gossip Harbor in 11th.

The top grossing mobile games of 2025: 11-20

11. Gossip Harbor (Microfun): $550m

12. Pokémon Go (Niantic): $494m

13. Clash Royale (Supercell): $453m

14. Kingshot (Century Games): $449m

15. Honkai: Star Rail (Mihoyo): $423m

16. Township (Playrix): $406m

17. Gardenscapes (Playrix): $396m

18. Love and Deepspace (Paper Games): $369m

19. Free Fire: Winterlands (Garena): $366m

20. TfT: Golden Spatula (Tencent): $365m

Plenty of new blood in the 11-20 bracket, and some notable risers, too – Gossip Harbor is up 44 places year-on-year to 11th, and Supercell’s Clash Royale leapt up 38 spots.

Pokémon Go’s IAP earnings are down for the fourth straight year – it has steadily declined from 2022’s recent high of over $600m to earning under $500m for 2025 – though new owner Scopely is likely increasingly monetising the game off-store.

Century Games’ second hit title Kingshot enters at 15th with nearly $450m earned last year, having only launched in February. If its current momentum continues it’ll easily break into the top ten for 2026.

Honkai: Star Rail had a very spiky year, but ends up down three spots year-on-year from 2024’s earnings of $562m to $423m in 2025. Fellow Mihoyo game Genshin Impact dropped out of the to 20, down to $335m earned in 2025 from $465m in 2024.

Paper Games’ Love and Deepspace has a great year, up ten places to 18th with $369m earned last year. And after a relatively slow start in 2024, Tencent shooter Delta Force really started raking it in over the second half of 2025 – it was the 21st top grossing title of last year with $355m earned.

The Brawl Stars comeback is definitely over – it dropped 19 places year-on-year, falling from cashing in $626m during 2024 to ‘just’ $271m last year. Clash of Clans is also down from $323m in 2024 to $254m last year, falling to 33rd spot.

Royal Kingdom has some momentum behind it, though – it gathered pace throughout 2025 and ended up as the 35th top earner by IAP with $246m.