Callaway Golf (CALY) is back in focus after launching its Quantum line of clubs and reintroducing itself under a refreshed corporate name and ticker. Together, these changes reshape how investors may view the business.

See our latest analysis for Callaway Golf.

Those product launches and the refreshed Callaway Golf identity come after a strong run in the shares, with a 30 day share price return of 31.01% and a 1 year total shareholder return of 90.82%, even though the 3 year and 5 year total shareholder returns remain negative.

If you are comparing Callaway Golf with other consumer names tied to spending on leisure and sport, it may also be worth scanning fast growing stocks with high insider ownership as a way to spot fresh ideas with strong insider alignment.

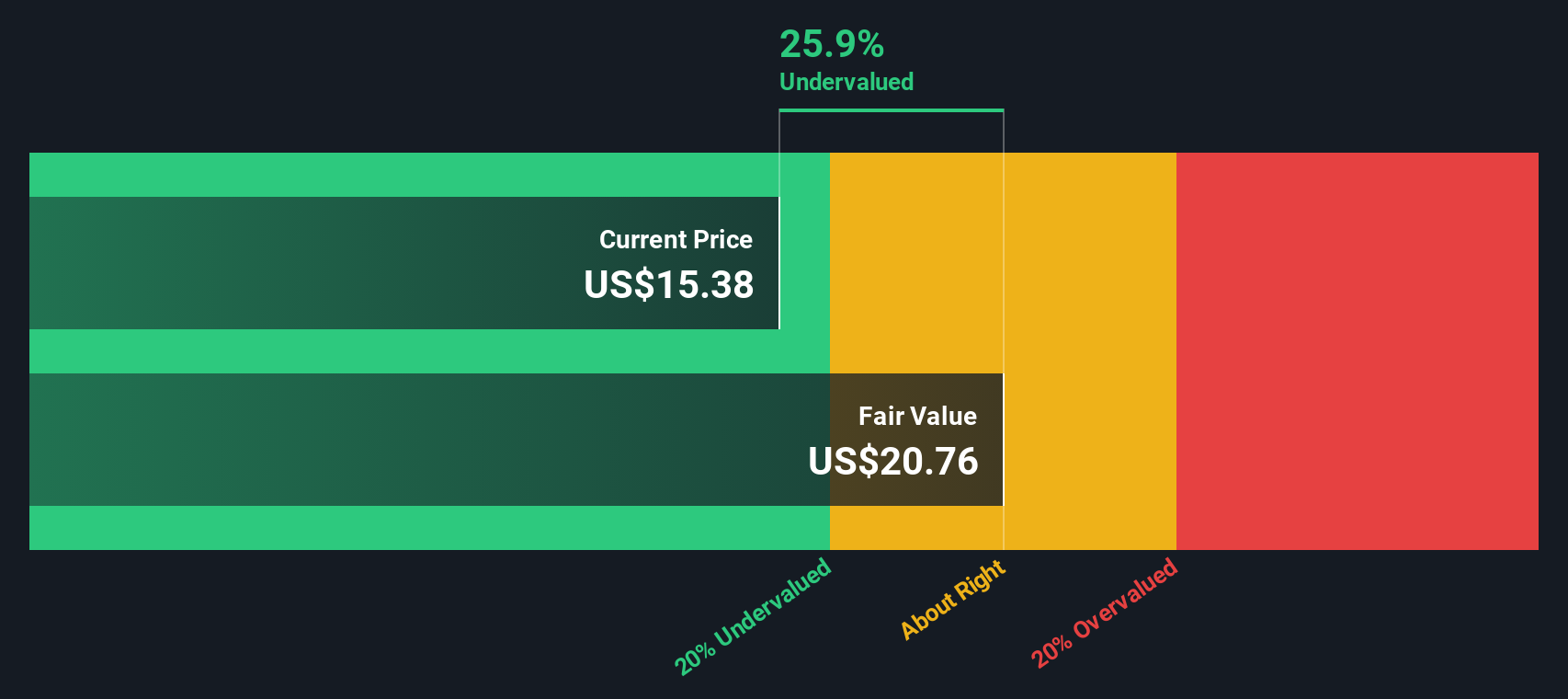

After a 90.82% 1 year total return, a recent 55.35% 90 day gain and a 30 day jump of 31.01%, plus an estimated 25.90% intrinsic discount, you have to ask: is there still value here or is the market already pricing in future growth?

Most Popular Narrative: 23% Overvalued

Compared with the most followed narrative fair value of $12.50, Callaway Golf’s last close at $15.38 sits above that estimate, which frames how some investors are thinking about the recent rally.

Strengthened financial flexibility from the sale of non-core assets (Jack Wolfskin) and targeted cost reduction measures enhances the company’s ability to reinvest in high-ROI initiatives, support growth, and improve margins, all of which are expected to positively impact earnings and return on equity.

Want to understand why a company with current losses still carries a premium to its $12.50 fair value estimate? The core of this narrative leans heavily on a future profit margin swing, steadier revenue assumptions, and a valuation multiple that sits below many leisure peers. Curious which inputs do the heavy lifting in that model and how the discount rate shapes the outcome? The full narrative lays out the numbers behind that call.

Result: Fair Value of $12.50 (OVERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, there are still pressure points, including ongoing losses of $1,505.0 million, as well as tariff and discounting risks that could weigh on the long term margin story.

Find out about the key risks to this Callaway Golf narrative.

Another View: Cash Flows Point a Different Way

The narrative fair value of $12.50 paints Callaway Golf as 23% overvalued, yet our DCF model suggests a fair value of $20.76, with the shares trading at $15.38. One framework flags downside risk, and the other implies upside. Which set of assumptions do you trust more: the narrative or the cash flows?

Look into how the SWS DCF model arrives at its fair value.

CALY Discounted Cash Flow as at Jan 2026 Build Your Own Callaway Golf Narrative

CALY Discounted Cash Flow as at Jan 2026 Build Your Own Callaway Golf Narrative

If you see the story differently or prefer to evaluate the assumptions yourself, you can build a custom view in minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Callaway Golf.

Ready to hunt for more investment ideas?

If Callaway Golf has caught your attention, do not stop here, the next great idea you add to your watchlist could come from a different corner of the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com