[HO CHI MINH CITY] Armed with just his phone, Singaporean digital nomad Bobby Liu pays for coffee across Asia by scanning QR codes from Thailand’s PromptPay, Indonesia’s QRIS and Malaysia’s DuitNow – all through his local banking or e-wallet apps, no cash or cards needed.

Now based in Hanoi, he’s eyeing Vietnam’s entry into this cross-border payment club, as it is linking up with Singapore, and the rest of Asean, to enable instant QR transactions across millions of merchant touchpoints.

“Imagine what that kind of instant payment can do for small businesses – it will significantly improve their cash flow,” said Liu, a fintech entrepreneur and former venture capitalist.

Such instant payment solutions, he said, will be key to boosting South-east Asian economies, which are dominated by small and medium-sized enterprises (SMEs).

He also expects these cross-border innovations to take a chunk out of legacy services for money transfers such as the US’s Swift network and credit card rails like Visa and Mastercard, as they offer faster, cheaper cross-border payments settled directly in local currencies, bypassing the US dollar as an intermediary.

Leader in digital payments

Over the past few years, the success and speed of implementing cross-border QR payment linkages in South-east Asia have been buoyed by the maturity of mobile payment penetration and national QR standards within each respective market, positioning the region as a leader in digital payments, experts say.

According to a DataReportal report, as at February this year, QR code payment adoption among Internet users aged 16 and above in Malaysia, Thailand, Vietnam, and Singapore exceeded the global average of 50.8 per cent, with Malaysia (66.1 per cent) and Thailand (61.5 per cent) ranking just behind China (67.4 per cent) globally.

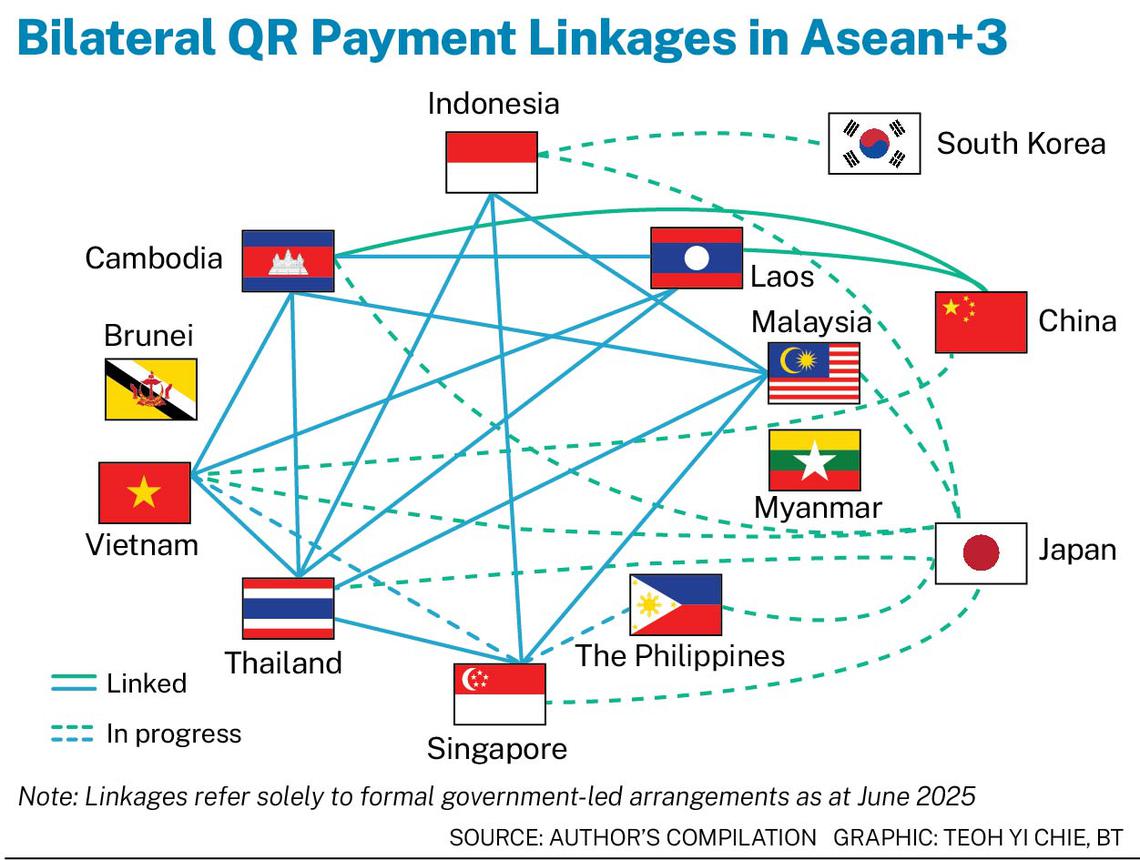

In an effort to expand the growth beyond domestic markets, the Regional Payment Connectivity initiative was launched in 2022 by five Asean member states – Singapore, Indonesia, Thailand, Malaysia and the Philippines. Since then, Vietnam, Laos, Brunei and Cambodia have been added to the initiative.

Its focus in the past three years has been to enable fast, seamless and more affordable cross-border payments in local currencies through standardised and interoperable QR codes, especially for retail transactions of small businesses, tourists, and migrant workers.

This has required bilateral efforts between each pair of countries to ensure technical compatibility and compliance with their respective regulatory frameworks.

“A single QR payment system across the region would offer a real alternative to US-based payment networks for retail users and small businesses,” said Nawazish Mirza, professor of finance at Excelia Business School in France.

“They can chip away at the dollar’s dominance in daily cross-border spending and help boost the use of local currencies over time.”

Advancing local currency use

In the joint statement at the 42nd Asean Summit held in May 2023, the 10-member bloc called for regional payment connectivity and promoted local currency transactions to support regional economic growth as well as strengthen financial resilience and integration.

According to the 2023 policy position paper of Asean+3 Macroeconomic Research Office (Amro), the introduction of cross-border QR linkages between members, along with improvements to real-time gross settlement systems, offers significant potential to facilitate local currency transactions, which could mitigate the region’s reliance on foreign currencies.

Syed Ahmad Taufik Albar, group chief executive of community financial services at Maybank, underlined the benefits of such payment connectivity in areas like cross-border trade among micro-enterprises and SMEs whose products have high contents of domestic and Asean inputs, as well as in intra-Asean foreign direct investment and tourism.

“A successful implementation of a cross-border QR system across Asean’s 10 member states will facilitate deeper Asean integration,” he said.

This year, the position was highlighted again at the 46th Asean Summit in Kuala Lumpur, with the bloc’s Economic Community Strategic Plan 2026-2030 noting that Asean will “promote the use of local currencies to reduce the region’s vulnerability to exchange rate fluctuations and external economic and financial shocks”.

The strategic plan was developed during a period when the US dollar – traditionally dominant in global trade and investment – had fallen to its lowest levels in several years, and the US-led tariff hikes forced nations to engage in prolonged trade negotiations.

Interest from Asian powerhouses

The payment connectivity has now witnessed strong interest from Asian powerhouses like China and Japan to plug their digital payment networks into the Asean ecosystem, paving the way for better usage of local currencies for intraregional transactions and a step away from US-dominant systems.

Last year, Japan’s Ministry of Economy, Trade and Industry said it is working to ensure the nation’s domestic JPQR payment system is compatible with the QR standards in seven Asean countries.

The monetary collaboration between China and its Asean partners has also deepened, with initiatives such as bilateral currency swap agreements and the rollout of cross-border QR code payment linkages.

Following the successful two-way QR payment connectivity with Cambodia earlier this year, China is advancing similar models through government-to-government cooperation across the South-east Asian region, with Vietnam, Indonesia in the pipeline.

In May, Bank Indonesia announced that Indonesian citizens will be able to make transactions using the rupiah currency in China and Japan through its cross-border QR payment system from Aug 17 this year.

Beyond government efforts, private financial institutions such as banks, digital payment firms and e-wallet operators are also playing a role in expanding the cross-border connectivity initiative.

CBDC as the next opportunity

Mirza believes that despite Asean’s significant progress in regional QR payment connectivity, these systems are unlikely to replace Swift or major card networks for large-scale cross-border corporate transactions in the near term.

“To move local currency usage into large trade and investment flows, central bank digital currencies (CBDC) are now taking centre stage,” he added.

Projects like mBridge have already piloted the use of CBDCs for cross-border payments among five participating central banks, including the People’s Bank of China and the Bank of Thailand, with over 25 other central banks – such as those of Malaysia, the Philippines, and Indonesia – serving as observers. The project has entered the minimum viable product phase since 2024.

By utilising the distributed ledger technology and smart contracts, CBDCs could reduce the need for financial intermediaries in cross-border payments and automate high-volume transactions in local currencies, significantly reducing both transaction speed and cost, Amro noted in its papers published in June 2025.

Some 90 per cent of central banks were reportedly engaging in work relating to CBDCs, with China taking the lead by introducing e-CNY for domestic use.

“The speed of wider adoption will depend on progress in regulation and technology. Still, the direction is clear,” Mirza said. “CBDCs are poised to become a key component of the region’s next wave of financial integration.”