This decision comes at *** moment of growing pressure on the Federal Reserve. President Donald Trump has publicly criticized the institution, and there are questions about its future independence. That tension now colliding with the central bank that says it’s not yet ready to cut rates. As President Trump touts the economy as booming, just this morning as I’m running out, I see the S&P 500 hit 7000 for the first time ever. The Federal Reserve hitting pause today, holding interest rates steady. Inflation has eased significantly from its highs in mid-2022 but remains somewhat elevated. If you were thinking about buying *** car next week, what the Fed does today shouldn’t matter. It’s *** decision likely to find disapproval in the White House. It’s too late. Jerome, too late, pal. He’s too late. This was the first rate decision since the Justice Department launched an investigation into the Fed chairman and the central bank’s renovation project. In *** separate case, the Supreme Court is weighing whether President Trump can fire one of the Fed decision makers, Governor Lisa Cook. Chairman Jerome Powell said despite the political pressure, the central bank remains independent. We at the Fed will continue to do our jobs with objectivity, integrity, and *** deep commitment to serve the American people. Jerome Powell’s term as Federal Reserve Chairman ends in May. The president has yet to announce who he’d like to see as the successor. In Washington, I’m Christopher Seles.

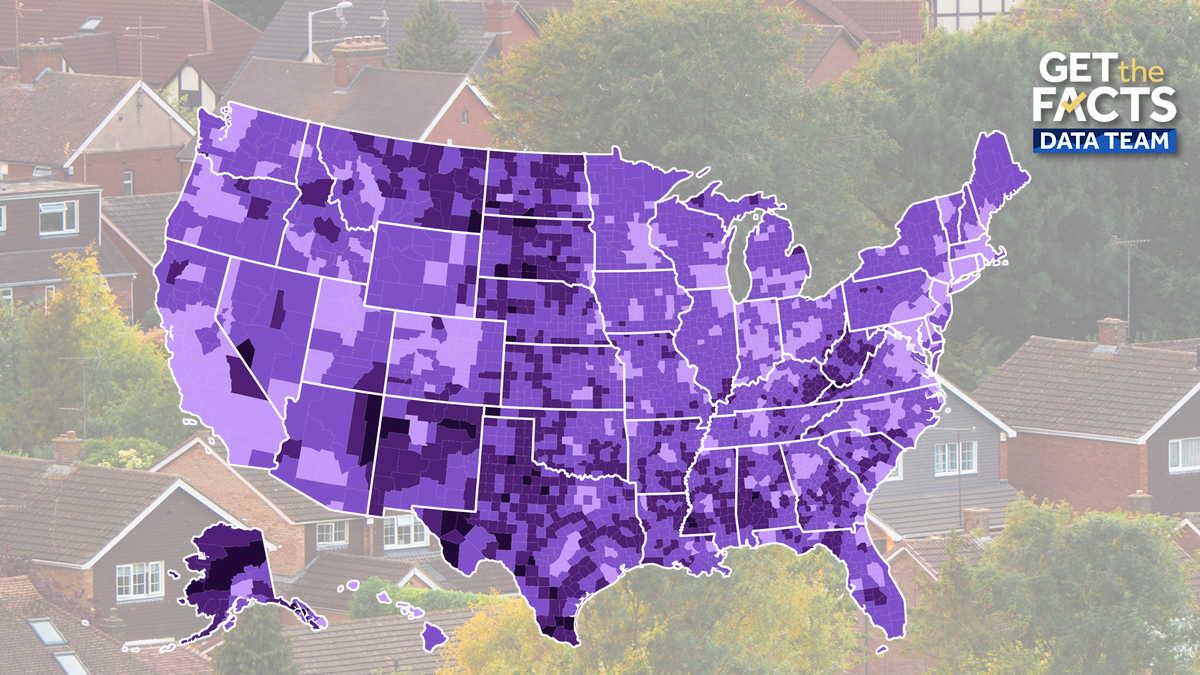

Map: Census estimates show nearly 40% of homeowners have no mortgage. See where

Updated: 11:36 AM EST Jan 30, 2026

There are now more than 33 million homeowners without a mortgage, according to new estimates released by the U.S. Census Bureau, making up about 40% of all homeowners.That is an increase from the 26.7 million from estimates released 10 years ago.While most homeowners have a mortgage, the majority has been growing smaller. This is because the number of homeowners paying off their homes is rising faster than the number of people who are becoming homeowners with a mortgage, an analysis from the Get the Facts Data Team found.The trends are “a possible reaction to higher interest rates and home prices that tend to discourage moves to new homes,” according to the U.S. Census Bureau.The data released this week were American Community Survey estimates for the five-year period ending in 2024. Survey responses are collected over a five-year time frame to identify long-term trends.The scope of the analysis focused on owner-occupied homes, so people who own homes they do not primarily live in are not included. So, second homes, vacation homes and homes rented to tenants are not counted.Homeowners in West Virginia had the highest percentage, 54%, of people owning their homes free and clear. That is about 294,000 out of the 545,600 housing units occupied by homeowners in the state. Mississippi followed West Virginia, with about 51% of homeowners not having a mortgage. In New Mexico, about 586,000 housing units are occupied by homeowners, and 49% of those homes are owned free and clear. Roughly 76% of homeowners in Washington, D.C., still have mortgages, the highest rate in the nation. Maryland and Colorado followed, ranking second and third at 71% and 69%. Explore the map below to see which counties had the most homeowners without mortgages.PHNjcmlwdCB0eXBlPSJ0ZXh0L2phdmFzY3JpcHQiPiFmdW5jdGlvbigpeyJ1c2Ugc3RyaWN0Ijt3aW5kb3cuYWRkRXZlbnRMaXN0ZW5lcigibWVzc2FnZSIsKGZ1bmN0aW9uKGUpe2lmKHZvaWQgMCE9PWUuZGF0YVsiZGF0YXdyYXBwZXItaGVpZ2h0Il0pe3ZhciB0PWRvY3VtZW50LnF1ZXJ5U2VsZWN0b3JBbGwoImlmcmFtZSIpO2Zvcih2YXIgYSBpbiBlLmRhdGFbImRhdGF3cmFwcGVyLWhlaWdodCJdKWZvcih2YXIgcj0wO3I8dC5sZW5ndGg7cisrKXtpZih0W3JdLmNvbnRlbnRXaW5kb3c9PT1lLnNvdXJjZSl0W3JdLnN0eWxlLmhlaWdodD1lLmRhdGFbImRhdGF3cmFwcGVyLWhlaWdodCJdW2FdKyJweCJ9fX0pKX0oKTs8L3NjcmlwdD4=

WASHINGTON —

There are now more than 33 million homeowners without a mortgage, according to new estimates released by the U.S. Census Bureau, making up about 40% of all homeowners.

That is an increase from the 26.7 million from estimates released 10 years ago.

While most homeowners have a mortgage, the majority has been growing smaller. This is because the number of homeowners paying off their homes is rising faster than the number of people who are becoming homeowners with a mortgage, an analysis from the Get the Facts Data Team found.

The trends are “a possible reaction to higher interest rates and home prices that tend to discourage moves to new homes,” according to the U.S. Census Bureau.

The data released this week were American Community Survey estimates for the five-year period ending in 2024. Survey responses are collected over a five-year time frame to identify long-term trends.

The scope of the analysis focused on owner-occupied homes, so people who own homes they do not primarily live in are not included. So, second homes, vacation homes and homes rented to tenants are not counted.

Homeowners in West Virginia had the highest percentage, 54%, of people owning their homes free and clear. That is about 294,000 out of the 545,600 housing units occupied by homeowners in the state.

Mississippi followed West Virginia, with about 51% of homeowners not having a mortgage. In New Mexico, about 586,000 housing units are occupied by homeowners, and 49% of those homes are owned free and clear.

Roughly 76% of homeowners in Washington, D.C., still have mortgages, the highest rate in the nation. Maryland and Colorado followed, ranking second and third at 71% and 69%.

Explore the map below to see which counties had the most homeowners without mortgages.