After Friday’s flash of Old Wall panic, financial headlines spent the weekend spiraling into doom-mode. But beneath the noise, markets told a very different story — one of opportunity, not collapse.

This is the kind of setup where data wins, not narratives.

Here are the three themes we’re watching this week:

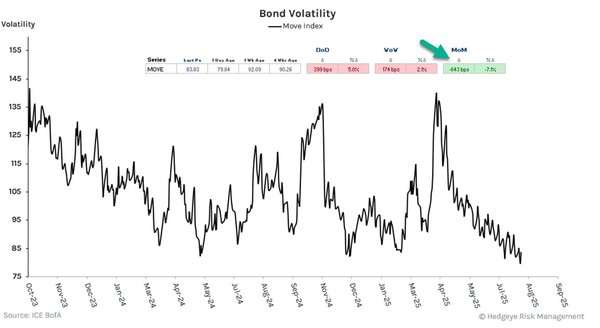

1) FED CUT? THE MARKET JUST PRICED IT IN

Friday’s selloff looked like a textbook #Quad4 day: stocks down, bond yields down.

But more importantly, bond markets front-ran the narrative and priced in a September rate cut.

2Y Yield: -23 bps (basis points) last week

10Y Yield: -17 bps last week

Yield Curve Steepened +7bps to +53bps (10Y-2Y)

Both the 2-year and 10-year Treasury yields broke below what we call their TREND levels — a key part of our signaling process that forecasts the likely direction of any publicly traded asset. That’s our data-driven process for confirming a shift.

Want to know how we’re positioning to capitalize on the shift? Get ETF Pro Plus FREE for 30 days— and see the ETF signals our CEO Keith McCullough is using to ride the cycle.

2) RUSSELL 2000: SQUEEZE SETUP BUILDING

The Russell 2000 (IWM) may be one of the most consensus shorted positions in global macro right now. According to CFTC data, hedge funds have piled into this trade — which sets the table for one thing: a potential squeeze.

Add to that:

The index just held TREND Signal Support

It was signaling oversold on a TRADE (short-term) basis

710 Russell companies have reported +20% YoY EPS growth

That’s not an MSM narrative. That’s positioning, price, and profit all leaning in one direction.

If you want the exact Buy/Sell levels we use to manage this position — and an immediate alert when it’s time to act — it’s all inside ETF Pro Plus.

Claim your 30-day free trial here.

3) VIX: PANIC PREMIUM = BUY SIGNAL

Friday’s volatility spike triggered fear, but it didn’t break out of its range. In fact, it stayed well within what we call the “Chop Bucket.” That means:

VIX Low-End of Risk Range = 14.12

SPX Implied Vol = +112% above 30-day Realized Vol

Translation: traders are overpaying for downside protection — a classic precursor to higher equity prices.

When fear premiums rise and realized volatility doesn’t confirm it, the signal is simple: fade the panic.

The Bottom Line: Trade Signals, Not NARRATIVES

Yields breaking down

Russell bottoming on signal

Volatility stretched and mispriced

You won’t find this setup in a CNBC segment or an economist’s year-end outlook. You’ll find it in ETF Pro Plus – Hedgeye’s real-time ETF investing playbook powered by our proven Macro process and data-driven signals.