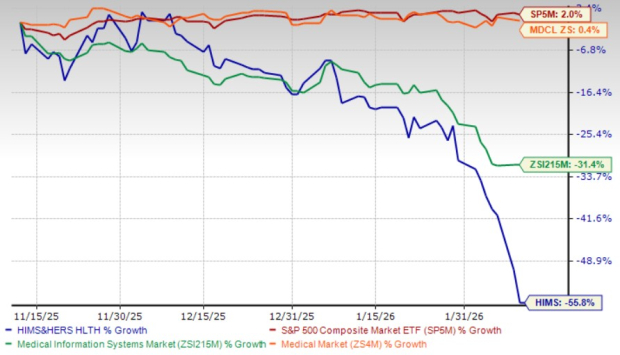

Hims & Hers Health, Inc.’s HIMS investors have been experiencing some short-term losses lately. The San Francisco, CA-based health and wellness platform’s stock has lost 55.8% compared with the industry’s 31.4% decline in the past three months. It has also underperformed the sector and the S&P 500’s gains of 0.4% and 2%, respectively, in the same time frame.

A major recent development of HIMS is the launch of Galleri, a cancer screening blood test that can detect a signal for more than 50 types of cancer even before symptoms appear, this month. The multi-cancer early detection test combines Hims & Hers’ scale with GRAIL, Inc.’s innovative cancer screening technology to significantly increase access to proactive care. The company also announced third-quarter 2025 results in November 2025.

Hims & Hers delivered robust top-line growth in the third quarter of 2025, driven by solid performance across both of its revenue streams. The company experienced healthy subscriber growth along with an increase in average monthly online revenue per subscriber. However, its weak bottom-line results during the quarter were disappointing. Furthermore, the contraction in both margins weighed negatively on the stock.

Hims & Hers is scheduled to release fourth-quarter 2025 results on Feb. 23, after the closing bell.

HIMS Three Months Price Comparison

Image Source: Zacks Investment Research

Over the past three months, the stock’s performance has remained weak, underperforming its peers like Teladoc Health, Inc. TDOC and Tempus AI, Inc.TEM. Teladoc Health and Tempus AI’s shares have lost 35.1% and 21.4%, respectively, in the same time frame.

HIMS expects revenues for the fourth quarter of 2025 and the full year in the bands of $605 million to $625 million (reflecting an uptick of 26%-30% year over year) and $2.335 billion to $2.355 billion (representing growth of 58%-59% from 2024 levels), respectively. The Zacks Consensus Estimate for revenues for the fourth quarter and the full year is currently pegged at $620.4 million and $2.35 billion, respectively, while the same for earnings per share is currently pegged at 4 cents and 48 cents, respectively.

The Zacks Consensus Estimate for revenues for the first quarter and the full-year 2026 is currently pegged at $639.5 million and $2.73 billion, respectively, while the same for earnings per share is 13 cents and 55 cents.

Hims & Hers’ Regulatory and Legal Pressures

A key concern is the heightened regulatory scrutiny surrounding compounded GLP-1 drugs. The FDA has indicated its intent to take action against companies mass-marketing non-FDA-approved compounded GLP-1 products, citing concerns over quality, safety and efficacy. This scrutiny directly affects companies like Hims & Hers, which offers compounded alternatives in the fast-growing weight-loss space.

In addition, Novo Nordisk has filed a lawsuit against Hims & Hers, alleging patent infringement related to its compounded semaglutide products and seeking to block their sale. The litigation not only introduces potential financial liabilities but also creates uncertainty around the long-term viability of a key growth driver.

Further adding to the overhang is HIMS’ reliance on complex compounding regulations under Sections 503A and 503B of the FDCA. Compounded drugs must meet specific exemption criteria, and any determination that products fail to qualify could subject the company or its affiliated facilities to enforcement actions, including warning letters, fines or other penalties. This regulatory complexity elevates compliance risk in one of its most important growth categories.

HIMS’ Financial and Competitive Headwinds

Despite strong revenue growth in the third quarter of 2025, profitability trends have softened. Gross margin declined year over year, reflecting cost pressures and mix shifts. At the same time, HIMS’ net income fell sharply from the prior-year period, underscoring earnings volatility that tempers the otherwise impressive top-line expansion.

Hims & Hers also operates in highly competitive markets, facing traditional healthcare providers, retailers and other telehealth platforms across specialties. Intensifying competition in weight loss and other core categories could pressure pricing power and customer acquisition efficiency over time.

Fundamentals to Drive Hims & Hers

HIMS continues to broaden its addressable market by launching new, high-demand specialties that deepen engagement across both the Hims and Hers brands. Recent category expansions include low testosterone treatments through an exclusive collaboration for branded oral therapy, as well as personalized compounded options and at-home testing that streamline diagnosis and care. On the women’s health side, the launch of menopause and perimenopause care adds a meaningful new specialty to a platform that already serves over half a million subscribers.

Hims & Hers is moving beyond reactive care with the introduction of comprehensive lab testing designed to deliver data-driven, proactive health insights. This shift toward diagnostics and personalization enhances cross-selling opportunities, strengthens retention and reinforces the subscription-based model that underpins recurring revenue growth.

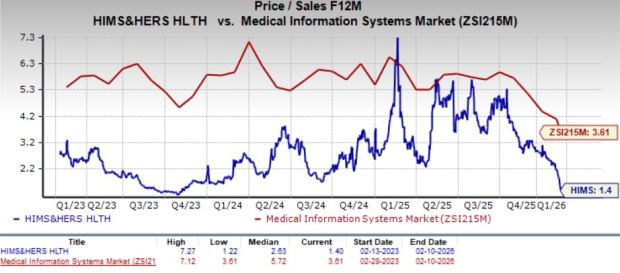

HIMS Stock’s Valuation

HIMS’ forward 12-month P/S of 1.4X is lower than the industry’s average of 3.6X and its three-year median of 2.6X.

Image Source: Zacks Investment Research

Teladoc Health and Tempus AI’s forward 12-month P/S currently stand at 0.3X and 6.2X, respectively.

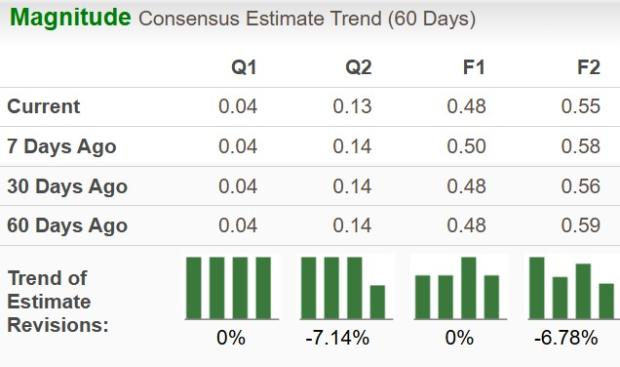

Hims & Hers’ Estimate Movement

Estimates for Hims & Hers’ 2026 earnings per share have moved 6.8% south to 55 cents in the past 60 days.

Image Source: Zacks Investment Research

Estimates for Teladoc Health’s 2026 loss per share have widened from 84 cents to 85 cents in the past 60 days.

Estimates for Tempus AI’s 2026 loss per share have widened from 17 cents to 18 cents in the past 60 days.

Our Final Take on HIMS

There is no denying that Hims & Hers remains strategically positioned, backed by its expanding care ecosystem and growing international footprint, including its official entry into Canada following the Livewell acquisition and the launch of the Hers platform in the U.K. to broaden access to holistic weight management care. Continued expansion into hormone health, diagnostics and personalized treatment offerings also strengthens its long-term platform ambitions.

However, holding on to this Zacks Rank #5 (Strong Sell) company at present does not seem prudent, as near-term pressure is building from weak bottom-line performance and margin compression, even as revenues continue to grow. Sustainability concerns persist around heavy marketing dependence, customer acquisition efficiency and potential churn as the company scales. Regulatory and supply sensitivities tied to customized and compounded offerings add another layer of uncertainty, particularly in high-growth categories. In addition, acquisition-led expansion introduces integration complexity and operational control risks that could weigh on performance consistency.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Estimate revisions reflect this cautious stance, with 2026 earnings projections edging slightly lower in recent weeks. While Hims & Hers retains meaningful long-term growth drivers, the combination of profitability pressures, regulatory overhang and execution risks suggests that investors may be better off trimming exposure and reallocating capital to more stable opportunities until visibility improves.

Zacks’ Research Chief Picks Stock Most Likely to “At Least Double”

Our experts have revealed their Top 5 recommendations with money-doubling potential – and Director of Research Sheraz Mian believes one is superior to the others. Of course, all our picks aren’t winners but this one could far surpass earlier recommendations like Hims & Hers Health, which shot up +209%.

See Our Top Stock to Double (Plus 4 Runners Up) >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Teladoc Health, Inc. (TDOC): Free Stock Analysis Report

Hims & Hers Health, Inc. (HIMS): Free Stock Analysis Report

Tempus AI, Inc. (TEM): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).