Weekend Reading – The RRSP is not a tax trap

Welcome to a new Weekend Reading folks, suggesting the RRSP is hardly a tax trap!

Before that take, some recent posts from my site:

Do you still participate in RRSP season?

Do you still participate in RRSP season?

And….last weekend, whether you contribute to your RRSP or not, I wondered in your porfolio if you still consider holding lots of bonds in retirement.

A few spicy reader comments on that one!

Weekend Reading – Do you need bonds in retirement?

Weekend Reading – The RRSP is not a tax trap

Headlining this edition are some counter-arguments to the RRSP tax trap content I’ve read over the years.

RRSP tax trap misconceptions:

While there is a risk that your RRSP can grow too large (my goodness!) – what a nice complaint to have in retirement – a large RRSP also means you have plenty of money to retire on. It also means you should have considered an RRSP withdrawal plan much sooner than age 71.While in the year you turn age 71, RRSPs must be converted (usually to a RRIF) which triggers a mandated schedule of registered withdrawals, this only makes sense since you never paid tax on the money invested and grown to date in the first place – the government wants their money back. You’ve had literally decades to consider how to invest, withdraw or convert tax-deferred money into tax-efficient money. Options in investing and in life are good. 🙂When comparing the TFSA investing route vs. the RRSP investing route (that I wrote about in my recent post above), a reminder that by design since you haven’t paid tax on money inside the RRSP or RRIF then if you don’t convert it or spend it until death, the entire remaining RRSP/RRIF balance is typically taxed as income in one year, potentially creating a VERY large tax bill for beneficiaries. This is not a trap but a means to pay what you owe. So, again, drawdown the RRSP/RRIF when you can.

Beneficiaries for TFSAs, RRSPs, RRIFs and other key accounts

If this still frustrates you when it comes to the overwhelmingly positive RRSP/RRIF benefits, I believe you have other options that also have pros and cons since there is no free lunch when it comes to investing for long-term gains and/or totally avoiding taxation:

Use the TFSA as much as you can – investments inside the TFSA grow tax-free but may be subject to annual contributions limits that are lower than any annual RRSP contribution room.Use a Non-Registered Account as much as you can – however, the RRSP is most valuable for higher-income earners who can contribute when their marginal tax rate is high and when their withdrawal rate in retirement is likely lower. So, investing in a non-registered account could be tax efficient but may also trigger ongoing taxation depending upon what you own. Use both – Tax-generated RRSP contribution refunds don’t always have to be reinvested inside the RRSP (although that is very wise) but instead the RRSP-refund can be diverted to contribute to your Tax-Free Savings Account (TFSA) for additional, tax-free growth or if cash-strapped, use the money to kill your debt.

Honestly, if I have great health and I’m able to complain about taxation as I get older in the coming decades, I think I will be thrilled…count me lucky and very fortunate.

For related reading, check out this pillar post:

Watch out for RRSP and RRIF taxation

More Weekend Reading – Beyond the RRSP is not a tax trap

Beyond my headline for the week, here are other recent reads you might find interesting!

Ben Carlson wrote about investing or paying down a mortgage. I had my preference when I had a mortgage.

For those of you on the fence, Ben’s wise words might help:

“I don’t like going to extremes. It doesn’t have to be all or nothing.”

If you do decide to make extra mortgage payments, don’t completely shut off your investments in the stock market.

They say no one ever regrets paying off their mortgage early.

No one regrets putting money into the stock market and letting it compound for multiple decades either.”

This is why I always did both: invested and paid down our mortgage at the same time.

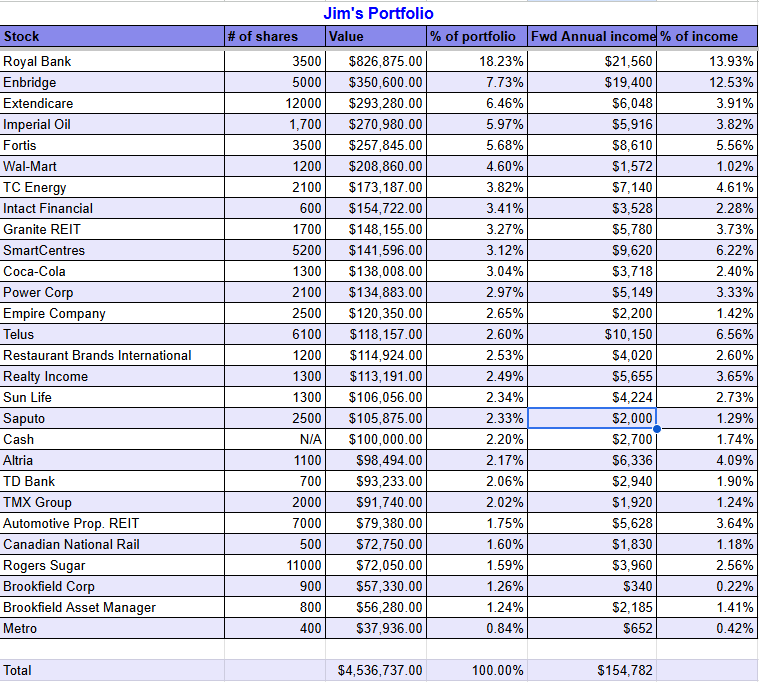

Canadian Dividend Investing finally met “Jim”, the multi-millionaire plumber from rural Alberta.

Incredible, read more from Nelson’s post…

“Sure, let’s give the people what they really want.

So to review, you retired at the end of 2021 with right around $3M and passive income of around $100k per year, correct?

Yeah. One day I was reviewing the portfolio, saw it hit $3M, and figured that was enough, y’know? That was the day I made the decision to retire. I ran my own business and had a few commitments, but I stopped taking new jobs. It was all over in a few weeks. My wife hung around her job a little bit beyond that, but it all happened pretty quickly after I decided.”

Things I’ve thought about this week that relate to the above:

So much success can be boiled down to consistently doing the obvious, simple things, well over a long period of time. Striving to make many good decisions over time is usually better than agonizing over finding the ideal decision – which only exists in hindsight.

My 84 year-old investing friend Henry Mah doesn’t think he’s a financial influencer.

Well, as an author of many DIY investing books, I think he is. Congrats to Henry and his success.

Have a great weekend!

Mark

My name is Mark Seed – the founder, editor and owner of My Own Advisor. As my own DIY financial advisor, I’ve reached financial independence. Now, I share my lessons learned for free on this site. Join the newsletter read by thousands every week.