A $3,000 bill charged to an Ontario man for a mileage overage on his leased vehicle following a crash that killed his wife and destroyed the car has been waived by Ford Canada, his son says.

Jason Greer, the son of Eric and Joan, said his parents were headed south on Country Road 27 near their home in Elmvale, Ont., on Family Day, Feb. 17, 2025, when they made a left turn amid snowy conditions.

“I don’t know where they were going. My dad still has no memory of this event at all…My dad made a left hand-turn, and I assume they were deciding the weather’s too bad, we’re going to go back home,” Greer, who lives just outside of Barrie, told CTV News Toronto in an interview.

Their vehicle, a leased 2023 Ford Bronco, was T-boned by a northbound Ford F-150 pickup truck as they attempted to complete the turn, he said. Eric and Joan’s heads collided on impact, leaving them both with critical injuries. Their vehicle was totalled. The driver of the F-150 was not injured or charged in the crash.

Greer said he got a call about the collision at 6 p.m. that night as he was sitting down for dinner with his family.

His parents were rushed to the Royal Victoria Regional Health Centre in Barrie, before they were moved to the intensive care unit at St. Michael’s Hospital in Toronto. Eric was airlifted, but Joan was transported by ambulance after Ornge was grounded due to the poor weather, Greer explained.

“My mom hung on for 12 days, and there were a couple of extubations, which she failed. Eventually I had to make the decision of she wasn’t going to get any better, it was just complications,” he said.

Joan died on Feb. 28 – just 10 days shy of her 81st birthday.

Eric suffered a brain bleed and was discharged from the ICU after two days. He remained in hospital for two months and was unable to attend Joan’s funeral, Greer said.

Before Eric was eventually sent home, Greer said he was diagnosed with stage 4 colon, liver and pancreatic cancer, all found during a “head-to-toe” CT scan following the crash.

“He blinked his eyes on February the 17th and then when he kind of became lucid again, two months later, his wife is dead, his liberty is gone, in the sense that he can’t drive anymore, and he’s been issued a death sentence,” Greer said, adding that his father has been told he has “months” left to live.

‘Profiteering off a terrible event’

Months after the crash and following an insurance claim that fully paid out the value of the totalled Ford Bronco, Greer said his father received an invoice from Ford Credit on June 3 for $2,997.93, plus tax for a “pro-rated-kilometre charge.”

“The balance of the loan has been satisfied by the Loss or Destruction of Vehicle waiver, except for the following unpaid amounts you are responsible for, as outlined in your lease agreement,” the letter, which was viewed by CTV News, read.

The invoice also included an insurance deductible of $500, for a grand total of $3,887.66.

Greer said that while he had “no problem” paying the insurance deductible as his father’s power of attorney, the “logic” of charging a mileage overage on a vehicle that “does not exist anymore” doesn’t add up.

“I get it if he’s over his kilometres, and the vehicle is being sold. I understand that completely, because the value of it has been lessened by the additional kilometres,” he said. “But the vehicle has been completely paid out and it’s destroyed. They’re not selling it. It just seems like they’re kind of profiteering off a terrible event.”

According to the lease agreement, which CTV News also viewed, Eric agreed to be charged 12 cents per kilometre over 64,105 kms following the end of the four-year agreement (roughly 16,000 km per year), which was set to expire in 2027. It’s unclear how many kilometres were on the vehicle at the time of the crash and the invoice does not specify how many kilometres Eric was charged for.

“They (my parents) would take outings here and there, but that was their primary track: Elmvale to Barrie and back. So, it’s hard to know how many kilometres they would have been over and again, there’s no breakdown of it. It’s just literally here: this is what you owe, this is the dollar value,” he said.

Greer said he got in touch with Ford and asked if the charge for excess milage could be waived on compassionate grounds, and considering the vehicle was destroyed. He said after about a month and a half of going back-and-forth with the car company, a representative for Ford told him it could not reverse the charge.

“If push comes to shove, I’ll pay it. It just leaves a bad taste in my mouth that they’re still going after my dad for kilometres for a vehicle that was paid out 100 per cent by the insurance company. Kind of in poor taste, I think,” Greer said, adding that he told Ford he would let the charge go to a collections agency, hoping for a lesser payout amount.

In a letter addressed to Eric dated July 18, Ford said: “We wish to make you aware that in order to avoid a negative credit report or further collection activity, you must do one of the following things within 15 days of this notice: remit the amount or make a satisfactory payment arrangement.”

Ford agrees to reverse charge

CTV News Toronto reached out to Ford Canada for a comment on Greer’s situation.

In a statement, a spokesperson said Ford had spoken to Greer to “resolve the concern.”

“Out of respect for customer privacy, we won’t be providing detail on a specific situation,” they wrote in an email.

Greer has since confirmed that Ford has agreed to cover all the costs associated with his father’s vehicle.

“My family and I are very grateful to Ford for finally doing the right thing in the end. It’s a bit distressing that I had to contact the media in order to find a remedy to this situation, but I am content with the outcome,” he said.

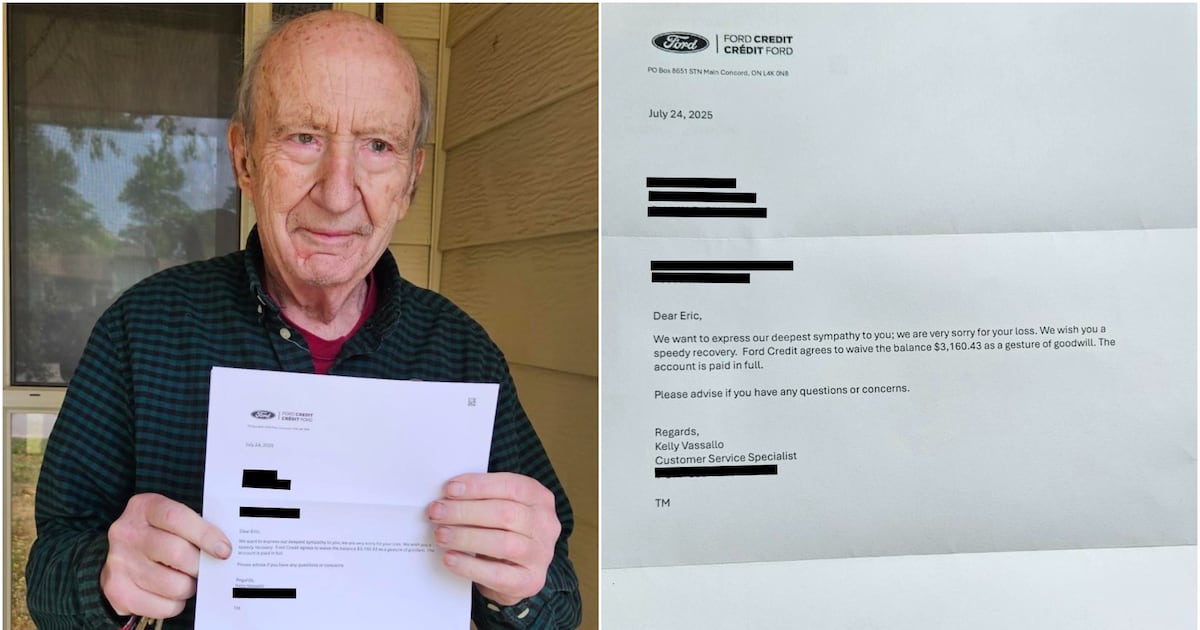

In a letter to Eric dated July 24, Ford wrote, “We want to express our deepest sympathy to you: we are very sorry for your loss. We wish you a speedy recovery…The account is paid in full.”

‘It is uncommon’: Car sales expert

Shari Prymak is a senior consultant with Car Help Canada, a non-profit organization that’s been helping Canadians buy and lease cars for over 25 years, and says “it is uncommon” for a car company to levy this kind of charge against a customer after a serious crash.

He said that, usually, when there’s a serious car collision and the car is a write off, the insurance company will pay the balance of the lease to the car company, as it did in Eric’s case, and “that’s the end of it.”

“So, whatever the remaining cost is on the lease—the buyout, plus the remaining lease payments—usually that equates to the vehicle’s value anyways, so that’s what the insurance company would pay to the manufacturer, and then the consumer would be off the hook for the lease, and they can go ahead and buy a new car again.”

However, Prymak emphasized that Ford was within its right to bill Eric for the milage overage, before eventually reversing the charge.

“It’s very clear in the lease agreement: there is a charge for every kilometre you go over your mileage limit…So if this consumer was returning their car at the end of the lease (and it wasn’t totalled) and they had gone over their mileage limit, they’d have to pay a penalty for that. No question.”

Prymak said drivers who lease their vehicles should be mindful of their annual mileage allowance before they return their vehicles at the end of the contract to avoid any overage charges.