Key Points

Lemonade is an insurance technology company, and artificial intelligence (AI) is at the core of everything it does.

Lemonade stock surged by 30% on Aug. 5, after the company revealed a stellar set of operating results for the second quarter of 2025.

The stock remains 70% below its 2021 record high, but a full recovery is looking increasingly likely.

Last week, I predicted Lemonade(NYSE: LMND) stock would surge once the company released its operating results for the second quarter of 2025 (ended June 30) on Aug. 5. It rocketed higher by 30% on the day, thanks to a spectacular report that showed continued momentum across the business.

Lemonade sells insurance, but with a twist: It relies on artificial intelligence (AI) to write quotes, process claims, and even price premiums, creating a faster, more convenient experience compared to traditional insurance companies.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Despite its recent gains, Lemonade stock is still trading 70% below its record high from 2021, when a frenzy in the technology sector drove its valuation to unsustainable heights. However, the company believes it can grow its business tenfold over the next decade, so the recent upside in its stock could have serious legs.

Image source: Getty Images.

Lemonade’s customer base is growing rapidly

Lemonade operates in the renters, homeowners, pet, life, and car insurance markets. Prospective customers who want a quote can visit its website and speak to an AI chatbot named Maya, which can provide one in under 90 seconds. Existing policyholders who need to make a claim can go through AI Jim, which can pay them out in less than three minutes without human intervention.

Lemonade’s approach is in stark contrast to the processes at traditional insurance companies, especially when it comes to claims, which often require several phone calls and lengthy waiting periods. Its popularity is soaring as a result; Lemonade had a record 2.7 million customers at the end of the second quarter, which was up 24% from the year-ago period. That growth rate marked an acceleration from its first-quarter result of 21%, which highlights the company’s momentum.

Further, Lemonade’s in-force premium (IFP, or the combined value of premiums from all outstanding policies) reached a record high of $1.08 billion in Q2, representing a 29% year-over-year increase. That was the seventh straight quarter in which IFP growth accelerated.

But there is more to Lemonade’s success than its fantastic customer experience. The company’s Lifetime Value (LTV) models, which are powered by AI, calculate the likelihood of a customer making a claim, switching insurers, and even buying multiple policies, in order to charge the most accurate premiums. These models also identify products and geographic markets that are underperforming, so management can pivot its operating costs to maximize revenue.

Lemonade significantly increased its revenue guidance for 2025

Lemonade’s soaring IFP wouldn’t mean much without a sustainable gross loss ratio, which is the proportion of premiums paid out as claims. The company believes a gross loss ratio of 75% is the sweet spot for a thriving insurance business, and it came in at an even better level of 70% during the second quarter.

When IFP increases and gross losses decline, the net result is more revenue. After discounting the premiums Lemonade paid to other insurers to reduce risk, its revenue came in at a record $164.1 million during Q2, which was up 35% year over year. That was comfortably above management’s forecast of $158 million.

On the back of the strong result, management increased its full-year revenue guidance for 2025 by a staggering $50.5 million, from $662 million to $712.5 million.

With all of that said, there is still some room for improvement at the bottom line. Lemonade’s preferred measure of profitability is adjusted earnings before interest, tax, depreciation, and amortization (EBITDA), where it lost $40.9 million during Q2. But it was better than the adjusted EBITDA loss of $43 million from the year-ago period, so the company is on the right track.

Plus, Lemonade had over $1 billion in liquidity on its balance sheet at the end of Q2, so it has plenty of runway to continue investing aggressively in growth initiatives, as long as its losses don’t increase too dramatically from current levels.

Lemonade stock might be cheap right now

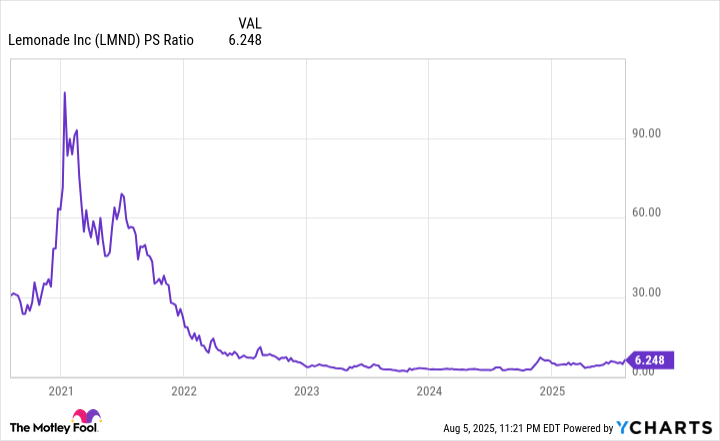

When Lemonade stock peaked during the tech frenzy in 2021, its price-to-sales (P/S) ratio topped 90, which was completely unsustainable. But the decline in the stock since then, combined with the company’s surging revenue growth, has pushed its P/S ratio down to just 6.1.

That’s near the cheapest level since Lemonade went public. Therefore, the stock still looks very attractive, even after the blistering gains that followed its Q2 earnings report.

LMND PS Ratio data by YCharts

As I mentioned, the recovery in Lemonade stock might just be getting started. The company plans to grow its IFP to $10 billion over the next decade, representing a near-tenfold increase from its current level, so investors willing to hold this stock for the long term could reap significant rewards from here.

Should you invest $1,000 in Lemonade right now?

Before you buy stock in Lemonade, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lemonade wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $635,544!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,099,758!*

Now, it’s worth noting Stock Advisor’s total average return is 1,046% — a market-crushing outperformance compared to 181% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 4, 2025

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Lemonade. The Motley Fool has a disclosure policy.