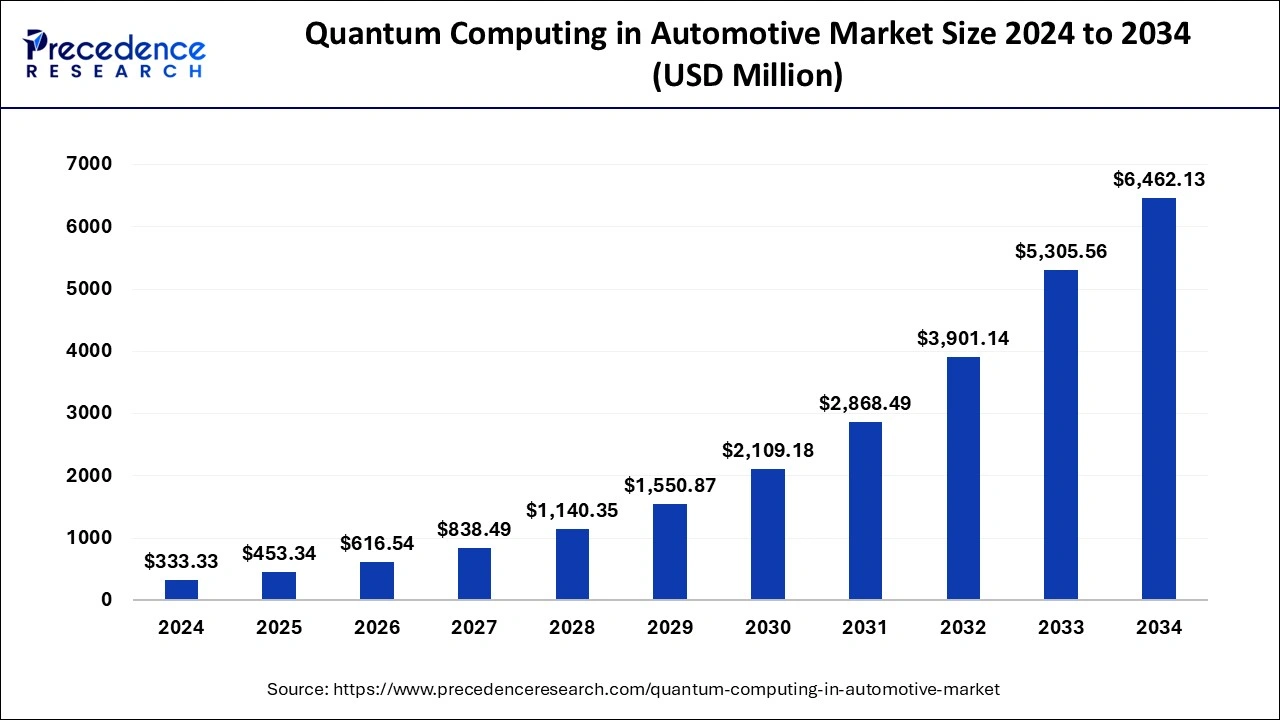

According to Precedence research, the global quantum computing in automotive market is forecasted to surge from $453.34 million in 2025 to a remarkable $6,462.13 million by 2034, expanding at an eye-popping CAGR of 34.51%.

Asia Pacific dominates with a projected market value of $2,681.79 million by 2034, propelled by rapid R&D acceleration in China, Japan, and South Korea. As OEMs and suppliers harness quantum’s transformative power from optimizing electric vehicle batteries and supply chains to enhancing autonomous driving investment and innovation are accelerating across the full automotive value chain.

Why Quantum Is Reshaping Automotive Innovation

The automotive sector is entering a paradigm shift, driven by quantum computing’s unprecedented ability to solve complex optimization, simulation, and machine learning problems. With a forecasted CAGR of 34.51% from 2025 to 2034, quantum technology’s adoption is fueled by surging electric vehicle sales, more sophisticated autonomous systems, and ever-rising industry demands for efficient, sustainable, and safe transportation solutions.

Quick Insights: Data-Driven Market Snapshots

In 2025, the quantum computing in automotive market will reach $453.34 million globally, from $333.33 million in 2024, on a rapid upward trajectory.

Asia Pacific is the top region led by China, Japan, and South Korea with the largest market share, projected at $2,681.79 million by 2034.

Tier 1 and Tier 2 automotive suppliers are positioned for dynamic growth, leveraging quantum-powered supply chain and manufacturing solutions.

Key players include Capgemini Group, ColdQuanta, Honeywell International, Google (Alphabet), AWS, Intel, IBM, IonQ, Isara Corporation, and ORCA Computing.

High M&A activity as leading automakers and tech companies vie for quantum expertise.

Revenue Breakdown

YearGlobal Market Value [USD Million]Asia Pacific Value [USD Million]2024$333.33$136.672025$453.34$185.872034$6,462.13$2,681.79

AI Supercharges Quantum Progress: The Next Frontier

Quantum computing and artificial intelligence are forming a powerhouse partnership in the automotive sector. AI-driven quantum algorithms are enabling manufacturers to run ultra-fast, highly accurate simulations—from molecular-level battery design to the optimization of self-driving systems. This collaboration isn’t just theoretical; real-world breakthroughs are surfacing rapidly.

For example, quantum-enhanced predictive analytics are helping automakers anticipate supply chain disruptions, optimize production scheduling, and fine-tune autonomous vehicle perception. By merging quantum’s computational might with AI’s learning capacity, the industry is on track for smarter, safer, and more sustainable mobility.

What’s Driving Growth in Quantum Automotive Innovation?

Electric and Hybrid Vehicle Surge: Soaring sales of EVs and HEVs create critical demand for complex battery management, vehicle design, and energy efficiency fields where quantum’s speed and accuracy are unrivalled.

Autonomous Driving Advance: Quantum computing powers ultra-fast data analysis for LIDAR, RADAR, and vision sensors, drastically improving self-driving vehicle safety and performance.

Supply Chain Optimization: Automotive suppliers are embracing quantum-powered logistics, achieving major cost and efficiency gains in inventory and production management.

Strategic Partnerships: Top automotive giants are teaming with quantum experts to accelerate innovation—see Capgemini-Renault, Volkswagen-IBM, Ford-Google, Toyota, and Daimler AG-ColdQuanta collaborations.

Government & R&D Investment: Asia Pacific governments, universities, and leading businesses are investing heavily in quantum, fueling development and adoption.

Opportunity & Trend: Where Will Quantum Take Automotive Next?

“Which New Use-Cases Will Define Tomorrow’s Automotive Quantum Market?”

Automotive companies are asking: What are the game-changing opportunities as quantum capability expands? Rapid simulation for advanced battery chemistries, real-time sensor fusion in autonomous vehicles, and quantum-secure data transmission are emerging as top priorities.

Quantum machine learning is already improving traffic management, object recognition, and cybersecurity. As quantum hardware and software mature, expect a cascade of new applications—from personalized mobility to intelligent vehicle networks.

Regional Leadership

Asia Pacific stands as the quantum automotive leader. Chinese, Japanese, and South Korean initiatives have set the pace, attracting top talent and global investment.

Segmentation Analysis

By Component

The market is divided into hardware, software, and services. The software segment holds the largest share, as quantum algorithms tailored for automotive applications are crucial for optimizing vehicle design, manufacturing, supply chain management, and autonomous systems. Innovative software solutions are central to unlocking the potential of quantum hardware for the automotive sector.

By Application

Key applications include vehicle design, manufacturing, supply chain optimization, autonomous driving, and especially routing and traffic management. Routing and traffic management represents the largest segment, due to the urgent need to reduce congestion, lower emissions, and improve transportation efficiency via complex data-driven optimization.

By Deployment

The cloud-based quantum computing segment dominates, enabling automotive firms to access scalable quantum resources without heavy investments in physical infrastructure. Cloud models allow for cost-effective, flexible experimentation, development, and collaborative research, accelerating innovation cycles.

By Stakeholders

The market’s fastest growth is in Tier 1 and Tier 2 automotive suppliers, who can use quantum computing for advanced process simulation, quality control, and supply chain optimization. OEMs, suppliers, and technology providers are forming partnerships to leverage quantum advances across the industry

Latest Breakthroughs from Leading Companies

Recent industry highlights:

Capgemini and Renault’s quantum partnership is unlocking next-gen vehicle design.

Volkswagen’s research lab, launched with IBM and IonQ, is pioneering quantum-powered autonomous vehicles.

Toyota’s targeted investment focuses on quantum for advanced driving technology.

Ford and Google are exploring quantum materials for batteries.

Daimler AG and ColdQuanta are developing quantum sensors for vehicle navigation and safety.

Top quantum automotive companies:

Capgemini Group, ColdQuanta, Honeywell International, Google (Alphabet), Amazon Web Services, Intel Corporation, IBM, IonQ, Isara Corporation, ORCA Computing Limited.

Facing the Challenges

Investment & Cost: High initial investment in quantum hardware and software slow wider adoption.

Talent Gap: Shortage of quantum-trained engineers remains a substantial bottleneck.

Security & Regulations: Data security and evolving global standards around autonomous systems introduce complexity and uncertainty.

Transition from Classical Computing: Quantum’s adoption is hindered by the capabilities of classical systems, though hybrid approaches are becoming common.

Case Study: Tier Supplier Revolutionizes Production

A leading Tier 1 supplier embraced quantum algorithms for production scheduling, enabling atomic-level process optimization. This cut defect rates and improved cost-efficiency meeting EV manufacturers’ strict quality requirements faster than ever before.