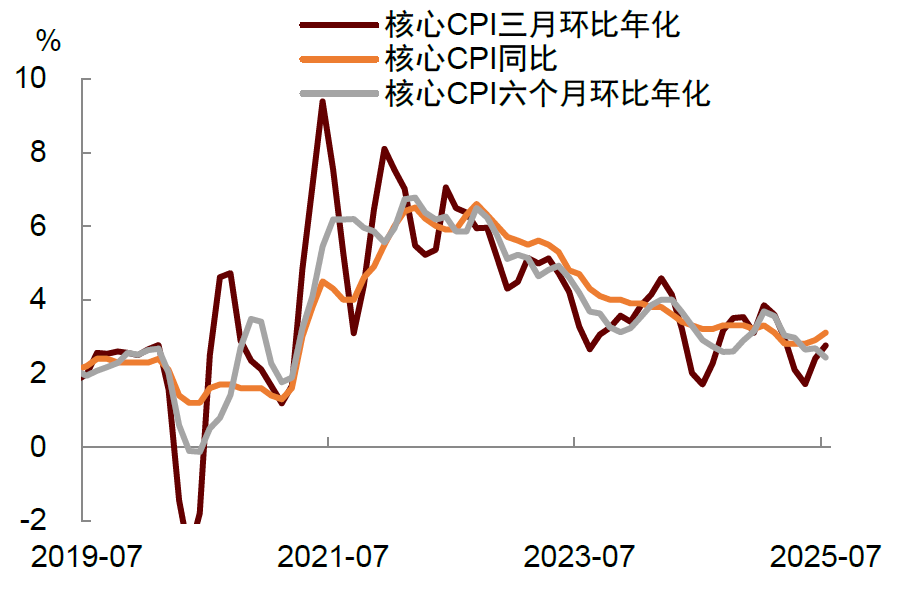

CICC stated that for the Federal Reserve, the core CPI has not converged toward the 2% target but has instead risen back above 3%, moving further away from the target. This may increase internal disagreements within the Fed, making it difficult to reach a consensus on policy decisions.

According to CICC’s research report, the US core CPI in July increased by 0.3% month-over-month on a seasonally adjusted basis, and rose from 2.9% to 3.1% year-over-year, exceeding market expectations; the overall CPI increased by 0.2% month-over-month and remained at 2.7% year-over-year, slightly below expectations. In terms of individual components, inflation in July showed a pattern of moderate goods inflation and a rebound in services: tariff costs are still being passed on to consumers, but some prices have also declined. Some previously falling service prices have turned to increases, adding to the stickiness of inflation. We maintain our previous view that US inflation will enter a phase of structural upward pressure. For the Federal Reserve, the core CPI is not converging towards the 2% target, but has returned to above 3%, moving further away from the target. This may increase internal disagreements within the Fed, making it difficult to reach a consensus on policy decisions. The uncertainties in the monetary policy path will significantly increase, leading to greater market volatility.

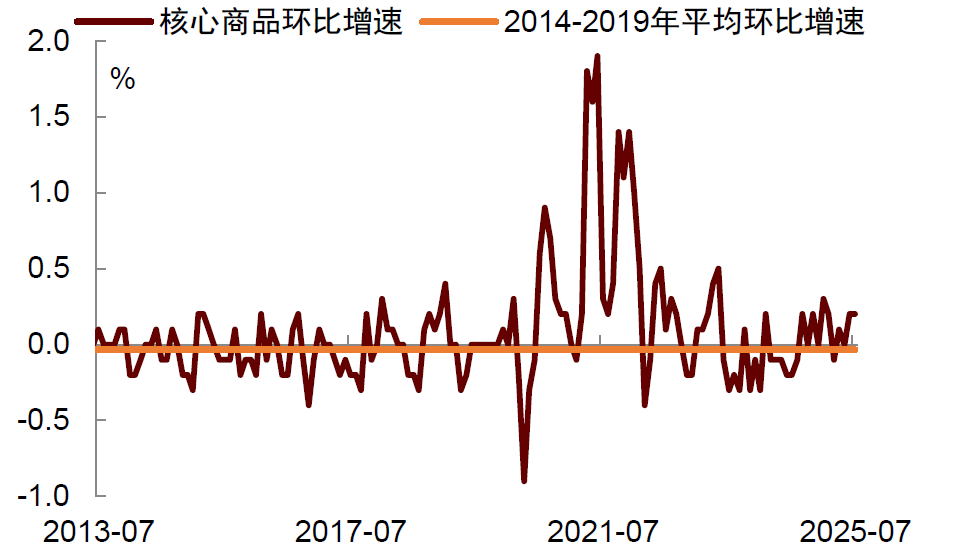

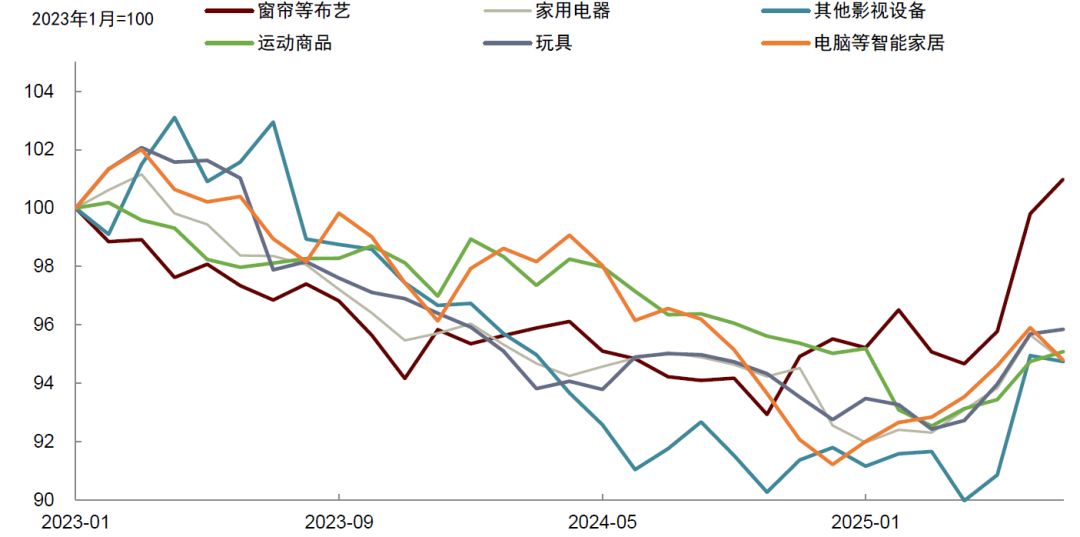

Inflation in July showed a pattern of moderate goods inflation and a rebound in services. On the goods side, tariff costs are still being passed on to consumers, but some prices have also declined. The core goods price index increased by 0.2% month-over-month on a seasonally adjusted basis, the same as last month. Among these, furniture and bedding (up 0.9% month-over-month), curtains (up 1.2%), audio-visual equipment (up 0.8%), and photographic equipment (up 2.1%) continued to show high growth rates, indicating the ongoing pass-through of tariff costs. However, some items that had previously seen strong increases weakened in July, such as household appliances (-2.2% month-over-month), men’s clothing (-1.3%), over-the-counter drugs (-0.5%), and computers (-2.6%).

Car prices, which had not risen before, showed signs of increasing in July. Used car prices rebounded to a 0.5% month-over-month increase, while new car prices stopped declining, and the price of automotive parts accelerated to 0.9% month-over-month. This trend aligns with the risks highlighted by CICC: car manufacturers and dealers had previously absorbed the cost impact of tariffs by compressing their margins, but as tariffs become institutionalized and normalized, this absorption space will shrink. As 2026 model cars are introduced, automakers may pass on these costs through higher prices (as discussed in ‘The US Economy Faces Quasi-Stagflation’).

Car prices, which had not risen before, showed signs of increasing in July. Used car prices rebounded to a 0.5% month-over-month increase, while new car prices stopped declining, and the price of automotive parts accelerated to 0.9% month-over-month. This trend aligns with the risks highlighted by CICC: car manufacturers and dealers had previously absorbed the cost impact of tariffs by compressing their margins, but as tariffs become institutionalized and normalized, this absorption space will shrink. As 2026 model cars are introduced, automakers may pass on these costs through higher prices (as discussed in ‘The US Economy Faces Quasi-Stagflation’).

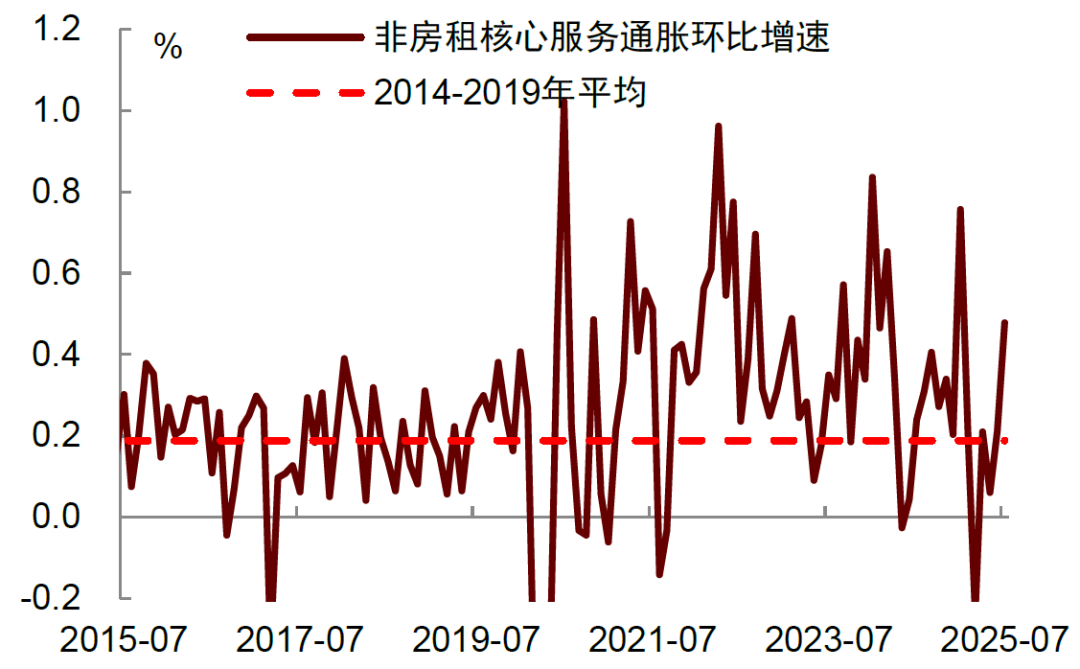

On the services side, some previously falling prices have turned to increases, adding to the stickiness of inflation. The supercore services price index, which excludes rent and is closely watched by the Federal Reserve, increased by 0.5% month-over-month, a significant acceleration. The most notable component was the rebound in airfare prices, which surged by 4% month-over-month. This suggests that the weak travel activity seen earlier in the year may be stabilizing, consistent with the statements made by Delta and other airlines in their second-quarter reports [1]. Additionally, prices for motor vehicle maintenance (+1.2%), motor vehicle repair (+0.8%), medical care (+0.8%), entertainment services (+0.4%), and courier services (+2.0%) continued to rise. Overall, the stickiness in service inflation remains.

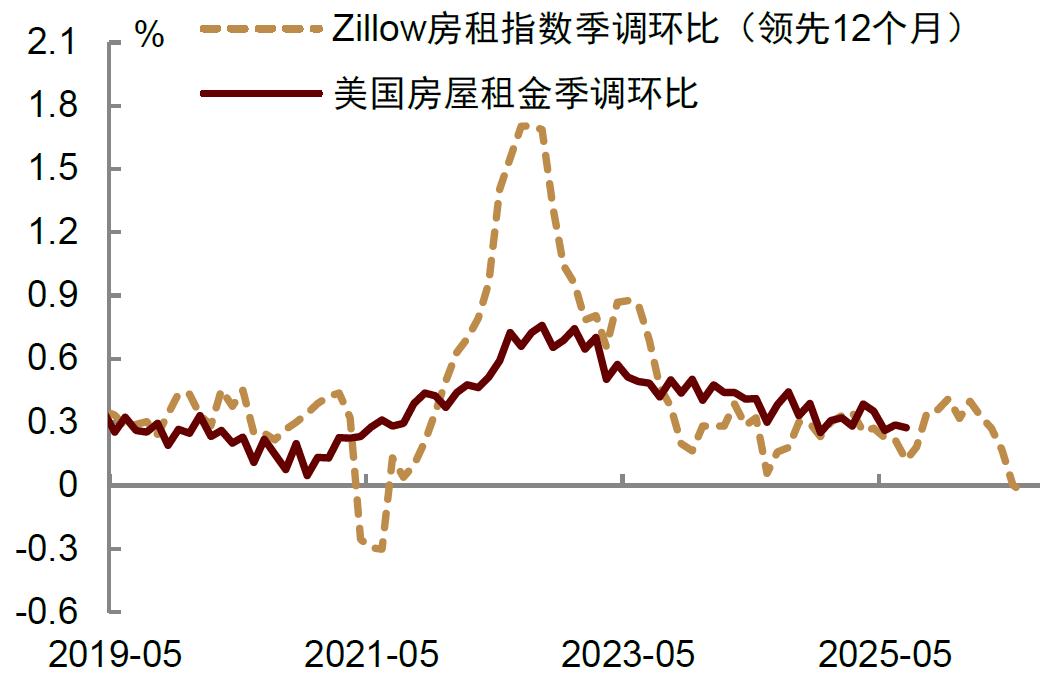

In other areas, food (0% month-over-month) and energy (-1.1% month-over-month) price growth slowed significantly compared to the previous month, helping to reduce the pressure on the overall CPI from the rebound in the core CPI. Rent inflation remained relatively stable, with the primary residence rent index rising slightly from 0.2% to 0.3% month-over-month, and the owners’ equivalent rent index remaining at 0.3%. The path of rent inflation is consistent with the trends shown by the forward-looking Zillow data.

Overall, the July CPI data did not change CICC’s assessment of the US inflation trajectory— inflation will enter a phase of structural upward pressure. As the effects of tariff cost pass-through become more evident in the coming months, core goods inflation will face further upward risks; at the same time, rent and service inflation may remain relatively mild but will also exhibit stickiness. In summary, the year-over-year growth rate of the core CPI is expected to rise further by the end of the year (refer to the report ‘The US Economy Faces Quasi-Stagflation’).

For the Federal Reserve, this CPI report does not provide a clear direction. On one hand, the pass-through of tariffs to retail prices has not been as severe as previously feared, temporarily alleviating concerns about the impact of tariffs; on the other hand, service inflation, which is not affected by tariffs, is rebounding, exacerbating the Fed’s concerns about sticky inflation. From a trend perspective, core CPI inflation is not converging towards the 2% target but is instead returning above 3%, moving further away from the target. In this context, more cautious officials within the Fed may continue to maintain a conservative stance. In other words, the debate over whether to cut interest rates will not be resolved, and divisions among officials may persist.

This division also means that the variability in the monetary policy path will significantly increase. In an environment where employment momentum is weakening and inflation pressures coexist, the Fed may find it difficult to reach a consensus on the policy path. The current economic data, characterized by alternating periods of stagnation and inflation, will make it more challenging for the Fed to provide early guidance on rate cuts. Although the market has already fully priced in a rate cut in September and expects three cuts by the end of the year, this pricing may underestimate the complexity of the macroeconomic situation. Whether the Fed ultimately chooses to cut rates or stand pat, it may face internal dissent. For the market, this often means higher volatility, with asset prices more likely to fluctuate under the influence of economic data and official remarks.

Chart 1: U.S. core CPI rebounded in July, exceeding market expectations

Source: Haver, CICC Research

Chart 2: Core goods inflation remains relatively subdued month-over-month

Source: Haver, CICC Research

Chart 3: Key components of core goods have seen significant price increases since the beginning of the year

Source: Haver, CICC Research

Chart 4: Non-housing core services inflation rebounded to 0.5% month-over-month

Source: Haver, CICC Research

Chart 5: The month-over-month increase in major housing inflation remained at 0.3%

Note: The housing rental item is calculated as the weighted average of the owner’s equivalent rent and the rent of the primary residence, expressed as a month-over-month growth rate.

Source: Haver, CICC Research