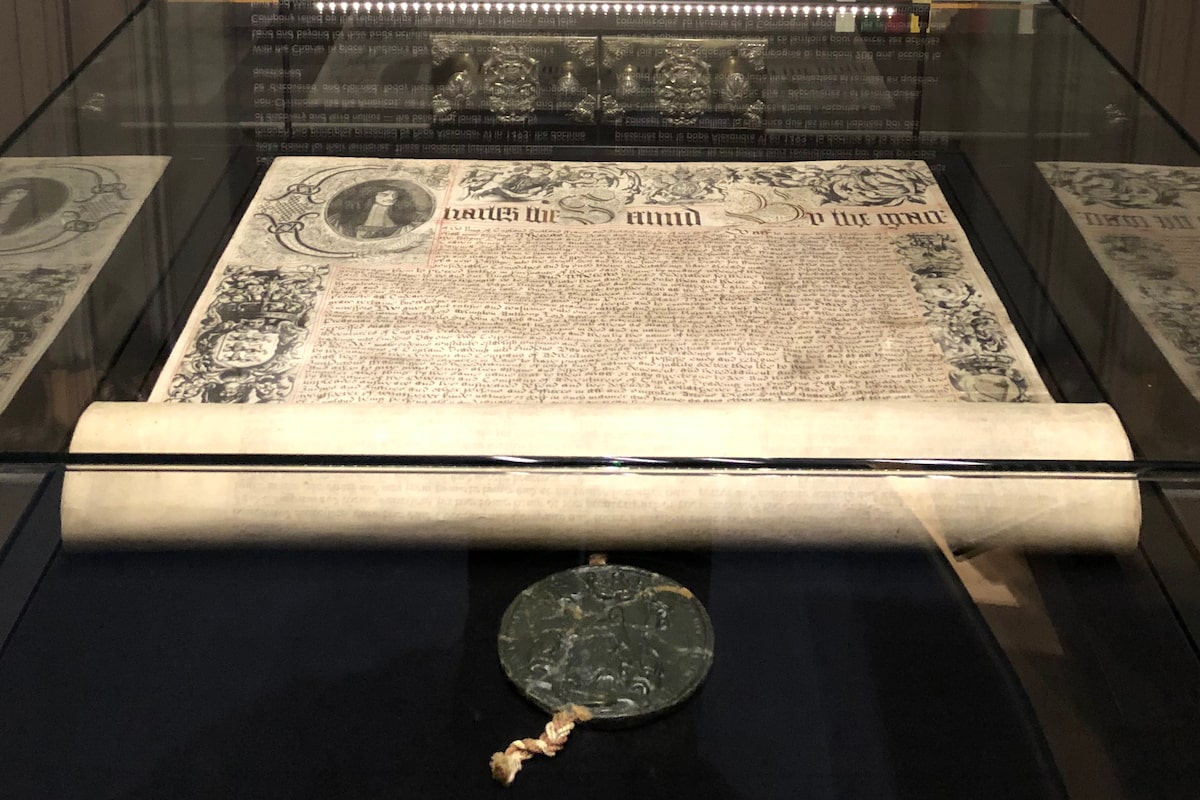

The 1670 charter signed by King Charles II that established Hudson’s Bay on display at the Manitoba Museum. Canadian businessman David Thomson has offered to buy the charter for at least $15-million and donate it to the Archives of Manitoba.HO/The Canadian Press

Canadian businessman David Thomson has stepped forward to express interest in buying the 1670 charter that launched the Hudson’s Bay Company – a foundational document in the history of the country – and donating it to the Archives of Manitoba.

He would pay at least $15-million, according to a filing with the Ontario Superior Court of Justice on Thursday – an amount that would exceed the $12.5-million offered by another of Canada’s wealthiest families, the Westons, who have declared their intention to donate the document to the Canadian Museum of History.

Mr. Thomson’s offer would come from DKRT Family Corp., his personal family holding company, according to the filing. (The Woodbridge Co. Ltd., another holding company and primary investment vehicle for the Thomson family, owns The Globe and Mail.) The company is also willing to submit bids higher than $15-million should the document go to auction, the filing says.

Weston family sought to avoid auction in bid for Hudson’s Bay charter

Opinion: The value, and values, of the HBC charter

The Weston deal, first announced earlier this month, still requires court approval. But as The Globe and Mail has previously reported, First Nations groups and cultural organizations have raised concerns about the transparency of the process being pursued by those overseeing the deal, which would result in the charter being sold to Weston family holding company Wittington Investments Ltd. without a public auction.

“I believe that it is possible to design policies and procedures for the art auction that provide appropriate protection to the Royal Charter considering its special importance to Canada’s history, and I am concerned about the lack of transparency in the process that has led to the proposed sale currently before the court,” Patrick Phillips, a director of DKRT, stated in an affidavit filed on Thursday.

The Hudson’s Bay charter carries unique significance to Canadian history. Carrying the royal seal of King Charles II, it granted the company a monopoly over trading rights in a vast swath of territory comprising roughly one-third of what is now Canada – without the consent of Indigenous people who already lived there.

The Globe and Mail first revealed in April that the charter had been advertised to potential bidders for the assets of Hudson’s Bay. Hobbled by a financial crisis, Canada’s oldest retailer filed for court protection from its creditors in March, but was unable to secure a plan for its future. All of the department stores across the country have now gone dark, and the company – which no longer goes by the name Hudson’s Bay following a sale of its intellectual property to Canadian Tire Corp. Ltd. – is in the process of winding up the business.

The Westons’ holding company approached Reflect Advisors LLC, the advisory firm overseeing the sale process, with an unsolicited bid for the charter, according to court documents. Wittington also expressed the opinion that the document should not be sold at auction, and suggested that it might not be prepared to participate in such a process. Hudson’s Bay then brought the offer before the court for approval.

The court set a deadline of Aug. 21 for any parties, including those who might oppose the deal, to make submissions regarding the sale of the charter. A hearing into the Wittington deal has been scheduled for Sept. 9.

News of the deal took other potential bidders by surprise, because Reflect had informed them that it would not accept offers in advance of the auction.

“I believe that the public was entitled to rely on the auction process as publicly announced,” the affidavit states. “Both David and I did so rely.”

The Thomson family has a personal connection to Hudson’s Bay: David Thomson’s late father, Kenneth Thomson, acquired a majority stake in the retailer in 1979. The affidavit notes that David Thomson also once worked as a store manager at The Bay in Toronto’s Cloverdale Mall, was later appointed director of licence departments for the stores, and was president of Simpsons Ltd. from 1988 to 1990. The family eventually sold its shares, and has held no interest in HBC since 1997.

Despite the connection, Mr. Thomson has no plans to hold the charter in a private collection, the affidavit states. The deal would donate the document to the Archives of Manitoba, which already houses the rest of the HBC archives, following a donation in 1994.

“DKRT respectfully suggests that the Royal Charter find its permanent home in Manitoba, where it will reflect the roots of HBC and its significance in the history of Western Canada, and where it can be most accessible to the places and peoples, including Indigenous groups, whose histories are most directly intertwined with that of HBC,” the affidavit states.

The court filing also included a letter from Manitoba Premier Wab Kinew, supporting that plan.

“The Charter is of national significance and should be preserved in a public institution so that it is accessible for generations to come,” Mr. Kinew wrote in the letter submitted to the court. “Ensuring that it stays in a part of the country so profoundly influenced by the charter as Manitoba, and alongside the rest of the company archives, will create the maximum opportunity for future generations to understand its historical significance and context.”

The bid would also provide for an additional donation of at least $2-million to support “consultation with Indigenous groups; collaborations with museums, archives, and other cultural institutions; and the sharing of the Royal Charter across Canada to maximize public access, as long as the Royal Charter, in the opinion of qualified experts, is not physically jeopardized in the process,” according to the affidavit, which added that a larger donation would be considered if needed to fund such initiatives.

The Wittington deal also included a commitment for an additional donation of $1-million to support similar consultation and sharing of the document with other institutions.

The affidavit suggests that the Wittington deal should not be withdrawn, but should be considered a “reserve bid” while the matter proceeds to an open auction.

“Given its unprecedented significance to Canada, I believe that a fair, transparent and open auction of the Royal Charter, accompanied by a companion donation in the manner I have proposed, would maximize the value of the Royal Charter for the benefit of the creditors of HBC, and it would preserve the Royal Charter for public display in a manner which preserves its unrivalled historic significance for all Canadians,” the affidavit states.