Lopsided market dynamics favor healthcare workers over others at the moment, concentrating job growth in a handful of sectors and leaving many workers on the outside looking in.

Key points:

Job postings are elevated compared to pre-pandemic levels in a small majority (54%) of sectors analyzed by Indeed, but overall job growth has been concentrated in just a handful of sectors that are typically female-dominated.

The US added 3.5 million jobs between July 2023 and July 2025, a two-year growth rate of just 2.3% — the lowest such rate in a decade (excluding the volatile Covid-19 period).

Of the 3.5 million jobs added over the past two years, more than 38% (1.35 million) have been female-held jobs in healthcare and social assistance.

Our monthly Labor Market Update examines important trends using Indeed and other labor market data. Our US Labor Market Overview chartbook provides a more comprehensive view of the US labor market. Data from our Job Postings Index — which stood 6.8% above its pre-pandemic baseline as of August 8 — and the Indeed Wage Tracker (including sector-level data) are regularly updated and can be accessed on our data portal.

US job growth fell to its lowest two-year rate in a decade in July (outside of the volatile pandemic period). What growth there has been over the past couple of years has been concentrated in just a handful of sectors — notably healthcare and social assistance — that are typically female-dominated.

Of the 3.5 million jobs added nationwide between July 2023 and July 2025, 1.35 million of them (more than 38%) have been female-held jobs in healthcare and social assistance, according to a Hiring Lab analysis of data from the Bureau of Labor Statistics. This super-concentrated growth among a single demographic in a single industry underscores the uneven nature of the post-pandemic jobs recovery and the unequal distribution of opportunities in the current labor market. Conditions look significantly different for those workers who currently have a job and/or those working in the most in-demand sectors (like healthcare) than those stuck on the outside looking in at these lopsided dynamics.

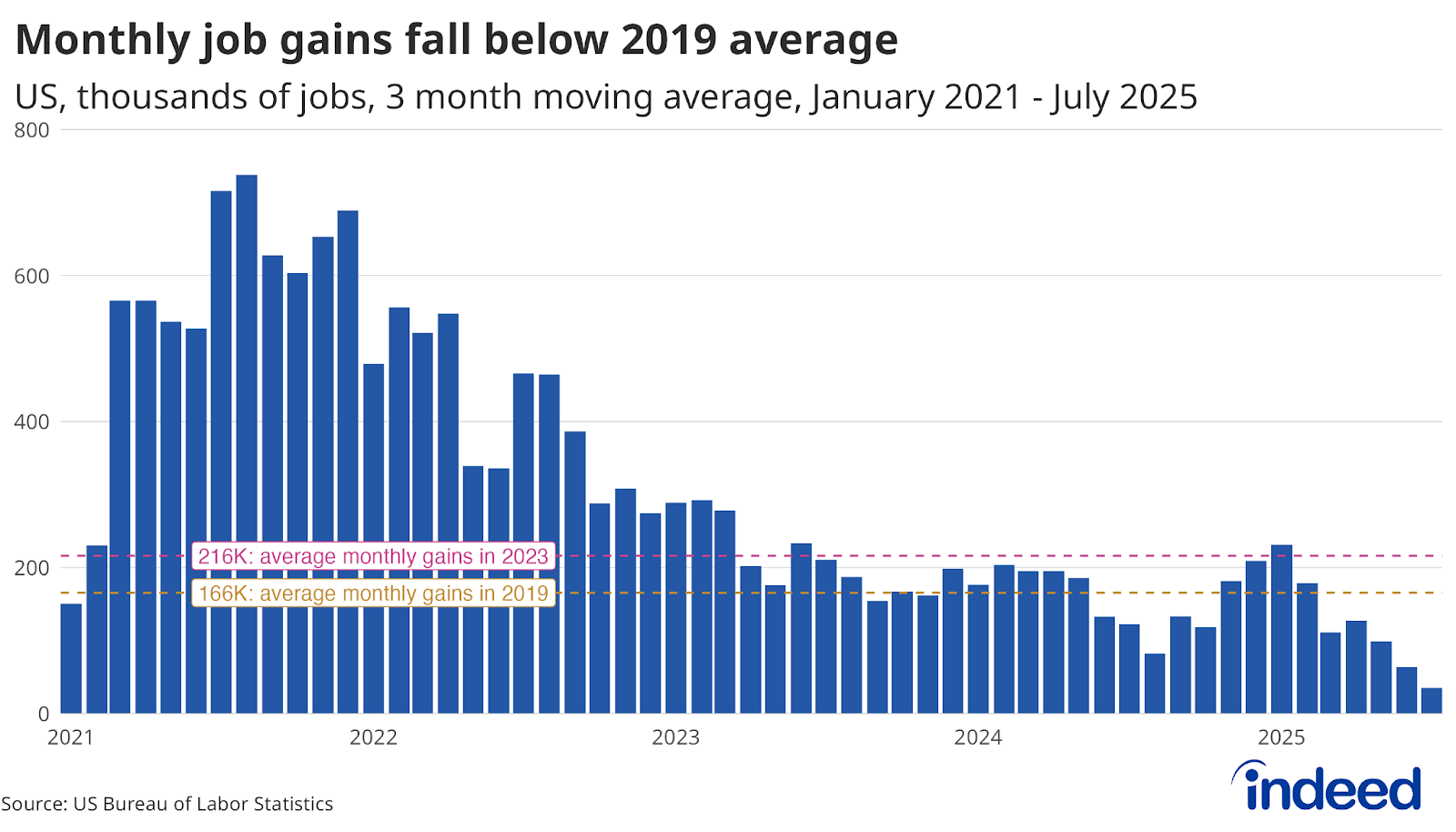

Following a remarkable streak of expansionary job reports spanning from mid-2020 through 2024, the labor market has taken a turn in 2025. Monthly job growth in the post-pandemic period has nearly always exceeded 100,000 — higher than what is needed to keep pace with population growth and keep unemployment steady. However, on average, over the past three months, estimated monthly job growth fell to around 35,000, a distressingly low level that, if continued, is likely to translate into higher unemployment going forward.

Bar chart titled “Monthly job gains fall below 2019 average” shows the three-month moving average of US payroll employment job gains. After a sharp increase between 2021 and 2023, the three-month moving average began to settle, with an average monthly gain of 216,000 jobs in 2023. Average monthly gains have fallen considerably in 2025 and have been below the 2019 average of 16,000 since the beginning of the year.

Bar chart titled “Monthly job gains fall below 2019 average” shows the three-month moving average of US payroll employment job gains. After a sharp increase between 2021 and 2023, the three-month moving average began to settle, with an average monthly gain of 216,000 jobs in 2023. Average monthly gains have fallen considerably in 2025 and have been below the 2019 average of 16,000 since the beginning of the year.

It’s tempting to describe the decline in job growth this year as a “return to normal,” where labor supply and demand are largely balanced after years of pandemic-related distortions. But a closer look at the data shows that there’s more to the story. Instead of achieving balance, recent jobs reports have indicated strong growth in a limited number of sectors, while others face either stagnation or outright declines.

This transition really began about two years ago in mid-2023, when the monthly number of jobs added began to regularly slip below 250,000. This represented a distinct downshift from the red-hot jobs numbers of the immediate post-COVID era, when the market was regularly adding 400,000 or even 500,000+ jobs per month. From July 2023 through July 2025, the US labor market added 3.5 million jobs, representing a two-year growth rate of 2.3%. Outside of the volatile COVID period, this is the lowest two-year growth recorded over the past decade.

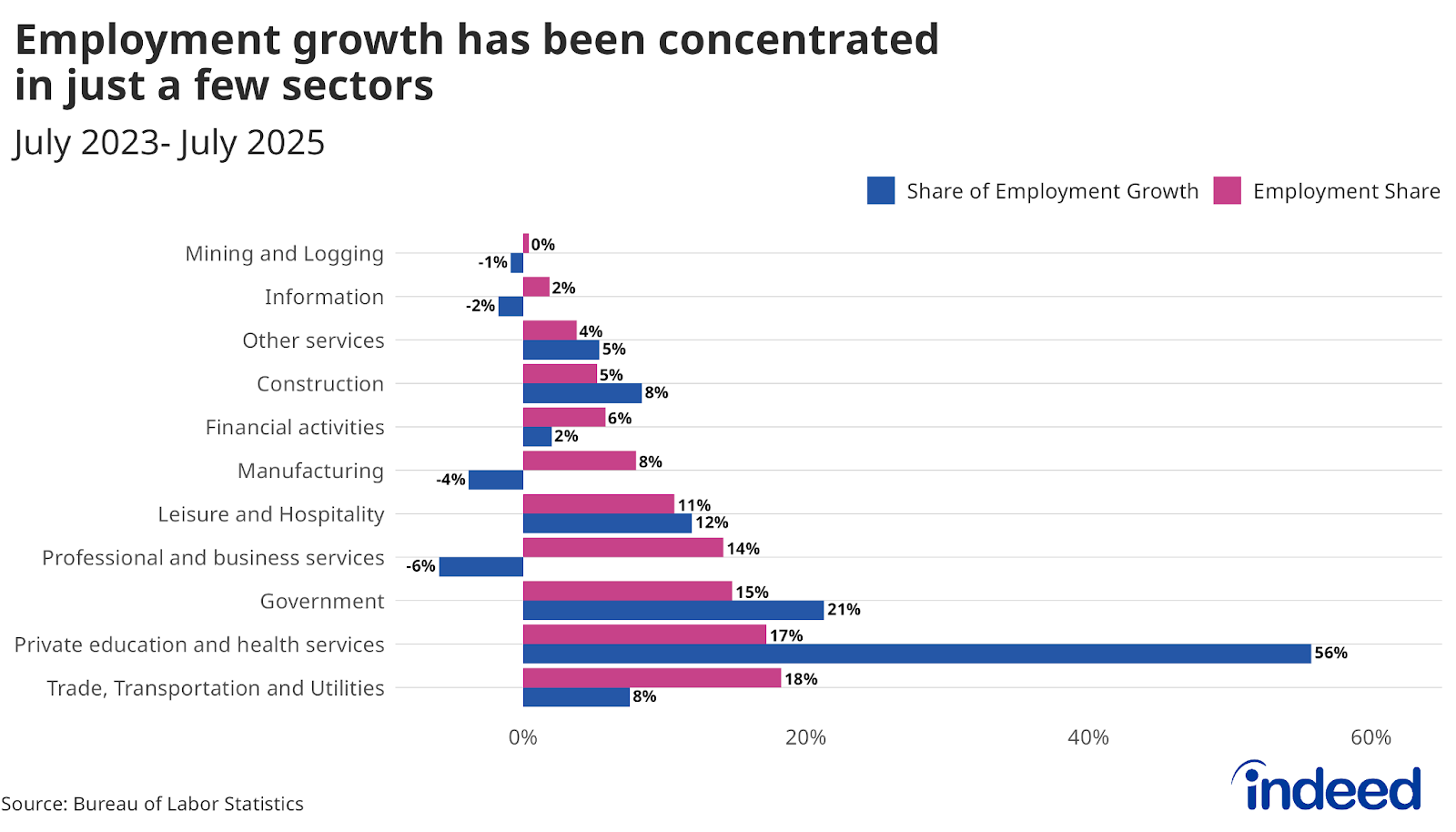

Additionally, the growth that has occurred during this time has not been evenly distributed across sectors, with some experiencing impressive growth while others have contracted. For example, employment in the private education and health services sector grew 7.7% while employment fell in the business and professional services, information, manufacturing, and mining and logging sectors, to varying degrees.

Bar chart titled “Employment growth has been concentrated in just a few sectors” shows the share of overall employment and the share of employment growth between July 2023 and July 2025 for each broad employment sector. Most sectors have seen growth shares that lag their share of overall employment. The exceptions are other services, construction, leisure and hospitality, government, and private education and health services, the latter accounting for 17% of employment and 56% of all employment growth.

Bar chart titled “Employment growth has been concentrated in just a few sectors” shows the share of overall employment and the share of employment growth between July 2023 and July 2025 for each broad employment sector. Most sectors have seen growth shares that lag their share of overall employment. The exceptions are other services, construction, leisure and hospitality, government, and private education and health services, the latter accounting for 17% of employment and 56% of all employment growth.

Over the past two years, a few sectors have experienced employment growth exceeding their overall employment share. For example, while construction workers represent just 5% of all workers nationwide, growth in the construction sector has represented 8% of all jobs added since July 2023. Still, no other sector compares to the growth observed in the private education and health services sector. Of the 3.5 million jobs added between July 2023 and July 2025, a comfortable majority (1.9 million) were in the private education and health services sector, and almost all of those jobs — some 1.8 million — were added just within the healthcare and social assistance subsector. As of July 2025, this subsector accounted for just 14.7% of all jobs in the United States. But over the past two years, it has accounted for a whopping 51.9% of all job growth. This is a notable increase from the preceding two-year period running from July 2021 to July 2023, during which healthcare and social assistance accounted for only 15% of employment growth, much more in line with its share of overall employment.

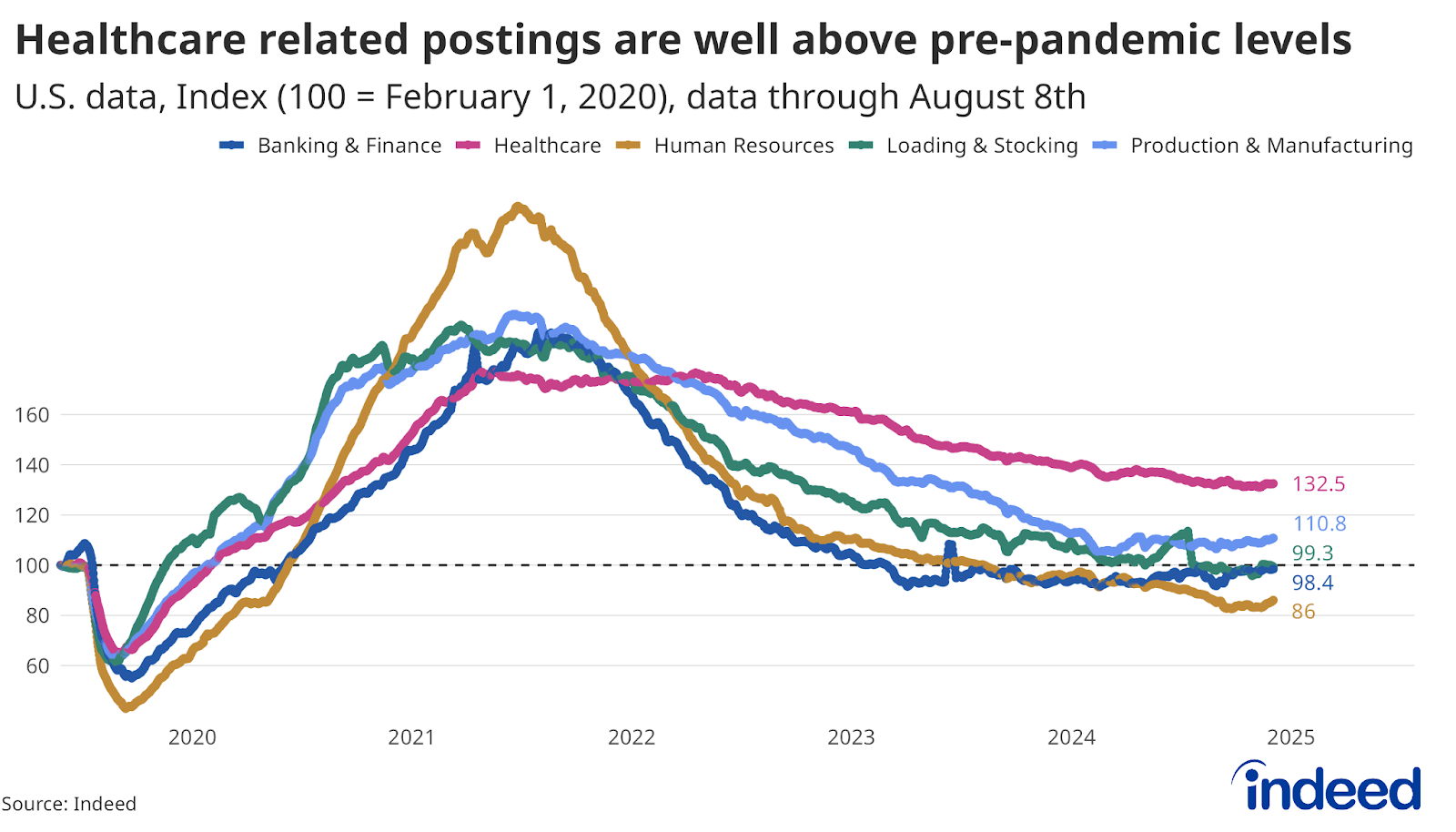

Indeed data mirrors the publicly available payroll employment data. Job postings for healthcare positions — a marker of employer demand — remain elevated at 32.5% above pre-pandemic levels. Job postings are especially elevated for physicians and surgeons and therapy positions, with demand for both currently more than 80% higher as of early August than it was in February 2020. And even where demand is fading somewhat in the healthcare industry, it remains red-hot relative to pre-pandemic norms. Postings for nursing positions, for instance, have declined more than any other healthcare job in recent months, but still remain more than 15% higher than pre-pandemic levels.

Line chart titled “Healthcare-related postings are well above pre-pandemic levels” shows the Indeed Job Posting Index for five sectors: Banking & Finance, Healthcare, Human Resources, Loading & Stocking, and Production & Manufacturing. JPI for each sector is shown from February 2020 to August 2025, and each is indexed to equal 100 in February 2020. Healthcare postings remain 32.5% above February 2020 levels and are considerably higher than the other sectors.

Line chart titled “Healthcare-related postings are well above pre-pandemic levels” shows the Indeed Job Posting Index for five sectors: Banking & Finance, Healthcare, Human Resources, Loading & Stocking, and Production & Manufacturing. JPI for each sector is shown from February 2020 to August 2025, and each is indexed to equal 100 in February 2020. Healthcare postings remain 32.5% above February 2020 levels and are considerably higher than the other sectors.

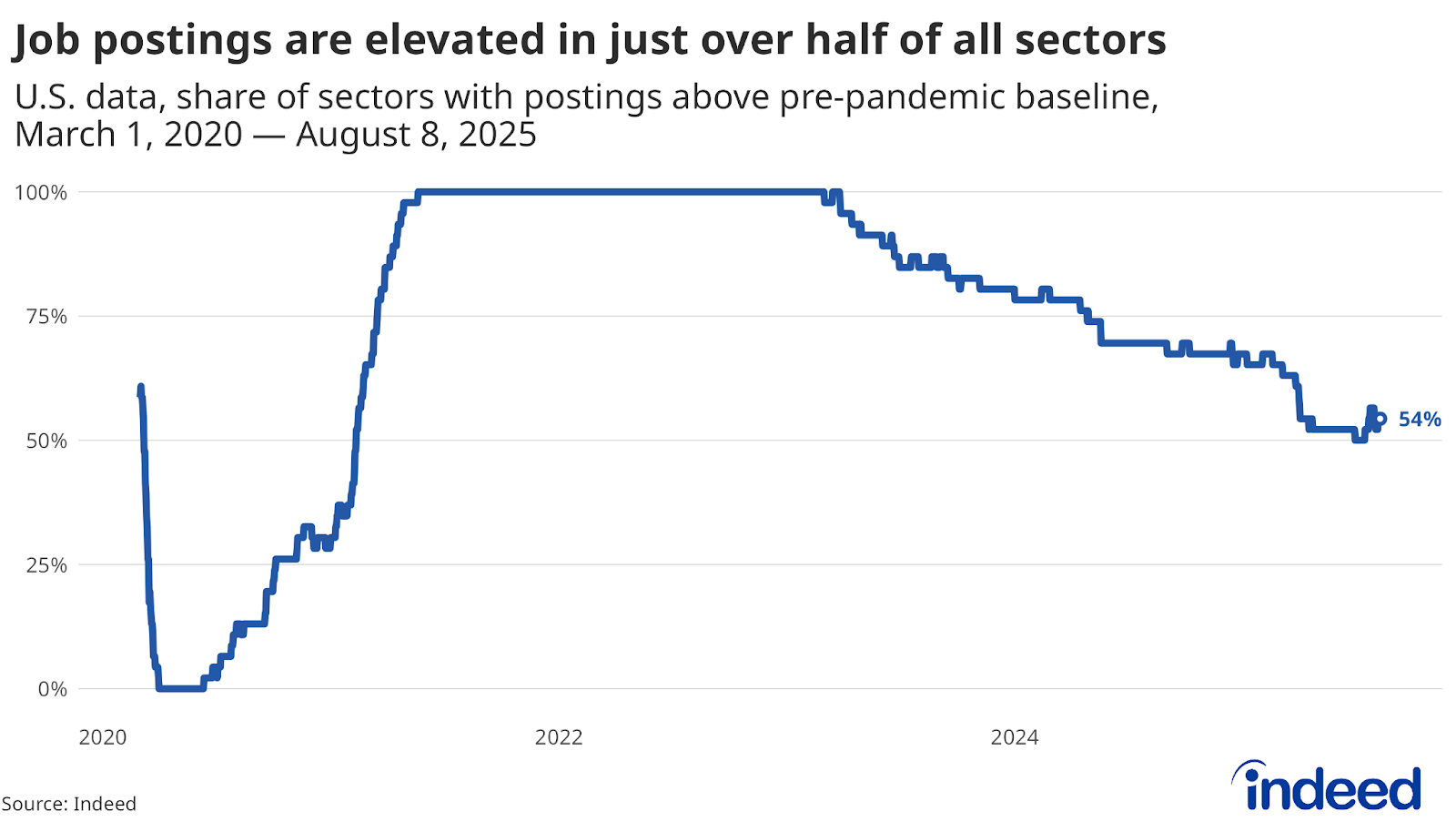

Postings for jobs in many sectors outside of healthcare, including human resources, banking & finance, and loading & stocking, are all lower than pre-pandemic levels. Employment growth in these sectors has also been weak, according to the payroll employment data. Overall, demand is higher than pre-pandemic norms in around half (54%) of all sectors tracked by Indeed. Even with 46% of sectors declining to below pre-pandemic levels, the overall aggregate level of job postings on Indeed remains more than 6% higher than pre-pandemic levels. This offers further proof of a market being held up in the aggregate by the strong performance of just a handful of segments.

Line chart titled “Job postings are elevated in just over half of all sectors” shows the share of sectors with job postings above pre-pandemic levels between February 2020 and August 2025, indexed to equal 100 in February 2020. All sectors had postings that exceeded those of February 2020 from mid-2021 until mid-2023. Since then, the share has been steadily declining, with an acceleration of that decline beginning in early 2025.

Line chart titled “Job postings are elevated in just over half of all sectors” shows the share of sectors with job postings above pre-pandemic levels between February 2020 and August 2025, indexed to equal 100 in February 2020. All sectors had postings that exceeded those of February 2020 from mid-2021 until mid-2023. Since then, the share has been steadily declining, with an acceleration of that decline beginning in early 2025.

A lopsided market, with women in the driver’s seat

Strong job gains and enduring demand for healthcare workers aren’t necessarily huge surprises. It has long been expected that healthcare jobs would continue to grow as the enormous Baby Boomer generation continued to age and require more care, and these roles have long topped the lists of fastest-growing jobs. What might be a surprise is the lopsided nature of this job growth and its implications for the gender distribution of workers.

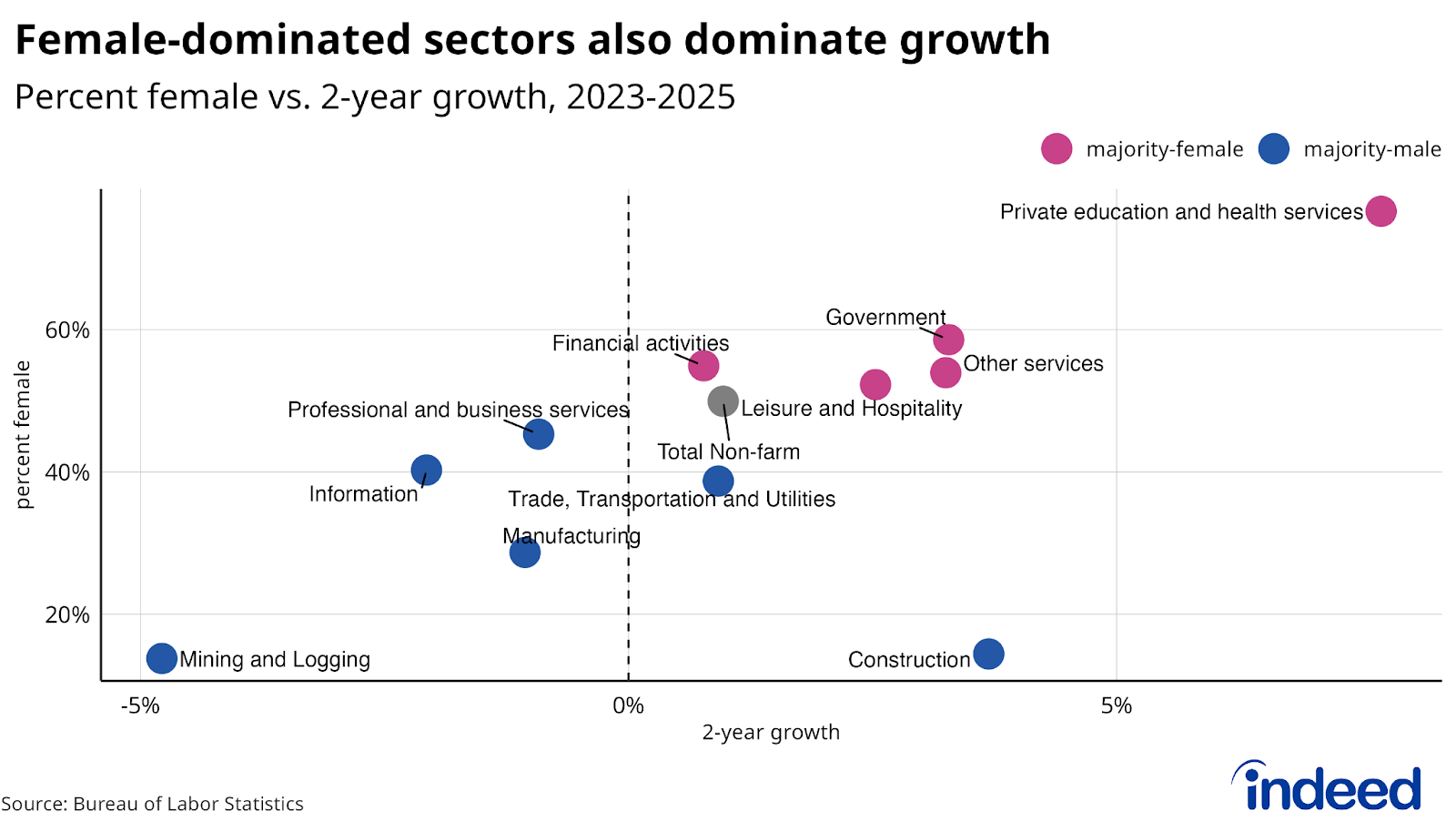

Interestingly, over the past two years, there has been a strong correlation between the percentage of female employees in a given professional sector and the payroll employment growth rate. In general, sectors with higher percentages of female employees have seen higher growth rates, the one exception being the construction sector.

Scatter plot titled “Female-dominated sectors also dominate growth” shows the 2-year employment growth rate on the x-axis, and the percentage of employees in each sector that are female on the y-axis. There is a positive relationship between the percentage of female employees and the 2-year growth rate. The one exception is the construction sector, which has a low percentage of female employees and has experienced higher-than-average employment growth.

Scatter plot titled “Female-dominated sectors also dominate growth” shows the 2-year employment growth rate on the x-axis, and the percentage of employees in each sector that are female on the y-axis. There is a positive relationship between the percentage of female employees and the 2-year growth rate. The one exception is the construction sector, which has a low percentage of female employees and has experienced higher-than-average employment growth.

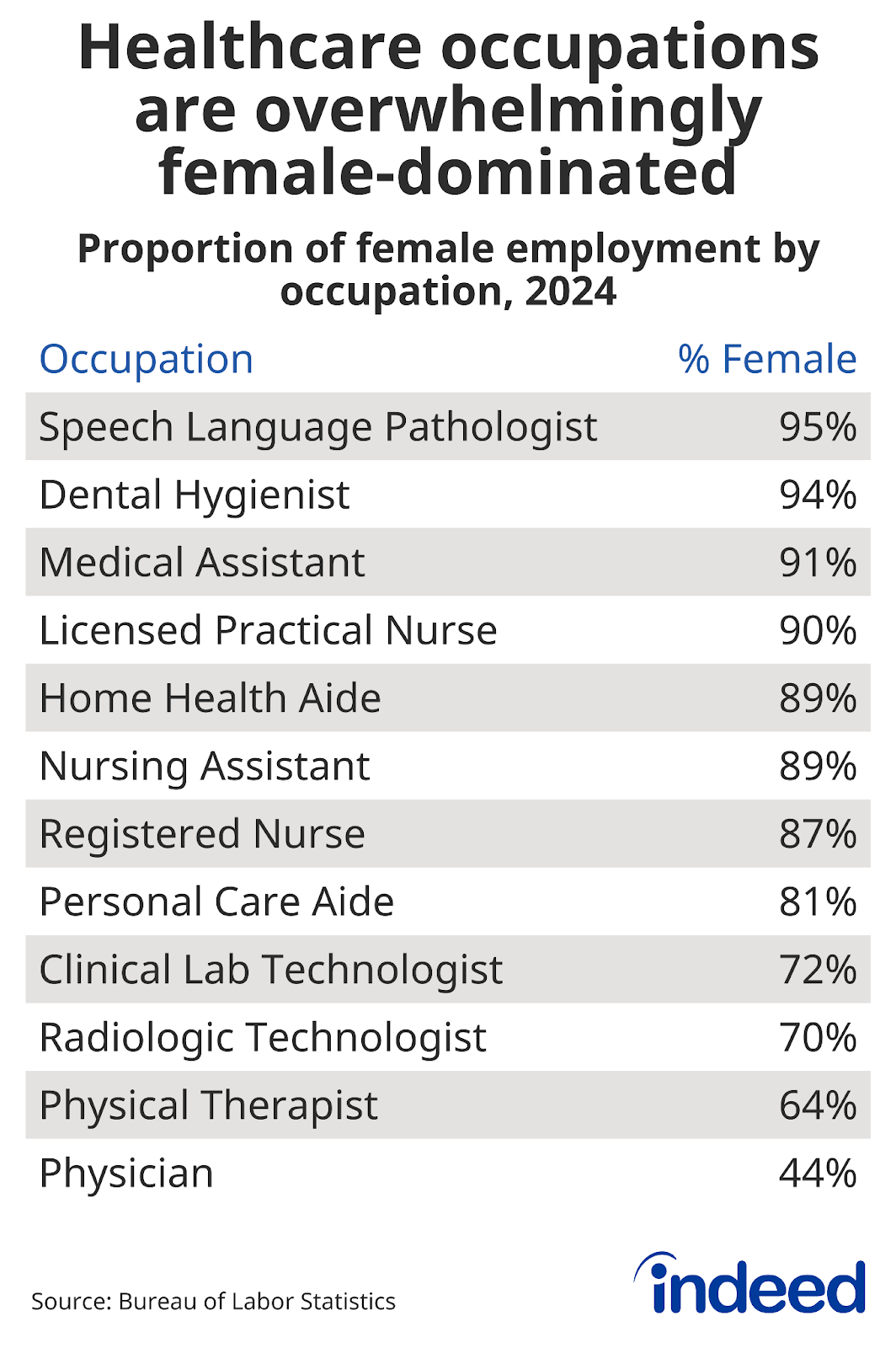

The healthcare and social assistance subsector — which has driven more than 90% of job growth overall in the broader private education and health services sector — is especially female-dominated, with women accounting for 78.9% of all employees, according to federal data. According to the 2024 Current Population Survey, many of the most common jobs in the healthcare field are significantly female-dominated, some at rates above 90%. The one exception is physicians, although the share of women physicians has grown from 36.7% to 44.5% over the past decade. Some other roles, including registered nurses, dental hygienists, and physical therapists, are slowly becoming less female-dominated, but the changes have been slight. For example, over the past decade, the share of female registered nurses fell from 90% to “only” 86.8%.

Table titled “Healthcare occupations are overwhelmingly female-dominated” shows the share of female employment in specific healthcare occupations. All are above 50% except for physicians, and almost all are above 70%.

Table titled “Healthcare occupations are overwhelmingly female-dominated” shows the share of female employment in specific healthcare occupations. All are above 50% except for physicians, and almost all are above 70%.

Because women make up such a large share of healthcare and social assistance employment, and this subsector has accounted for a majority of total job growth in the past two years, a significant share of these new healthcare jobs have been female-held positions. In fact, of the 1.8 million jobs added in the healthcare and social assistance subsector between July 2023 and July 2025, 1.35 million of them(74.1%) have been female-held jobs.

Much of this is driven by cultural norms rather than some specific need for women to have these positions. One important note is that most healthcare roles require specific training that ranges from short-term credentials (nursing assistant or phlebotomist) to a professional degree (physicians and physical therapists). Females are dominating the educational programs that train workers for these fields. For example, 87% of bachelor’s of nursing students in 2023 and 96.4% of speech-pathology master’s degree students during the 2023-24 academic year were female. This is also now true for medical school students. According to the Association of American Medical Colleges, female students accounted for 54.6% of all medical school students in 2024, having become the majority for the first time during the 2019-2020 school year.

Conclusion

The current labor market is being propped up by a narrow base of sectors, with healthcare and social assistance carrying far more weight than their overall share of employment would suggest. This highlights the uneven job growth across the broader economy, where employment growth in many sectors remains stagnant or in decline. The result is a complicated jobs landscape: Those with the skills needed to enter high-demand fields such as healthcare are experiencing robust opportunities, while others face diminishing prospects in sectors that once powered job growth.

With the Baby Boomer generation aging rapidly, demographic trends all but guarantee continued growth in healthcare employment. At the same time, economic uncertainty — from shifting tariff policies to cuts to government funding to slowing economic growth — has left many other sectors struggling. The solution isn’t for everyone to begin to work in healthcare — broader job growth will eventually return across industries. But in the near term, workers may find it advantageous to build skills tied to healthcare and social assistance, where demand shows no sign of slowing.

As the economy moves forward, it will be important to ensure that opportunities are not so narrowly concentrated that the health of the entire labor market depends on a single sector — and a single demographic — to sustain its momentum.

Methodology

Data on non-seasonally adjusted Indeed job postings are an index of the number of job postings on a given day, using a seven-day trailing average. February 1, 2020, is our pre-pandemic baseline, so the index is set to 100 on that day. Data for several dates in 2021 and 2022 are missing and were interpolated.

The number of job postings on Indeed.com, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.