Middle East Animal Genetics Market Summary

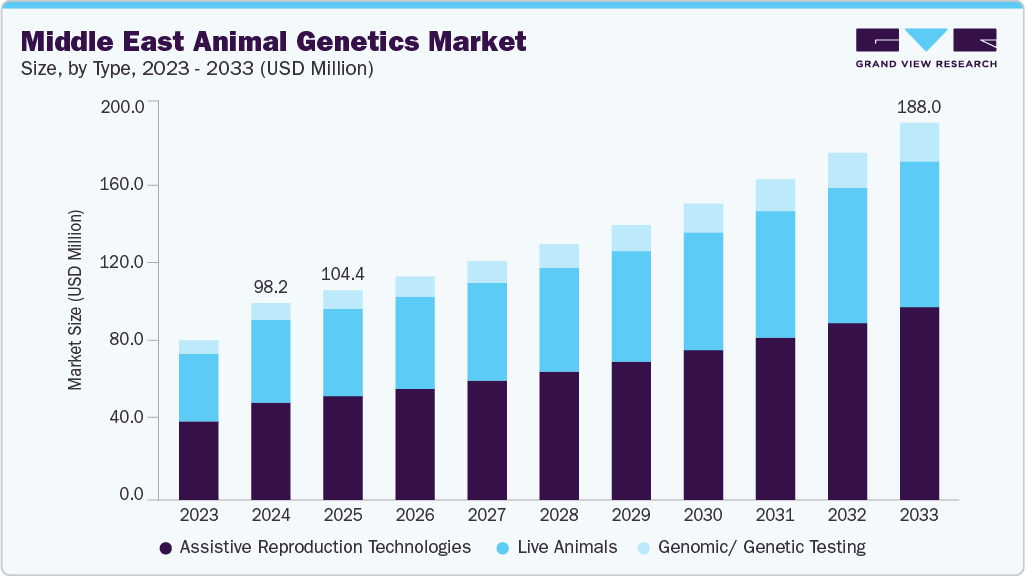

The Middle East animal genetics market size was estimated at USD 98.2 million in 2024 and is projected to reach USD 188.0 million by 2033, growing at a CAGR of 7.63% from 2025 to 2033. The market is expanding due to the rising demand for high-quality livestock production to meet increasing meat and dairy consumption, alongside strong government initiatives to improve food security and livestock productivity.

Key Market Trends & Insights

Saudi Arabia animal genetics market held the largest share of 11.02% of the Middle East animal genetics market in 2024.

By animal, cattle segment held the largest share of over 52.42% of the market in 2024.

By type, assistive reproduction technologies segment held the largest market share of 49.45% in 2024.

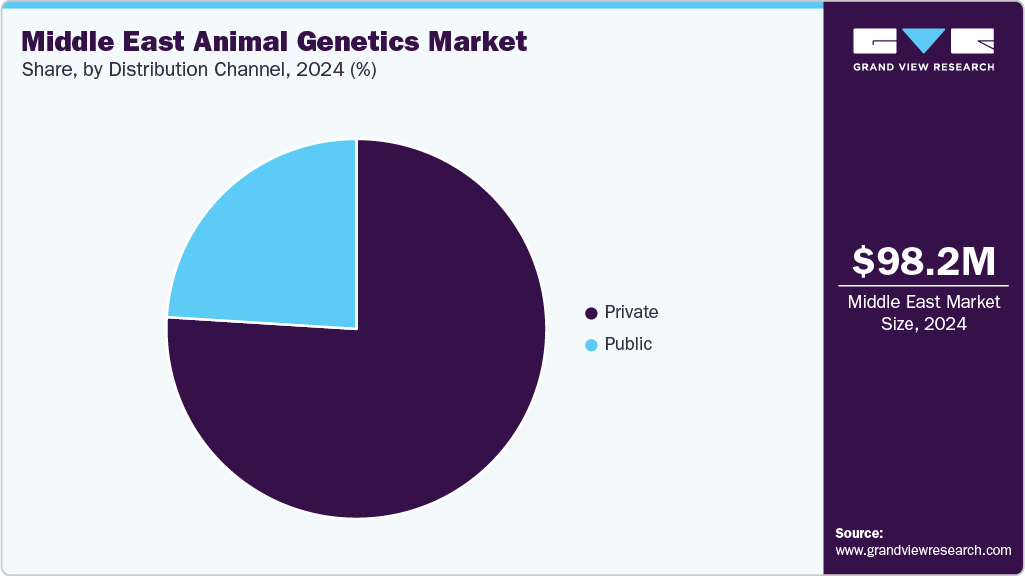

Based on distribution channel, private segment held the highest market share in 2024.

Market Size & Forecast

2024 Market Size: USD 98.2 Million

2033 Projected Market Size: USD 188.0 Million

CAGR (2025-2033): 7.63%

Saudi Arabia: Largest market in 2024

Kuwait: Fastest growing market

In addition, increasing focus on developing disease-resistant and climate-adapted breeds supports sustainability efforts, further accelerating the adoption of advanced animal genetics across the region. Increasing meat consumption in the Middle East is a key market driver, as the rising demand for protein-rich diets pushes producers to enhance livestock quality and productivity. Higher per capita meat intake creates pressure to improve breeding efficiency, animal growth rates, and disease resistance, all of which are achievable through advanced genetic technologies. For instance, according to the World Population Review (2025), meat consumption reached 58.5 kg per capita, with pig meat accounting for 45.6 kg, underscoring the scale of demand. To meet these consumption levels, livestock producers are increasingly adopting genetic solutions such as artificial insemination, embryo transfer, and genomic selection, thereby fueling regional market growth.

Moreover, according to an FAO article published in January 2025, Saudi Arabia is modernizing its small ruminants sector by introducing advanced genetic practices. A 12-week intensive course on “Introduction to Genomic Selection and Animal Breeding,” conducted under the Sustainable Rural Agricultural Development (SRAD) Programme, was completed through collaboration between the FAO, the Ministry of Environment, Water and Agriculture (MEWA), Reef Saudi, and the National Livestock and Fishery Development Program (NLFDP). This initiative has equipped national livestock scientists and specialists with expertise in genomic selection, genetic evaluation, and modern breeding strategies, which is expected to accelerate the adoption of advanced animal genetics practices in Saudi Arabia, improve livestock productivity, and significantly contribute to market growth.

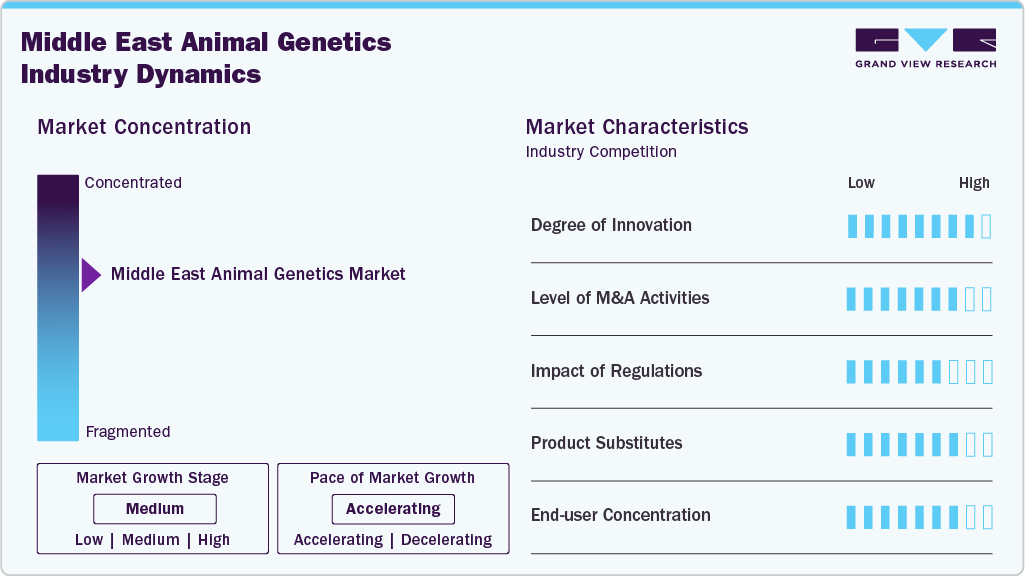

Market Concentration & Characteristics

The Middle East animal genetics industry demonstrates a moderate level of concentration, with several major players maintaining a significant share alongside numerous small and mid-sized companies. The market is currently in a high-growth phase, reflecting the rising demand for animal genetics products and services. Growth momentum is strengthening, fueled by the increasing demand for animal protein across the region, rapid advancements in genetic technologies, a stronger emphasis on sustainability and efficiency in animal farming, and expanding opportunities within emerging markets.

The degree of innovation in the Middle East animal genetics industry is moderate to high, as companies are increasingly adopting advanced biotechnologies such as genomic selection, CRISPR-based gene editing, and artificial insemination techniques to enhance breeding efficiency and animal productivity. These innovations enable the development of disease-resistant breeds, improve fertility rates, and optimize traits like milk yield, growth rate, and meat quality.

The market is experiencing significant merger and acquisition activity, fueled by strategic consolidation, expanding market share, and the pursuit of complementary technologies and expertise. Major players actively acquire smaller firms to diversify their product portfolios, enhance competitive strength, and tap into new markets and customer bases.

The market faces a moderate to high regulatory influence, with rules governing areas such as genetic modification, breeding practices, animal welfare, and intellectual property rights. While these frameworks promote ethical and sustainable standards, they challenge market participants, especially in managing complex approval procedures and maintaining compliance across multiple requirements.

The market is witnessing significant product expansion, driven by rapid technological advancements, rising demand, and diversification strategies adopted by industry players. Companies are steadily broadening their portfolios to cover a wide spectrum of genetic services, ranging from genomic testing and advanced breeding programs to reproductive technologies and comprehensive animal health solutions.

In the Middle East, the concentration is moderately high, with veterinary hospitals and breeding facilities driving a significant portion of the demand. They actively adopt genetic solutions for improving livestock productivity, disease resistance, and reproduction efficiency. Meanwhile, research institutes and universities contribute to innovation and technology validation, but their share remains comparatively smaller.

Type Insights

Assistive Reproduction Technologies (ART) accounted for the largest segment with a share of 49.45% in 2024, by enabling higher reproductive efficiency, improved herd productivity, and faster genetic advancement. These technologies, such as artificial insemination, embryo transfer, and in-vitro fertilization, offer several advantages, including reduced breeding costs, enhanced disease control by limiting natural mating, increased conception rates, and the ability to preserve and transport superior genetics across regions. By providing these benefits, ART supports better animal health and productivity and boosts demand for veterinary pharmaceuticals, equipment, and specialized services, thereby fuelling overall market expansion.

Genomic and genetic testing is the fastest-growing segment in the market. The introduction of DNA testing by a major Saudi state facility for Arabian horses is expected to significantly drive the genomic/genetic testing segment, as it ensures verified lineage and breed purity, enhances selective breeding by identifying hereditary traits and disease risks, and boosts the economic and export value of certified animals. Given the global prestige of Arabian horses, DNA-verified pedigrees will increase market credibility and demand, while also setting a precedent for wider adoption of genetic testing across equine, livestock, and companion animals in the region, thereby accelerating the segment’s growth.

Animal Insights

Cattle represented the largest segment with a revenue share of 52.42% in 2024. Rising beef exports from the U.S. to the Middle East reflect the region’s increasing demand for high-quality cattle products, which directly fuels the need for advanced animal genetics to improve herd productivity, meat yield, and quality. According to the USDA article published in October 2024, U.S. beef exports to the Middle East reached 4,253 mt in July, marking a 13% increase from the previous year, with export value rising 2% to $19.6 million. This growing demand for beef underscores the importance of genetic solutions that enhance cattle breeding efficiency, disease resistance, and overall production, thereby driving market growth.

The companion animals segment is projected to be the fastest growing market, driven by rising pet ownership and the humanization of pets increases the demand for advanced healthcare, preventive care, and genetic services. For instance, according to an article published by Soluky, Saudi Arabia is witnessing a significant rise in pet ownership, driven by a cultural shift that increasingly views pets as part of family life. While cats continue to dominate ownership due to deep-rooted cultural and historical preferences, dog ownership is steadily growing, particularly among younger generations and urban households. The overall pet population has expanded notably, increasing from 0.8 million to 2.4 million, with dogs gaining traction as popular companions.

Distribution Channel Insights

The private segment represents both the largest and fastest-growing share of the market. It ensures faster and more efficient delivery of genetic products such as semen, embryos, and genomic testing kits directly to farms and breeding facilities. Unlike public procurement systems, private players operate flexibly, building strong networks with dairy farms, poultry producers, and equine breeders.

In addition, private distribution networks customize offerings to meet the diverse needs of local farmers, often providing credit facilities, after-sales technical support, and localized storage solutions to handle sensitive genetic material. For example, private equine clinics in the UAE work with specialized genetics companies to deliver same-day DNA testing for Arabian horses, streamlining pedigree verification and breeding decisions.

Regional Insights

The Middle East animal genetics market is propelled by several underlying factors, most notably the heightened emphasis on achieving long-term food security, which has prompted governments and private stakeholders to prioritize higher-yield and disease-resistant livestock. The steady expansion of commercial-scale farming enterprises and ongoing initiatives to modernize agricultural practices foster greater demand for advanced genetic solutions. Furthermore, continuous progress in genetic research and biotechnology, the rising adoption of artificial insemination techniques, and the growing push toward sustainable and efficient livestock production systems collectively transform the sector’s dynamics and reinforce its upward trajectory.

Saudi Arabia Animal Genetics Market Trends

The animal genetics market in Saudi Arabia is advancing due to strong government support for food security, rising demand for premium livestock, and the adoption of artificial insemination, genomic testing, and precision breeding tools. Companies like Neogen, Genus Plc, Zoetis, and Hendrix Genetics lead innovations in disease-resistant and climate-adapted breeds. Capacity-building programs in genomic selection are boosting genetic improvement across the sector.

Key Middle East Animal Genetics Company Insights

The market demonstrates a fairly competitive landscape, driven by the active presence of established players and the rising pressure to enhance livestock productivity to meet growing regional and global demand. Increasing consumer preference for premium-quality animal products further intensifies competition, compelling companies to strengthen their positions through strategic initiatives. Leading firms are not only broadening their product portfolios to cover diverse species and advanced genetic technologies but are also actively engaging in partnerships, joint ventures, and collaborations to extend their geographic reach, leverage shared expertise, and consolidate market influence.

Key Middle East Animal Genetics Companies:

Neogen Corporation

Genetics Australia

Hendrix Genetics BV

URUS Group LP

CRV

Semex

Swine Genetics International

STgenetics

Animal Genetics Inc.

Generatio GmbH

Zoetis Services LLC

Genus plc

Recent Developments

In March 2025, the United Arab Emirates is making significant investments in advanced biotechnological innovations with a dual focus on preserving the genetic heritage of elite camel breeds and enhancing national food security. By adopting technologies such as cloning and genetic conservation, the country aims to safeguard culturally significant species that hold immense economic, historical, and social value, while also utilizing these advancements to build a more resilient and sustainable livestock sector. These efforts ensure the long-term protection of prized camel bloodlines and align with broader national strategies to reduce dependence on imports, strengthen self-sufficiency, and secure the future of food production in the region.

In September 2024, Zoetis partnered with Danone to advance sustainable dairy farming, combining genetics expertise with environmental stewardship. The collaboration integrated genomic testing to improve cattle health, reduce environmental impact, and promote long-term industry resilience.

Middle East Animal Genetics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 104.4 million

Revenue forecast in 2033

USD 188.0 million

Growth rate

CAGR of 7.63% from 2025 to 2033

Actual data

2021 – 2024

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal, type, distribution channel, country

Country scope

Saudi Arabia; UAE; Kuwait; Qatar; Oman

Key companies profiled

Neogen Corporation; Genetics Australia; Hendrix Genetics BV; URUS Group LP; CRV; Semex; Swine Genetics International; Stgenetics; Animal Genetics Inc.; Generatio GmbH; Zoetis Services LLC; Genus plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Animal Genetics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East animal genetics market report based on animal, type, distribution channel, and country:

Animal Outlook (Revenue, USD Million, 2021 – 2033)

Cattle

Pigs

Sheep & Goats

Companion Animals

Others

Type Outlook (Revenue, USD Million, 2021 – 2033)

Distribution Channel Outlook (Revenue, USD Million, 2021 – 2033)

Country Outlook (Revenue, USD Million, 2021 – 2033)

Frequently Asked Questions About This Report

b. The Middle East animal genetics market size was estimated at USD 98.2 million in 2024 and is expected to reach USD 104.4 million in 2025.

b. The Middle East animal genetics market is expected to grow at a compound annual growth rate of 7.63% from 2025 to 2033 to reach USD 188.0 million by 2033.

b. Saudi Arabia dominated the Middle East animal genetics market with a share of 11.02% in 2024. This is attributable to strong government support for food security, rising demand for premium livestock, and adoption of artificial insemination, genomic testing, and precision breeding tools.

b. Some key players operating in the Middle East animal genetics market include Neogen Corporation, Genetics Australia, Hendrix Genetics BV, URUS Group LP, CRV, Semex, Swine Genetics International, STgenetics, Animal Genetics Inc., Generatio GmbH, Zoetis Services LLC, Genus plc

b. Key factors that are driving the market growth include rising demand for high-quality livestock production to meet growing meat and dairy consumption, alongside strong government initiatives aimed at improving food security and livestock productivity.