September 7, 2025

From August 28 to September 2, 2025, Abacus Data surveyed 1,500 Canadian adults on the state of federal politics. The poll was conducted over the Labour Day long weekend, following Pierre Poilievre’s byelection win in Calgary and just ahead of the federal cabinet’s late-summer retreat. The data capture a moment of political pause but economic unease, as fresh GDP figures showed that the Canadian economy contracted in the second quarter of 2025—marking the first quarterly decline in nearly two years.

Against this backdrop, the numbers reveal subtle but notable movement: approval of the federal government under Prime Minister Mark Carney continues its slow descent, Carney’s personal favourables have softened further, and concerns about the economy are climbing back toward the top of the political agenda. The Liberals have regained a narrow lead in vote intention, but it’s the directional signs that may be more telling than any single datapoint.

Direction of the Country: Static, But Not Optimistic

Views of the country’s direction remain essentially unchanged. Just over a third of Canadians (35%) believe things are moving in the right direction, while 48% say the country is on the wrong track. These numbers have held steady across the summer, suggesting a persistent undercurrent of concern, though not an active deterioration. Views of the world (13% right direction) and of the United States (14%) remain bleak, underscoring the sustained pessimism in broader international outlooks.

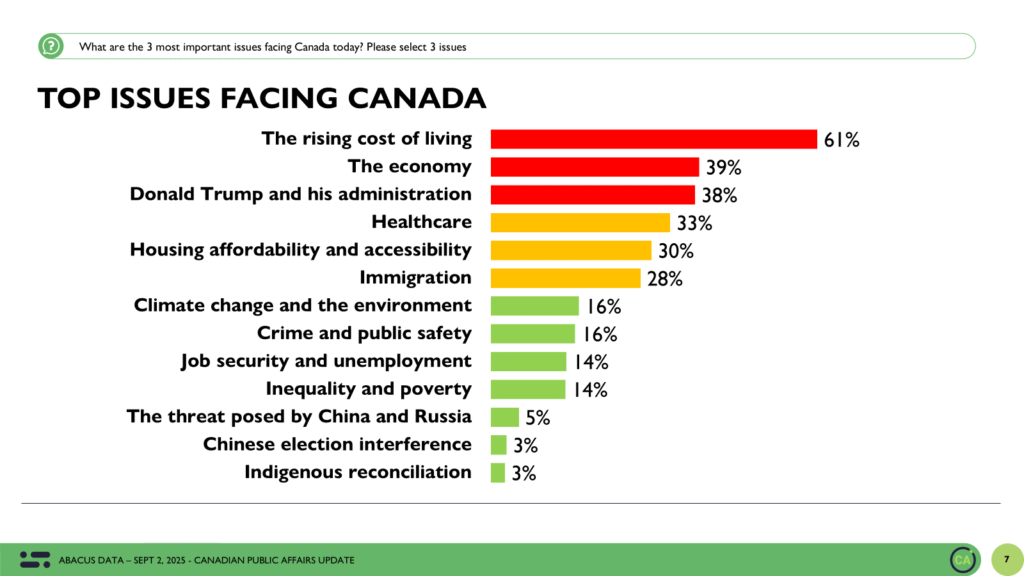

Top Issues: Affordability Tops the List as Economic Concern Grows

The rising cost of living remains the defining issue of the moment. Six in ten Canadians (61%) name it among their top three concerns, virtually unchanged from mid-August. But what’s shifting is the salience of the broader economy: 39% now cite it as a top concern by as many people as the Trump administration, up from 36% in the last wave. This increase is likely tied to renewed attention following the news that Canada’s economy contracted by 1.6% in Q2, a development that’s reignited public and political debate about whether the recovery is faltering.

Housing affordability (30%) and healthcare (33%) round out the top four, while concern about Donald Trump and his administration continues to fade. Just 37% of respondents now list Trump as a top issue, down one point from two weeks ago and well off the highs seen earlier in the year. Immigration, meanwhile, remains mid-pack at 28%, stable in both ranking and intensity.

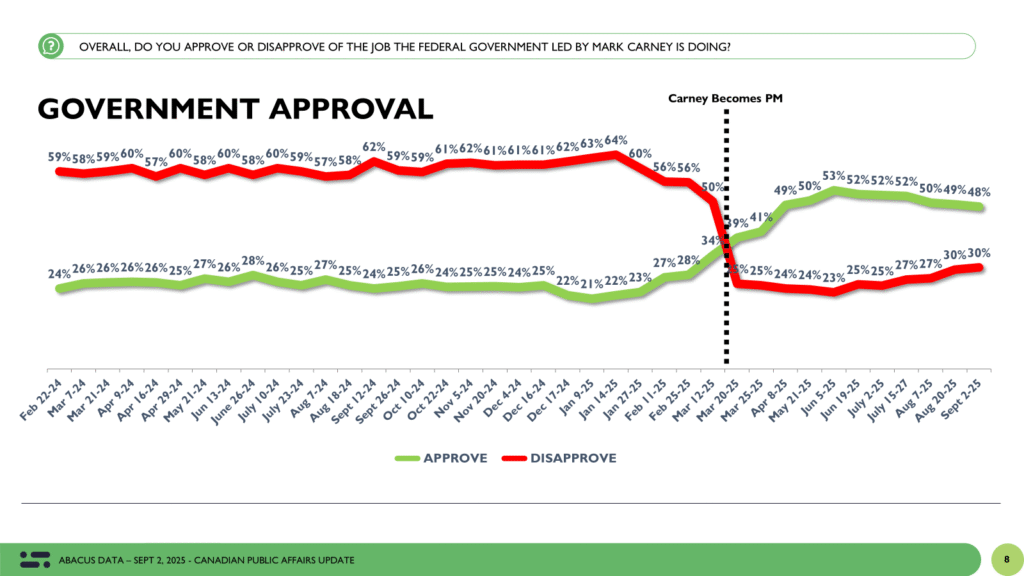

Government Approval: Gradual Erosion Continues

Approval of the federal government led by Mark Carney now sits at 48%, down a point from our previous wave. Disapproval has edged up to 30%. These figures are still relatively strong in historical context, but the trend is clear: the government’s approval rating has been slowly drifting downward since early summer, with no sign yet of a rebound.

The current slide may reflect growing economic anxiety and the sense among some Canadians that while the government is competent, it may not be moving fast enough to address affordability and economic concerns.

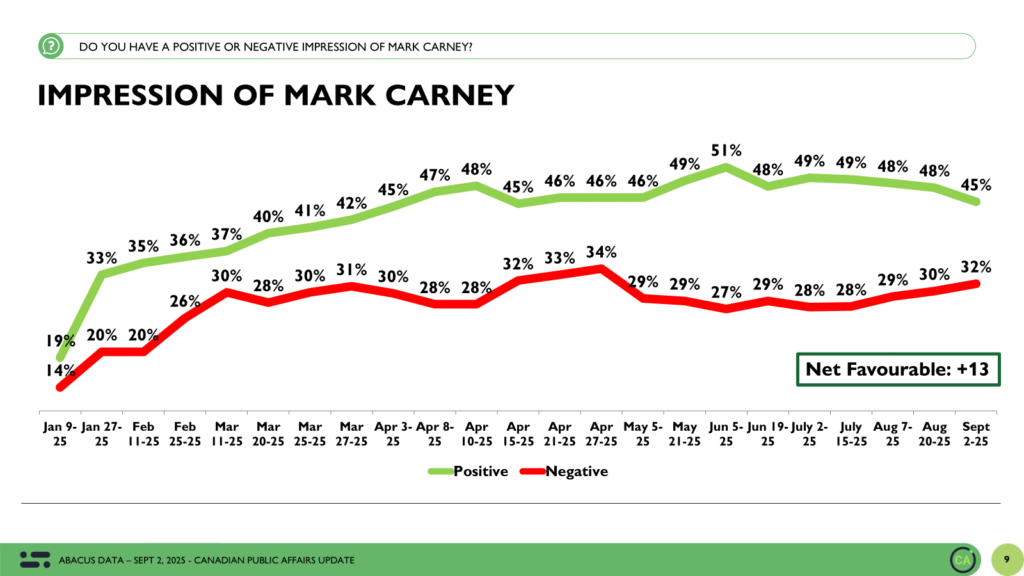

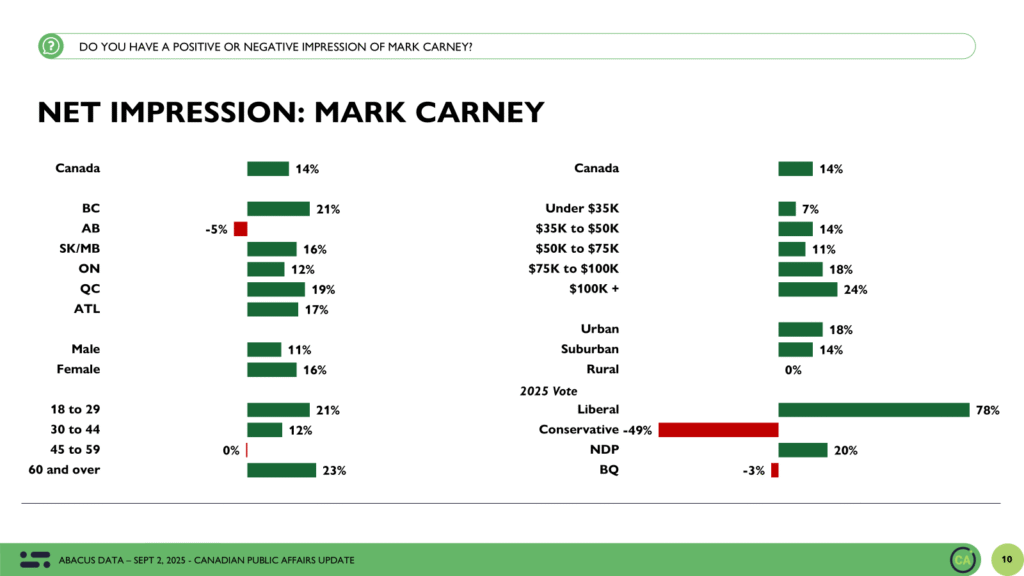

Leader Impressions: Carney’s Numbers Dip Slightly, Poilievre Holds Ground

Mark Carney continues to maintain a net positive favourability rating, but the gap is narrowing. This wave, 48% of Canadians express a favourable view of the Prime Minister, down one point, while 35% view him unfavourably, up slightly. His net rating now stands at +13, down from +18 two weeks ago and +21 in mid-July. The erosion is subtle but sustained, and notably, his ratings have declined across most regions and demographic groups.

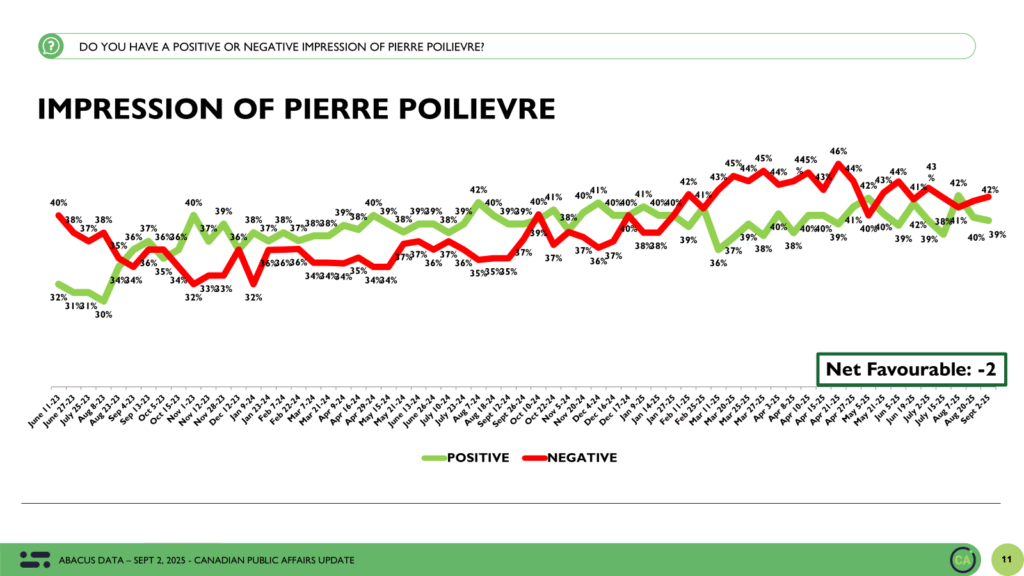

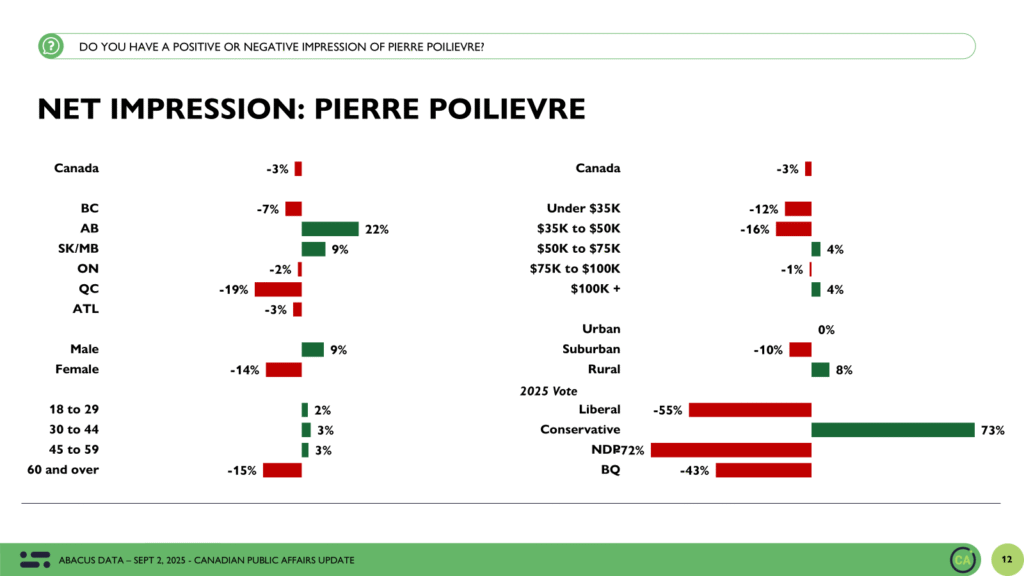

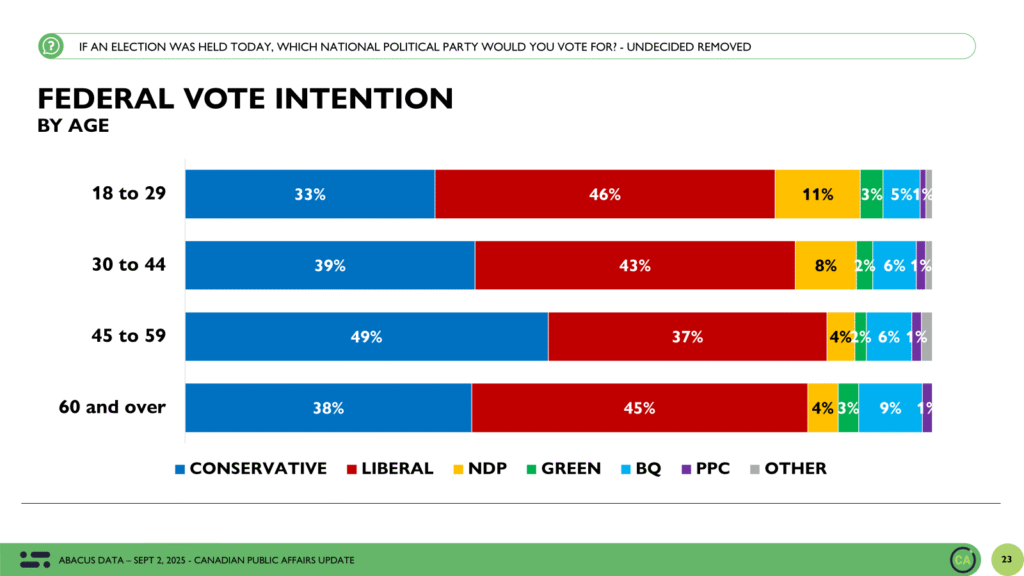

Pierre Poilievre’s numbers remain steady. He is viewed favourably by 39% and unfavourably by 42%, for a net rating of -3, down from the previous wave. His numbers continue to be stronger among younger men and in the Prairies, while trailing in Quebec and among older Canadians (60+).

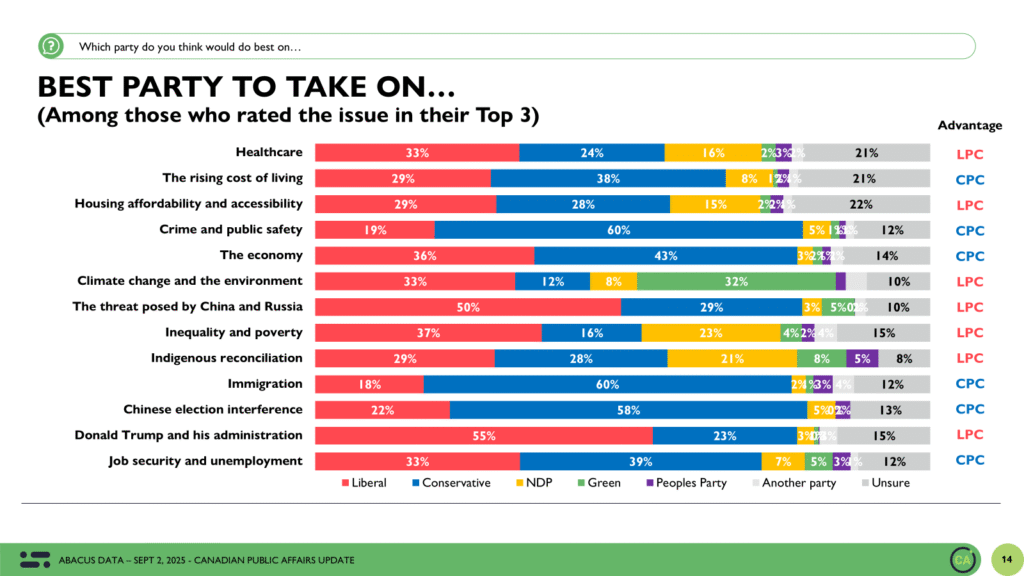

Issue Ownership: Conservatives Lead on Economy and Cost of Living

When Canadians are asked which party is best able to handle the issues they care most about, the Conservatives continue to lead on the economic front. On cost of living, they hold a 9-point advantage over the Liberals (38% to 29%), and a 7-point lead on managing the economy overall (43% to 36%), among the 39% of people who put that issue in their top 3.

They also dominate on immigration, where 60% believe the Conservatives are best equipped, compared to just 18% for the Liberals.

However, the Liberal Party continues to hold clear advantages on other issues: they are the preferred party on climate change (33% to the Conservatives’ 12%) and on handling the Trump administration and U.S.-Canada relations (55% vs. 23%) and on healthcare (33% to 24%).

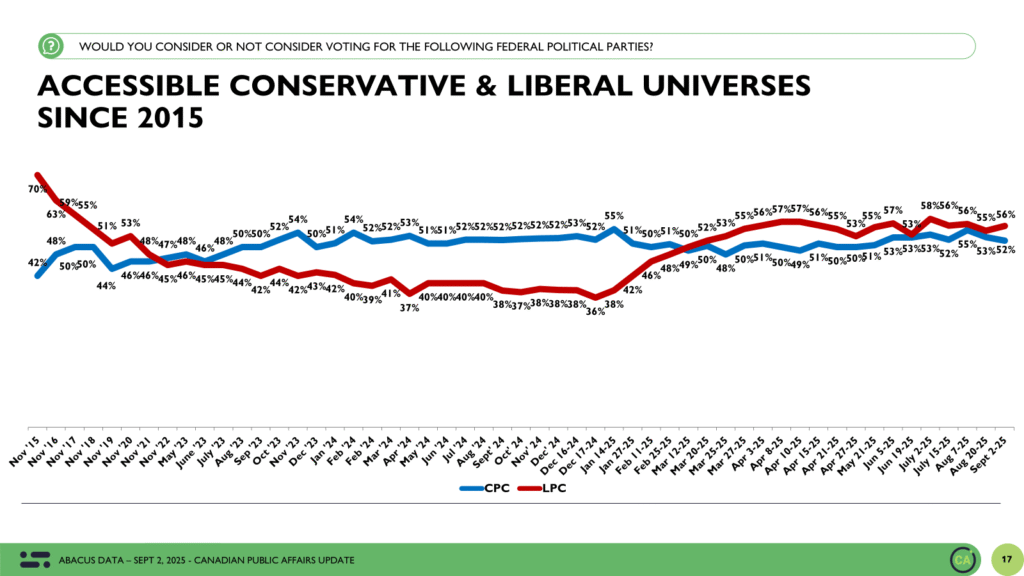

Accessible Voter Pools: Flat and Competitive

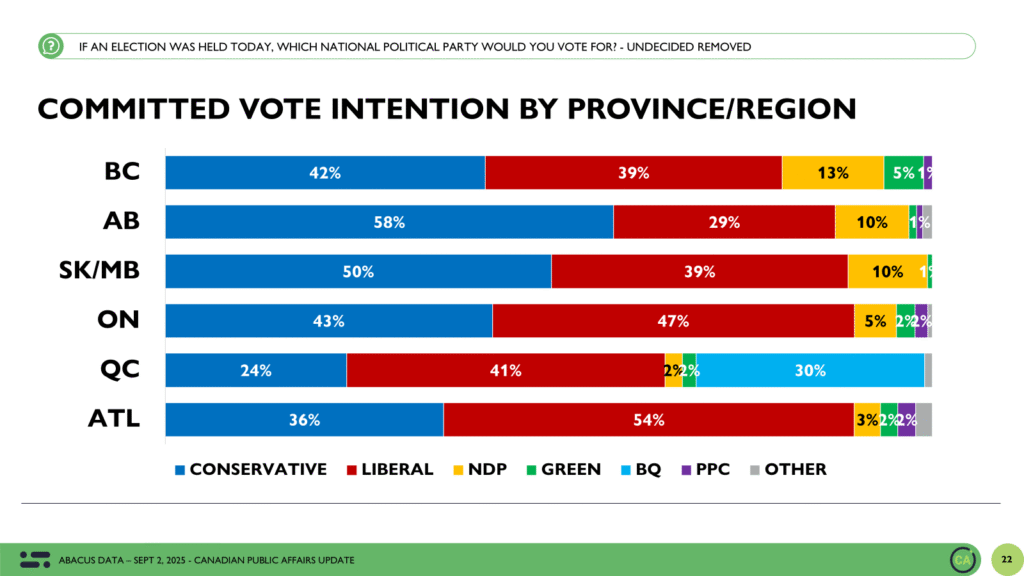

The Liberal Party remains accessible to 56% of Canadians, statistically unchanged from our last wave. The Conservatives follow closely at 52%. The NDP’s accessible pool sits at 34%, also unchanged. Regionally, the Liberals continue to lead in Ontario and Quebec, while the Conservatives are ahead in B.C..

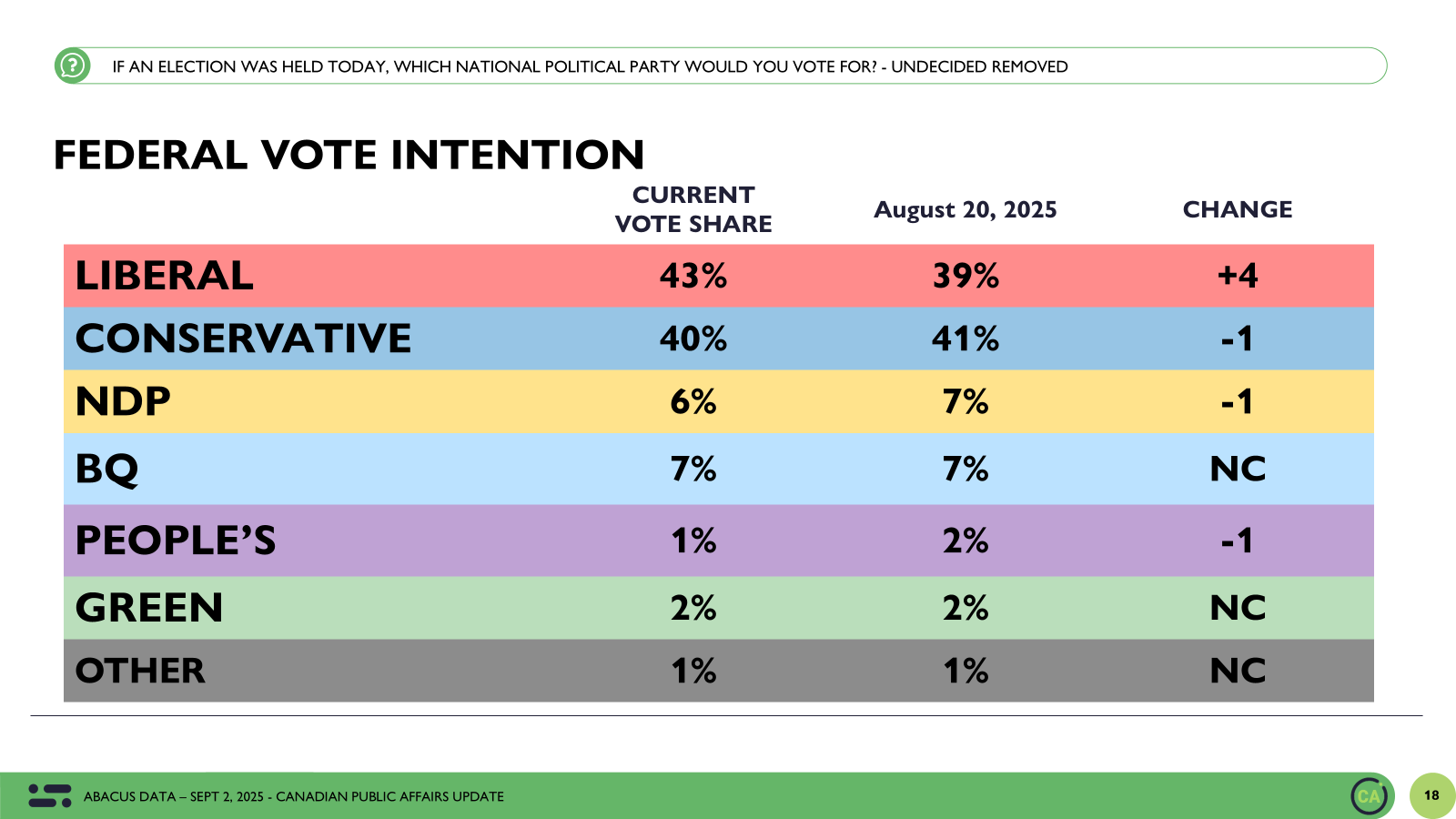

Vote Intention: Liberals back in the lead

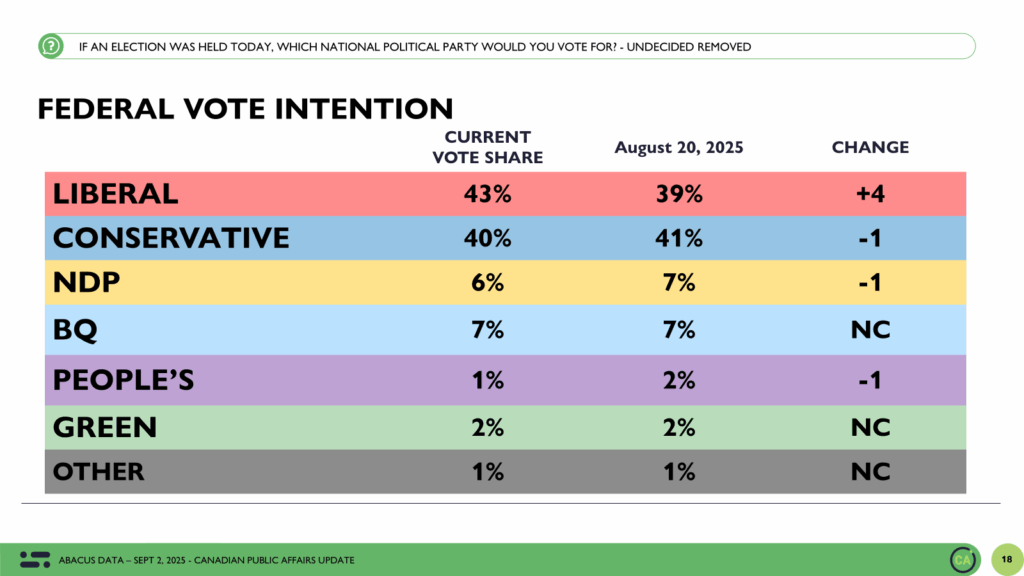

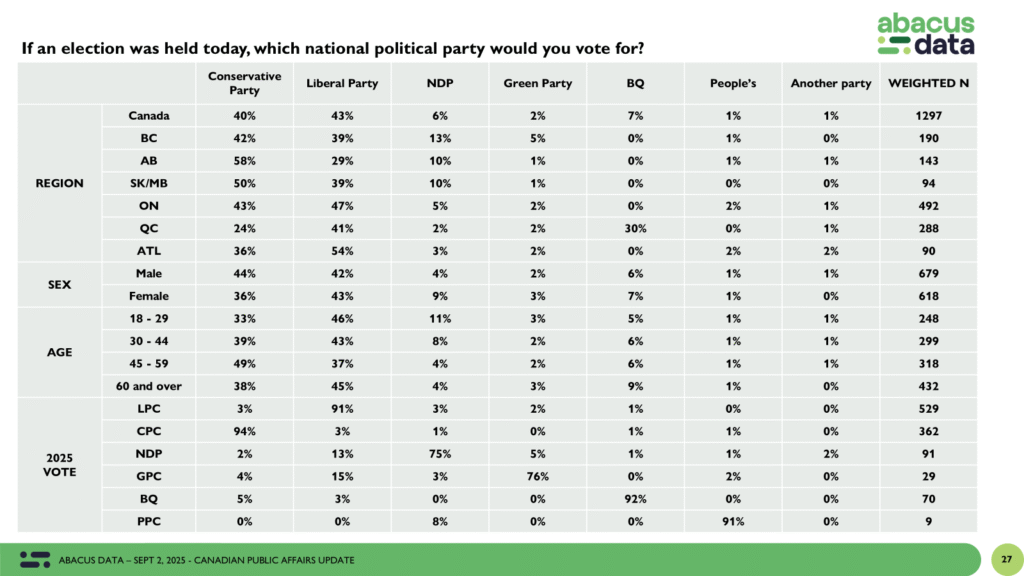

If an election were held today, 43% of decided voters would cast a ballot for the Liberal Party, up four points since mid-August. The Conservatives are at 40%, down one point. The NDP holds at 6%, Bloc Québécois at 7%, Greens at 2%, and the PPC at 1%.

Among those certain to vote, the race is a dead heat: both Liberals and Conservatives are tied at 42%. This suggests the Liberals may benefit slightly from a turnout advantage—particularly among older voters, where their support remains stronger.

Demographic Trends: Stability in the Divides

The underlying demographic patterns remain familiar. The Liberals lead among women by seven points, while the Conservatives lead among men by a similar margin. Carney’s party maintains an 11-point advantage among university-educated voters, while the Conservatives lead among those with a college diploma or less education.

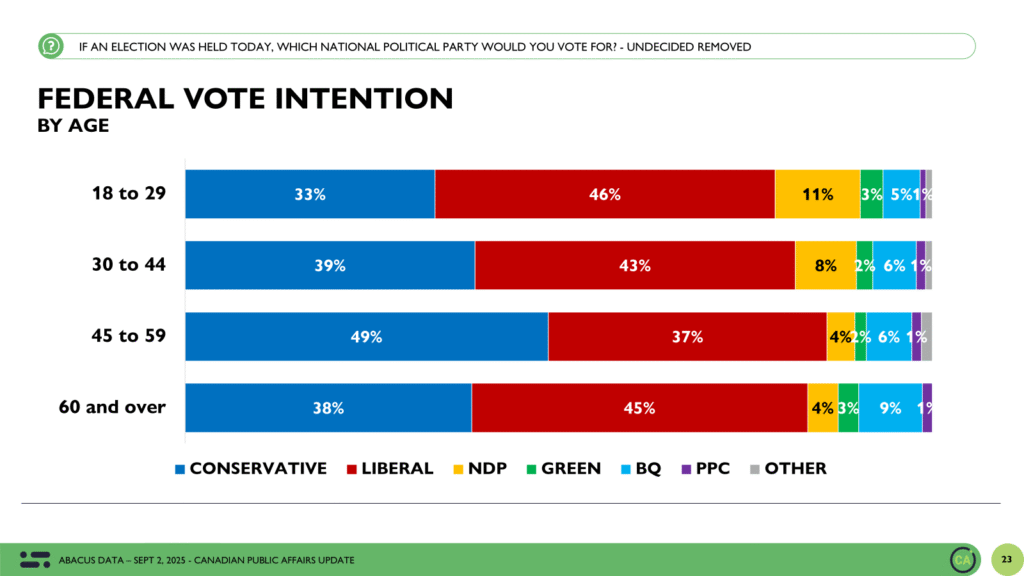

By age, the Liberals lead among voters under 45 and over 60, while the Conservatives hold a notable lead among those aged 45 to 59.

The Upshot

According to Abacus Data CEO David Coletto: “While the top-level vote numbers suggest relative stability, underneath we continue to observe slow but meaningful erosion in the Carney government’s standing. His personal favourables remain in net-positive territory, but they’ve been drifting downward for several weeks. More notably, government approval remains below 50%, and Canadians are increasingly anxious about the economic outlook.

The fact that the economy contracted in Q2—the first decline in nearly two years—is likely to reinforce that anxiety. That’s not an easy environment for an incumbent government. As concerns about affordability and economic management become more top-of-mind, feeling that the government is responsive to those concerns becomes more important.

The summer of political calm may be ending. With Parliament returning and the government facing rising pressure to respond to economic headwinds, we could see more significant movement in the months ahead.”

Methodology

The survey was conducted with 1,500 Canadians from August 28 to September 2, 2025. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.5%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, and region. Totals may not add up to 100 due to rounding.

Abacus Data follows the CRIC Public Opinion Research Standards and Disclosure Requirements that can be found here: https://canadianresearchinsightscouncil.ca/standards/

ABOUT ABACUS DATA

We are Canada’s most sought-after, influential, and impactful polling and market research firm. We are hired by many of North America’s most respected and influential brands and organizations.

We use the latest technology, sound science, and deep experience to generate top-flight research-based advice to our clients. We offer global research capacity with a strong focus on customer service, attention to detail, and exceptional value.

And we are growing throughout all parts of Canada and the United States and have capacity for new clients who want high quality research insights with enlightened hospitality.

Our record speaks for itself: we were one of the most accurate pollsters conducting research during the 2025 Canadian election following up on our outstanding record in the 2021, 2019, 2015, and 2011 federal elections.

Contact us with any questions.

Find out more about how we can help your organization by downloading our corporate profile and service offering.