Advisors with Manulife Wealth Inc. and Investia Financial Services Inc. rated their firms lower in enough categories to weigh negatively year over year on their IE ratings. Those firms’ respective ratings this year were 6.1 and 7.8 out of 10, down from 7.2 and 8.3 a year ago.

CI Assante Wealth Management saw its IE rating rise from 7.5 to 8.4 this year. This firm saw its ratings rise significantly compared with 2024 in nearly all categories (see main results table for 2025).

Serving the high-net-worth

There is room for improvement across multiple categories. For example, “products & support for high-net-worth clients” had an overall performance average of 7.6 out of 10, down significantly from 8.1 a year ago.

Average ratings among the firms in that category ranged from 4.8 (Manulife Wealth) to 9.0 (IG Wealth Management Inc.).

Our research team heard a range of opinions from advisors about whether firms can or should assist with their high-value clients.

“I feel it’s mostly on us to do all that [for wealthier clients],” an advisor in the Prairies with Peak Financial Group said.

Peak Financial was rated 7.3, down significantly from 8.6 a year ago, in the category. The firm told IE in an emailed statement that it encourages advisors to serve these clients as they see fit. Meanwhile, the firm will do its part to ensure “advisors are efficient and effective with their clients,” Robert Frances, founder, chairman and CEO, said during an interview. The firm completed a review of its tools and systems after the pandemic, Frances added.

More recent projects have included in-house efforts to organize client data plus improve “internal processes, internal forms and internal policies.” Indeed, 80% of the firm’s advisors told us Peak has been investing in time-saving tools over the past year or more.

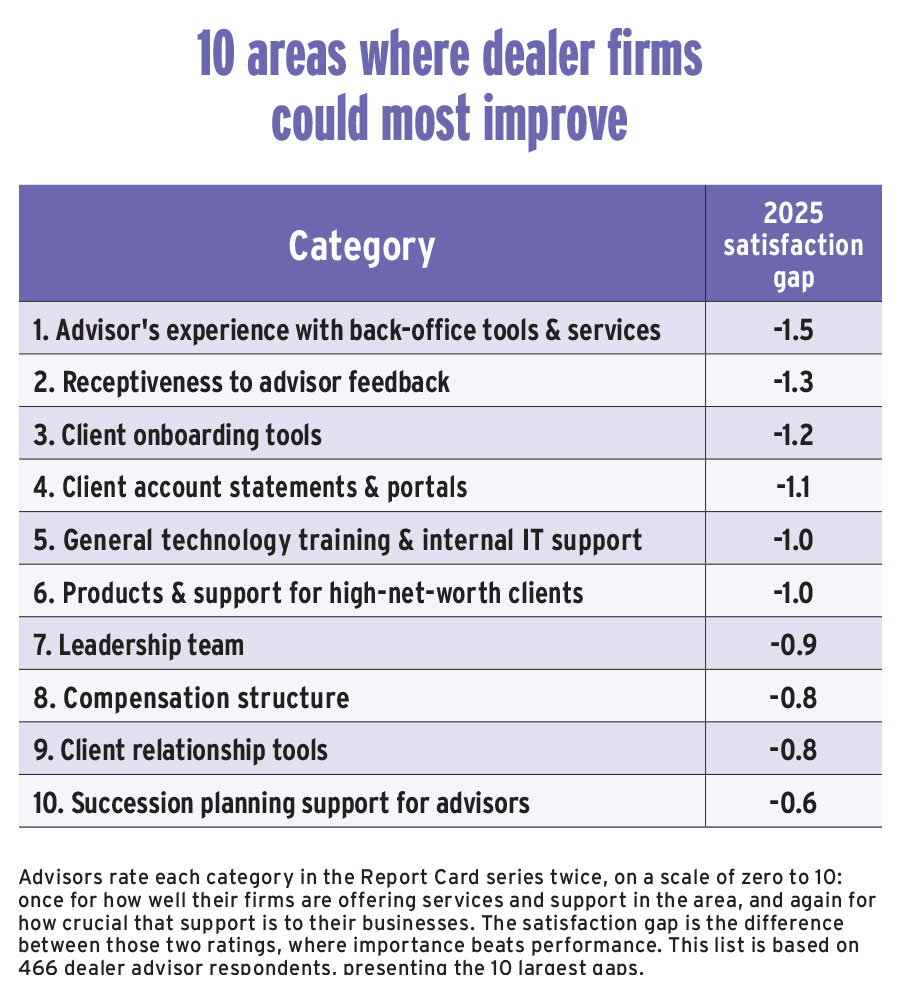

While the high-net-worth category wasn’t among the 10 rated most important in 2025, it was among the 10 with the largest satisfaction gaps — where a category’s importance average noticeably exceeds its performance average. (See 10 areas where dealer firms could most improve.)

One firm that improved its high-net-worth support was CI Assante (rated 8.8 in that category from 7.4 in 2024).

Advisors there have tended to lean more on the structured firm resources offered at the dual-registered dealer, versus going it alone. These respondents referenced CI Assante Private Client, a group that caters to wealthy individuals, families and business owners.

“[The] wealth planning team is our strength,” offering access to accountants, insurance and investment experts, according to a CI Assante advisor in Alberta.

Looking across the full data set, there were advisors in the dealer space broadly who sometimes felt pushed to sell specific products to high-net-worth clients or reach productivity targets — a key concern. Others said access to advanced planning experts was limited based on low capacity.

When asked about Investia Financial’s advanced planning resources, one of that firm’s advisors in B.C. reflected on the capacity issue. “I think they [the firm] need to develop more; they need to do more.” This advisor had expert planner connections and external resources of their own but said newer advisors might struggle to get help for wealthy clients.

Investia Financial president Louis DeConinck told us that the dealer isn’t prescriptive with advisors out of respect for their independence. The firm focuses most on developed advisors. Business and marketing tools, and specialized wealth support, can be accessed through parent company iA Financial Group, he added. Investia predominantly works on improving digital automation in the middle and back office.

Nearly two-thirds of the Investia Financial advisors polled (64.7%) said the firm was actively investing in automation.

Give me independence

Dealer advisors again said they wanted to feel respected and heard.

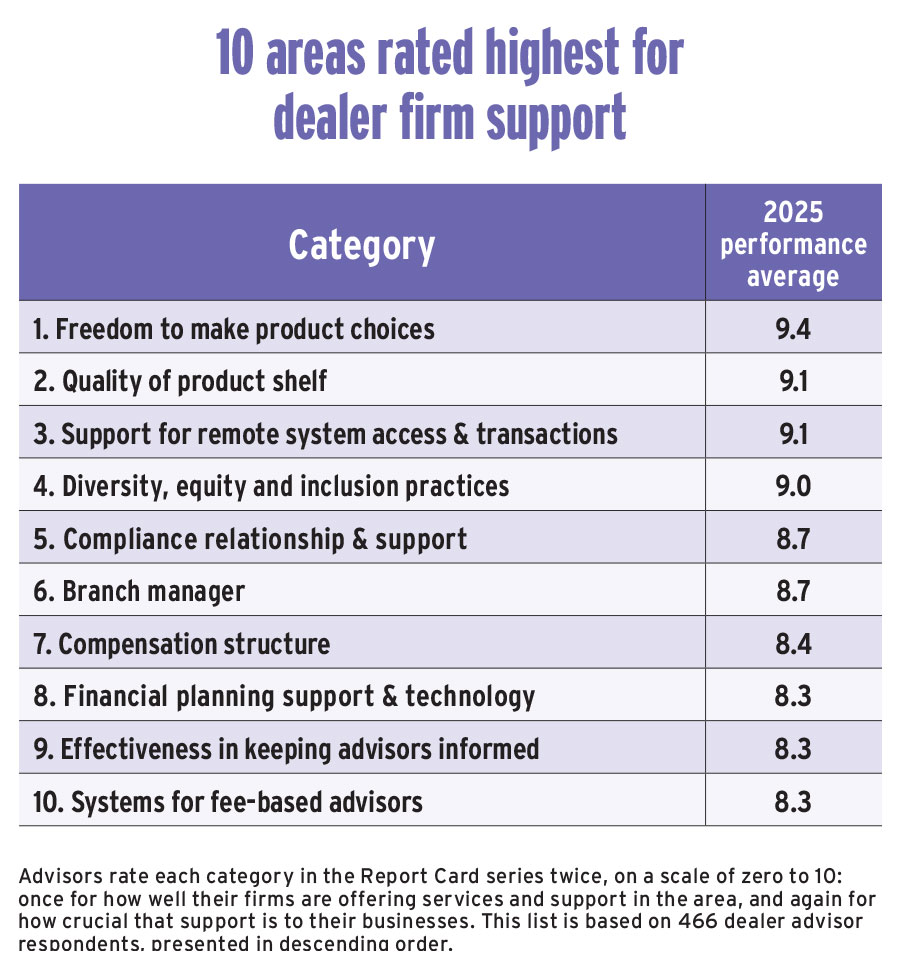

The three categories with the highest importance averages in this Report Card were “freedom to make product choices,” “quality of product shelf” (relating to general product rules, not specifically to a dealer’s own products where that applies) and “support for remote system access & transactions.” Each tied into the need of these entrepreneurial professionals to direct how and where they work. (See 10 areas rated most important by dealer advisors.)

Like last year, though, the 10 areas with the highest importance averages also included three firm culture categories. Advisors prize a good “compliance relationship & support” (rated 9.3 for importance in 2025) as well as “receptiveness to advisor feedback” by a strong “leadership team” (each of those categories were rated 9.1 for importance this year) — suggesting that advisors care if their firm has their back.

Compliance support across the 11 firms remained consistently solid compared with a year ago, while the other two categories were again identified as areas where firms could most improve.

There were four firms with significantly lower results in the leadership category, compared with 2024. The same number had notable year-over-year decreases in their feedback receptiveness ratings. That meant an overall, though not quite significant, drop in both categories’ performance averages: to 8.2 from 8.6 and 7.8 from 8.1, respectively.

Moreover, advisors with nearly all 11 firms yearned for improved understanding and communication. Advisory councils, working groups and annual conferences are all common in the full-service and mutual dealer space. But these firms are also known for having diverse advisor workforces with varying priorities.

Multiple firms also saw significant year-over-year changes in their ratings for the “effectiveness in keeping advisors informed” category.

At Sterling Mutuals Inc. for example, advisors suggested improvements had been made to advisor communication, with more timely and open messages from management. Yet, others wanted more of a heads-up on industry changes. The firm was rated 7.8 for both the communication effectiveness and receptiveness to advisor feedback categories, down from 8.5 and 8.4 in 2024, respectively.

“Even though we have a wish list, whenever we [advisors] suggest something, we are told things could take a year or two to develop,” said one of the firm’s advisors. “We have made suggestions that we feel fall on deaf ears.”

Sterling Mutuals senior vice-president Rocky Ieraci said, “[It’s] tough. We try. We make it a point to see every advisor in the country at least once a year, personally. We put on regional meetings, annual conferences. We try to disseminate what’s new, what’s going on, [and] that’s where we ask for feedback from the advisors.”

Sterling Mutuals isn’t alone in facing this challenge. The Report Cards consistently reveal that advisors want a voice. Yet, firm leaders often describe how difficult it is to validate advisors’ opinions while helping them understand how much work is required to update processes.

Advisors are increasingly seeking collaborative cultures. Nearly one-third of this year’s advisor sample (31.8%) identified the firm culture group of categories as the most important area for their firms to focus on. That was followed by the technology suite group (chosen by 24.6% of advisors).

Investment Planning Counsel Inc. (IPC) was getting this right, according to one advisor in Alberta. After working with another firm, where “nobody did what they said,” this advisor said IPC’s culture was as advertised. They called this “[s]o refreshing.”

The bottom line is advisors want respect: “I want to work at a company where even if you’re the lowest-[earning] broker, you’re as valued,” said an advisor in Ontario with Desjardins Financial Security Investments Inc.

Click image for full-size chart

Click image for full-size chart

Click image for full-size chart

Click image for full-size chart

This article appears in the September 2025 issue of Investment Executive. Subscribe to the print edition or read the articles online.