Weather: Not much going on weather wise – a clean week rainfall wise for Australia but relatively low temps so not much to drive markets.

Markets: All about the Argy tax announcement – interesting that the pressure is starting to build amongst the farmer lobby groups in the US. The fact that Ags were not the main topic of conversation between the US and China has the soybean grower more than a little concerned – the Argy tax announcement couldn’t come at a worse time.

Australian Day Ahead: Lower – our foot hold into the Asian flour mills took a hit with Argy wheat more competitive today. The world is a fluid place right now – Trump talking to the UN should be the next big sound bite for markets to trade.

.

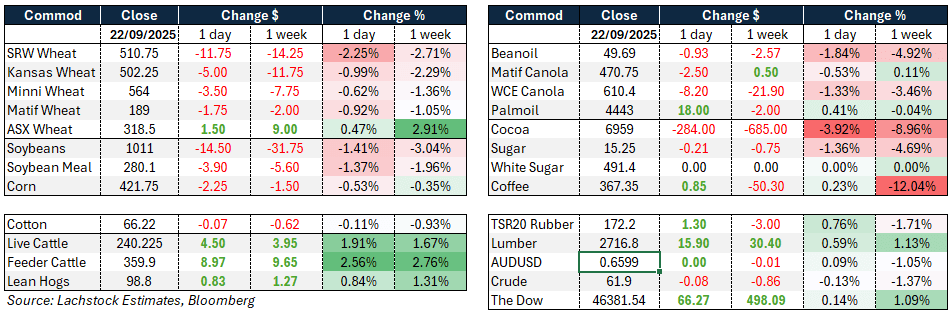

Wheat markets were under heavy pressure, with Chicago, Kansas City and Minneapolis futures all setting fresh contract lows.

Weak spreads and implied volatility in Chicago WZ closed at 20.56 percent.

Paris Matif also weakened while Russian cash wheat eased slightly to US$229.

Algeria is tendering for 50,000t soft wheat, and Ukraine’s wheat exports are down 28pc year on year at 4 million tonnes (Mt).

Kazakhstan is forecasting 24Mt grains, down from last year’s record.

Forecasts from the International Grains Council, Coceral and Russia point to larger global supplies, pushing Chicago wheat to its lowest since mid-September.

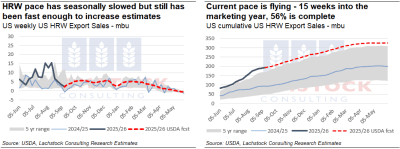

US inspections were strong at 854kt, up 13pc on the year, while winter wheat planting is progressing at 20pc complete and nearly all spring wheat harvested.

Argentina unexpectedly suspended wheat export taxes until October 31, adding more pressure to US competitiveness in export markets.

Other grains and oilseeds

Corn held up better, with December futures losing just 2.25c, supported by a 320kt daily sale to Mexico and inspections at 1.329Mt, up 59pc year on year.

Crop conditions dipped slightly to 66pc.

Argentina’s suspension of its 9pc corn tax increases global competition but farmers may hesitate to sell due to peso dynamics.

Ukraine’s corn exports are down 66pc year on year, highlighting supply shifts.

Soybeans bore the brunt of the Argentine policy, with futures dropping sharply, products weaker, and October crush margins narrowing.

US soybean inspections were soft at 484kt, still up 34pc year on year, while crop conditions fell to 61pc. China continues to avoid new crop US purchases, weighing heavily on sentiment. Brazil’s soybean sowing has just started, 0.9pc complete, and crushing capacity is expanding rapidly on biodiesel demand.

China imported over 10m tons of Brazilian soybeans in August, 85pc of its total.

Funds have recently added soybean length, suggesting concern that USDA yield estimates may be too high.

Malaysian palm oil futures firmed on stronger rival oils, festive demand in India and a weaker ringgit.

Macro

Markets remain risk-sensitive with global trade politics in focus. Argentina’s temporary suspension of export taxes is effectively a targeted devaluation aimed at securing $7bn in crop sales before Oct 31, with Milei seeking to stabilize the peso and negotiating US support. The peso rebounded and Argentine bonds rallied on the announcement and US backing.

In the US, the Chicago Fed National Activity Index rose slightly in August to -0.12, showing below-trend growth but modest improvement.

Euro area consumer confidence improved marginally to -14.9, tentatively finding a floor after months of deterioration.

Fed officials struck a mixed tone, some warning against over-easing while others pushed for deeper cuts; Chair Powell is due to speak next.

Broader geopolitical currents include US-China tensions, stalled agricultural trade progress despite Trump–Xi discussions, US-Taiwan trade deals, and Trump pressing Europe to halt Russian energy purchases.

Australia

Week started lower in the west with canola bids back A$5–$10 to $809 FIS Albany, wheat unchanged at $340, and barley a little softer at $307.

Through the east of the country canola was also lower with track Port Kembla bids at $767, wheat $319, and barley $276.

Domestic consumers, much like global ones, are happy to sit back and let the market come to them. With the next two weeks looking largely dry, the question is whether this will prompt them to put some cover on the books.

Pulses are struggling to find any support, with new crop lentil bids around $550 delivered Wimmera packers. Exporters show little interest in buying, with global demand slow and a big crop looming.

With pulse prices where they are, it will be interesting to see what growers choose to sell for cashflow through harvest—canola looks the obvious first choice, followed perhaps by barley.