Employer and Workplace Drug Testing Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

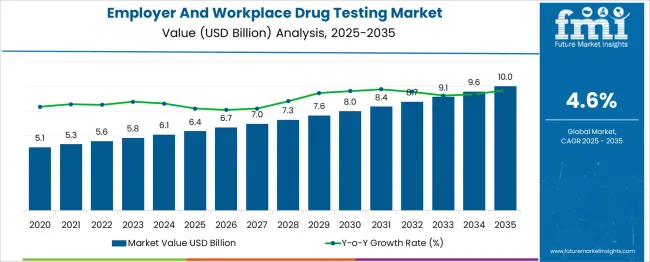

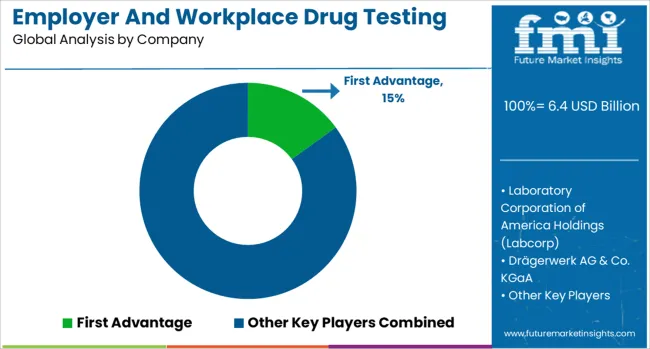

The employer and workplace drug testing market is valued at USD 6.4 billion in 2025 and is projected to reach USD 10 billion by 2035, with a CAGR of 4.6%. Breakpoint analysis of the market indicates a gradual expansion with identifiable phases of acceleration and stabilization over the forecast period. Early adoption and regulatory compliance requirements create initial growth spurts, while mid period consolidation reflects steady market penetration among enterprises across various sectors. The moderate CAGR suggests limited volatility, with incremental revenue gains supporting predictable scaling. Key breakpoints in market growth are likely to align with technological advancements in testing methods, stricter workplace safety regulations, and increased organizational focus on employee wellness and compliance.

Quick Stats for Employer and Workplace Drug Testing Market

Employer and Workplace Drug Testing Market Value (2025): USD 6.4 billion

Employer and Workplace Drug Testing Market Forecast Value (2035): USD 10 billion

Employer and Workplace Drug Testing Market Forecast CAGR: 4.6%

Leading Type in Employer and Workplace Drug Testing Market: Post-employment (78%)

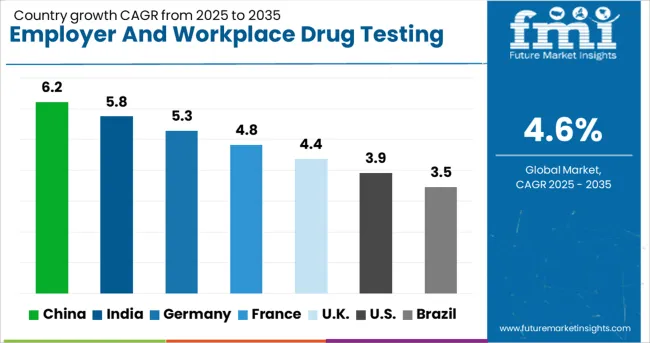

Key Growth Regions in Employer and Workplace Drug Testing Market: China, India, Germany

Top Key Players in Employer and Workplace Drug Testing Market: First Advantage, Laboratory Corporation of America Holdings (Labcorp), Drägerwerk AG & Co. KGaA, Bio-Rad Laboratories Inc., Abbott, Clinical Reference Laboratory Inc., Quest Diagnostics, Cordant Health Solutions, DISA Global Solutions, HireRight LLC, OraSure Technologies Inc., Omega Laboratories, Psychemedics Corporation

Employer and Workplace Drug Testing Market Key Takeaways

Item

Value

Market Value (2025)

USD 6.4 Billion

Forecast Value (2035)

USD 10 billion

Forecast CAGR

4.6%

The market has shown a stable upward trend in recent years, driven by increasing workplace safety regulations, employee health initiatives, and compliance requirements across multiple industries. Historical year-on-year data indicates consistent growth, with early-stage annual increases ranging from 3% to 4%, followed by slightly stronger growth of 5% in later years as organizations increasingly implement pre-employment, random, and post-incident testing programs. The expansion of remote work and the need for digital monitoring solutions have also contributed to incremental demand. Short-term analysis suggests that these trends are likely to continue, as regulatory frameworks remain stringent and employers prioritize maintaining drug-free work environments to minimize liability and enhance productivity.

Projecting 1–3 years ahead based on historical YoY trends, the market is expected to experience moderate growth, with annual increases averaging around 4% to 5%.

The first year may reflect a slight acceleration due to new government guidelines and enhanced testing technologies, followed by steady expansion in subsequent years as adoption reaches a broader range of industries. While economic fluctuations and budgetary constraints could temporarily impact some segments, overall market momentum remains positive. Companies providing testing kits, laboratory services, and software solutions are anticipated to benefit from consistent demand, indicating a stable short-term growth trajectory with incremental gains rather than abrupt spikes or declines.

Why is the Employer and Workplace Drug Testing Market is Growing?

Market expansion is being supported by the increasing workplace safety regulations across industries and the corresponding need for comprehensive drug testing programs to maintain safe working environments. Companies across sectors require systematic testing protocols to comply with occupational safety standards and reduce liability risks associated with substance abuse in the workplace.

The growing complexity of substance abuse patterns and increasing regulatory scrutiny are driving demand for advanced testing technologies that can detect multiple drug types and provide accurate results within required timeframes. Employers are investing in comprehensive testing programs to reduce workplace accidents, improve productivity, and ensure regulatory compliance across multiple jurisdictions while maintaining employee safety standards.

Segmental Analysis

The market is segmented by type outlook, product outlook, mode outlook, drug outlook, end use outlook, and region. By type outlook, the market is divided into post-employment and pre-employment drug screens. Based on product outlook, the market is categorized into consumables, instruments, rapid testing devices, and services. In terms of mode outlook, the market is segmented into urine, hair, oral fluid, and instant testing. By drug outlook, the market is classified into cannabis/marijuana, alcohol, cocaine, opioids, amphetamine & methamphetamine, LSD, and others. Based on end use outlook, the market is divided into other professional services, manufacturing, transportation, construction, retail and hospitality, healthcare, education, and IT/finance. Regionally, the market is divided into China, India, Germany, France, UK, US, and Brazil.

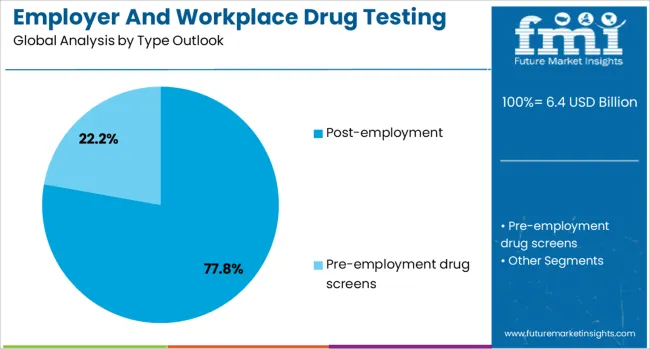

By Type Outlook, Post-employment Segment Accounts for 78% Market Share

Post-employment testing is projected to account for 78% of the Employer and Workplace Drug Testing market in 2025. This leading share is supported by the widespread adoption of ongoing workplace monitoring programs that ensure continued compliance with drug-free workplace policies. Post-employment testing provides continuous oversight of employee substance use patterns while maintaining workplace safety standards across various industries. The segment benefits from established testing protocols and comprehensive service networks that support regular monitoring requirements.

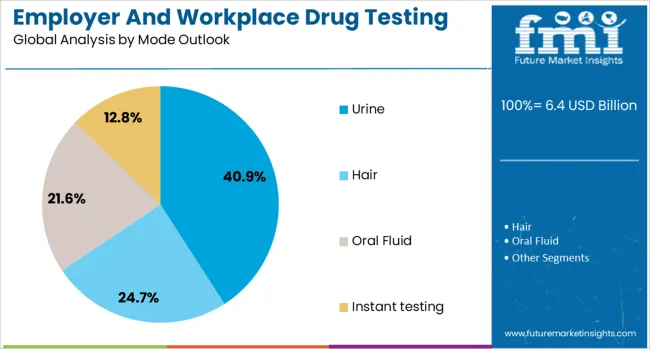

By Mode Outlook, Urine Testing Segment Accounts for 41% Market Share

Urine testing is expected to represent 41% of drug testing mode demand in 2025. This dominant share reflects the widespread acceptance of urine analysis as the gold standard for workplace drug testing due to its accuracy, reliability, and comprehensive drug detection capabilities. Urine testing provides effective detection of recent drug use across multiple substance categories while offering cost-effective implementation for employers. The segment benefits from established collection procedures and standardized laboratory analysis protocols that ensure consistent results.

By Product Outlook, Consumables Segment Accounts for 33% Market Share

Consumables are projected to contribute 33% of the market in 2025, representing the ongoing materials and supplies required for drug testing operations. This segment includes testing kits, collection containers, reagents, and other disposable materials essential for testing procedures. Consumables provide recurring revenue streams for suppliers while ensuring consistent testing quality and compliance with regulatory standards. The segment benefits from continuous demand driven by regular testing requirements across various workplace environments.

By Drug Outlook, Cannabis/Marijuana Segment Accounts for 58% Market Share

Cannabis/marijuana testing is estimated to hold 58% of the drug-specific testing market share in 2025. This dominance reflects the widespread focus on marijuana detection in workplace testing programs despite changing legal landscapes in various jurisdictions. Employers continue to maintain cannabis testing requirements due to workplace safety concerns and federal regulatory obligations. The segment provides comprehensive detection capabilities for both recent use and longer-term consumption patterns.

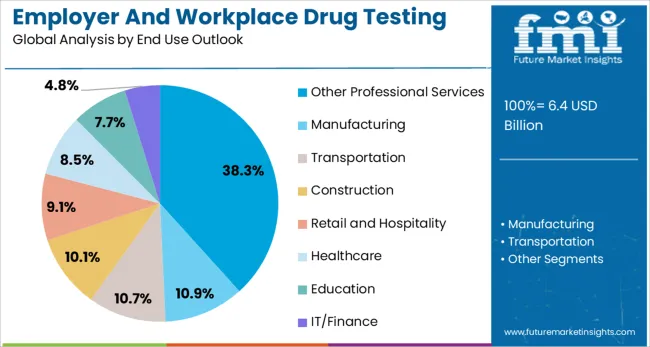

By End Use Outlook, Other Professional Services Segment Accounts for 38% Market Share

Other professional services are expected to represent 38% of end-use demand in 2025. This segment encompasses diverse professional industries that require drug testing for safety, security, and regulatory compliance purposes. Professional service organizations implement testing programs to maintain workplace standards while meeting client requirements and industry regulations. The segment benefits from growing awareness of substance abuse impacts on professional performance and liability concerns across service industries.

What are the Drivers, Restraints, and Key Trends of the Employer and Workplace Drug Testing Market?

The employer and workplace drug testing market is advancing steadily due to increasing workplace safety awareness and growing recognition of substance abuse impacts on productivity and safety. The market faces challenges, including privacy concerns, legal complexities regarding testing policies, and varying regulatory requirements across different jurisdictions. Technological advancement and standardization efforts continue to influence testing accuracy and market development patterns.

Integration of Rapid Testing Technologies

The growing deployment of rapid testing systems is enabling immediate results for workplace testing programs while reducing administrative delays and improving decision-making capabilities. Point-of-care testing devices provide instant screening results that allow employers to make timely personnel decisions while maintaining testing accuracy standards. These technologies are particularly valuable for transportation, construction, and manufacturing industries that require immediate safety assessments.

Development of Comprehensive Substance Monitoring Programs

Modern testing providers are incorporating advanced analytical capabilities that detect emerging drug threats and synthetic substances while providing comprehensive substance abuse monitoring. Integration of multiple testing methodologies and expanded drug panels enables complete substance abuse detection across traditional and emerging drug categories. Advanced programs also support employee assistance initiatives and rehabilitation monitoring services.

Analysis of Employer and Workplace Drug Testing Market by Key Country

Countries

CAGR (2025–2035)

China

6.2%

India

5.8%

Germany

5.3%

France

4.8%

United Kingdom

4.4%

United States

3.9%

Brazil

3.5%

The global market is expected to grow at a CAGR of 4.6% between 2025 and 2035, reflecting increasing regulatory compliance and workplace safety requirements. China leads with 6.2% growth, supported by expanding industrial workforce and stricter government regulations on employee testing. India follows at 5.8%, driven by growing awareness among employers and rising adoption of workplace safety protocols. Germany records 5.3%, reflecting focus on regulatory compliance and advanced testing technologies. France is projected at 4.8%, supported by government-mandated drug testing programs and workplace monitoring initiatives. The United Kingdom grows at 4.4% with increasing corporate adoption of employee testing solutions, while the USA expands at 3.9%, influenced by established safety standards and routine screening practices. Brazil shows 3.5%, reflecting gradual adoption of workplace testing regulations.

The report covers an in-depth analysis of 40+ countries, top-performing OECD countries are highlighted below.

Market Potential of Employer and Workplace Drug Testing in China

China is forecasted to register the highest CAGR of 6.2% between 2025 and 2035, driven by growing corporate compliance requirements and industrial safety regulations. Large manufacturing, construction, and logistics firms have increasingly adopted pre-employment and random drug testing programs. Government campaigns focusing occupational safety have accelerated testing in high-risk sectors. Local testing laboratories and service providers have expanded capacity to meet rising corporate demand. Integration of technology in testing workflows, including digital record keeping and faster sample processing, has contributed to operational efficiency. Multinational corporations operating in China have been adopting global compliance standards, increasing market penetration. Despite a moderate regulatory framework compared with Western markets, testing adoption is expected to rise steadily over the forecast period.

Industrial sector compliance programs increased corporate testing adoption by 2024

Multinationals implemented standardized drug testing policies across China

Local labs expanded capacity for pre-employment and random testing services

Market Expansion of Employer and Workplace Drug Testing in India

India is expected to grow at a CAGR of 5.8% from 2025 to 2035, with adoption influenced by rapid industrialization and corporate safety initiatives. Testing programs have been increasingly implemented in manufacturing, logistics, and IT sectors to mitigate operational risks. Both pre-employment and periodic employee testing are being employed by leading companies to ensure workplace safety. Laboratory infrastructure is being scaled to support rising demand, with private service providers playing a key role in expanding market reach. Awareness campaigns on drug-free workplaces have encouraged adoption among mid-sized and large corporations. With compliance enforcement gradually improving, India’s market is positioned for steady growth over the forecast period.

Pre-employment and random testing increased in manufacturing and logistics sectors

Private laboratories expanded service coverage nationwide

Awareness campaigns by industry associations promoted drug-free workplace initiatives

Market Analysis of Employer and Workplace Drug Testing in Germany

Germany is projected to grow at a CAGR of 5.3% during 2025–2035, supported by strict labor regulations and a strong focus on workplace safety. Large industrial, logistics, and transportation companies have implemented drug testing protocols to ensure compliance and reduce accidents. Testing methods include urine, saliva, and hair sample analysis, with focus on accuracy and traceability. Technological adoption in lab automation and digital reporting has increased efficiency. Market growth has been influenced by a culture of employee safety and regulatory compliance rather than mandatory legislation for all sectors. Laboratory service providers and specialized testing firms continue to compete on service speed, accuracy, and coverage.

Industrial and logistics sectors implemented comprehensive drug testing programs

Hair and saliva testing gained preference for long-term substance detection

Lab automation increased efficiency and accuracy of test results

Future Prospects of Employer and Workplace Drug Testing Market in France

France is expected to expand at a CAGR of 4.8% between 2025 and 2035, shaped by labor safety laws and growing awareness of workplace productivity risks. Pre-employment testing and periodic screening have been gradually adopted in industrial and transportation sectors. While strict privacy regulations limit widespread testing, companies in high-risk operations have maintained regular monitoring programs. Laboratory services and point-of-care testing are being deployed to ensure compliance and fast results. Multinational firms operating in France have contributed to market development by introducing standardized global drug testing protocols. Corporate focus on employee well-being, risk mitigation, and legal liability continues to drive adoption in selected sectors.

Pre-employment testing was implemented by industrial and transport companies

Privacy regulations influenced testing frequency and reporting practices

Multinational firms introduced global compliance standards

Adoption of Employer and Workplace Drug Testing Market in the United Kingdom

The United Kingdom is forecasted to grow at a CAGR of 4.4% during 2025–2035, influenced by health and safety legislation and corporate compliance programs. Companies in transportation, construction, and manufacturing sectors have adopted drug testing to reduce workplace incidents and maintain regulatory compliance. Testing services include urine, hair, and oral fluid analysis, supported by accredited laboratories. Digital reporting and automated result systems have been increasingly deployed for efficiency. The market is shaped by private service providers offering rapid testing solutions and multinational corporations enforcing global policies. Adoption has been gradual due to privacy concerns and voluntary corporate compliance frameworks.

Industrial and construction sectors increased drug testing adoption

Hair and oral fluid testing preferred for workplace compliance

Digital reporting enhanced efficiency in large scale testing programs

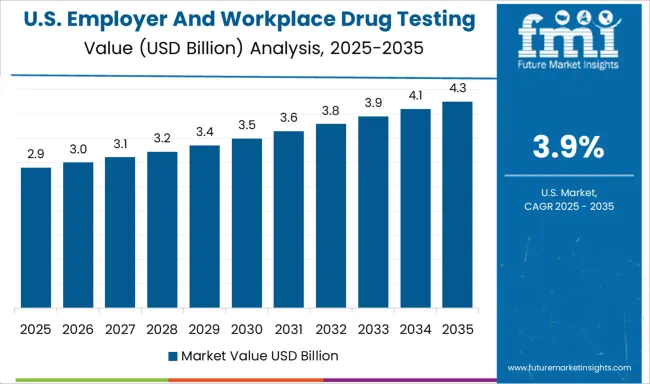

Growth Outlook of Employer and Workplace Drug Testing Market in the United States

The market in the United States is projected to grow at a CAGR of 3.9% between 2025 and 2035, supported by federal and state regulations governing workplace safety. Testing adoption has been driven by occupational safety standards, transportation industry compliance, and employee wellness initiatives. Companies have increasingly implemented both pre-employment and random drug testing programs to reduce liability and enhance productivity. Laboratory services and point-of-care testing have been leveraged to provide rapid and accurate results. The competitive landscape has been shaped by firms such as Laboratory Corporation of America and Quest Diagnostics, offering integrated testing solutions. While market growth is moderate due to regulatory saturation, technological adoption in testing methods and automation has supported efficiency improvements across sectors.

Over 70% of USA employers conducted some form of workplace drug testing in 2024

Point-of-care testing adoption increased by 15% in corporate settings

LabCorp and Quest Diagnostics dominated large-scale testing services

Growth Assessment of Employer and Workplace Drug Testing Market in Brazil

Brazil is expected to grow at a CAGR of 3.5% between 2025 and 2035, with adoption concentrated in industrial, logistics, and mining sectors. Drug testing has been implemented primarily as part of safety management programs to reduce workplace accidents. Private laboratories provide both on-site and centralized testing solutions, while multinational corporations have introduced standardized drug-free policies across subsidiaries. Regulatory oversight is moderate, with testing primarily guided by sector-specific safety standards rather than nationwide legislation. Market growth is moderate but steady, supported by increased awareness of employee safety and corporate risk management.

Industrial and mining sectors prioritized drug-free workplace programs

Private laboratories expanded regional testing services

Multinational companies enforced global compliance standards

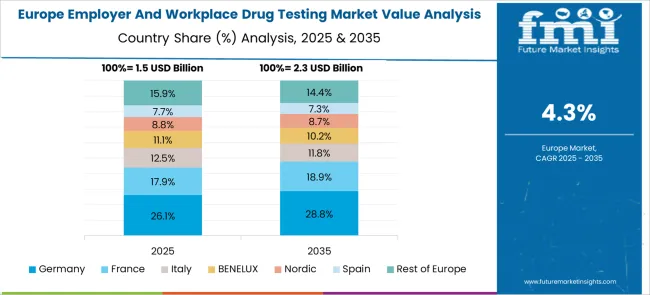

Europe Market Split by Country

Europe’s market is led by Germany, which commands the largest revenue share due to strict regulations and extensive implementation across industries, supporting robust market growth and technological advancements in testing. The UK registers the fastest CAGR, propelled by rising workplace safety awareness and strong adoption of drug screening policies, particularly in safety-critical sectors. France sees expanding adoption driven by increasing concern over workplace productivity and public safety, with particular focus in sectors such as transportation and heavy industry. Southern European, Eastern European, and Nordic countries demonstrate rising uptake as regulatory measures and workplace safety focus strengthen across the region.

Competitive Landscape of Employer and Workplace Drug Testing Market

The market has been shaped by global diagnostics leaders and specialized testing providers, competing on accuracy, speed, and compliance.

First Advantage, Labcorp, Quest Diagnostics, and Abbott have focused on high-throughput laboratory testing, leveraging advanced immunoassay and chromatography technologies to ensure reliable detection of substances. Their strategies focus on regulatory compliance, fast turnaround times, and integration with employer health programs. Drägerwerk AG, Bio-Rad Laboratories, and OraSure Technologies have concentrated on on-site and point-of-collection testing, providing portable solutions and oral fluid or hair-based analyses for immediate screening results.

Regional and niche players including Clinical Reference Laboratory, Cordant Health Solutions, DISA Global Solutions, HireRight, Omega Laboratories, and Psychemedics Corporation have differentiated through specialized services such as forensic-grade testing, tailored employee screening programs, and long-term monitoring. Product brochures highlight sensitivity, specificity, and multi-panel testing capabilities. Focus is placed on accuracy, tamper-proof collection methods, and compliance with federal and state workplace safety regulations. Quest Diagnostics and Labcorp emphasize laboratory scalability, while Drägerwerk and OraSure showcase portable, user-friendly testing devices suitable for diverse workplace environments.

Key Players in the Employer and Workplace Drug Testing Market

First Advantage

Laboratory Corporation of America Holdings (Labcorp)

Drägerwerk AG & Co. KGaA

Bio-Rad Laboratories Inc.

Abbott

Clinical Reference Laboratory Inc.

Quest Diagnostics

Cordant Health Solutions

DISA Global Solutions

HireRight LLC

OraSure Technologies Inc.

Omega Laboratories

Psychemedics Corporation

Scope of the Report

Item

Value

Quantitative Units

USD 6.4 billion

Type Outlook

Post-employment, Pre-employment drug screens

Product Outlook

Consumables, Instruments, Rapid Testing Devices, Services

Mode Outlook

Urine, Hair, Oral Fluid, Instant testing

Drug Outlook

Cannabis/Marijuana, Alcohol, Cocaine, Opioids, Amphetamine & Methamphetamine, LSD, Others

End Use Outlook

Other Professional Services, Manufacturing, Transportation, Construction, Retail and Hospitality, Healthcare, Education, IT/Finance

Regions Covered

China, India, Germany, France, United Kingdom, United States, Brazil

Country Covered

China, India, Germany, France, United Kingdom, United States, Brazil

Key Companies Profiled

First Advantage, Laboratory Corporation of America Holdings (Labcorp), Drägerwerk AG & Co. KGaA, Bio-Rad Laboratories Inc., Abbott, Clinical Reference Laboratory Inc., Quest Diagnostics, Cordant Health Solutions, DISA Global Solutions, HireRight LLC, OraSure Technologies Inc., Omega Laboratories, Psychemedics Corporation

Additional Attributes

Dollar sales by type outlook, product outlook, mode outlook, drug outlook, and end use outlook, regional demand trends across major economies, competitive landscape with established testing service providers and specialized laboratories, integration with rapid testing technologies and comprehensive substance monitoring systems, innovations in analytical capabilities and point-of-care testing devices, and adoption of comprehensive workplace safety programs with integrated testing and compliance management solutions