When Jason Robinson set out to build a cleantech manufacturing plant in southern Ontario, the moment seemed made for him. The co-founder and CEO of Toronto-based Evoco had spent a decade developing sustainable materials for global footwear, car and furniture brands, and with the country buzzing with talk to “build Canada” and buy domestically, Evoco seemed to embody the kind of homegrown, globally ambitious innovation business leaders and politicians wanted to champion.

But as Robinson tries to raise money and grow his business in Canada, he says the “elbows up” spirit hasn’t translated into real support. “There’s lots of talk, very little action. ”

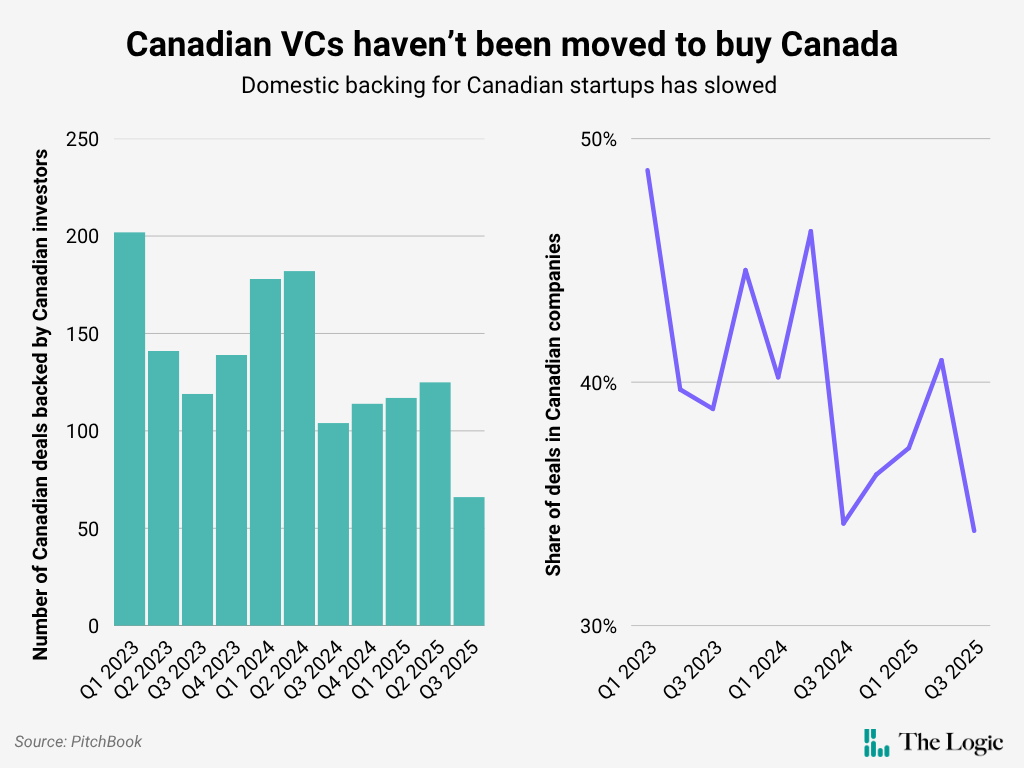

Domestic investing data highlight how little has changed in the eight months since U.S. President Donald Trump’s trade policy triggered a chorus of appeals for economic patriotism.

Talking Points

Despite messages to support Canadian companies and buy their products, entrepreneurs and investors say the discourse has yet to translate into support for domestic tech startups

PitchBook data shows Canadian venture capital investors’ backing for domestic firms as a share of overall deals has declined nearly four per cent compared to 2023 and 2024

The decline in domestic investing comes as more Canadian founders move abroad

In the quarter that ended Sept. 30, Canadian VCs made 66 investments in domestic companies, down from 125 deals the previous quarter and 104 a year earlier, PitchBook data shows. About two-thirds of all deals backed by Canadian investors went to foreign companies. As of Sept. 30, the share of Canadian investments in Canadian companies this year was 3.9 per cent below the average for the same period in 2023 and 2024.

Robinson is trying to raise between $25 million and $30 million to grow his company, which counts global brands including Vans, Michael Kors and Lacoste among its customers. He plans to set up a domestic manufacturing facility for Evoco’s plant-based materials, which are alternatives to petrochemical and animal-derived products like foam in shoe soles or leather car interiors. Currently, the company makes its products at a factory in Vietnam.

Robinson said getting support from government and private investors in Canada is more difficult than it was two years ago, when he raised a $12-million round led by Montreal investment conglomerate Circular Innovation Fund. These days, he’s getting more traction with investors in Europe and Asia. While he ideally wanted to build out the business in Canada, he’s instead pursuing a licensing agreement with a manufacturer in Italy and is considering expanding operations in Vietnam. “We are hoping to still have some support here in Canada,” he said, “but that’s seemingly challenging at the moment.”

Canadian founders have long lamented the dearth of capital available in the country to fund their growth. That’s driven many entrepreneurs to raise money from foreign—mostly American—investors and, in some cases, to relocate to the U.S.

Gideon Hayden, co-founder and managing partner of Toronto-based Leaders Fund, said the steady stream of startups moving stateside reinforces the venture capital shortage—a cycle the buy-Canada push has yet to break.

A recent study conducted by Leaders Fund found the rate of promising startups leaving Canada for the U.S. has accelerated over the past decade. From 2015 to 2019, 70.3 per cent of Canadian-led “high-potential” startups—those that had raised at least $1 million and were founded over that period—were based in Canada. In 2024, just 32.4 per cent of such companies were located in Canada, with nearly half based in the U.S.

That means there are fewer good companies in Canada for investors to back, said Hayden. “If you’re looking to invest in venture scale businesses—companies that have the potential to grow really fast, they operate in massive markets—the pool for those startups locally has shrunk,” he said.

Hayden said he noticed a shift in the language VCs use to describe their support for Canadian innovation while doing the study, which tracked nearly 3,000 startups. “It went from ‘we invest in Canadian companies’ to ‘we invest in Canadian founders wherever they reside.’”

Whether they’re talking about backing Canadian firms or Canadian founders abroad, Hayden said national pride isn’t enough to get most VCs to write a cheque. “Canadian investors would love to invest in Canadian startups,” he said, “but at the end of the day, the job of venture capital is profit maximization.”

Stephanie Curcio, co-founder and CEO of NLPatent, an AI-powered patent research firm, said domestic support falls short in more ways than just capital. Curcio worked as a Bay Street lawyer before making the leap to entrepreneurship in 2018 and starting NLPatent, which mainly serves law firms, in 2021. “I was expecting that the Canadian legal ecosystem would embrace my business with open arms,” she said, “and that, unfortunately, was not the case.”

With the exception of a former employer, Curcio’s early customers were largely American. It wasn’t until the business started taking off in the U.S. that other Canadian law firms began buying her product, she said. “People are picking the Canadian cereal off the shelf,” said Curcio, “but when it comes to technology, Canadians are not choosing to buy in Canada.”

Tech industry leaders have called on governments to step up as customers for Canadian businesses. The Council of Canadian Innovators has urged the federal government to overhaul its procurement processes to make it easier for startups to participate. The industry association, which represents scaling companies, also suggested the government set a target for how much it will purchase from small and medium-sized firms.

Ottawa has since announced a $5-billion Buy Canadian policy, initially targeting defence and construction procurement. And last week, Industry Minister Mélanie Joly unveiled a sweeping plan to support homegrown innovation and emerging industries like semiconductors.

“The government setting the tone is good,” said Hayden, adding that Ottawa could also incentivize the private sector to buy Canadian technology with levers like tax credits. He also suggested tax breaks to encourage angel investing among citizens, whom he says may be more motivated than VCs or corporations to support local firms. “It signals to entrepreneurs that they are valued,” he said, “that we want them to be here.”