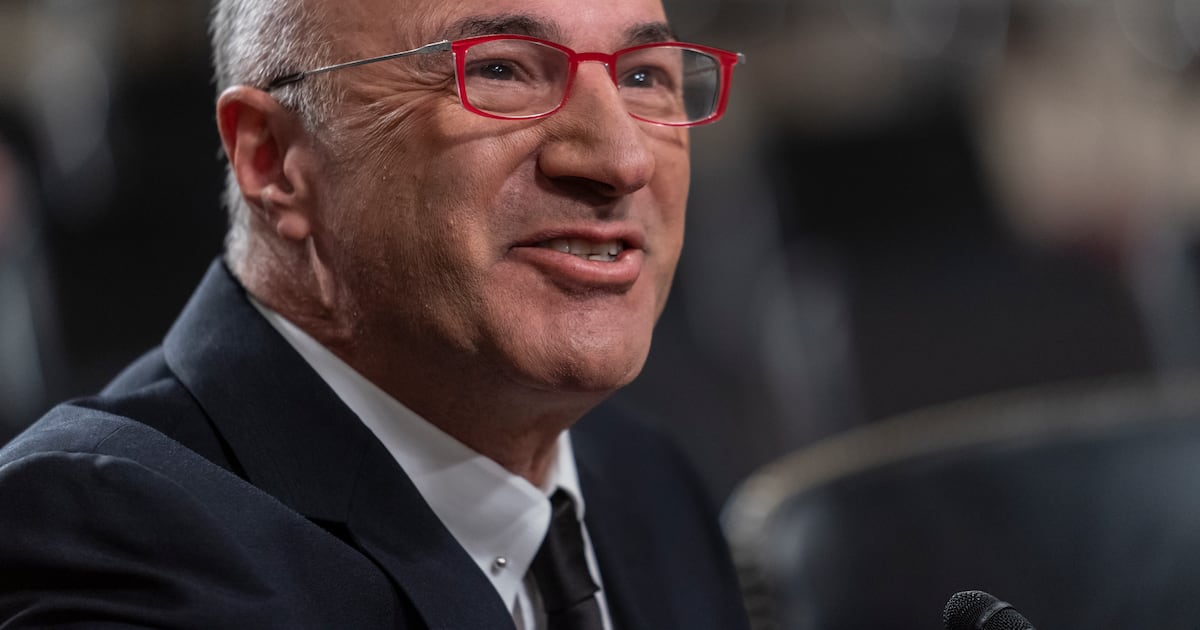

When it comes to getting rich, Kevin O’Leary doesn’t believe the formula has changed much, even in the age of artificial intelligence.

The Shark Tank star and longtime investor says wealth still comes from spotting disruption early and backing the right people.

“I think the analogy that best suits it is Gretzky’s,” O’Leary told me during our Ticker Take interview on YouTube. “You’ve got to skate to where the puck is going, not where it is now. The majority of gains come when you see the first light of disruption. You don’t have to bet the farm, but you’ve got to be early.”

He points to Nvidia as the perfect example. “Four years ago, people thought it just made graphics cards. Unless you understood what was happening in AI, you missed that 20x return,” he said. “You can still make money, but those incredible returns have come and gone.”

Betting on Great Managers

For O’Leary, the real differentiator isn’t technology, it’s management. “When I’m looking at a new technology, I call the founder. I want to hear their vision and understand their team,” he said. “Great leaders can distinguish the signal from the noise. I’m looking for that focus. When I find it, I invest — because I was there first.”

It’s an approach shaped by his experience working with Steve Jobs in the 1990s. “He told me great managers separate the signal from the noise,” O’Leary said. “That’s how I invest.”

The AI–Power Connection

O’Leary believes the biggest fortunes ahead will be made where AI, digital payments, and blockchain converge.

He envisions a world where consumers simply say, “Big Mac with fries,” and AI, geo-location, and blockchain instantly process the order and payment. “It’s incredibly complex under the hood, and full of investment opportunities,” he said.

That future, he adds, will require enormous amounts of power and that’s where Canada comes in.

“There’s no power left on the American grid,” O’Leary told me. “Where’s the puck going? To Alberta. That’s why I have 13,000 acres under contract near Grande Prairie. Canada has stranded natural gas, hydro, and sub-six-cent power: that’s what AI data centres need.”

O’Leary’s Top Investing Ideas

1. AI Infrastructure

O’Leary shared two familiar names: Nvidia and AMD. “AI is being used in all sectors of the economy. That trend is not going away.”

2. Utilities

He’s watching power companies and Brookfield Infrastructure Partners as data-centre demand explodes. “Canada is on the cusp of a renaissance,” he said.

3. The Canadian Dollar

O’Leary believes investors will pour money into Canada to build AI infrastructure, and they’ll need Canadian currency to do it. “I’ve moved out of Euros and U.S. dollars and into Canadian dollars,” he said. “You can earn a yield and benefit as capital flows north.”

4. Crypto and Exchanges

O’Leary’s crypto holdings are now focused on Bitcoin, Ethereum, Solana, and USDC. “You don’t need 27 tokens,” he said. He also owns the exchanges: Coinbase, Robinhood, and Canada’s WonderFi, which Robinhood is acquiring. “If you own the gold, you should own the picks and shovels.”

5. Index Funds

Despite his high-conviction bets, O’Leary says most investors should stick to indexes. “Buy the S&P 500 or Canada’s XIU and try to beat it — you won’t,” he said. “It’s almost impossible. The index should be your core holding.”

6. Canadian Banks

Finally, he holds Canadian bank ETFs — like XFN — as a cornerstone of his portfolio. “Amanda Lang once told me, ‘You can’t pick one bank over another, just buy the index.’ She was right.”

The Takeaway

For O’Leary, getting rich starts with discipline and a clear sense of where the world is headed. “You can’t time the market,” he said. “But you can position yourself for the next wave. That’s where the puck — and the profit — will be.”

Jon Erlichman is a BNN Bloomberg contributor and the host of Ticker Take on YouTube.