Ekati’s owner says open-pit diamond mining at the Point Lake site has been shut down with the loss of hundreds of jobs.

In a statement to Cabin Radio on Wednesday afternoon, Burgundy Diamond Mines said it had “made the decision to temporarily suspend” mining at Point Lake because low prices for diamonds had made the work “sub-economic.”

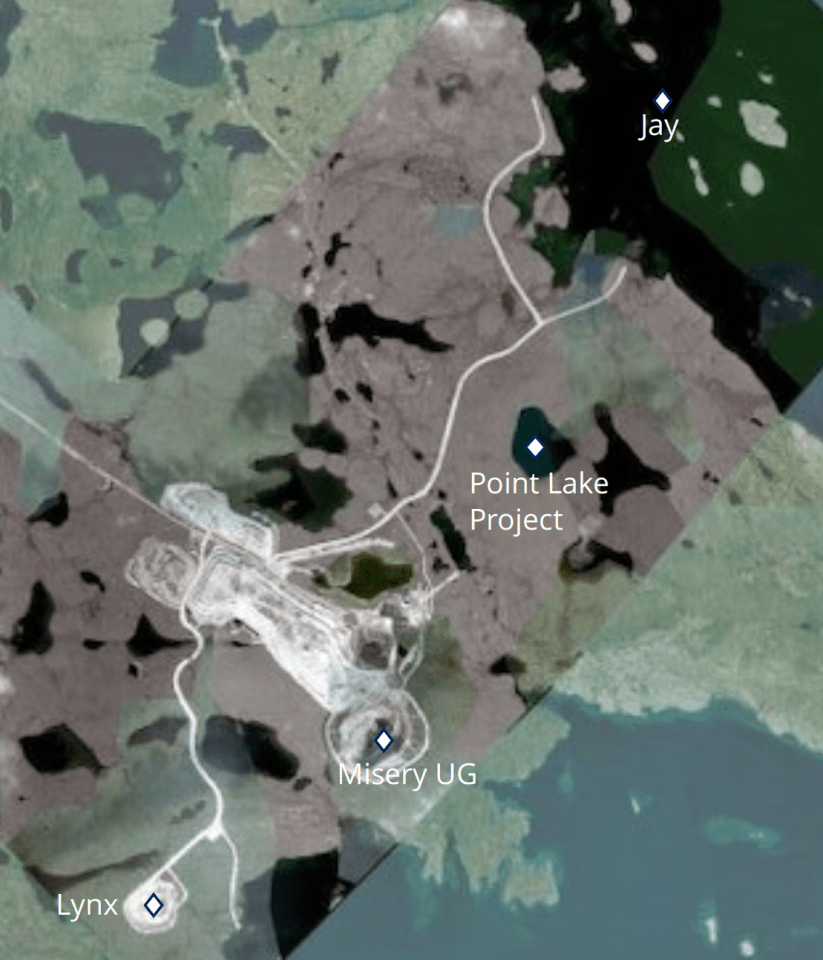

A map of the Ekati site shows Point Lake prior to its development alongside the Misery underground (or UG) project, where mining continues. Lynx, another pit, was operational until 2019.

A map of the Ekati site shows Point Lake prior to its development alongside the Misery underground (or UG) project, where mining continues. Lynx, another pit, was operational until 2019.

“Mining will continue at Misery underground mine, unaffected by the suspension of activities at Point Lake,” Burgundy stated. Misery and Point Lake were Ekati’s two remaining operational zones.

Burgundy confirmed some employees and contractors have been laid off but did not initially provide a figure for the jobs lost. A spokesperson later estimated “several hundred employees and contractors” are affected.

Ekati is one of the NWT’s largest employers and has been at the heart of the territory’s most valuable economic sector, diamond mining, since the late 1990s.

Over the course of 2024, Burgundy says it employed 700 staff and 542 contractors at Ekati, of which 28 percent were northern.

Wednesday’s announcement represented the shuttering of a major project at the site, one that owners of the mine had previously said was key to keeping it open in the longer term. The NWT government recently invested millions of dollars in supports to help keep Ekati and other diamond mines open, arguing in part that doing so was a job protection measure.

“Without action, there is a clear risk of disruption to northern jobs, contracting opportunities, and the economic stability of communities that rely on the sector,” the GNWT had said in April as it announced new funding to help the mines.

Despite that support, which some territorial politicians had opposed, this week’s news delivers a blow to the NWT’s economy.

“Burgundy will continue to maintain Point Lake to ensure that it can quickly and efficiently restart operations should market conditions allow. The company has scaled its operating model to support a viable adjusted mine plan without near-term surface operations,” Burgundy stated.

Burgundy, an Australia-based firm, issued a notice earlier on Wednesday applying for a trading halt on the Australian Securities Exchange. Companies usually ask for a trading halt when significant news is imminent and Burgundy told the ASX it planned to issue an “operational update” in the coming day.

Two messages to Cabin Radio reported some contractors had been told on Wednesday morning not to travel to Ekati, which is one of three active diamond mines in the NWT. Multiple workers confirmed they had been laid off.

Burgundy said Misery’s underground mining operation would remain active because “production rates have significantly improved in recent months via improved mining techniques and equipment utilization.”

The company said it will provide a production update toward the end of the month.

Leadership changes

Burgundy had spent the past year issuing warnings in various forms about its performance and the state of the broader diamond market, which has been disrupted by the growth of lab-grown diamonds to rival naturally mined gems.

In 2024, Burgundy wrote to NWT Premier RJ Simpson asking for a range of new or improved government supports – and threatening to “revisit the viability of the Ekati asset and focus on growth elsewhere” if nothing changed.

Earlier this year, the company said it was “pleased” with the GNWT’s response, which included new supports to Ekati and other mines worth more than $10 million.

Even so, Burgundy reported trimming its workforce by about 20 percent over the past year as it battled to cut costs.

In terms of tonnes of ore processed and carats recovered, Ekati’s results for the first quarter of 2025 were its lowest in years. Meanwhile, rough diamond prices remain low and the United States’ fluctuating tariff threats have introduced what Burgundy termed “uncertainty” over the past six months.

At the start of the year, Burgundy said it would place “significant focus on gaining financial flexibility” in 2025, including initiatives designed to make sure the company had cash to work with.

Ekati, which occupies a central role in the NWT’s economy as a pillar of the territory’s largest industry, has had a rollercoaster existence since the pandemic.

The mine, which opened in 1998, was sold by financially troubled Dominion Diamond Mines to a group of its creditors, dubbed Arctic Canadian, in 2021.

Arctic Canadian then sold the mine to Burgundy in 2023.

Major leadership changes in the past year include the retirement of chief executive officer Kim Truter in May, with Jeremy King his replacement.

Brent Mierau replaced Brad Baylis as Burgundy’s company secretary in June. Baylis was also the firm’s chief financial officer. No replacement for that role has been named.

Are you affected?

If you’re affected by what’s happening at Ekati and have information you’d like to share, you can use this form to contact our reporter.

Related Articles