Monthly Social Security payments could increase by $200 per month, if a bill introduced by Democratic Senators in late October passes.

Here’s what to know about the proposed legislation.

What is the Social Security Emergency Inflation Relief Act?

The proposed Social Security Emergency Inflation Relief Act (S. 3078) aims to provide “emergency inflation relief” payments to certain benefit recipients. It would authorized the Secretary of the Treasury to make monthly “economic recovery payments” of $200 per month to eligible individuals during the “applicable period” in January through June 2026.

The bill was co-signed by Democratic Senators Elizabeth Warren (Massachusetts), Kirsten Gillibrand (New York), Ron Wyden (Oregon) and Church Schumber (New York).

Who would be eligible?

Eligible recipients of the economic recovery payments include those entitled to the following:

benefits under Title II of the Social Security Act, including old-age, survivors and disability insurance benefits

monthly annuity or pension under the Railroad Retirement Act of 1974

compensation or pension payments under certain sections of Title 38 of the U.S. Code for veterans

Supplemental Security Income (SSI) cash benefits

Those eligible under multiple categories would still receive just one payment each month.

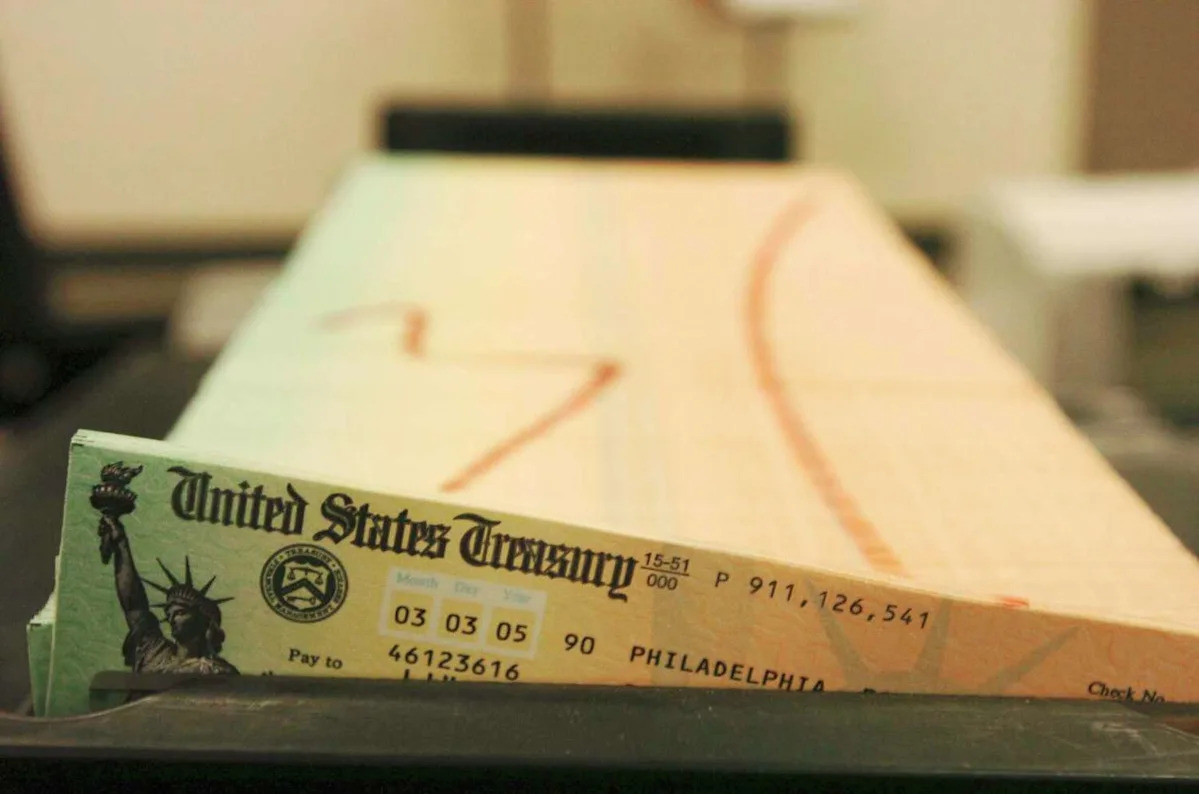

A bill proposed by Democratic Senators aims to help fixed-income Americans cope with inflation and rising costs. (Don and Melinda Crawford/UCG/Universal Images Group via Getty Images)

Why is it being proposed?

The monthly payments “would provide relief to seniors, veterans and Americans with disabilities who live on a fixed income that would not be able to keep up with Trump inflation,” according to a bill summary.

The bill explains the payments would be delivered in accordance with certifications by the relevant agencies, like the Social Security Administration, the Railroad Retirement Board and the Department of Veterans Affairs. These payments would not count as income, meaning they would not be taxed and would not reduce other benefits, and would be protected from garnishment, according to PoliScore. It would also act as an add-on rather than a replacement of the regular annual COLA mechanism.

How much is Social Security going up in 2026? What to know about new COLA increase

In response to the proposal, a White House statement sent to Newsweek said, “President Trump will always protect and strengthen Social Security, which is why he signed historic legislation removing taxes on Social Security benefits for nearly all beneficiaries.”