Source: Yurbed.com

By Guest Blogger Ryan Lewenza

By Guest Blogger Ryan Lewenza

.

From CNBC headlines to client conversations, one topic dominates right now: Is today’s AI boom echoing the dotcom bubble of 2000 – and are we headed for a similar drop? With the spotlight squarely on this important issue, I’m tackling it headon today, offering my perspective on whether the current surge in AI is just hype or the next big thing.

Let’s first separate the extraordinary technological advancement of AI from the lens of investing. From a purely technological perspective, AI stands as one of the most transformative innovations of our lives – on par with the printing press, electricity, the steam engine, and the internet.

Source: Elon Musk’s xAI datacentre in Memphis

I use AI chatbots like ChatGPT, Copilot, and Grok with increasing frequency, and each week I discover new and productive applications. Though still in its relative infancy, AI is evolving at such a rapid pace that we can barely envision what the technology and advancements will look like in 3, 5, or 10 years.

The potential is staggering: AI will reshape the workplace, revolutionize how we learn and consume information, accelerate scientific breakthroughs, and perhaps even play a role in humanity’s journey to becoming multiplanetary – living on Mars or beyond.

Today’s focus is not on the incredible technology, but rather the investing world around AI.

Let’s begin with the positives for AI.

First, like the introduction of the internet which led to the creation of new products like the iPhone, new services like Uber, and new apps like my Peloton app, AI will lead to whole new products, services and apps being created. This will generate billions in new revenue streams and profits for companies.

Second, AI promises sweeping productivity gains by automating tasks. It will streamline administrative work, enhance customer service, and transform manufacturing through robotics. Since productivity is a key driver of long-term economic growth, these efficiencies could translate into higher GDP growth.

Third, across America and around the world, there are hundreds of massive data centres being built as the big tech companies like Meta, Amazon and Google, race to build out their AI networks. This includes building the physical structures, computers to run the AI programs, graphic processing units (GPUs) from Nvidia, network switches and massive amounts of power to run the data centres.

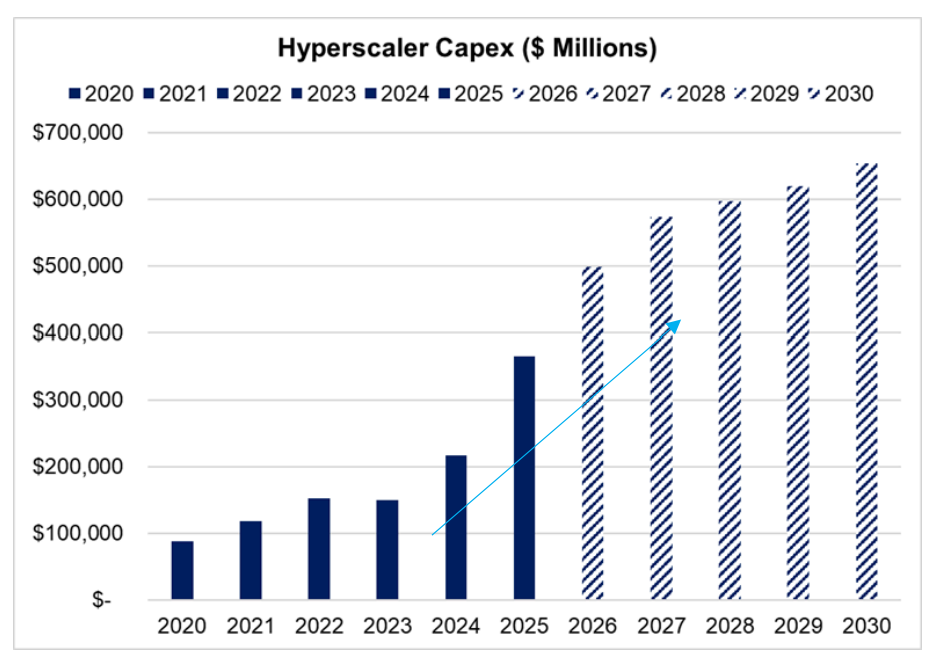

This year alone, the major tech players – known as hyperscalers – are projected to spend US$500 billion on building data centres, a figure that’s expected to keep climbing. This capital expenditure is essential for scaling AI infrastructure, and so far, there’s little indication of a slowdown. However, when this spending eventually tapers off, it could expose vulnerabilities in AI-related stocks, potentially triggering a broader market reaction.

Importantly, today’s AI boom differs significantly from the dotcom bubble of the early 2000s. Back then, many unprofitable startups soared to billion-dollar valuations despite having minimal revenues and no earnings. In contrast, the current AI landscape is dominated by highly profitable tech giants like Amazon and Microsoft. This distinction matters: even if enthusiasm around AI cools, the financial strength of these companies suggests we’re unlikely to see a collapse on the scale of the early 2000s – when the Nasdaq plunged more than 70%.

Big tech ‘hyperscalers’ investing billions in AI

Source: Bloomberg, Raymond James Strategy

Now let’s turn to the concerns around AI – some of which have been keeping me up at night.

First, there’s the sheer volume of hype and capital flooding into the space. Back in 2000, the excitement centered around the internet and laying fiber optic cables across the globe. Today, the spotlight is on AI, with billions being poured into building data centres. Having witnessed this kind of exuberance before, my ‘Spidey sense’ is tingling.

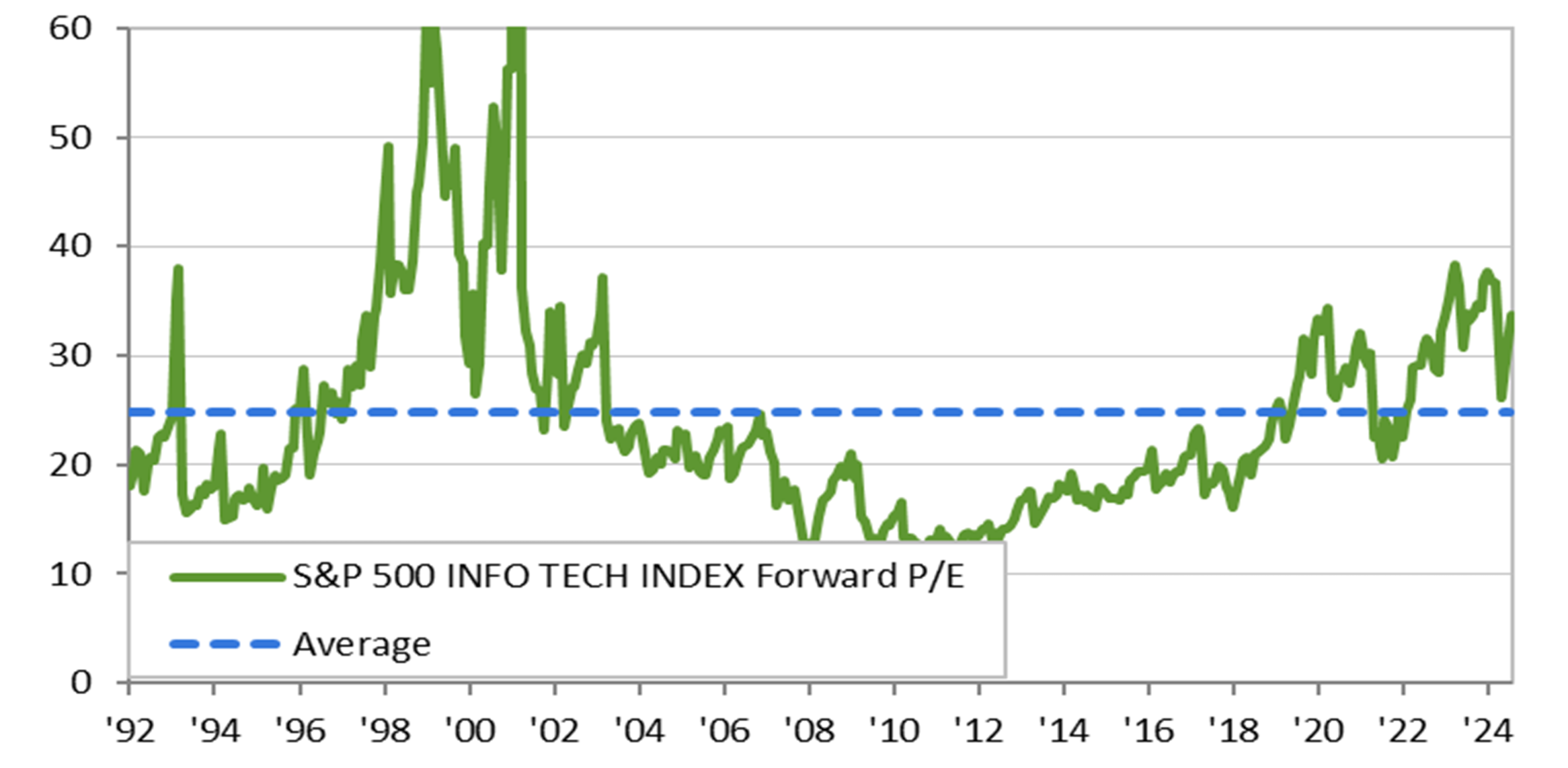

Second, valuations are climbing fast and getting up there. The massive gains posted by leading AI companies have pushed valuations to elevated levels. For example, the S&P 500 Information Technology sector currently trades at a forward P/E ratio of 38x, which is above its long-term average of 25x. Importantly, while this is still well below the peak levels seen during the 2000 tech bubble, it’s a reminder that today’s AI surge, while different in many ways, is not immune to the risks of overvaluation.

S&P 500 information technology sector P/E ratios

Source: Bloomberg, Turner Investments

Third, the central question behind this investment frenzy is whether it will ultimately generate future revenues and profits. The critical metric here is return on investment (ROI). Take Meta, for example: the company is projected to spend an astonishing US$60 billion on AI initiatives this year alone. The real issue is whether such massive expenditures will translate into meaningful financial returns.

Interestingly, a recent report from MIT researchers revealed a sobering insight: 94% of AI investments to date have not resulted in increased revenues or profits. This raises a fundamental concern – what if AI fails to deliver the transformative business models and revenue streams many are banking on? Will this historic wave of spending prove to be a miscalculation?

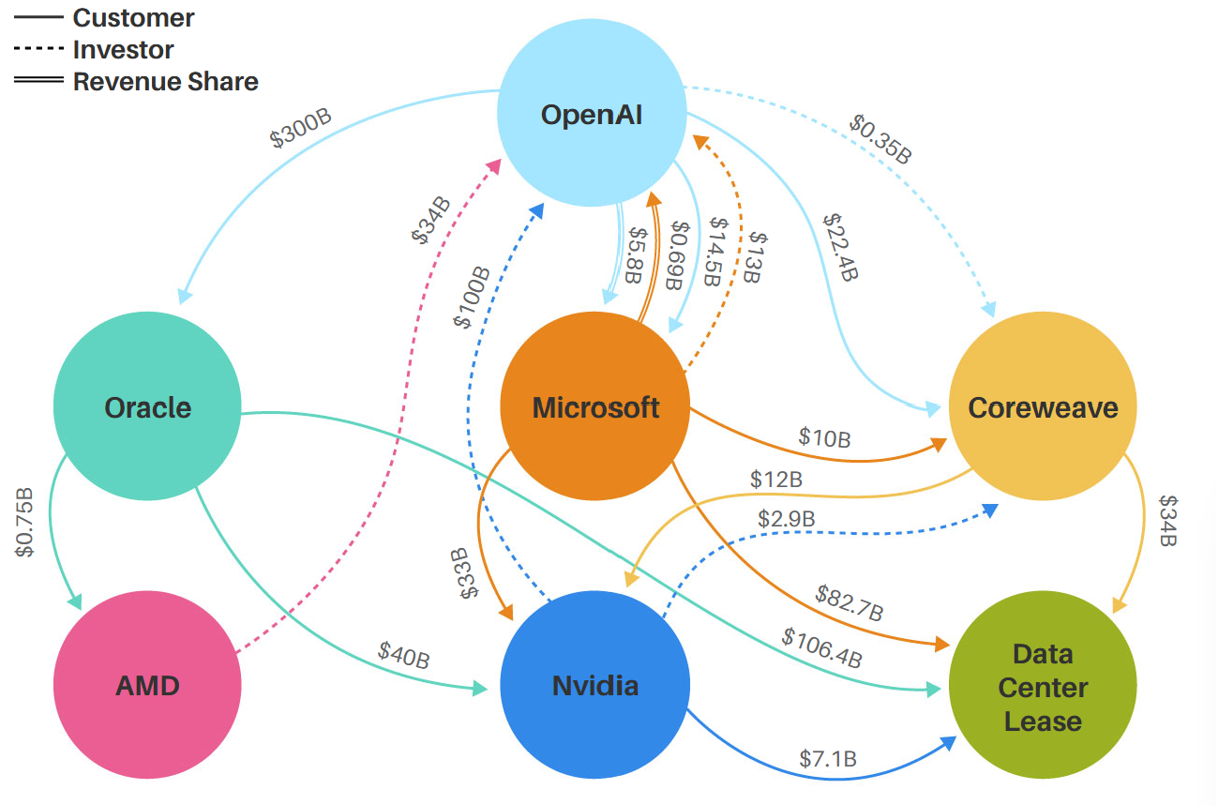

Next, consider the growing circularity within the AI ecosystem. Circularity refers to the intricate web of interdependencies among AI companies. For instance, Nvidia has invested in ChatGPT, which in turn uses those funds to secure long-term contracts with Oracle. This interconnectedness means that a slowdown in spending by one player could ripple across the entire sector, impacting multiple companies simultaneously. The infographic below illustrates these complex relationships.

AI is poised to reshape our world. While it offers groundbreaking capabilities, it also poses risks such as potential job displacement. We’re monitoring AI and tech stocks closely, as concerns are mounting. However, as long as major tech firms continue pouring resources into AI and expanding their data centre infrastructure, this rally may still have momentum.

Increasing ‘circularity’ of the AI ecosystem

Source: Morgan Stanley

Ryan Lewenza, CFA, CMT is a Partner and Portfolio Manager with Turner Investments, and a Senior Investment Advisor, Private Client Group, of Raymond James Ltd.