By Krystal Hu

(Artificial Intelligencer is published every Wednesday. Think your friend or colleague should know about us? Forward this newsletter to them. They can also subscribe here.)

The race to launch the most advanced AI models is still very much on, even as investors are increasingly looking for signs of how model improvements are translating into real revenue.

Google this week introduced its new flagship: Gemini 3 , which independent evaluators have called one of the most capable in the world. The launch, arriving 11 months after Gemini 2, reaffirmed its lead among frontier AI labs. The same week, Elon Musk’s xAI rolled out its own upgrade, Grok 4.1, to keep the pressure on.

Even so, new model launches have struggled to stand out beyond the developer circle, gaining attention mostly when they stumble, as Meta META did earlier this year.

Meanwhile, users are looking for product experience and business results: Alphabet’s GOOG stock climbed this year on tangible returns from AI-powered cloud services.

The fear of falling behind is unlocking enormous capital: Anthropic has secured up to $15 billion in investment from Microsoft MSFT and Nvidia

NVDA, while committing to spend $30 billion on Azure to support its research ambitions.

Even more AI investment could come from zeroing in on Saudi Crown Prince Mohammed bin Salman’s visit to the Trump White House. In the newsletter, we also shed light on how Big Tech is meeting its zero-emission goals amid the data center boom. The short answer? More money. Scroll on.

Email me or follow me on LinkedIn to share any thoughts.

Our latest reporting in tech & AI:

Nvidia Q3 earnings call live updates: AI bubble fears in spotlight

How Big Tech is faring against US antitrust lawsuits

Larry Summers resigns from OpenAI board after Epstein emails

No firm is immune if AI bubble bursts, Google CEO says

Brookfield launches $100 billion AI infrastructure program with Nvidia

Big Tech-led demand for carbon removal credits fuels supply crunch

AMD, Cisco and Saudi’s Humain launch AI joint venture, land first major customer

MBS in the house:

The White House East Room has seen its share of powerful visitors, but few carry the same mix of ambition, controversy and capital as Saudi Crown Prince Mohammed bin Salman.

His visit to Washington, D.C., this week — his first since 2018 — was both a diplomatic comeback and a commercial statement. U.S. and Saudi officials announced billions in new investments and expanded business ties, underscoring how deeply intertwined the two economies have become, particularly in technology and AI.

At the U.S.-Saudi Investment Forum held at the Kennedy Center, the guest list read like a who’s who of Silicon Valley: Elon Musk, Nvidia’s Jensen Huang and executives from Google, IBM, Salesforce, Andreessen Horowitz, Palantir, Cisco and Adobe. The message was clear — Riyadh’s capital ambitions and America’s AI aspirations are now meeting in the same room.

For Silicon Valley, that convergence is both practical and uncomfortable. The killing of journalist Jamal Khashoggi in 2018 halted many U.S. tech firms from seeking Middle Eastern money. But as the post-2022 tech downturn squeezed traditional sources of venture funding, reality set in. The region’s wealth is too large to ignore, and investors told themselves not all money from the Gulf should carry the same stigma. They could tap capital in less controversial regions like the Emirates.

Ethical concerns a ‘difficult principle’:

The AI boom has only magnified the need for capital. Anthropic CEO Dario Amodei has wrestled with the dilemma, with CNBC reporting he ruled out direct Saudi funding over security and ethical concerns — only for Qatar’s sovereign fund to join its $13 billion round a year later. In an internal note reported by Wired , Amodei conceded, “This is a real downside… but ‘no bad person should ever benefit from our success’ is a difficult principle to run a business on.”

The Middle East’s sovereign funds — from the ones behind Abu Dhabi’s G42 to Saudi Arabia’s Public Investment Fund and its new AI venture Humain — are reshaping the global AI map. They’re eager to diversify beyond oil, investing aggressively across the ecosystem and leveraging their resources to gain access and influence.

For example, OpenAI’s $500 billion Stargate data center project includes backing from MGX, an Emirati state-owned fund. Months later, OpenAI announced plans for a data center in Abu Dhabi to help foreign governments “build sovereign AI capability in coordination with the U.S.” Nvidia, meanwhile, is lobbying to sell its high-end chips across the region.

Not all U.S. policymakers are cheering. China hawks in Washington worry about advanced chips and AI models flowing into a region where U.S. influence can be uneven. That tension captures the reality of AI in 2025: AI in the middle of the global superpower race. The money flowing from Riyadh and Abu Dhabi is transforming the balance sheet of American innovation — and once that tide of capital surges in, it may be much harder to turn back.

Chart of the week:

Thomson ReutersBig Tech’s Race to Clean Up Its AI Footprint

Thomson ReutersBig Tech’s Race to Clean Up Its AI Footprint

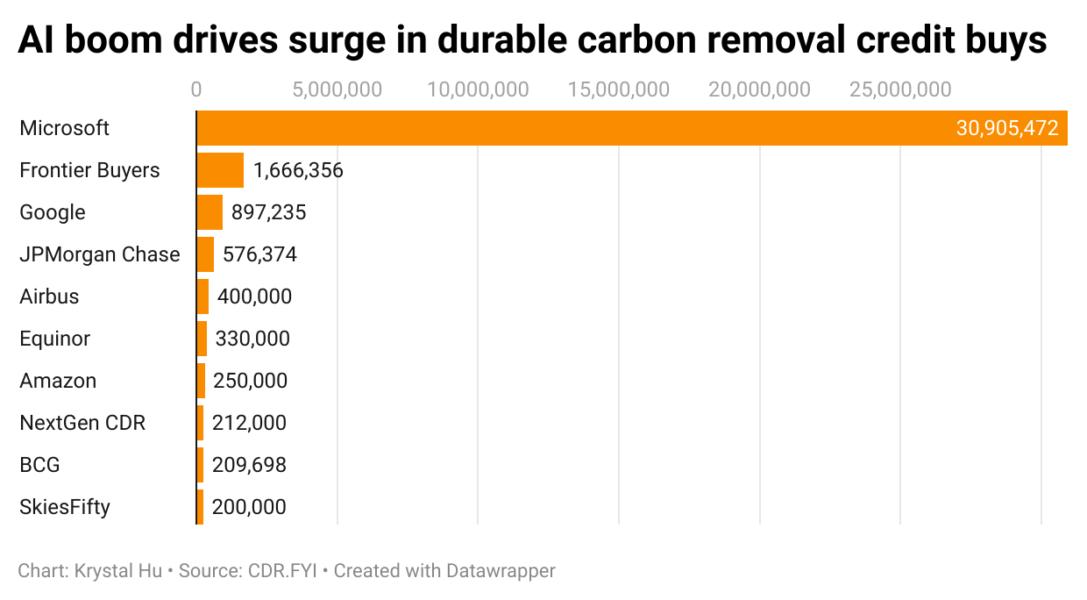

As tech giants race to build out data centers to power the AI boom, they’re also spending heavily to offset the environmental costs. Data from CDR.fyi shows a surge in demand for high-quality, durable carbon removal credits — those that capture and store carbon dioxide for decades or longer. Microsoft has purchased more than 30 million credits, roughly 20 times more than the next-largest buyer, the Frontier Buyers coalition. Google and Amazon also rank among the biggest purchasers.

From my colleagues’ in-depth analysis , this AI-fueled demand is driving up prices and reshaping the carbon market. Durable carbon credits — linked to projects like biochar production, direct air capture and restoring degraded land — are now nearly four times more expensive than traditional offsets tied to forest preservation. The tech giants have pledged to eventually eliminate their emissions on a net basis, yet those offset purchases don’t immediately counter the local environmental impacts of data centers — from water use to strain on regional power grids.