Following the launch of guidelines for card tokenisation in 2023, international and local payment applications like Samsung Pay and Apple Pay were launched in the Sultanate.

According to the Central Bank of Oman’s annual report, these applications allow users to make payments using smartphones and smart watches, instead of carrying cards.

Samsung Pay was launched at the end of April 2024, while Apple Pay was launched in September 2024.

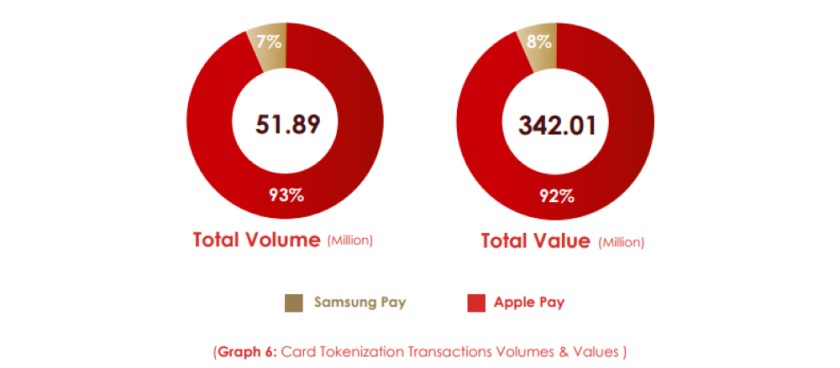

The number of transactions made through digitized cards reached approximately 51.89 million, resulting in around RO342 billion in total payments.

Apple Pay

Apple Pay has the highest share due to its popularity among consumers, capturing 93 percent of the number of transactions and 92 percent of their value. On the other hand, Samsung Pay, despite being launched earlier, holds a transaction share of 7 percent and 8 percent in terms of volume and value, respectively.

The report added that card tokenization has encouraged innovative electronic payments, reduced reliance on cash, enhanced security in card payment transactions, and provided a smooth and easy payment experience, in addition to supporting the national program for digital transformation and the e-commerce strategy.

Volumes routed through cards at POS, and payment gateways show that debit cards represent the highest percentage among the types of active cards, with 584.7 million transactions during the year, followed by credit cards with 30.7 million, and then prepaid cards, which recorded the smallest percentage with 3.4 million transactions.

Debit cards

As for the amount of value, debit cards recorded the highest amount, equivalent to RO7.133 billion, followed by credit cards with RO1.130 billion, which offer multiple financial facilities, and the least used among them are prepaid cards with a total of RO0.031 billion.

The total number of cards in circulation reached 4,963,116.

The usage of active cards varied throughout 2024, according to the rates of their adoption and the purposes for which they are used by individuals and institutions, as these trends are influenced by the benefits and facilities provided by banks and payment service providers for each.

Data reveals that debit cards recorded the highest percentage with 4.6 million active cards observed during 2024, representing 93% of the total active cards, as a result of their convenience and ease of use for daily transactions.

Credit cards

In contrast, the number of active credit cards reached 239.3 thousand cards, which is equivalent to 5% of the total cards, along with the benefits provided by banks, in addition to ongoing promotional offers.

As for prepaid cards, 93 thousand active cards were recorded, which represents 2% of the total cards, and they are primarily used for shopping, fuel payments, and other daily transactions.

The instant payment system, Mobile Payment Clearing and Switching System (MPCSS), includes three methods for identifying the beneficiary when making payments: Mobile Number, Alias Name, and QR Code. However, each method caters to different transaction needs. The chart above illustrates the various types of transactions within the system.

Person-to-Person (PPP) transactions

Person-to-Person (PPP) transactions witnessed significant growth, with the number of transactions rising from 40.55 million in 2023 to 169.36 million in 2024. Additionally, the value of these transactions increased from RO1.718 billion to RO5.558 billion during the same period. This category represents the largest share within the mobile payment system, reflecting its widespread adoption across various banks and its preference among individual users.

Person-to-Business transactions

On the other hand, Person-to-Business transactions increased from 56,230 in 2023 to 190,900 in 2024, with their value rising from RO0.858 million to RO2.03 million. This accelerated growth indicates a growing reliance on digital payments for commercial transactions, highlighting the increasing acceptance of mobile payments in business dealings.