According to Bangladesh Bank data, capital machinery imports fell by around 9.5% during July-October

01 December, 2025, 10:25 pm

Last modified: 02 December, 2025, 12:53 am

Infographic: TBS

“>

Infographic: TBS

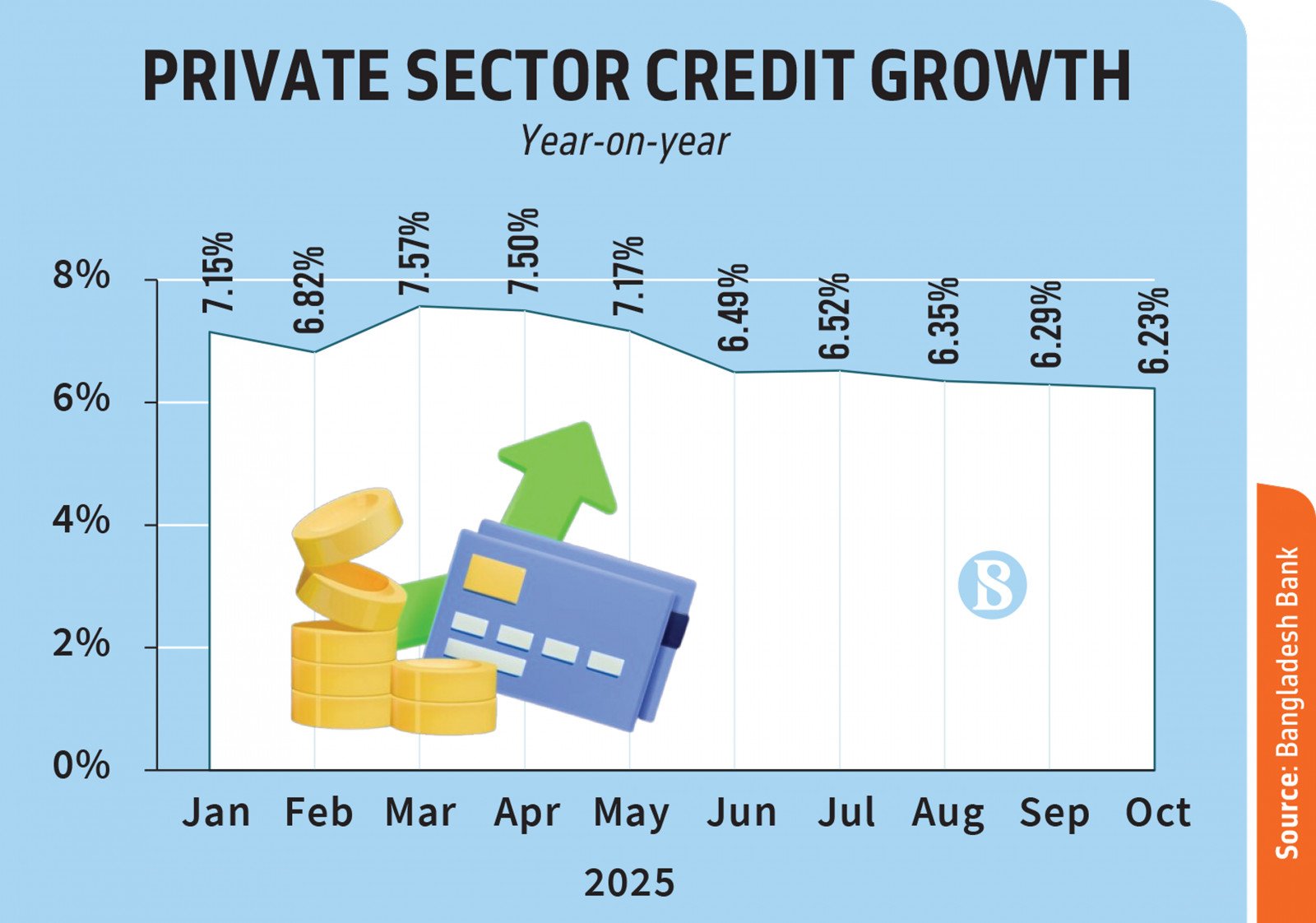

Private sector credit growth in Bangladesh has continued its downward trend, falling to its lowest point in four years in October 2025, according to Bangladesh Bank data.

Central bank figures show that private sector credit growth stood at 6.23% at the end of October this year, slightly down from 6.29% in September. A year earlier, in October 2024, growth was recorded at 8.30%.

Economists and bankers describe the persistent slump as a cause for concern. According to them, the decline is mainly due to the fall in new investment since August last year.

With businesses reluctant to expand, demand for capital machinery has also decreased – leading to lower borrowing. They also noted that businesspeople are facing various obstacles while trying to operate their businesses.

Keep updated, follow The Business Standard’s Google news channel

Zahid Hussain, former lead economist at the World Bank’s Dhaka office, said, “The main reason for falling private credit growth is weak new investment. When there is no new investment, imports of capital machinery fall and loan demand drops. There is no sign of a turnaround in investment, and that is the biggest factor behind the slowdown.”

He added that the earlier practice of borrowing for fraudulent purposes has declined, while dollar shortages that previously limited import payments have eased.

“But one major problem now is the energy crisis. Many factories are struggling to operate because of gas shortages,” he said.

According to Bangladesh Bank data, capital machinery imports fell by around 9.5% during July-October.

Moreover, non-performing loans (NPLs) have surged to a historic high of Tk6.5 lakh crore, equivalent to about 35% of total disbursed loans. With a large share of funds stuck in defaulted loans, many banks remain under financial stress and are cautious about fresh lending.

Dr Ashikur Rahman, principal economist at the Policy Research Institute of Bangladesh, said, “There is stagnation in new investment. When investment rises, capital machinery imports increase too – but right now business expansion is simply not happening.”

Regarding NPLs, he said, “There are both supply and demand issues. NPLs are very high, so banks are very careful about whom they lend to. Banks are looking for safe areas for credit.”

Md Touhidul Alam Khan, managing director and CEO of NRBC Bank, said, “Some banks are facing liquidity pressures and a rise in non-performing loans, which restricts their capacity and willingness to extend fresh credit. High inflation and elevated borrowing costs are also holding back private credit growth.”

Political uncertainty slows decision-making

Economists and bankers also noted that the current political environment has further discouraged business investment, with many waiting for clarity after the national election.

Touhidul said, “The slowdown in private sector credit can be attributed to a simultaneous decline in both credit demand and supply. On the demand side, political uncertainty has led to cautiousness among investors, resulting in delays in new investment decisions.”

Dr Ashikur said, “Over the next three months, new investment will remain limited. Much depends on whether a new political government improves the business environment. The economy is in a very difficult reality.”

Touhidul stressed that to restore lending momentum, banks and businesses needed stability and confidence. “First and foremost, sustained political stability and a predictable policy framework are vital to ensure that entrepreneurs can plan and invest with certainty.”

“Additionally, strengthening the banking sector through enhanced governance, improved recovery processes for non-performing loans, and necessary liquidity support will empower banks to lend more confidently and competitively,” he said.

‘No right environment’ for investment

Business leaders say they are struggling simply to sustain existing operations, let alone expand.

Taskeen Ahmed, president of the Dhaka Chamber of Commerce & Industry (DCCI), highlighted two major concerns – law and order and the energy crisis.

He also said there were doubts whether conditions would improve even in the next two years.

“It may take a year and a half after the national election for an investment-friendly environment to develop. In a country where law and order is not stable, on what grounds will businessmen make new investments?,” he added, further noting that foreign investors will also not invest in such an environment.

“At present, the energy crisis is the biggest challenge because in many places the gas supply is not adequate,” Taskeen said.

Meanwhile, Mohammad Hatem, president of the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), said, “Bank loan interest rates are very high. It has become very challenging to run businesses with such high rates.”

Banks turn to government securities for income

Private sector lending has slowed, prompting banks to increase their investment in treasury bills and bonds. A senior private bank official said reduced loan demand has pushed banks toward these instruments.

A major share of traditional banks’ income now comes from such investments.

Although early 2025 brought concerns over rising deposit rates, persistent inflation, weak loan demand, squeezed margins and political uncertainty, the opposite unfolded.

Private banks, especially stronger ones, saw profits grow, not through loan expansion but through substantial earnings from government securities, which have become the sector’s new lifeline and reshaped bank balance sheets.

BRAC Bank, for example, saw its investment income surge from around Tk700-800 crore between 2020 and 2022 to Tk2,880 crore in 2024, nearly a four-fold rise.