Canstar’s Sally Tindall notes that the detail of the quarterly inflation figures were positive from the perspective of allowing further interest rate reductions.

“Services inflation printed at 3.3% annually, down from 3.7% — the lowest since June 2022. This includes a notable slowing in rental price rises, which recorded a 4.5% rise annually. While this may seem high, it is down from an annual rate of 5.5% recorded in the previous quarter. Similarly, insurances clocked in at 3.9%, down from 7.6%,” she observes.

It’s also important to note, when looking at services inflation, that it has historically been above 3% per annum, averaging 3.2% since September 2001 (once the inflationary effects of the GST had washed out).

So 3.3% is pretty close to this century’s average for services inflation.

This is necessary to keep overall inflation within the target range of 2-3%, as Australia has imported a lot of deflation in key manufactured goods, such as clothing, cars and, particularly, electronics over the past few decades.

Tindall also noted very low price rises in one of the CPI’s biggest weighted categories.

“New dwelling inflation continued to head towards zero, with an annual inflation rate of 0.7%, down from 1.4% in the previous quarter and down from the peak in September 2022 of 20.7%.”

All in all, she believes that makes an August 12 rate cut extremely likely, but not something you should count on yet when budgeting.

“While an RBA cut looks to be a near-certainty, if you’ve got a mortgage, don’t bank on any extra cash until it lands in your bank account. The RBA has shown it doesn’t dance to the beat of market expectations — it’s the one steering the ship.

“Banks are also at the helm of your mortgage and while we expect the big banks to step up to the plate and pass the next cut on in full, there’s no guarantee every lender will do this.”

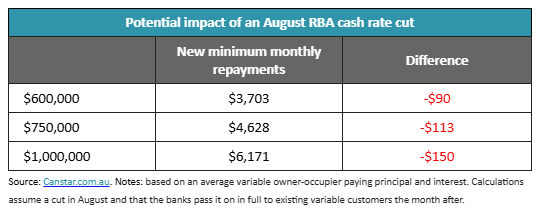

If it is passed on in full, Canstar says it’ll save someone with a $600,000 mortgage around $90 a month.

Someone with a million dollar mortgage debt will save $150 a month if rates fall 0.25ppt (Canstar)

Someone with a million dollar mortgage debt will save $150 a month if rates fall 0.25ppt (Canstar)

BDO economics partner Anders Magnusson says the RBA runs a real risk of slowing the economy more than it needs to.

“With inflation clearly moderating and monetary policy already restrictive, holding rates steady may now risk constraining growth more than necessary,” he warns.

“Recent data from Roy Morgan highlights that mortgage stress is rising sharply, with 28.4% of mortgage holders now considered ‘at risk’. This is the highest level since January, despite the rate cuts delivered earlier this year, driven not just by interest rates but by larger loan sizes and elevated property prices.

“While monetary policy alone can’t solve all pressures facing households, with inflation contained, the RBA has room to act and ease the burden on those most affected.”