Donald Trump is not the only one who “weaves.” This “weave” may cause the next Great Depression unless Trump does first.

I never heard of CoreWeave until I read about it in an article in The Atlantic. I suspect we will be learning a lot about it in the near future if Donald Trump’s “greatest economy in the history of our country” collapses.

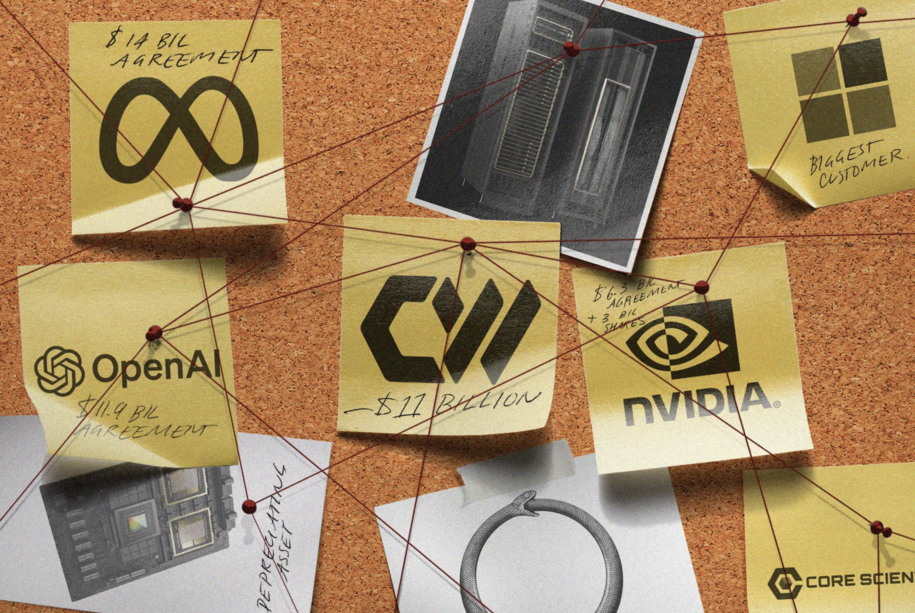

Since it went public in March 2021, CoreWeave’s share price has more than doubled, outperforming the top tech stocks. This year it announced a series a major deals, a $22 billion partnership with OpenAI, a $14 billion deal with Meta, and a $6 billion arrangement with Nvidia. What is strange is that CoreWeave expects to spend $20 billion in 2025 buying up high-end computer chips, and building or leasing data centers, while bringing in only $5 billion in revenue. If my math is correct, it is $15 billion in the “red’ for just one year alone. According to The Atlantic, CoreWeave has been busy borrowing money, much of it from unregulated private-equity firms at high interest rates. It also has over $30 billions in lease payments coming due. When it goes down, its partners, including OpenAI (Microsoft owns over 25% of OpenAI), Meta, and Nvidia will also take big hits and the private-equity industry may completely dissolve.

Microsoft and Nvidia are especially at-risk. Microsoft is CoreWeave’s largest customer providing three-fourth of its revenue. Nvidia is the exclusive supplier of CoreWeave’s high-end computer chips that it buys with borrowed cash.

CoreWeave is not the only company threatened with dissolution if the AI bubble bursts. Other major companies are tied into this network. OpenAI which partners with CoreWeave is also a financial partner with Microsoft, Oracle, and Amazon and it is one of Nvidia’s most important customers. OpenAI is projected to lose $15 billion in 2025.

Estimates this year are that tech companies will spend more than $400 billion on data centers and that the cost of construction, operation, and maintenance of these centers will exceed $7 trillion by 2030 without any clear plan for profitability. Morgan Stanley believes overall AI indebtedness will reach $1.5 trillion by 2028. Credit agencies rate loans to these tech companies as risky investments and the unregulated private equity funds that loan them money charge them higher interest rates. When AI and tech collapses, it with probably bring down the private-equity companies that are tied into major banks and insurance companies, so they may start to fail as well.

Trump weaves in his incoherent speeches and probably with his hair. These companies are all woven together and they are gambling with the economic health of the country and the world.

Happy New Year!