The shift from saving to spendingMy last paycheque from a decades-long career at my current employer will be arriving in a few months for me – so there is a real need (soon) to shift from saving to spending.

I’ve been thinking about some form of retirement for some time.

There are many ways one might retire.

Unlike others, maybe, retirement is hardly the end of any personal finance journey but instead just the beginning of something new.

Some financial experts say that retirement is a process – I would agree with those comments – since a process is a series of actions or key steps taken in order to achieve a particular end. In this case, the end goal is earning meaningful, stable income when your employer paycheque no longer exists.

Shifting from savings mode to spending (asset decumulation) mode requires both a technical shift in money management and a behavioural shift: to an emotionally secure, structured withdrawal plan or at least some sort of income plan to generate meaningful cashflow from your portfolio.

(You might recall my business partner Joe and myself at Cashflows & Portfolios offer low-cost projections services to help any DIY investor map their retirement income plan.)

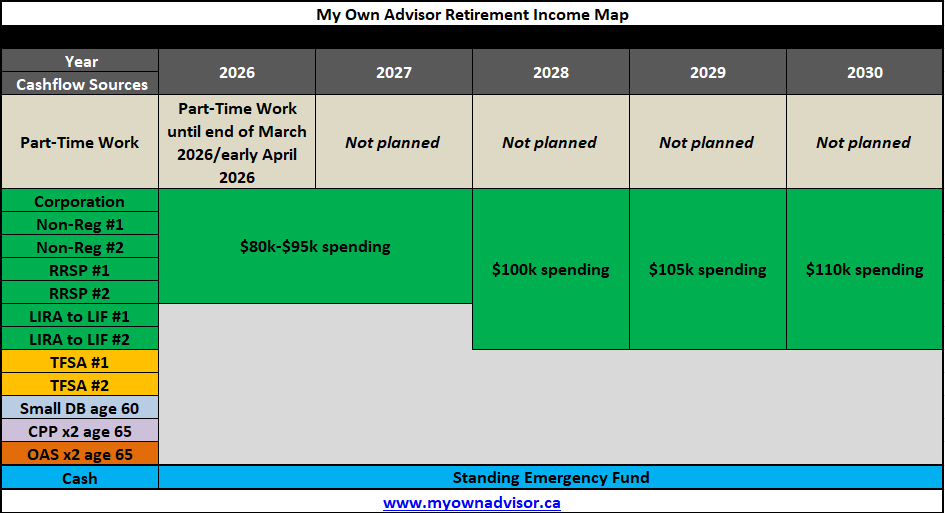

In fact, I’ve been doing this mapping work myself which is contained in any broader projections reports we deliver to clients: all projections reports paint a near-term and long-term picture of where any retirement income money is coming from. I’ll share my own, customized version of our Retirement Income Map later in this post that you might find helpful.

The shift from saving to spending

Most people who reach out to financial planners or advisors for support as part of their retirement income plan already seem to know the basics before they retire.

I’ve learned (at least from folks reading my site over the years) many DIY investors are already well aware of the following in asset accumulation mode or planning for asset decumulation mode:

Getting out of debt and then staying out of debt throughout retirement is usually smart.Having a cash cushion/buffer in place before AND during retirement is probably wise.Taking Old Age Security (OAS) and Canada Pension Plan (CPP) benefits at age 65 will likely take pressure off any registered withdrawals (i.e., RRSPs/RRIFs, LIFs, etc.) – those OAS and CPP income streams are valuable retirement paycheques for most seniors. Instead of focusing on a retirement number, they know it’s essential to understand what you intend to spend during retirement. Just like living expenses while you are working with a paycheque coming in, inflation is a retirement headwind to factor in: so always consider income, growth, total return from your portfolio after inflation. High fees paid to others or paid as part of owning financial products that others sell you will likely cost you a lot of money you will never get back.You should never depend on large stock market returns in any given year to be successful. Life is unpredictable, so your spending in any asset decumulation years (just like your asset accumulation years) must be flexible and even moreso than before when working – so plan around that. Contributions to and then allowing Tax Free Savings Accounts (TFSAs) to compound away, uninterrupted, is smart and so retirees need to consider registered account withdrawals (RRSPs/RRIFs, LIFs, pensions, etc.) before TFSAs in retirement. And the list goes on….

Although I’ve been guilty of tinkering with a retirement number and posting some ideas on that from time to time, I’ve posted for almost 20-years now on this blog that I’ve been focused on living off some dividends and distributions for retirement for the simple reason that I can use that income for retirement spending.

That dividend and distribution income can be my base.

So, instead of trying to hit some artificial retirement number although rules of thumb can be good, I’ve long since preferred to focus on the reasonable return our portfolio can generate year over year and then live off that.

Once I hit that financial independence number, I knew I could retire.

And so, I will. 🙂

Your Free Playbook to Retirement Income Planning

The shift from saving to spending – our Retirement Income Map

One visual that I’ve found helpful to construct is our Retirement Income Map to help map out the shift from saving to spending.

Some financial planners will focus on giving you a large financial plan or report with many facts and figures in it to suggest what might happen 20 or 30-years from now. While interesting of course, this is only helpful to a point.

Consider this:

When you look back at your life, from your 40s or 50s or older ages today – did all life events work out like you planned?

OR

When you look back, you can’t believe what happened in some cases and you have fond memories of how you’ve changed or grown or navigated things through many ups and downs?

I suspect much more of the latter.

The truth I’m realizing more and more in my own retirement income planning work is that there are probably three types of retirement spending plans you should probably consider:

A desired spending plan – what you want to spend with some buffer built in for travel and other life activities you might have put off until retirement. A MAX spending plan – what could you spend if everything goes well financially such that portfolio performance, lower-taxation and lower-inflation works out ideally for you, andA bare minimum lifestyle spending plan – what are the essentials in life you need to cover, should some things hardly go as planned: there is higher, sustained inflation, there is lower long-term portfolio performance such as “Lost Decades”, there are higher healthcare costs or other big events to fund you simply didn’t see coming without 20/20 hindsight.

Any financial planner worth their weight should be delivering multiple retirement income plans related to these themes because life doesn’t move in a straight-line and we don’t live any of our lives in a spreadsheet.

Such planners if you hire them should also consider lowering your total return assumptions and increasing inflation assumptions as major buffers for this simple reason: having more money is better. Everyone can live with higher returns and lower inflation = more spending, a bit more taxation and headaches to complain about online like OAS clawbacks.

Given good health, having “a tax problem” is likely one of the best problems to have throughout retirement.

We should all be so fortunate…and I hope all things considered you have that financial headache too.

Long-time subscribers of my site will likely remember we use the following from our 90/10 equities/fixed income/cash mix these days as part of our retirement income assumptions that you might find helpful:

5% annualized rate of return i.e., over the coming decades from RRSPs/RRIFs, TFSAs and Non-Registered Accounts. Historically, we’ve earned much more than that but I like to be cautious. 3% sustained inflation. I personally wouldn’t go any lower than 2.5% although many financial planners do.

Many financial planners also include “slow-go” and “no-go” spending years in their reports to clients which is fine to a point, but this does not consider aging costs: healthcare and longevity risks that might become very expensive 20 or 30-years down the line. Not everyone is going to age gracefully and easily in place.

While you cannot head into retirement or semi-retirement or any form of retirement without some numbers for sure, work I do and support here in fact, I believe it is impossible to do any meaningful retirement income projections work without understanding your near-term spending goals since 30-year PDF reports today can and will change drastically over time.

This is our Retirement Income Map:

Instead of living in the ideal world 30+ years from now, we live in a more pragmatic work by mapping out our key income sources for the upcoming 5-years – a window of time that we’ll monitor more closely vs. decades into the future as life will change significantly on us.

The shift from saving to spending summary

Retirement means different things to different people. No two spending plans and what people will spend their money on in retirement will be same. I do this work all the time so I can know that with confidence.

Even when people think they have ample savings, there’s a modest level of stress and anxiety that comes with retirement. Even my friend Rob Carrick at The Globe and Mail is dealing with this now (subscription) – and he’s one of Canada’s best-known personal finance journalists who has lived-and-breathed this stuff for decades. I mean, if he is struggling a little bit – why wouldn’t you?

From Rob:

“For now, the challenge is fighting a sense that we need to keep saving despite assurances from our financial planner that we’re well positioned. We have savings for emergencies and contingencies, but what if it’s not enough for a big health-, home- or family-related cost?”

While change is good, change can be hard.

And with any change there can be a huge retirement cocktail of emotions too.

As a project manager along with other hats at my workplace over the years, I’ve seen this and experienced this seemingly a million times over. My role in change at work helps others manage it well. In our personal lives, big decisions also come with second-guessing and sometimes in poor outcomes, regret.

My approach to retirement won’t be too different than my asset accumulation years to be honest, striving to follow many of the same simple concepts I’ve practiced for decades in the years leading up to this point:

Stay out of debt. Keep my investing costs and money paid to others, low. Remain diversified. Be reasonable with my spending using conservative assumptions. Be flexible and adaptable over time. Be OK with the fact that as much as financial plans are good and well intentioned to make decisions – life will not go according to plan. So, the process of financial planning is always critical.

Life will bring changes at any age.

Turning savings into spending isn’t just a financial shift, it’s an emotional shift too.

This is because retirement isn’t the end of any financial journey, more like a new chapter.

I welcome your thoughts on this article or the related subjects enclosed, at any time.

Mark

Further Reading:

I will update this post in the spring of 2026 once I retire from the workforce.

My name is Mark Seed – the founder, editor and owner of My Own Advisor. As my own DIY financial advisor, I’ve reached financial independence. Now, I share my lessons learned for free on this site. Join the newsletter read by thousands every week.