When the interim government assumed office around 18 months ago, it inherited an economy under severe strain.

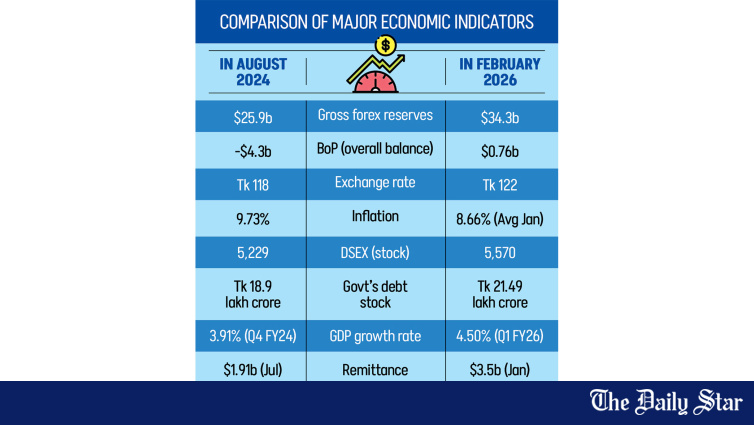

All major economic indicators were flashing red. Foreign exchange reserves were depleting fast, the balance of payments (BoP) was in deficit, inflation was painfully high, debt was rising, GDP growth was slowing, and the financial sector was fragile.

Besides, the true state of the banking sector remained unclear. Several banks and non-bank financial institutions were bouncing cheques, while some repaid depositors using borrowed funds.

Insurance companies were also struggling to meet client demands. And, an ailing stock market added to investor anxiety.

Over the past one and a half years, the economic situation has improved, especially in the external sector. Remittance and export earnings have grown, while imports remained subdued during the early months.

With better dollar liquidity, the Bangladesh Bank (BB) began purchasing foreign exchange from commercial banks, acquiring $4.15 billion so far. This marked a reversal from previous years, when the central bank had to sell more than $25 billion from its dollar reserves to manage crises.

As a result, foreign exchange reserves, which had fallen to $25.90 billion in August 2024 from $48 billion in 2021, rebounded to $34.3 billion by February 2026. The exchange rate, which had depreciated nearly 40 percent over three years, stabilised at Tk 123.

The balance of payments returned to positive territory at $0.76 billion in February, compared with a deficit of $4.3 billion when the previous government fell in August 2024.

Following the political changeover, new BB Governor Ahsan H Mansur reported that a pending $2.5 billion payment from the former government had been settled.

“Any abrupt political changeover often disrupts the economy,” said Zaidi Sattar, chairman of the Policy Research Institute of Bangladesh (PRI).

He described the financial condition as “catastrophic” when the interim government took office. Although GDP had grown under the previous government, he said, underlying vulnerabilities remained.

“On balance, the interim government has stabilised key macroeconomic indicators, though inflation remains high and the financial sector, while restructured, is still fragile,” added the economist.

Fahmida Khatun, executive director of local think tank Centre for Policy Dialogue (CPD), expressed similar views.

“The economy was weak and vulnerable when the interim government assumed office. Almost all macroeconomic indicators were in decline,” she said.

“That downward trend has now stopped, but the economy is not yet comfortable. Inflation has begun to ease, but investment remains weak, unemployment has risen, and the tax-to-GDP ratio has fallen,” said Fahmida.

Some relief has come in the external sector, and banking reforms have clarified the real health of financial institutions. Yet Fahmida said that several reforms remain incomplete and will require attention from the new government.

Although the policy rate was high and monetary policy contractionary during the period of the interim government, inflation did not ease to the desired level.

The country experienced above 9 percent inflation for most of 2023, with consumer prices staying above that threshold from March onwards. During the interim government’s tenure, inflation fell slightly below 9 percent but remained above 8 percent. Lowering tariffs on essential imports provided only limited relief.

Debt stock continued to rise amid a low tax-to-GDP ratio. By February 2026, total government debt reached Tk 21.49 lakh crore, up from Tk 18.9 lakh crore in August 2024.

GDP growth, which had slowed to 3.91 percent in mid-2024, recovered to 4.5 percent by, according to the Bangladesh Bureau of Statistics (BBS). However, private investment has remained subdued over the past several years.

“Austerity measures, including reduced public investment, also restrained private investment, muting GDP growth,” said PRI Chairman Sattar. “The new government now inherits a comfortable reserve position and a more stable macroeconomic environment. Its focus should shift to growth, job creation, and reducing income inequality.”

Zahid Hussain, former lead economist at the World Bank’s Dhaka office, described the economy as having been on the edge of collapse when the interim government took office.

“From that position, the economy has moved to a relatively comfortable state. Reserves have risen by $8-$9 billion, the exchange rate has stabilised, and the negative BoP has been eliminated. Financial sector panic has eased, though some distress remains,” he said.

Hussain added that beyond the five banks already identified, several institutions are effectively on life support. Inflation has eased but is above tolerable levels, and confidence in a sharp decline is limited.

As for economic revitalisation, he said little progress was expected from an interim government given its short tenure.

“Which investor would commit when there is no guarantee that decisions will remain under the next administration?”

However, the economist said the interim government hit a “big six” in the last ball through a smooth transfer of power.

“Despite many uncertainties, the election was held, and after the polls, there was no significant disagreement among the major parties. This is the government’s major success. It will send a strong message to investors and entrepreneurs.”

Whether this big hit ultimately wins the match will depend on the performance of the next government, Hussain concluded.