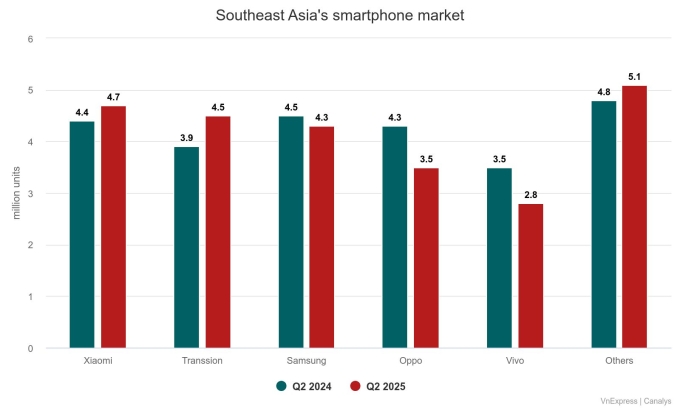

It accounted for 19% of market share, driven by strong Redmi series sales and expanded channel reach, according to a latest report by U.S.-based market researcher Canalys.

Its performance was boosted by the expansion of its direct-to-consumer and operator channels, creating a solid foundation to scale its sub-brands, said Canalys research manager Le Xuan Chiew.

Shipments of Poco, a sub-brand of Xiaomi, more than doubled, while the premium Xiaomi 15 series grew 54% year on year, a milestone for a brand long perceived as a budget flagship, he added.

China’s Transsion climbed to second place with 4.5 million units, a 17% jump, on the back of new launches in the entry-level portfolio. It held a share of 18%.

Samsung ranked third with 4.3 million units, down 3% year on year, though demand for its 5G-capable devices grew in markets like Vietnam and Singapore, supported by the improved value proposition of its Galaxy A06 5G and A16 5G models.

It had a 17% market share.

Chew said that Samsung has strengthened channel diversification and premium positioning by expanding its enterprise strategy, an advantage rooted in its legacy as a trusted partner to large enterprises and government sectors.

This reflects the South Korean company’s growing focus on vertical integration and business-to-business engagement, setting it apart from competitors, he said.

Two Chinese companies rounded up the top five.

Oppo (excluding OnePlus) was placed fourth with 3.5 million units, falling 19%, as competition in the entry-level tier intensified. The brand had a 14% market share.

Vivo came in fifth, shipping 2.8 million units, a drop of 21% amid a strategic pivot toward improving profitability. It claimed a 11% market share.

Overall, Southeast Asia’s smartphone market declined 1% year on year in the second quarter to 25 million units, as tariff uncertainty continues to cloud the region’s outlook.

“The ongoing U.S.–China trade tensions are creating significant knock-on effects, as vendors realign supply chains away from China to prioritize shipments for the U.S.,” Chew said.

This inevitably impacts production and stock allocation from manufacturing hubs such as China and Vietnam to both Southeast Asia and the U.S., disrupting inventory planning and constraining product availability, he added.

Currency volatility, particularly a weakened U.S. dollar, is influencing local purchasing power and retail pricing, forcing vendors to adjust prices or promotions to remain competitive, he said.

Although shipment volumes stayed relatively steady, looming tariff uncertainties and persistent macroeconomic headwinds are dampening consumer sentiment, especially in the mass market segment, he added.