Weekend Reading – Managing Your Debt Burden

Welcome to a new Weekend Reading edition about managing your credit and debt burden – if you have one!

Here is my recent post in case you missed it – selling most of my individual U.S. stocks.

Weekend Reading – Selling my U.S. stocks

And even with boring, low-cost ETFs in our portfolio earmarked for growth, our income needed for retirement in 2026 grew higher.

July 2025 Dividend Income Update

Weekend Reading – Managing Your Debt Burden

Headlining this edition, I found that a new TD survey found that 59% of new Canadians say better access to credit would improve their living experience. At the same time, nearly 8 in 10 report difficulty building credit once they arrive here.

Tricky issue – in that nearly all of Canada’s population growth (97.6%) in 2023 came from international migration, underscoring how newcomers play a central role in our economy and communities (Source: StatCan).

It’s not just newcomers to Canada who struggle with access to credit or managing debt – whether that’s for something as simple as a cell phone plan or something more tangible like a rental unit or home. Without easy access to credit, everyday essentials can become barriers.

But we know debt can be crippling.

I’ve heard from a few readers in the past few months on this subject…

Anyone who’s acquired even the smallest amount of debt understands how much it can affect your world – it can be like rust building up. Debt can eat at us both physically and psychologically, including putting lots of stress on our relationships/partners. Debt-related stress can create anxiety, depression, sleep disturbances and more.

We used to have debt, lots of it. Hundreds of thousands of dollars of it. I used to stress about it.

This brings me to one of many reader questions as part of this Weekend Reading edition:

Mark, I get you like investing but do you still have debt and if so, how much? Would you ever consider entering your retirement with debt?

Thanks for your question.

Do we have debt?

Nope.

Read On: We paid off over $350,000 in mortgage and related borrowing costs.

Would we ever consider entering our retirement with debt?

No way.

For us, it was always important to start semi-retirement or retirement without debt. So we have. With debt, you are paying other people first.

I believe it’s problematic to have debt in retirement when you’re no longer working full-time:

Managing a mortgage along with line of credit or other debt obligations can cause unnecessary stress as you age, andDebt / paying other people first limits your cashflow.

On the flipside, I like the freedom that comes from knowing everything I/we have is ours. Less taxes of course.

My advice to anyone struggling with debt (at any age) should consider one or more of the following approaches:

Take time to define your debt. Analyze who you owe, for what and by when, in detail. Take time to create and practice a budget. Analyze your income and expenses to create a realistic budget – where money needs to go; identify all needs vs. all wants.Explore financial management opportunities. Explore ways to a. increase your income and/or, b. cut back expenses and/or c. use debt consolidation approaches including access to professional help for guidance.

I hope that reply helped!

Another reason question:

Mark, are you buying anything of late with the recent market run-up?

I have! 🙂

In our April income update I mentioned we bought more XAW:

“… lower prices in my other main equity ETF I own (XAW) has triggered some buying opportunities over the last month. So, I did buy more.”

April 2025 Dividend Income Update

Earlier this summer, I got more Brookfield (BN).

“Thanks to many dividend raises earlier this year, with more BN in the portfolio, along with more HEQT dripped inside my small LIRA each month, our *projected income moved higher this past month!”

June 2025 Dividend Income Update

More recently, I got some more utilities in my portfolio when one stock I like in particular dipped in price in early August. You’ll need to wait until I share my upcoming August 2025 Dividend Income Update for that news. 🙂

Readers, have you buying anything recently? If so, what?

Mark, any idea of what your asset mix is? Why is that?

For sure!

Right now, we’re about 90% equities and 10% fixed income.

Of note, we will use our fixed income in place for 2026 semi-retirement / retirement expenses without selling any equities during the year.

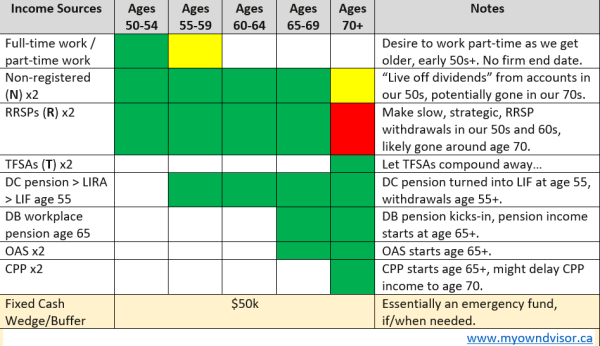

I shared some sort of Retirement Income Map I keep with you before. This is what I mean: mapping out retirement income sources in 5-year blocks to know where and how much our own retirement income funding will come from…

I’ll refine this map later this year since things have shifted a bit but generally speaking our drawdown order remains the same in the table: NRT.

“NRT” = Non-Registered (N) with Corporation withdrawals, along with RRSP assets (R), then TFSAs (T).

(FYI: This is actually the default logic in fact for many professional software programs.)

The reasoning behind this NRT approach is to force some withdrawals from taxable accounts, first to avoid too much ongoing taxation, then use up the tax liability that is RRSPs/RRIFs sooner than later. This leaves tax-free money via TFSAs “until the end” for estate planning.

I welcome any and all other reader questions, anytime!

Have a great weekend with some further links and reading material below.

Mark

Further Reading:

When summer spending and fun leaves you in a financial hangover, this is what to do. This is aligned with my debt and credit tips above.

This is how financial journalists like Rob Carrick plan for their own retirement. A fine read.

There are dozens of Retirement stories from many DIY investors and essays you can learn from here.

Instead of focusing on the 4% rule, you can drawdown your portfolio via Variable Percentage Withdrawal (VPW) using this free calculator.

Enjoy more FREE retirement calculators such as my personal favourites here.

Want some personalized help?

Tired of searching for a financial plan and paying thousands of dollars for it?

Have you tried all the “free” financial calculators online, but just can’t seem to get the personalized answers that you are looking for?

I get it.

I don’t blame you.

I wouldn’t pay thousands either.

I provide all DIY investors and My Own Advisor readers an automatic 10% discount – always.

Mark

My name is Mark Seed – the founder, editor and owner of My Own Advisor. As my own DIY financial advisor, I’ve reached financial independence. Now, I share my lessons learned for free on this site. Find out what I did and how I reached financial independence to tailor your own path. Join the newsletter read by thousands.