Safe Withdrawal Rates for Every Investment Horizon, From 3 to 50 Years

This article draws heavily on Bill Bengen’s new groundbreaking safe withdrawal rate research and references his latest updates. Bill was kind enough to review the article and his insights are included.

Bill is widely recognized as the originator of the “4% rule” and nearly every academic paper, financial-planning article, and media piece on retirement withdrawal rates references his work. Bill now unveils his updated safe withdrawal rate for a 30-year investment horizon* — increasing it from 4.0% to 4.7%.

The increase from 4.0% to 4.7% stems primarily from Bill’s updated assumptions. In the past, Bill assumed a 50/50 U.S. stock-and-bond portfolio. His new model (4.7%) assumes a well-diversified portfolio. **

The Math Behind the Change from 4.0% to 4.7% amounting to a 17.5% Raise

In the first year of retirement. a retiree with $1 million in retirement savings can withdraw $47,000 instead of $40,000 ($7,000 raise divided by $40,000 = 17.5%).

Reminder of How Bill’s Safe Withdrawal Rate Works

You start by withdrawing 4.7% (formerly 4.0%) from your retirement savings and in each subsequent year, you increase the initial year’s withdrawal by a percentage equal to the annual inflation rate — regardless of market fluctuations. So, even if the portfolio’s value drops to $850,000 after year one and inflation is 3%, your year two withdrawal is still based on the year one withdrawal of $47,000 increased by 3% (inflation) resulting in a year two withdrawal of $48,410.

Why Horizons Matter

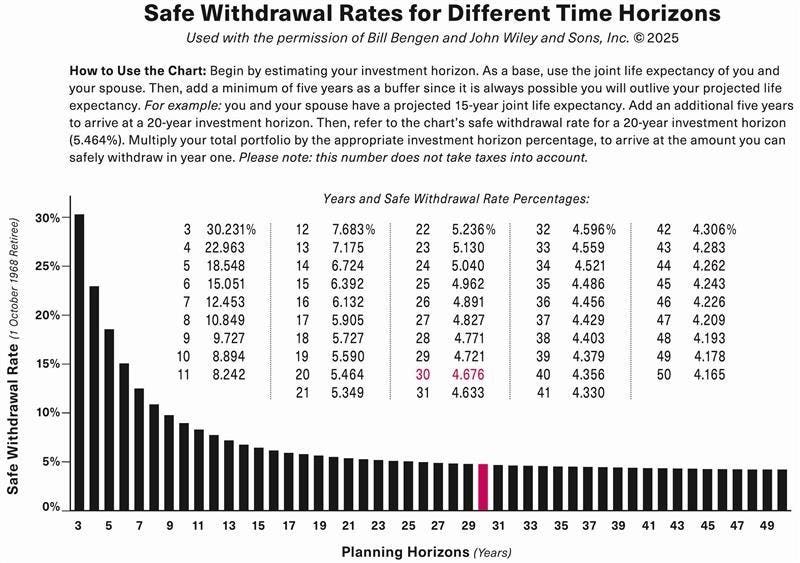

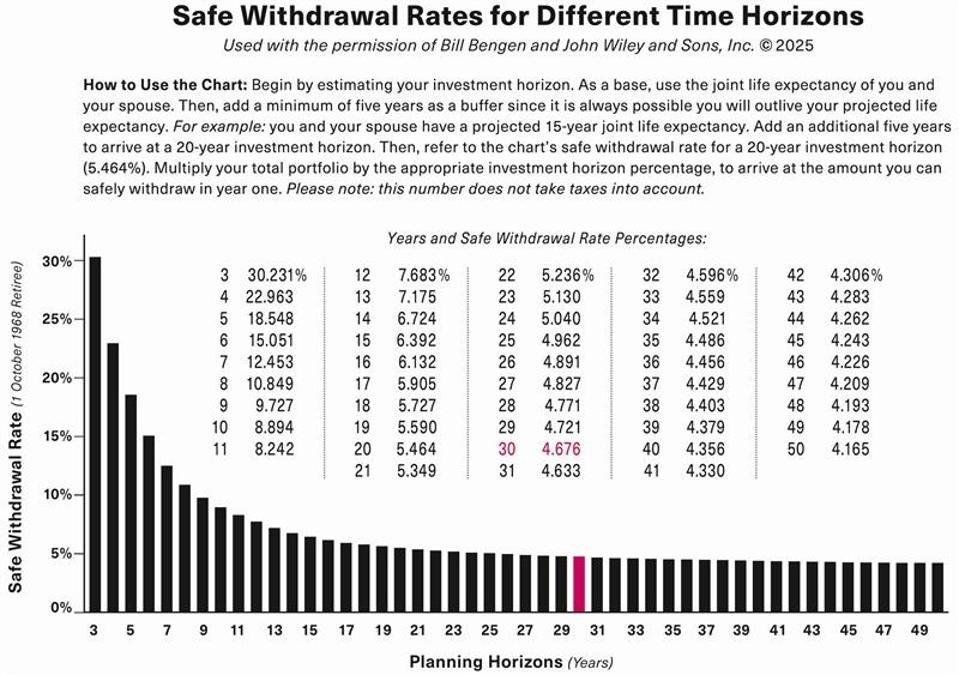

Few retirees have an exact 30‑year investment time horizon; many will need income for only a few years, while others for half a century. Bill’s simple but revelatory chart shows the new safe withdrawal rates for different investment horizons between 3 and 50 years. The chart on page 81 of his new book*** reproduced in this article provides an authoritative picture of how much money you can safely withdraw from your portfolio and never run out of money. The percentages are surprisingly high.

The new projections allow retirees to match their withdrawal strategy to their own realistic investment horizon instead of anchoring their planning to a one‑size‑fits‑all 30‑year investment horizon assumption.

For example, if you have a ten-year investment horizon, you can now safely withdraw 8.894% for twenty years, 5.464%.

Bill Bengen’s updated Safe Withdrawal Rate chart shows how much you can safely withdraw from your portfolio each year based on your personal investment time horizon, which ranges from 3 to 50 years, without running out of money.

Used with permission of Bill Bengen and John Wiley & Sons, Inc. © 2025What the Chart Reveals and Why it Could Be Life Changing

The chart illustrates the new safe withdrawal percentages along a 50-year timeline using the experience of people who retired on October 1, 1968 — the worst retirement start date in recorded U.S. history. Retirees on that date suffered the devastating combination of a severe bear market and the high inflation of the 1970s. Even under historically worst-case conditions, the updated safe withdrawal rates hold up. This chart is conservative. Most retirees will likely experience even better outcomes.

The Practical Impact for Retirees

Depending on your expected investment horizon, you can now know how much you can conservatively — but confidently — withdraw from your portfolio and not run out of money.

Beyond the numbers, the quality-of-life impact is significant. Safely spending more may allow retirees to enjoy more travel and indulge in experiences that might otherwise have seemed out of reach.

My father-in-law, who is 101 years old, sponsors an annual family vacation including all the children, spouses, grandchildren and now great grandchildren. What a legacy! This advice aligns with a growing body of happiness research which shows that spending money on experiences rather than material possessions generally creates more lasting satisfaction and well-being. Alternately, you may prefer to make financially meaningful gifts to children when they need it most rather than leave it to them after you pass. Even if you don’t change your spending or gifting, I hope if nothing else this article reduces your fear of outliving your money.

If Leaving a Legacy is A Goal

If you have a legacy goal in mind, you can adjust your safe withdrawal rate accordingly. Section 7.2 on page 98 projects starting with $1,000,000 and a 30-year investment horizon. By reducing your withdrawal rate to 4.21% from 4.67%, you could leave a legacy of at least $500,000 in today’s dollars.

Caveats and Conclusion

No system is immune to risk. A historically unprecedented sequence of poor returns could disrupt even the most robust model. In addition, even Bill acknowledges there are other viable safe withdrawal methods. That said, Bill’s framework and methodology is by far the best known and has survived for over thirty years.

Despite the caveats, Bill’s chart on page 81 of A Richer Retirement: Supercharging the 4% Rule to Spend More and Enjoy More, reproduced here, may truly be one of the most important pages in recent retirement literature. Whether your planning horizon is 3 years, 30 years, or 50 years, Bill’s work offers the most authoritative roadmap for spending safely without outliving your money.

The suggestions below are not Bill’s but mine and there are plenty of exceptions.

Optimize your Social Security planning so that the spouse with the stronger earnings record waits until age 70 to collect. Take the equity of your home into account, by taking out a HELOC or reverse mortgage or doing nothing now but knowing they are both future options. Consider purchasing an immediate annuity (especially good for people with long life expectancies and no children). Do a series of Roth IRA conversions. Spend your after-tax dollars first, then IRAs, and last, Roth IRAs. Prepare estate planning documents utilizing Lange’s Cascading Beneficiary Plan℠.

But, when analyzing how much money you can safely withdraw from your portfolio, Bill Bengen provides retirees with an invaluable framework. By applying his research, individuals can pursue both financial security and a fuller, happier retirement.

*Throughout the article, I use the term “investment horizon” because that number may be different from your projected life expectancy number. If you are married, it should represent the joint life expectancy of you and your spouse. As Bill also points out, it is best to overestimate your life expectancy to arrive at your investment horizon. If you think you will live 25 years, consider using 30 years to be conservative.

**Bill’s assumptions for the foundational 4.7% rate include:

· Accounting for the variability of high inflation and high market valuations.

· A defined 30‑year planning horizon.

· Withdrawals come from retirement accounts. (but you must pay the tax).

· No dollars left at the end of the horizon.

· A well‑diversified portfolio of seven different asset classes with 55% stock, 40% bond, and 5% cash.

· Periodic portfolio rebalancing.

· Accepting market returns rather than attempting to beat the market.

· Withdrawals spread periodically throughout the year.

*** Bill Bengen: A Richer Retirement: Supercharging the 4% Rule to Spend More and Enjoy More (Wiley, 2025).