USD/JPY is trading over the 153-level reflecting broader dollar strength and expectations that the BoJ will refrain from lifting rates over the coming meetings. Nationwide inflation data released today revealed an annual increase from 2.7% to 2.9% in September. Energy inflation jumped from -3.3% to +2.3% as bigger energy subsidies from a year earlier dropped out. The surge in rice prices also continued to fade. Core-core inflation slowed from 3.3% to 3.0% and services inflation slowed modestly as well. The data certainly won’t put any added pressure on the BoJ to hike. The OIS market pricing for a hike by December is now less than 50% although by January is at 85%. PM Takaichi also gave a key policy speech. The JGB market is stable but Takaichi spoke of “responsible, proactive fiscal policy” and that air of ‘Abenomics’ has helped reinforce further moderate yen weakness.

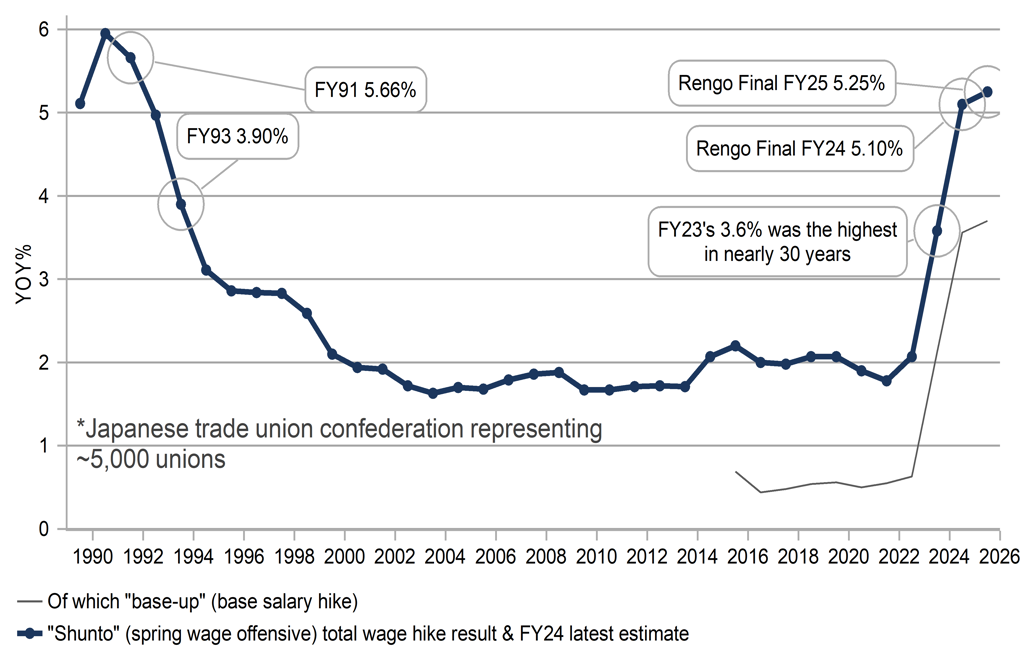

The inflation data released today follows the news yesterday that Rengo, the primary confederation of unions in Japan will seek a 5% pay increase for fiscal year 2026-27 that incorporates a base pay increase of 3.0%. Rengo represents around 7mn workers in Japan, so around 10% of the working age population and its power tends to mean its workers receive better wages than the average worker. Hence, the official monthly wage data does not show wage growth that high. Still, as a benchmark it does at least imply that wage growth, which has been consistent with the BoJ’s policy of gradual rate increases. The Rengo wage growth figure announced yesterday was the same as the initial estimate a year ago. Last year the final agreement was in fact higher, at 5.25%. That could well be the case again in negotiations that lie ahead. Food prices, which tend to be an important determinant in negotiations have been elevated. In October last year, nationwide food prices on an annual basis stood at 3.5% but by January had surged to 7.8% and the latest reading for August stands at 7.2%.

The yen continues to trade at weaker levels and the surge in crude oil prices has certainly helped to reinforce the near-term negative yen sentiment. Japan imports all its energy fossil fuels requirements and the 8% jump in crude oil prices has likely brought in USD-buying importer related flows, especially given there was a building consensus that oil prices were set to decline further. Furthermore, if the jump in crude oil extends further still, it lifts inflation expectations, which in turn drives real yields lower in Japan, thus reinforcing the BoJ ‘behind the curve’ trade of JGB yield curve steepening and yen selling.

The US CPI report today will be key for the US dollar in general. A stronger inflation print with clear evidence of tariff-related goods inflation could result in a near-term test of the 155-level. That would be unfortunate for the new government with President Trump in Tokyo next week and we will likely begin to hear vocal opposition to yen weakness but with the BoJ expected to hold next week, rhetoric is unlikely to hold much sway. We would still not expect USD/JPY to sustain a move above 155.00.

RENGO FINAL AGREED WAGE INCREASES SET TO REMAIN ELEVATED

Source: Bloomberg, Macrobond & MUFG GMR