Jump to winners | Jump to methodology

Next generation of a graying industry

The wealth management landscape across Canada favours the older demographic, making it challenging for the younger generation to make its mark.

Data published by Investor Economics shows that the average advisor age in Canada is almost 53, which is a notable rise from about 50 back in 2015. The report also reveals that almost four in 10 advisors have been operating for more than two decades. Other research details that advisors in brokerages across Canada have an average age of over 50, while it’s lower but still above 40 in retail banks.

These facts make the achievements of Wealth Professional’s Top 40 Under 40 Rising Stars even more impressive, as they battle to create a space and attract clients when they are out of sync with the average demographics. Younger advisors, particularly those with the ability to pivot on market trends, are best equipped to thrive, says Heather Holjevac, financial planner and founder of Holjevac Financial Group.

“They are very adaptable, which is essential in this fast-paced industry. They also bring fresh, diverse perspectives to the table, leading to creative solutions as well as energy to go the extra mile to excel in their roles.”

Meanwhile, Tina Tehranchian, senior wealth advisor at Assante Capital Management, stresses how important the fundamentals are regardless of age.

“A younger or less experienced wealth professional needs to be passionate about their profession, deeply care about their clients, have grit, aim for excellence, and constantly improve their knowledge.”

To determine the Top 40 Under 40, companies nominated professionals for consideration based on their performance and achievements over the past 12 months. The advisors who made the prestigious list were those committed to a career and who clearly hold a passion for wealth management.

Some of the standout achievements by the 2025 cohort include:

Kidsurance™ launch: a national initiative reframing life insurance for children, focusing on flexibility and intergenerational wealth; this has driven client base growth, industry collaboration, and reshaped industry conversations

Major capital raise: leading successful capital raises, directly contributing to AUM growth and firm positioning

Breakthrough ETF strategies: launching innovative ETF products and educational content, enhancing advisor confidence and client engagement

Firm-wide technology overhaul: overseeing the implementation of analytics, risk management, and cybersecurity platforms, along with new marketing and compliance training

Exit planning integration: earning CEPA® designations and formally introducing value acceleration methodology, expanding the advisory offering for business owners

Rebranding and team transition: leading a complete rebrand to transition from a founder-led to a multigenerational team, resulting in industry recognition and client pride

Thought leadership and inclusion: publishing in major outlets and co-chairing inclusion committees to foster a culture of belonging and innovation

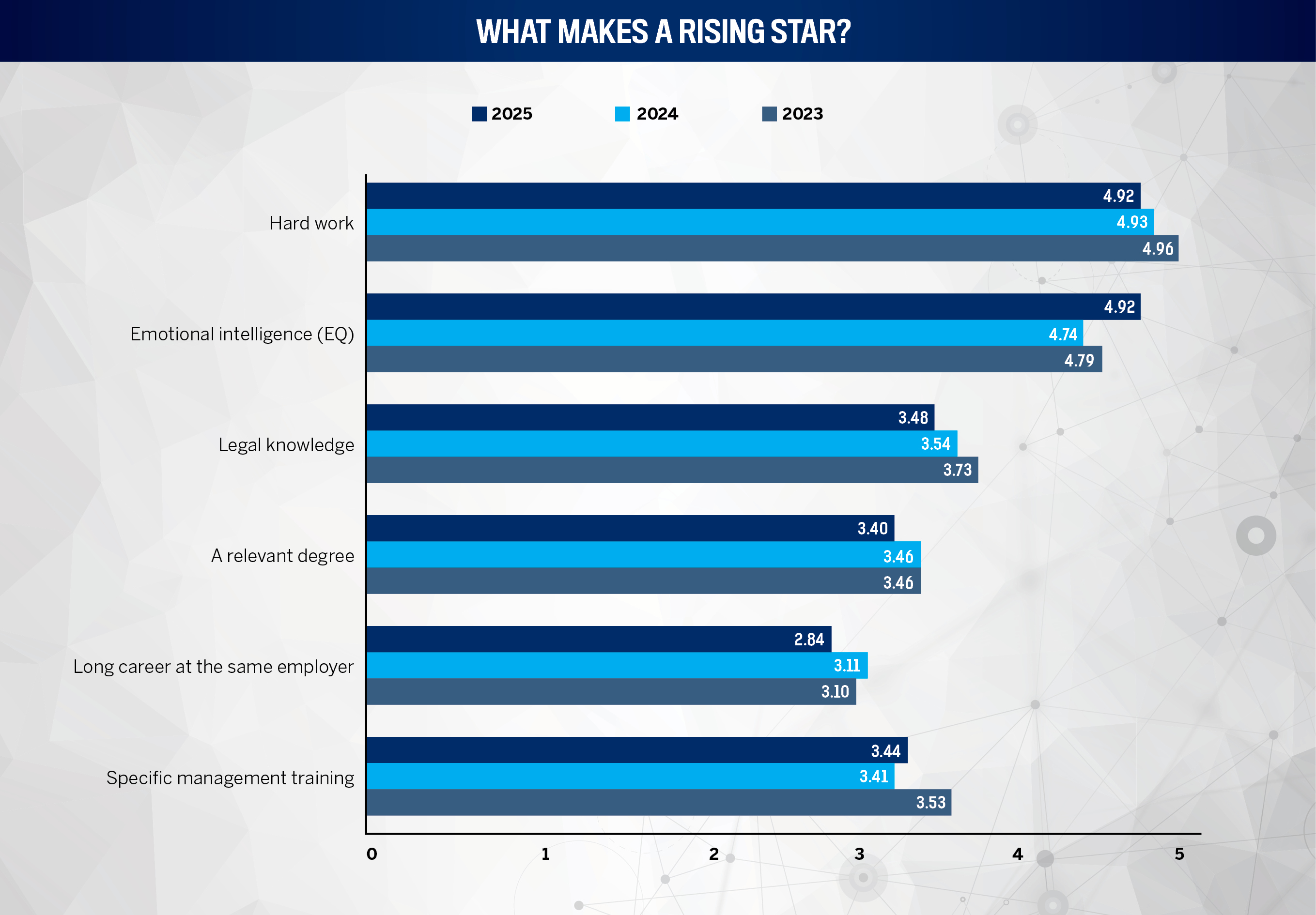

WPC’s 2025 data also shows that industry nominators value hard work and emotional intelligence as the leading attributes since 2023. However, there has been a notable decline in the importance of all other qualities.

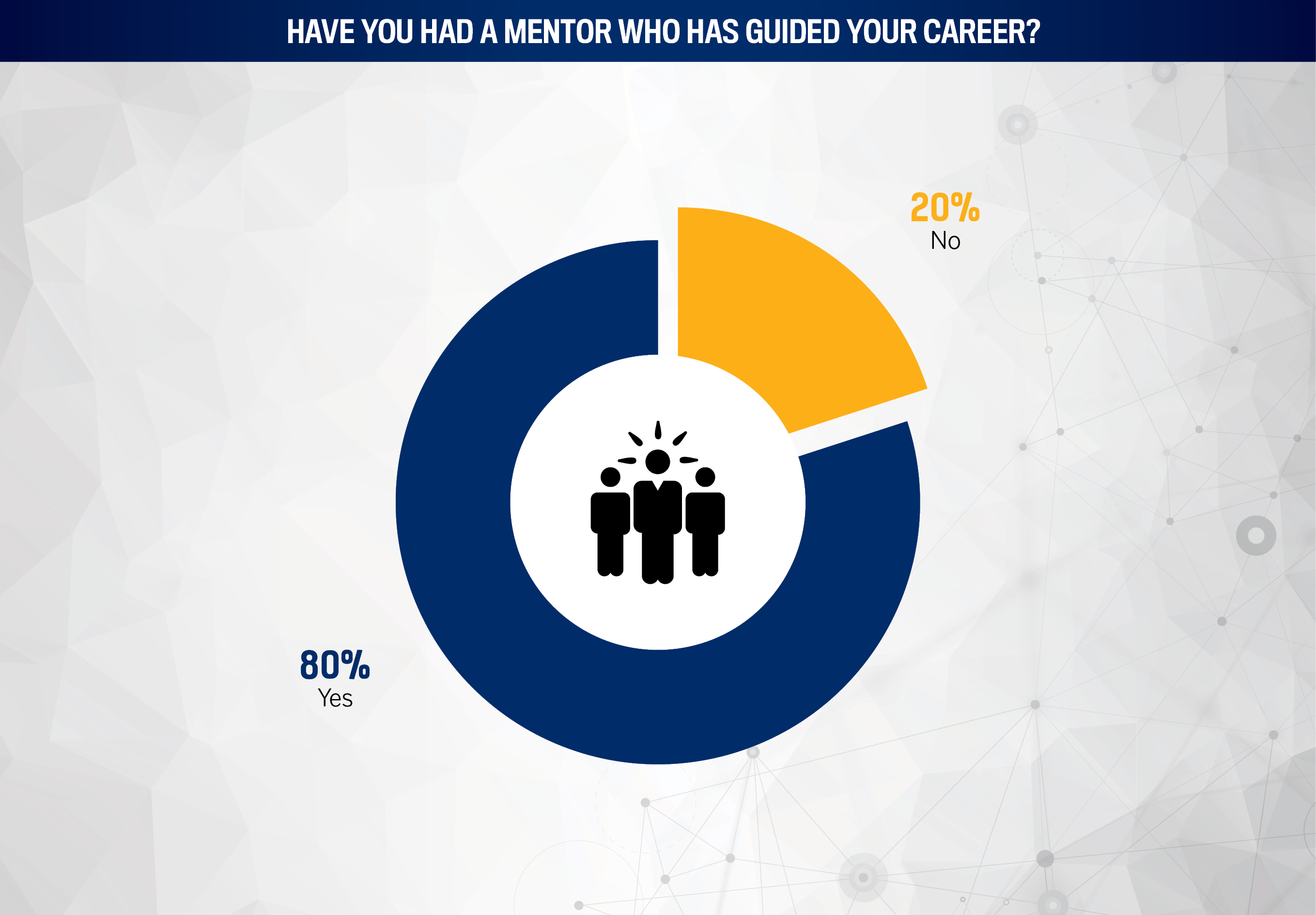

Finding a mentor is a foundational component of the early stages of a young wealth management professional’s career. WPC’s 2025 survey indicated that 80 percent of respondents have had a mentor guide them in their career.

Holjevac underlines why a mentor is so valuable for those in the early stages of their career.

“For those aiming to be future Rising Stars, the key is to set clear goals. Set a path for what success looks like and work toward it,” she says. “Asking for feedback from peers and mentors is invaluable to be able to determine what works and what doesn’t.”

More firms offering increased flexibility would also help remove some of the current barriers facing young advisors, according to Tehranchian.

“Wealth management firms need to provide more support for young parents to allow them to have a balanced family life while building their book of business and servicing their clients,” she notes.

“Burnout is a serious problem in our industry. Providing more support and flexibility for young parents can help attract young talent and more female advisors to our industry.”

Firm: Sunnidale Family Wealth, Wellington-Altus Private Wealth

Location: Barrie, ON

Age: 31

Year started in industry: 2020

“I think the toughest thing for a young professional entering wealth management is gaining the trust of your clients,” says Ferguson, wealth advisor and associate portfolio manager at Sunnidale Family Wealth, Wellington-Altus Private Wealth.

He kickstarted his career by appreciating the need to make connections and be part of a community.

“You develop relationships outside of the workforce that ultimately helps build your name and allows people to become comfortable with you,” he says.

Ferguson also suggests that younger advisors hold a strategic advantage in longevity, as they can offer their services well into a client’s future.

“As a young professional, you can work with individuals throughout retirement and the remainder of their life, whereas the older people in the industry – at the average age – are 55 or so. They’re going to retire in the next five to 10 years.”

“The needs of clients are more sophisticated now and, as a result, you need to have a larger toolbox”

Graham FergusonSunnidale Family Wealth, Wellington-Altus Private Wealth

Plotting a path forward, Ferguson leaned into the financial planning side of the business, obtaining certification to establish himself as an expert.

“I had very little experience in financial planning when I joined the industry, so I went about it by taking as many courses as I could. I became a certified financial planner and a trust and estate practitioner,” he explains.

Finding your own niche within the industry moves the needle for younger advisors, according to Ferguson, who highlights his role in a team that offers clients a wide array of financial solutions.

He says, “It’s important to partner with professionals who have different skill sets than you. As a practice, you want to be able to provide a more holistic approach, rather than trying to do everything yourself.”

Firm: Equiton

Location: Toronto, ON

Age: 35

Year started in industry: 2012

Transparency, humility, and empathy have guided Lang’s career, allowing him to connect with clients on a personal level.

Equiton provides access to real estate investment, and being able to present this in basic terms is another advantage.

“I always say be transparent with your clients, be forthright. I think those things have helped me in my career,” explains the SVP of business development. “I love real estate because it’s very easy to resonate with clients. Everybody understands it.”

After graduating from university, Lang followed the advice of a former boss to take a Toastmasters course, which he credits as helping develop a combination of interpersonal skills.

As a service provider to advisors understanding their client base – including demographics and risk tolerance – Lang tailors products to specific market demands.

“When advisors are talking about Equiton to a client, we arm them with enough ammo to ensure they can talk to their clients eloquently – they know the strategy, they know what’s going on within our company, not just our fund,” he explains. “We make sure that our communication is paramount to help the advisors as much as possible.”

“You can’t have an ego in this industry. You have to relate to your clients and be empathetic”

Geoff LangEquiton

With elevated market volatility prevalent throughout 2025, Lang highlights his team’s consistency in its long-term strategy that has provided value and predictability to advisors and their clients.

“What I’m most proud of is the fact that we don’t style drift to catch flavours of the month. We’re going to be consistent. And I think our advisors really appreciate that,” he says.

Lang highlights the shift from a traditional 60-40 portfolio makeup to a modern portfolio of 50-30-20 over the past three years, bringing ample opportunity to the alternatives space in which Equiton operates.

“It all started in 2022, when both the equity markets and fixed income markets were down by double digits,” he recalls. “That really spearheaded a push in the alternative landscape and showed that the 60-40 equity to fixed income might not be what clients need.”

As investors increasingly look to alternatives to diversify their portfolios, Lang suggests that Equiton’s Apartment Fund strategy allows advisors and investors to enter the alternative space with an easy-to-understand product.

“If you’re going to dip your toes into alternatives, real estate seems to be that first move,” he adds.

Firm: Mackenzie Investments

Location: Toronto, ON

Age: 38

Year started in industry: 2007

Being curious about what’s around the corner and coming next is a difference maker that Mathews, Mackenzie Investments’ vice president of ETF product strategy, has used to her advantage.

“Curiosity is a very big attribute,” she says. “It was true for me when I first started in the early days in ETFs, but also true in how I hire for my team today. The interest to learn or to solve problems is critical.”

And she continues, “A lot of the learning in ETFs I’ve found over my career has been on the job, and it really can’t be taught any other way.”

A “light bulb” moment for Mathews was understanding the importance of soft skills. As an introvert, she didn’t develop these qualities naturally, though she has cultivated the ability to assume public speaking roles and host daily conference calls.

“Hard work and technical skills are great, but those two things alone aren’t going to help you continue to elevate your career. It’s everything else that needs to support those two key elements that drive you forward.”

Part of Mathews’s role as a mentor has been to show younger professionals not only the exciting sides of wealth management, but also the more difficult components, and how she carved her own path in the industry.

“I have really tried to focus my energy personally on what I can control, and that is what I deliver”

Prerna MathewsMackenzie Investments

Showcasing her influence, Mathews has personally touched 56 of Mackenzie’s 60 ETFs on its shelf and brought them to market. This has seen her play a role in strategy evolution.

“The things that I’ve most benefited from have been the tough conversations I’ve had with people over the years,” she says.

While the performance of Mackenzie’s ETFs is paramount to Mathews, they need to fit the needs of advisors and their clients. By understanding the challenges advisors and their clients are facing, Mathews and her team create solutions.

Her focus is currently on building out key segments of Mackenzie’s platform and launching more active equity mandates, which have performed well and resonated with buyers.

“Advisors are incredibly busy individuals, and the job continues to be more and more challenging with market dynamics, client needs evolving, and continued regulatory pressures. As partners to advisors, we are mindful of all that,” she explains.

“For us, it comes down to identifying the problem the advisor is trying to solve.”

Firm: Sandstone Asset Management

Location: Calgary, AB

Age: 38

Year started in industry: 2010

Beginning her career in oil and gas, portfolio manager Dunne discovered a passion for modelling, looking at commodity prices and putting them into company projections. From there, she made the switch into global wealth management.

Her primary focus is working for families to secure multigenerational wealth, as she is adept at understanding a variety of viewpoints and synthesizing them into her work.

“I build those relationships early, bringing in the kids and the grandkids to help discuss what’s important to them – what are their values, what are their interests, and how do we tie this back to the family foundation,” she says.

This high-touch communication can be a valuable tool for any advisor, according to Dunne.

“Communication is huge. Knowing how to speak with them, knowing how to understand when something doesn’t feel right. If there is a worry about a headline out there, or if there’s a worry about a macro event that’s unfolding in our world, it’s about having those conversations,” she explains.

“If you can be available to your clients by phone, it gives a sense of confidence. No matter what’s going on, when it’s going on – pick up the phone, we’re here.”

“I’m very structured as an individual”

Niki DunneSANDSTONE Asset Management

After entering the industry, Dunne proactively searched for mentors, cold calling experienced professionals to ask for their advice. She remains in touch with many of her early mentors.

“They can help guide you in the direction you want to go because they’ve seen it, they’ve been there,” she says.

Having paved her own successful path, Dunne now happily shows younger professionals how to chart their own route to the top.

“I’m definitely trying to pay it forward. I hope I can do what others did for myself at the time,” she explains. “Step number one is opening that door and saying, ‘Somebody else did this for me and I definitely want to do it for others to help them get started.’”

Dunne is also humble enough to concede that despite being highly rated, she can keep improving and sharpening her edge.

“I don’t think you’re ever done learning. I think there’s always something else that can help going forward – a different perspective, a different education. You need to have that learning desire because everything is rapidly changing.”

Conclusion: What makes a Rising Star

in 2025?

Recognition is a major motivator: Awards and industry accolades are highly valued, serving as both personal milestones and external validation of client-centric excellence.

Innovation is client-driven: The most successful advisors are those who innovate with the client’s needs at the core – whether through new products, technology, or educational outreach.

Holistic and future-focused advice: There is a clear shift from traditional investment advice to holistic, multidimensional wealth management, including succession, tax, and estate planning.

Professional growth is continuous: Ongoing education, credentialling, and industry involvement are seen as essential to maintaining high standards and adapting to change.

Culture and team matter: Building inclusive, collaborative, and multigenerational teams is a priority, with a focus on mentorship and industry leadership.

Adrian LeRoy

Wealth Advisor

LeRoy Wealth

Agha Raza

Chief Operating Officer

Mandeville Private Client

Chadi Sayeh

Director Manager, Research and Oversight

National Bank Investments

Christian Langman

Regional Vice President

Skyline Group of Companies

Christopher Redcliffe

President and Principal Advisor

Redcliffe Financial

Courtney Castledine

Certified Financial Planner

Prosperity Planning

Dami Gittens

Wealth Advisor, Client Relationship Manager

Nicola Wealth

Domenic Gallippi

Managing Director, Alternative Assets

Forum Asset Management

Emmy Pachenski

Investment Associate

Wellington-Altus Private Wealth

Frederick Pratt Jr.

Certified Financial Planner

Desjardins Financial Security Independent Network

Gonen Hollander

Vice President, Private Wealth

Obsiido Alternative Investments

Jenny Chen

Chief Executive Officer

Catalais Consulting

Jessica Smith

VP, Strategic Operations & Growth

Designed Securities

Jonathan Dixon

Principal Advisor

Dixon Advisory

Jordan Mauro

Investment Advisor and Associate Portfolio Manager

Wellington-Altus Private Wealth

Keanan Boomer

Associate Investment Advisor

CIBC Wood Gundy

Kerry Leard

Senior Wealth Advisor

Genea Wealth, Assante Financial Management

Linson Chen

Financial Advisor and Portfolio Manager

RGF Integrated Wealth Management

Michael Mauro

Investment Advisor

Wellington-Altus Private Wealth

Michael Minicucci

Investment Advisor

Wellington-Altus Private Wealth

Paul Kornfeld

Director of Technology Services

SIA Wealth

Peter Kluz

Tax and Estate Planner

TD Wealth, Wealth Advisory Services

Philippe Charbonneau

Director, Individual Financial Services

Coughlin & Associates

Puneet Grewal

Chief Operating Officer and Chief Compliance Officer

Obsiido Alternative Investments

Rémi Laurencelle

Investment Advisor

Tetrault Wealth Advisory Group

Tara Brooks, CFP, RRC

Financial Consultant

Dennis Hunt & Associates

IG Private Wealth Management

Insights

As part of our editorial process, Wealth Professional’s researchers interviewed the subject matter experts below for an independent analysis of this report and its findings.

To uncover the most promising young professionals in the Canadian wealth management industry, Wealth Professional launched its ninth annual Rising Stars report through a rigorous marketing and survey process, leveraging its connections to thousands of advisors across the country. Starting in June, companies were given the opportunity to nominate professionals for consideration based on their performance and achievements over the past 12 months.

To be eligible, nominees had to be age 40 or younger (as of September 30, 2025) and working in a role that relates to, interacts with, or impacts the wealth management industry. When reviewing the nominations, WPC concentrated on those who have committed to a career in the industry and clearly hold a passion for wealth management.

To maintain a focus on new talent, only nominees who hadn’t been previously recognized as a Rising Star (or a Young Gun) were considered. After reviewing all the nominations, the WPC team whittled down the list to 40 deserving winners.