Labour demand has hit a four-year low, as job advert numbers fell to levels not seen since the middle of the pandemic, writes Muiris Ó Cearbhaill.

A softening in labour demand was expected after a spike in the post-Covid years, but external factors, such as declining disposable incomes and US tariffs, have accelerated the fall in new job listings.

Economists have warned that not enough was done in the Budget to address these factors, which could stall recovery in the labour market.

Figures presented to Minister for Finance Paschal Donohoe a month before the Budget – which were obtained by BusinessPlus.ie – warned that continued economic uncertainty risked employment growth this year.

It was one of the main risks Mr Donohoe would repeatedly claim was present during tariff negotiations between the EU and US last summer.

The presentations given to the minister, detailing unemployment statistics between June and August, were released through Freedom of Information laws.

In August, according to the documents, job demand fell to roughly 6% and the rate of new listings began to soften.

Similar levels have not been seen since the middle of 2021, between lockdowns but while restrictions were still in place.

Leading economist Austin Hughes said the market is in a “cooling” stage, brought on following a dramatic rise in employment after the end of restrictions.

He said, however, that Irish companies are likely to continue delaying hiring new staff, based on external factors out of their control.

These include households feeling the squeeze and seeing a drop in disposable income, as well as ongoing uncertainty due to US tariffs and other trade measures.

Mr Hughes said multinational firms will likely “pause” hiring because of the level of uncertainty.

“The situation now is it’s probably more prudent to postpone something you can do tomorrow, rather than trying to get the workers in today,” he said.

Fewer cost-of-living measures and the lack of an income tax package in the Budget have also increased unease among households, preventing Irish firms from projecting their future performance.

Last week’s Credit Union Consumer Sentiment Index reported more households are beginning to “feel bad” about spending due to the lack of supports in Budget 2026.

Only one in three households expect to earn a higher income next year, and the lack of tax cuts has pulled back consumer spending power.

The Government billed the Budget as a range of packages to protect jobs. It did so by announcing plans to reduce VAT for food-based hospitality firms to 9% from March 2026.

This came at the cost of an income tax package for workers and put an end to once-off payments, such as energy credits.

Mr Hughes said: “The issue is what happens next. The concern would be that there is further [decline] in domestic spending, as a result of the Budget taking money out of people’s pockets, and more hesitation on the part of multinationals because… there is still the element of Trump waking up and thinking something different every day.

“It’s not a climate where you accelerate hiring.”

Mr Hughes said tariffs have contributed to general uncertainty among domestic companies and multinational firms, which the State is reliant on for high tax receipts.

He added: “There’s increased uncertainty, evidence of slowing down in economic growth and cost pressures. This means companies are being more careful in their hiring.”

A reduction on labour demand is “no great negative”, Mr Hughes said, adding that there was a period after the pandemic when the jobs market was “really buoyant”.

Dr Laura Brambrick, head of social and employment policy at the Irish Congress of Trade Unions (ICTU), said a slowdown was expected, due to rapid post-pandemic growth.

But the reduction in labour demand rates may have been accelerated by lower levels of consumer confidence and increased uncertainty.

One economist, who spoke anonymously, said a two-sided approach to protect businesses and cut taxes was needed in Budget 2026 to prevent future, sharp reductions in labour demands and overall economic activity.

Dr Brambrick claimed some consumers lost confidence in their spending plans because of lobbying by industries such as the hospitality sector.

She said: “Employers who are thinking about expanding might say, ‘We will wait until we have more clarity’.

“That then expands into households thinking, ‘Will we really move into that new house, or build that extension, or will we be better off saving that money?’

“A lot of the uncertainty [from tariffs] hasn’t materialised… But, at the time, over this year, we didn’t know what we were going to be dealing with – especially in the international sector, which we are reliant on for corporation and income tax.”

The ICTU argued after the Budget that jobs within the hospitality sector did not need additional investment or supports.

It pointed to tax receipts the State receives from the sector, comparing them to those of multinationals, and suggested supports were better placed elsewhere.

Dr Brambrick said the lack of a tax package has “created a vicious cycle of caution and nervousness” among households.

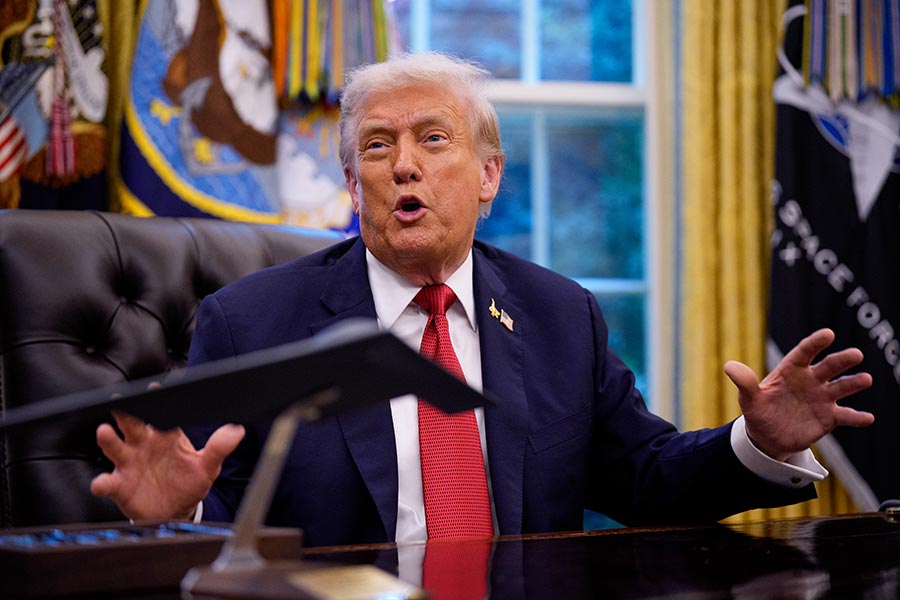

Ongoing uncertainty due to Trump’s US tariffs is an issue for companies looking to hire. (Photo by Andrew Harnik/Getty Images)

Ongoing uncertainty due to Trump’s US tariffs is an issue for companies looking to hire. (Photo by Andrew Harnik/Getty Images)

She said that if you take the Government at its word, the jobs market will remain stable next year, but families will likely be down “hundreds of euro each month”.

Mr Hughes said: “All of these elements are combining to give us this uptick [in unemployment], so far, rather than a dramatic change in the jobs market – it is getting cooler out there.”

Unemployment w a s recorded at 4% in June, but that was later revised to 4.6%.

In a memo to Mr Donohoe, detailing July’s unemployment levels, the rate rose to 4.9%. This declined to 4.7% in August, but these rates were subject to revision.