Nationwide, 47 of the 50 states had public pension debt at the end of 2024, Reason Foundation’s Annual Pension Solvency Report finds. The study shows that 23 states each had over $20 billion in unfunded pension liabilities at the end of the 2024 fiscal year, the most recent year with complete data available.

Two states had more than $200 billion in public pension debt: California ($265 billion in unfunded pension liabilities) and Illinois ($201 billion).

Two other states reported more than $90 billion in unfunded pension liabilities: Texas ($92.2 billion) and New Jersey ($92 billion).

Unfunded liabilities exceeded $60 billion in two additional states: Pennsylvania ($67 billion) and Ohio ($61 billion).

Fourteen states have more than $30 billion in unfunded liabilities, including Massachusetts ($44 billion), Florida ($44 billion), New York ($45 billion), Kentucky ($40 billion), Connecticut ($37 billion), Michigan ($36 billion), Georgia, ($33 billion), and Maryland ($31 billion).

Tennessee, Washington, and South Dakota are the only three states that did not report any aggregate unfunded pension liabilities at the end of 2024, according to Reason Foundation’s pension report.

With $15,804 in pension debt per person, Illinois has the highest unfunded pension liabilities per capita, according to the Reason Foundation report.

Connecticut has the second-most public pension debt per capita at $10,151.

Six other states have public pension debt exceeding $8,000 per person: Alaska ($9,990), Hawaii ($9,784), New Jersey ($9,688), Mississippi ($9,033), New Mexico ($8,641), and Kentucky ($8,626).

California and Massachusetts have more than $6,000 in pension debt per resident.

Thirty-five states have at least $2,000 in public pension debt per capita, and 45 have at least $1,000 per person.

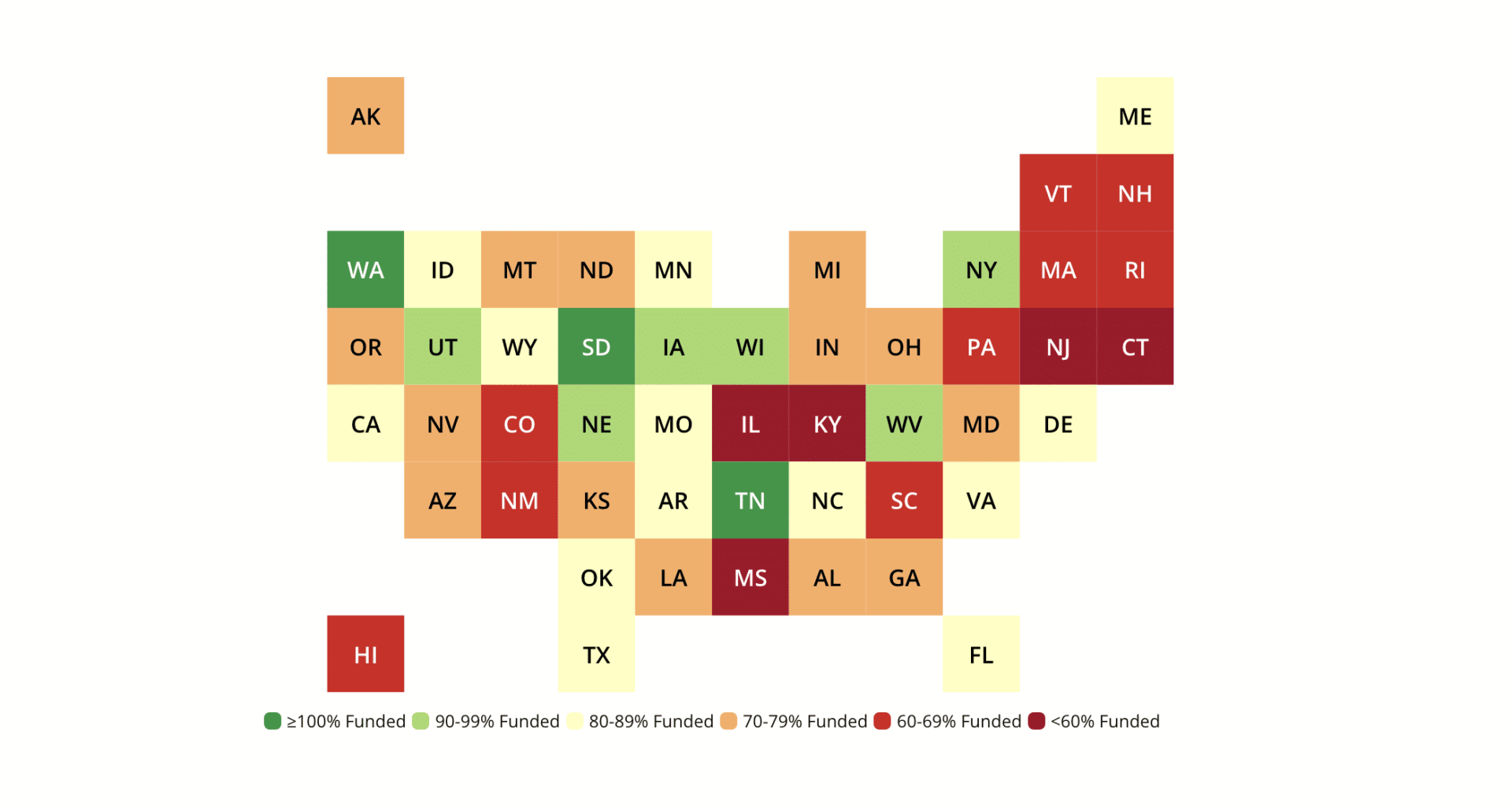

In the aggregate, state and local pension plans had $1.48 trillion in debt. Reason Foundation finds that the median funded ratio of all U.S. public pension plans was 79% at the end of 2024. This means governments have 79 cents for every dollar of pension benefits already promised to public workers and retirees.

With its public pension systems just 52% funded, Illinois has the worst funded ratio in the nation.

The other states with funding below 60% are Kentucky (54%), New Jersey (55%), Mississippi (56%), and Connecticut (59.5%).

State with public pension systems with funded ratios below 70% are South Carolina (62%), Hawaii (63%), Rhode Island (65%), New Mexico (66%), Pennsylvania (66%), Massachusetts (66%), Vermont (67%), New Hampshire (69%), and Colorado (70%).

Just three states had fully funded public pension systems at the end of 2024: Tennessee (104% funded), Washington (102%), and South Dakota (100%) and another six states were over 90% funded.

For detailed information about public pension plans’ unfunded liabilities, asset allocation, contribution rates, stress testing, and more, please visit Reason Foundation’s full Annual Pension Solvency and Performance Report.

The report ranks public pension systems from best to worst across five core dimensions: funded status, investment performance, contribution rate adequacy, asset allocation risk, and probability of meeting assumed returns.

Reason Foundation extracted these values from publicly available audited financial reports. Despite a thorough review, data collection at this scale can lead to discrepancies. Please alert us if you identify any errors. Reason Foundation’s pension team provides tailored technical assistance and resources to address the specific needs of states, counties, and cities. So please don’t hesitate to contact us at pensionhelpdesk@reason.org.

Stay in Touch with Our Pension Experts

Reason Foundation’s Pension Integrity Project has helped policymakers in states like Arizona, Colorado, Michigan, and Montana implement substantive pension reforms. Our monthly newsletter highlights the latest actuarial analysis and policy insights from our team.