Frozen Pastries Market Size and Share Forecast Outlook 2025 to 2035

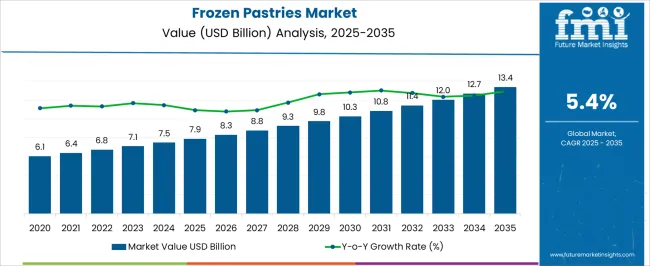

The frozen pastries market is estimated to be valued at USD 7.9 billion in 2025 and is projected to reach USD 13.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

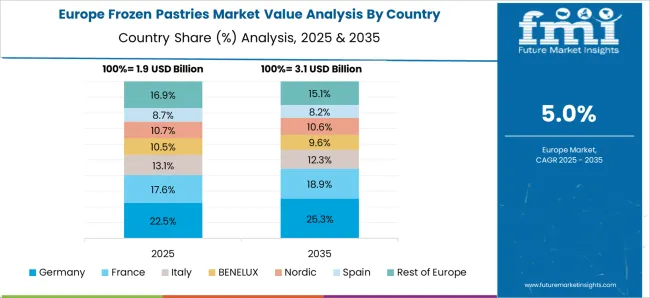

The growth pattern indicates that the industry is transitioning from the growth phase toward early maturity. Demand is being reinforced by consumer preference for convenience, consistent quality, and wider availability through modern retail and online channels. However, the moderate CAGR suggests that expansion is not explosive but measured, aligning with markets that are approaching saturation in developed economies. In the adoption lifecycle, frozen pastries are positioned in the late majority stage in mature markets such as Europe and North America where household penetration is already high. Growth here will rely on product diversification, healthier formulations, and premium variants to maintain consumer interest.

In contrast, Asia-Pacific and parts of Latin America remain in the early majority stage, where urban lifestyle changes and cold-chain infrastructure development are fostering accelerated adoption. The incremental rise from USD 7.9 to 13.4 billion reflects stable acceptance across demographics while leaving scope for emerging regions to sustain long-term momentum. By 2035, innovation in flavors, portion control, and sustainable packaging will help sustain relevance even as the category matures globally.

Quick Stats for Frozen Pastries Market

Frozen Pastries Market Value (2025): USD 7.9 billion

Frozen Pastries Market Forecast Value (2035): USD 13.4 billion

Frozen Pastries Market Forecast CAGR: 5.4%

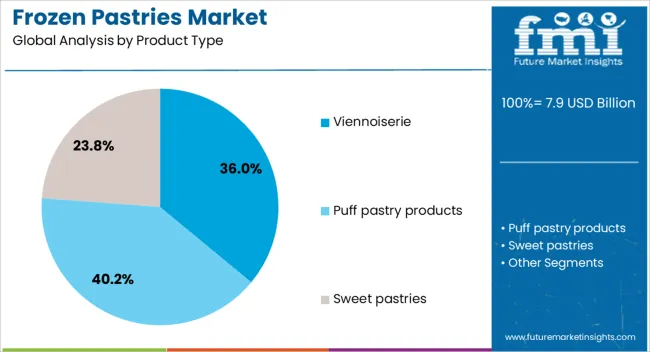

Leading Segment in Frozen Pastries Market in 2025: Viennoiserie (36.0%)

Key Growth Regions in Frozen Pastries Market: North America, Asia-Pacific, Europe

Key Players in Frozen Pastries Market: Grupo Bimbo, Aryzta AG, Lantmännen Unibake, J&J Snack Food Corp., Dawn Foods / Dawn Food Products, Rich Products Corporation, Europastry S.A., General Mills Inc., Kellanova

Frozen Pastries Market Key Takeaways

Metric

Value

Frozen Pastries Market Estimated Value in (2025 E)

USD 7.9 billion

Frozen Pastries Market Forecast Value in (2035 F)

USD 13.4 billion

Forecast CAGR (2025 to 2035)

5.4%

The frozen pastries market is recognized as an emerging yet influential category within the global food industry. It contributes around 9.2% to the frozen bakery products sector, reflecting the strong preference for ready to bake and ready to eat pastry options. In the wider bakery products market, frozen pastries hold nearly 4.6%, supported by growing consumer inclination toward versatile baked goods. Within frozen food, a 3.3% share is estimated, highlighting the convenience that frozen pastries provide. In the convenience food sector, the share stands at 2.7%, while packaged food represents 1.9%, driven by supermarket and retail distribution. Recent industry trends have been marked by product diversification and technology integration in frozen pastries.

Ground breaking advances include extended shelf life innovations, improved freezing methods to maintain texture and taste, and clean label formulations. Plant based ingredients and gluten free pastry lines have gained strong momentum, catering to evolving dietary preferences. Key players have introduced premium frozen croissants, puff pastries, and tarts with artisanal quality for retail and foodservice channels. Strategic moves involve expanding cold chain logistics, adopting automated production technologies, and investing in sustainable packaging to attract eco conscious buyers. These trends have elevated the frozen pastries market as a competitive growth driver within frozen bakery products.

Why is the Frozen Pastries Market Growing?

The market is experiencing consistent expansion as consumer demand for convenient, high-quality bakery products continues to rise. Growth is being supported by the increasing penetration of frozen bakery items in retail channels and foodservice establishments, with manufacturers focusing on premium quality, innovative flavors, and extended shelf life. The ability to maintain freshness and texture through advanced freezing technologies has enhanced the appeal of frozen pastries in both developed and emerging markets.

Rising urbanization, changing dietary habits, and the growing influence of Western bakery trends in new geographies are further supporting market growth. Strategic investments in cold chain infrastructure and efficient distribution networks are enabling broader availability and accessibility.

Moreover, the adaptability of frozen pastries to diverse consumption occasions, from breakfast offerings to dessert menus, is expanding the customer base With ongoing innovation in clean-label ingredients, reduced sugar formulations, and artisanal quality replication, the Frozen Pastries market is well-positioned for sustained growth over the forecast period.

Segmental Analysis

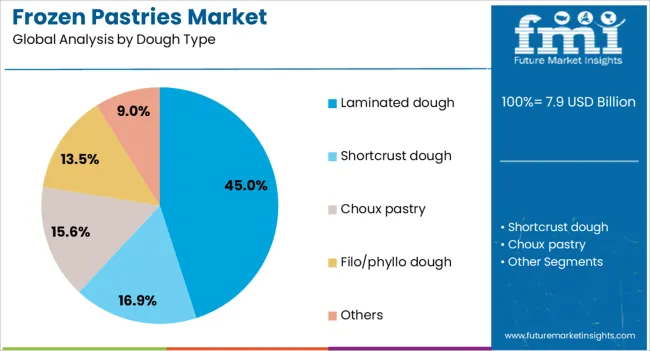

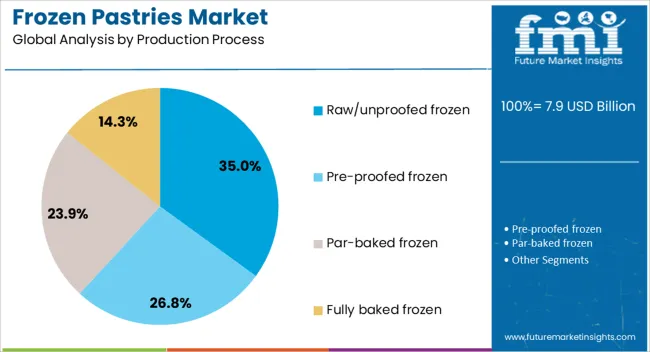

The frozen pastries market is segmented by product type, dough type, production process, distribution channel, and geographic regions. By product type, frozen pastries market is divided into viennoiserie, puff pastry products, sweet pastries, savory pastries, and others (specialty & ethnic). In terms of dough type, frozen pastries market is classified into laminated dough, shortcrust dough, choux pastry, filo/phyllo dough, and others. Based on production process, frozen pastries market is segmented into raw/unproofed frozen, pre-proofed frozen, par-baked frozen, and fully baked frozen. By distribution channel, frozen pastries market is segmented into Retail, Foodservice, and Institutional. Regionally, the frozen pastries industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Insights into the Viennoiserie Product Type Segment

The Viennoiserie product type segment is projected to hold 36% of the frozen pastries market revenue share in 2025, making it the leading product category. Growth in this segment has been driven by the widespread appeal of buttery, flaky pastries that combine indulgence with versatility. Viennoiserie products have been favored for their premium positioning and ability to cater to both sweet and savory preferences. The segment has benefited from increasing consumer willingness to pay for artisanal quality in convenient frozen formats, supported by advancements in freezing methods that preserve texture and flavor. The strong performance of Viennoiserie is also linked to its popularity in hospitality, cafés, and quick-service restaurants, where consistent quality and portion control are critical. Manufacturers have leveraged innovation in fillings, portion sizes, and clean-label recipes to align with evolving dietary preferences This combination of consumer indulgence, operational efficiency for foodservice, and ongoing product innovation has ensured the segment’s leading position in the overall market.

Insights into the Laminated Dough Dough Type Segment

The laminated dough segment is expected to account for 45% of the market revenue share in 2025, emerging as the leading dough type. The growth of this segment has been supported by its ability to deliver the characteristic flakiness, lightness, and rich mouthfeel that consumers associate with high-quality pastries. Laminated dough has been widely adopted by manufacturers and foodservice operators due to its adaptability in producing a variety of products, including croissants, Danish pastries, and puff pastry items. The segment’s dominance is reinforced by technological advancements in dough preparation and freezing that maintain product integrity after baking. Its premium sensory appeal and compatibility with both sweet and savory applications have made it a preferred choice across markets. Additionally, the laminated dough category benefits from its strong association with European bakery traditions, which are increasingly influencing global pastry preferences The combination of craftsmanship, consumer appeal, and production versatility continues to secure its leadership in the market.

Insights into the Raw/Unproofed Frozen Production Process Segment

The raw or unproofed frozen production process segment is projected to hold 35% of the market revenue share in 2025, making it the leading production method. The segment’s growth has been driven by the operational flexibility it offers to bakeries, foodservice outlets, and retailers. This process allows businesses to proof and bake pastries on demand, ensuring maximum freshness and aroma for the end consumer. The raw frozen method also enables greater control over production scheduling, inventory management, and customization, which is particularly valuable for establishments offering varied product lines. Advances in freezing technology have ensured that dough structure, yeast activity, and flavor profiles remain intact during storage, resulting in consistent quality after baking. The method has found strong adoption among operators seeking to balance product variety with reduced waste, as smaller batches can be prepared based on demand This combination of freshness, customization potential, and operational efficiency has solidified its leadership in the production process category.

What are the Drivers, Restraints, and Key Trends of the Frozen Pastries Market?

The frozen pastries market has developed as a vital segment within the frozen bakery industry, driven by consumer need for convenience, extended shelf life, and consistent quality. Products such as croissants, puff pastries, Danish pastries, turnovers, and tarts are distributed through retail, foodservice, and bakery chains. Manufacturers have focused on deep freezing technology, packaging innovations, and formulation improvements to maintain freshness and texture. Growth has been guided by changing eating habits, expanded retail penetration, and rising interest in indulgent bakery items across diverse demographics.

Convenience and time saving benefits shape consumption

Frozen pastries have been favored for their ability to provide freshly baked taste with minimal preparation time. Households and foodservice outlets rely on pre proofed or ready to bake pastries that eliminate complex preparation steps. Advances in freezing technology have preserved natural texture, buttery layers, and flavor integrity, enhancing consumer confidence. For restaurants, cafes, and hotels, frozen pastries provide consistent supply without skilled labor dependency. The convenience of storage, portion control, and reduced wastage has driven strong adoption. This reliance on frozen bakery products has reflected a lifestyle shift where time saving solutions in meal and snack preparation are valued highly.

Product diversification widens consumer appeal

Manufacturers have introduced wide variations in frozen pastries, ranging from traditional butter croissants to innovative chocolate, fruit filled, and savory cheese variants. Mini formats and snack sized options have been designed for quick consumption occasions. Seasonal offerings and limited edition flavors have been used to capture consumer interest. Gluten free, vegan, and reduced sugar pastries have been introduced to target health conscious segments. Customization in portion size and flavor innovation has supported broad market acceptance. Retail freezers have become showcases for diverse pastry selections, allowing consumers to experiment and build loyalty. This diversification has helped frozen pastries remain competitive against fresh bakery alternatives.

Supply chain efficiency and retail penetration drive expansion

The growth of hypermarkets, supermarkets, and specialty frozen food stores has played a crucial role in making frozen pastries accessible. Cold chain logistics have been strengthened to ensure consistent availability across regions. Packaging innovations with improved barrier properties and resealable formats have maintained quality during extended storage and transport. Foodservice distribution networks have also expanded, allowing cafes and quick service restaurants to offer premium pastries without onsite baking infrastructure. The combination of reliable cold storage, efficient distribution, and wider retail shelf space has positioned frozen pastries as a mainstream choice. The role of retail and distribution efficiency has therefore been decisive in market development.

Indulgence and lifestyle trends influence preferences

Consumer desire for indulgent snacks and premium bakery experiences has guided demand for frozen pastries. Croissants, puff pastries, and Danish rolls are perceived as premium, European inspired bakery items, making them attractive in urban and hospitality settings. Increasing café culture and home café trends have contributed to frozen pastry consumption. Single serve and on the go packs have catered to busy lifestyles. At the same time, health oriented consumers have sought cleaner labels, reduced additives, and natural ingredients. This balance between indulgence and wellness has encouraged ongoing product reformulation. Lifestyle preferences and indulgence driven choices have therefore shaped the innovation pipeline in frozen pastry offerings.

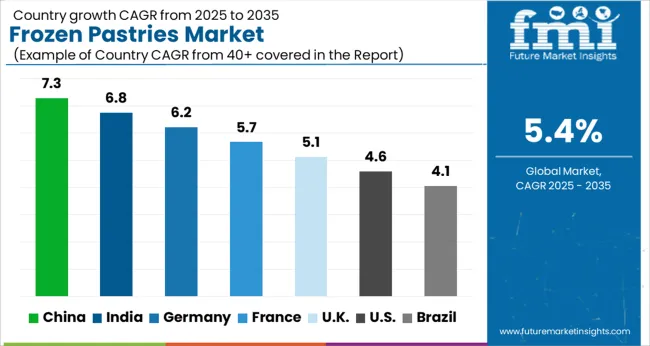

Analysis of Frozen Pastries Market By Key Countries

Country

CAGR

China

7.3%

India

6.8%

Germany

6.2%

France

5.7%

UK

5.1%

USA

4.6%

Brazil

4.1%

China achieved the strongest rise in the frozen pastries market with a forecast growth rate of 7.3%, supported by the expansion of modern retail formats and increasing consumer interest in convenient bakery products. India followed with 6.8%, where rising adoption of frozen food in urban households and foodservice outlets sustained momentum. Germany stood at 6.2%, backed by a strong tradition in bakery consumption and the presence of advanced frozen food manufacturing facilities. The United Kingdom recorded 5.1%, with demand being shaped by preference for ready to bake and premium pastry varieties. The United States registered 4.6%, where growing product diversification and distribution in retail chains contributed to consistent development. Together, these countries highlight the importance of innovation, consumer preference shifts, and manufacturing capacity in shaping the frozen pastries market. This report includes insights on 40+ countries; the top markets are shown here for reference.

Demand Forecast for Frozen Pastries Market in China

China is advancing at a CAGR of 7.3% in the market, supported by increasing consumer interest in convenient bakery products. The rising influence of Western-style eating habits is enhancing demand for croissants, puff pastries, and filled bakery items. Urban households are adopting frozen formats as they provide longer shelf life and quick preparation, which suits modern lifestyles. Domestic manufacturers are expanding their frozen bakery assortments, while global players are investing in distribution networks to capture rising demand. Premiumization in baked products is also contributing to the market growth, with consumers preferring higher-quality ingredients and innovative flavors. This trend is expected to position China as a leading growth hub for frozen pastries within the Asia-Pacific region.

Growing popularity of Western bakery culture is fueling demand

Frozen formats are gaining traction for convenience and storage

Premium ingredients and flavors are shaping consumer preferences

Analysis of Frozen Pastries Market in India

India is registering a CAGR of 6.8% in the market, fueled by rising consumption of ready-to-eat bakery products. Increasing exposure to global food trends through cafes, quick-service restaurants, and modern retail formats is influencing the adoption of frozen pastries. Domestic bakeries and foodservice outlets are increasingly sourcing frozen formats to ensure consistent quality and easy preparation. Changing lifestyles, particularly among younger consumers in metropolitan cities, are boosting demand for indulgent yet convenient food options. With the expansion of cold chain infrastructure and retail penetration, frozen pastry availability is widening across diverse consumer segments, enhancing market opportunities for both domestic and international producers.

Foodservice channels are driving adoption of frozen pastries

Cold chain development is strengthening product availability

Younger consumers are showing preference for convenient indulgence

Growth Outlook for Frozen Pastries Market in Germany

Germany is growing at a CAGR of 6.2% in the market, supported by strong demand for bakery convenience products. German consumers value high-quality baked goods, and frozen options are becoming integral for both households and foodservice sectors. The emphasis on premiumization is evident, with a focus on organic ingredients, artisanal recipes, and healthier variations of pastries. The bakery sector in Germany is mature, but frozen innovations are revitalizing consumption patterns by offering extended shelf life and reduced food waste. Retailers and bakeries are increasingly collaborating with frozen pastry suppliers to enhance product variety and maintain consistent quality for customers.

Premium and organic pastries are gaining traction in the frozen format

Household and foodservice sectors are key demand drivers

Frozen innovations help reduce waste and extend shelf life

Future Outlook on Frozen Pastries Market in the United Kingdom

The United Kingdom is experiencing a CAGR of 5.1% in the market, with rising consumer interest in convenient bakery indulgence. The increasing popularity of café culture, along with demand for affordable bakery products, is boosting adoption. Frozen pastries allow retailers and foodservice providers to ensure availability without compromising freshness, which suits evolving shopping patterns. Innovation in flavors and fillings is creating differentiation, while the trend of at-home café experiences is supporting frozen pastry consumption. The growing appeal of affordable luxury in bakery items is reinforcing demand, making frozen formats a preferred choice in the UK bakery sector.

Café culture and home indulgence are boosting frozen pastry demand

Flavor innovations are creating strong consumer interest

Frozen formats ensure convenience and availability for retailers

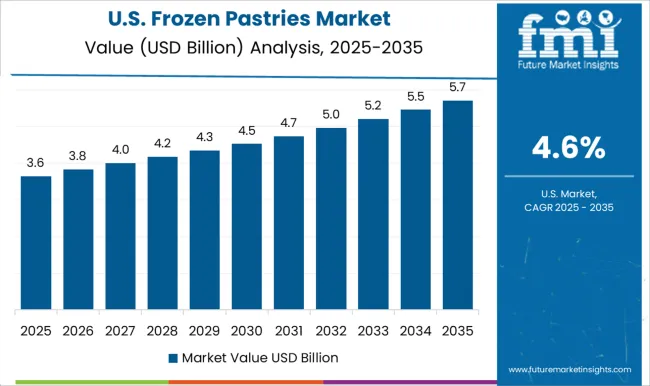

Frozen Pastries Market Growth Analysis in the United States

The United States is advancing at a CAGR of 4.6% in the market, driven by convenience-oriented consumption patterns. Consumers are increasingly seeking indulgent yet time-saving bakery products, and frozen pastries meet both needs. Retailers are expanding frozen bakery assortments to cater to breakfast, snacking, and dessert occasions. The influence of premium and specialty bakery brands is visible in frozen offerings, with a stronger focus on healthier recipes, gluten-free varieties, and innovative flavors. Foodservice chains also play a crucial role, sourcing frozen pastries to maintain efficiency and consistent quality. This dynamic is ensuring steady growth for frozen pastry consumption across the US.

Health-oriented variations are gaining attention in frozen pastries

Retail expansion is increasing product visibility and accessibility

Foodservice chains rely on frozen pastries for consistency

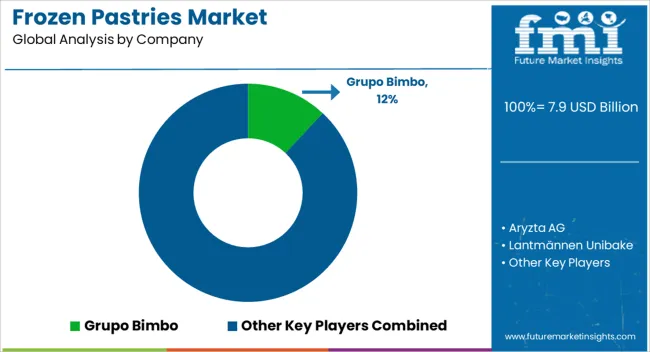

Competitive Landscape of Frozen Pastries Market

The market is characterized by strong participation from global bakery leaders and diversified food producers with wide distribution networks. Grupo Bimbo has developed a significant footprint through its extensive product portfolio and large-scale bakery operations that include frozen croissants, puff pastries, and Danish products. Aryzta AG plays a central role with its strong European presence, supplying artisanal-style frozen pastries to both retail and foodservice channels while focusing on convenience and consistent quality. Lantmännen Unibake stands out with its Scandinavian heritage, specializing in frozen bakery solutions tailored for quick-service restaurants, hotels, and catering operators across global markets. J&J Snack Food Corp. contributes to the segment through its range of ready-to-bake pastries and sweet goods, while Dawn Foods is recognized for providing frozen dough bases that support bakeries in maintaining production efficiency without compromising freshness.

Rich Products Corporation leverages its extensive frozen food expertise, delivering pastries designed for both retail shelves and commercial kitchens. Europastry S.A. is highly influential in Europe, offering innovative frozen pastry lines with premium formulations that meet evolving consumer preferences. Additionally, General Mills and Kellanova extend their presence beyond cereals and snacks into frozen bakery categories, enhancing their brand portfolios and creating diversified growth opportunities within the global frozen pastries landscape.

Key Players in the Frozen Pastries Market

Grupo Bimbo

Aryzta AG

Lantmännen Unibake

J&J Snack Food Corp.

Dawn Foods / Dawn Food Products

Rich Products Corporation

Europastry S.A.

General Mills Inc.

Kellanova

Scope of the Report

Item

Value

Quantitative Units

USD 7.9 billion

Product Type

Viennoiserie, Puff pastry products, Sweet pastries, Savory pastries, and Others (specialty & ethnic)

Dough Type

Laminated dough, Shortcrust dough, Choux pastry, Filo/phyllo dough, and Others

Production Process

Raw/unproofed frozen, Pre-proofed frozen, Par-baked frozen, and Fully baked frozen

Distribution Channel

Retail, Foodservice, and Institutional

Regions Covered

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

Country Covered

United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa

Key Companies Profiled

Grupo Bimbo, Aryzta AG, Lantmännen Unibake, J&J Snack Food Corp., Dawn Foods / Dawn Food Products, Rich Products Corporation, Europastry S.A., General Mills Inc., and Kellanova

Additional Attributes

Dollar sales by pastry type and distribution channel, demand dynamics across retail, foodservice, and bakery sectors, regional trends in frozen bakery adoption, innovation in flavor varieties, packaging, and preservation methods, environmental impact of cold chain logistics and packaging waste, and emerging use cases in convenience foods and premium bakery offerings.