Report Overview

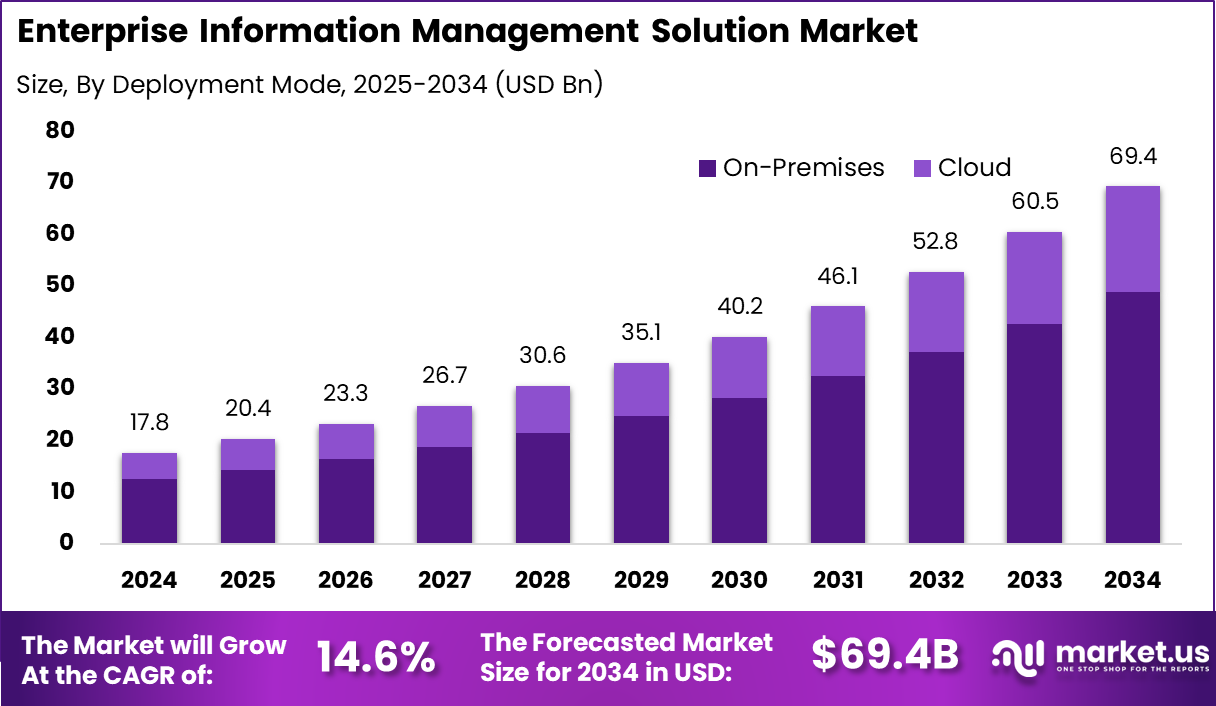

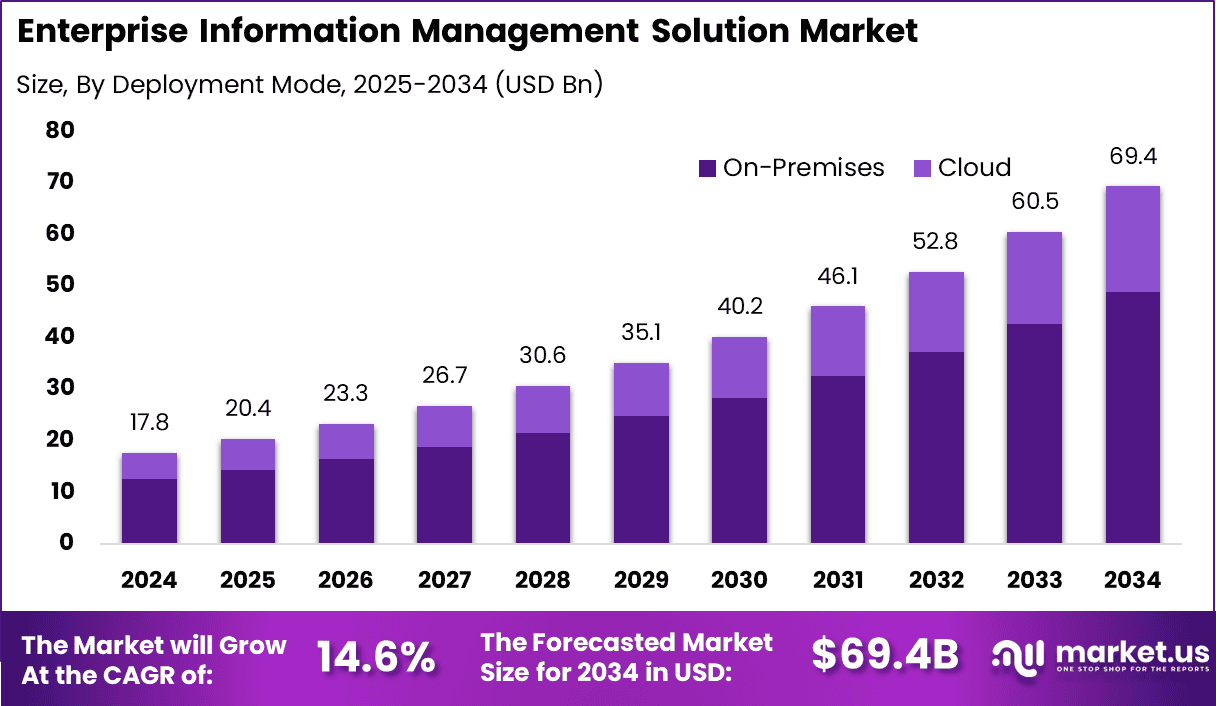

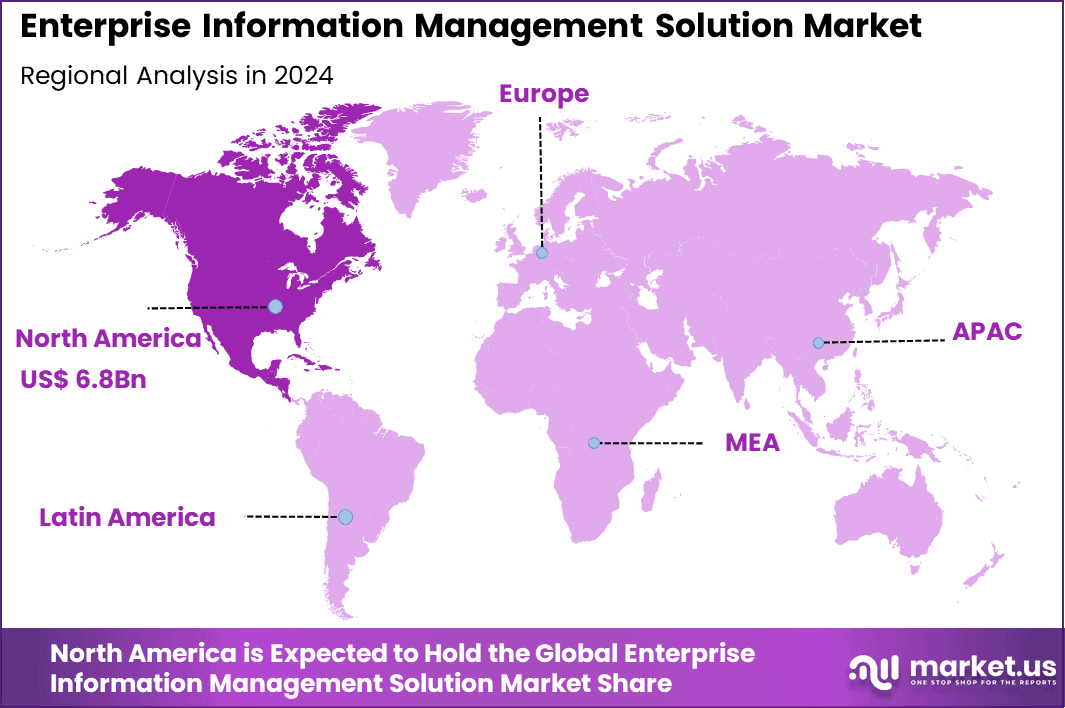

The Global Enterprise Information Management Solution Market size is expected to be worth around USD 69.4 Billion By 2034, from USD 17.8 billion in 2024, growing at a CAGR of 14.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 38.6% share, holding USD 6.8 Billion revenue.

The Enterprise Information Management (EIM) Solution Market includes software and services that help organizations manage, structure, and protect business information across departments. These solutions allow companies to capture, organize, store, access, and use information more effectively. EIM tools combine content management, data governance, records management, and analytics to ensure that business data is reliable, secure, and usable for strategic decision-making.

One of the main drivers of this market is the growing need to manage increasing volumes of enterprise data. As organizations handle more digital information, there is a need for systems that can ensure consistency, accuracy, and compliance. Regulatory demands related to data protection and retention have also influenced the adoption of EIM solutions.

Businesses are investing in these tools to avoid data silos, reduce duplication, and gain better control over content across multiple platforms and teams. Demand is high across industries that rely on accurate and accessible information for daily operations and compliance. Sectors such as healthcare, banking, manufacturing, and legal services are investing in EIM solutions to improve data handling, customer service, and risk management.

Key Insight Summary

By solution, Enterprise Information Management Software dominated with a 74.7% share.

On-premises deployment led the market, securing 70.6% share.

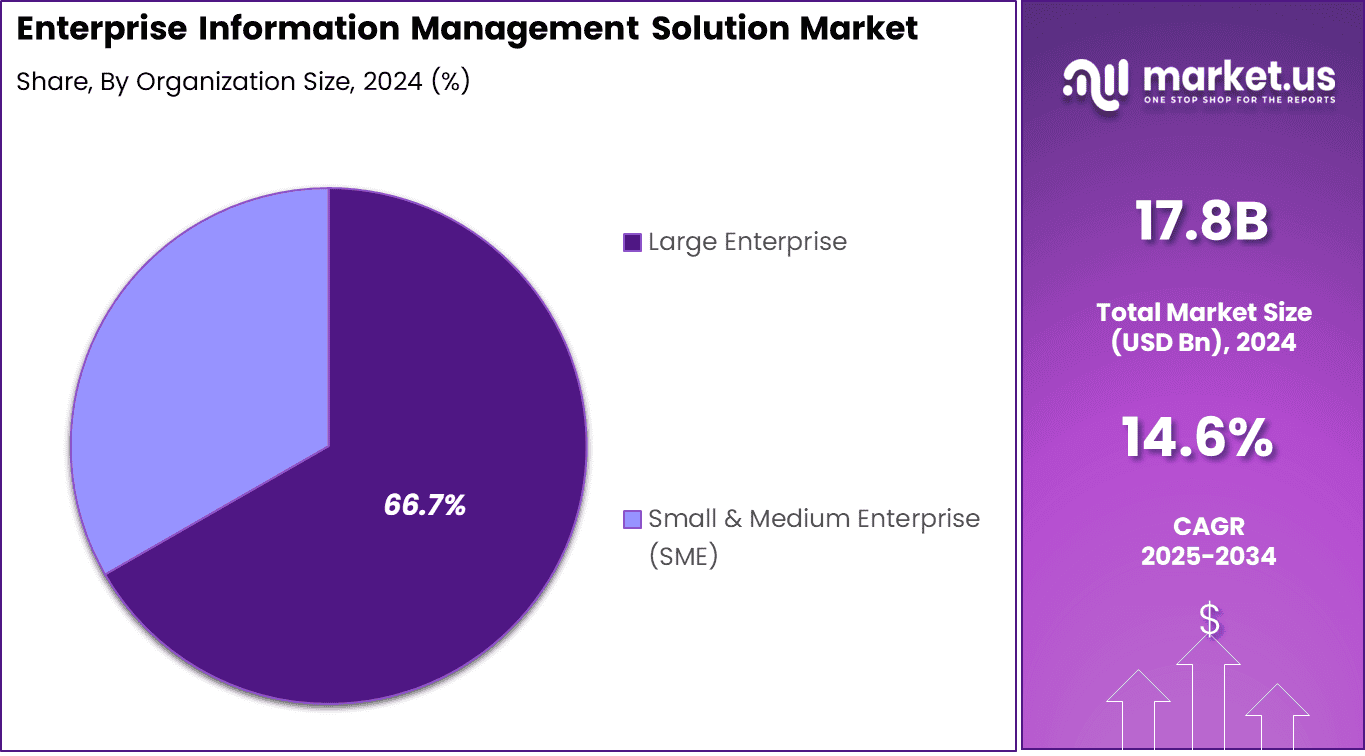

Large Enterprises were the main adopters, accounting for 66.7% share.

By industry, Banking, Financial Services, and Insurance (BFSI) held the top position with 34.5% share.

Regionally, North America captured 38.6% share of the market.

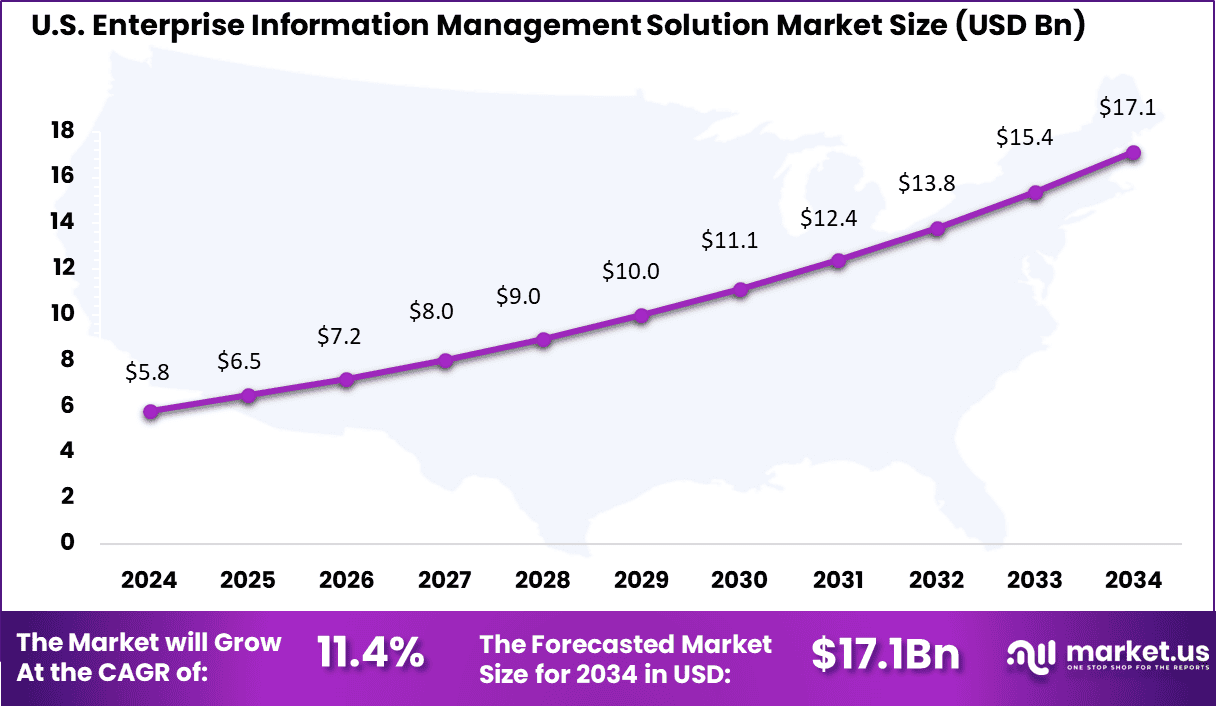

The U.S. market was valued at USD 5.82 Billion, expanding at a steady 11.4% CAGR.

Analysts’ Viewpoint

Advanced technologies such as artificial intelligence, machine learning, and cloud computing are being added to EIM systems. These tools help automate classification, improve search functions, and deliver insights from large data sets. Cloud-based EIM platforms offer flexibility and remote access, which is important for distributed teams.

AI-powered tools also support predictive analytics and automated tagging, which reduce the manual effort involved in managing content and improve data quality. Organizations adopt EIM solutions to create a unified system for managing all business data and documents.

These systems reduce the time spent searching for files, improve collaboration, and help in meeting regulatory requirements. EIM platforms also support audit trails and version control, ensuring data integrity over time. Companies that manage sensitive or regulated data rely on these solutions to maintain compliance and reduce legal risks.

Investment and Business Benefits

There is rising interest in platforms that offer full integration between data management, content storage, and business analytics. Investors are focusing on providers that support cloud-native deployment, strong security features, and scalability. As more small and medium enterprises look to improve their data governance, affordable and modular EIM tools are expected to attract more investment.

Opportunities also exist in expanding these platforms to support mobile access and multilingual environments. By using EIM solutions, businesses improve the accuracy, accessibility, and security of their information. These systems reduce operational costs by lowering paper usage, eliminating duplication, and streamlining document workflows. They also enhance decision-making by ensuring that accurate data is available when needed.

The need to comply with data privacy and retention regulations such as GDPR, HIPAA, and others is a major factor behind EIM adoption. These solutions help businesses enforce data access controls, maintain audit records, and apply policies for data lifecycle management. Failure to comply with regulatory requirements can result in penalties, so many companies see EIM as essential for meeting legal standards and maintaining trust with stakeholders.

Role of Generative AI

US Market Size

The U.S. Enterprise Information Management Solution Market was valued at USD 5.8 Billion in 2024 and is anticipated to reach approximately USD 17.1 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 11.4% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than 38.6% share and generating USD 6.8 billion in revenue in the enterprise information management (EIM) solution market. The region’s leadership stems from its advanced digital infrastructure, strong presence of global technology providers, and early adoption of data-driven enterprise solutions.

Organizations in the United States and Canada are increasingly focused on improving data governance, compliance, and analytics capabilities, which has accelerated the uptake of EIM platforms. With the rising volume of structured and unstructured data, enterprises in North America have prioritized investments in solutions that enhance operational efficiency and decision-making.

The dominance of North America is further reinforced by stringent regulatory requirements, particularly in industries such as healthcare, banking, and government, where data protection and compliance are critical. These regulations have driven organizations to adopt comprehensive information management frameworks that ensure data integrity and transparency.

Emerging Trends

Growth Factors

By Solution Analysis

Enterprise Information Management (EIM) Software dominated the solution segment with a commanding share of 74.7% in 2024. This high market share is attributed to the essential role that EIM software plays in helping organizations manage, organize, and govern their vast and varied enterprise data effectively.

Such software solutions offer capabilities like document management, data quality control, content management, and data governance, which enable enterprises to streamline their internal workflows, minimize errors, and ensure regulatory compliance.

The increasing demand for digital transformation across industries further propels the adoption of these software solutions, as they provide a unified platform to harness the growing volume of both structured and unstructured data.

Moreover, EIM software enhances decision-making processes by providing timely, accurate, and accessible data that supports business functions at all levels. Organizations realize improved operational efficiency, risk mitigation, and better customer insights by leveraging these sophisticated software tools. Continuous innovations, including integrations with AI and analytics, enrich these systems, driving higher adoption rates and expanding their functionality, which reinforces their dominant market position.

By Deployment Analysis

The on-premises deployment segment held the largest share at 70.6% in 2024. Many large enterprises and regulated industries continue to prefer on-premises solutions due to the greater control, security, and customization they offer.

On-premises EIM systems enable organizations to maintain full ownership of their data infrastructure and meet stringent internal policies or industry regulations, especially important in sectors with critical data such as BFSI and healthcare. This deployment model also allows for tailored integrations with legacy systems and finely tuned performance optimization, providing a stable and reliable platform for enterprise data management.

Despite the growing momentum of cloud-based deployments, on-premises solutions remain favored in environments where data sensitivity and compliance concerns outweigh the agility benefits of the cloud. Organizations also value the predictability of costs associated with on-premises infrastructure investments compared to recurring cloud subscription fees.

By Enterprise Size Analysis

Large enterprises dominated the market segment by enterprise size with a 66.7% share in 2024. These organizations often handle immense volumes of diverse data generated across multiple departments and geographical locations.

The complexity of their operations demands advanced EIM solutions capable of centralizing data governance, improving information accessibility, and ensuring the integrity and security of business-critical data. Large enterprises also have significant resources to invest in comprehensive EIM strategies, integrating software with data analytics, compliance tools, and AI capabilities to drive transformational business outcomes.

Furthermore, large enterprises face increasing regulatory pressures and the need for stringent data audits, escalating the necessity for robust EIM systems. These organizations seek to minimize risks related to data breaches, non-compliance, and ineffective data management processes, making EIM investments a strategic priority.

By Industry Analysis

The BFSI sector held a significant share of 34.5% in the enterprise information management solution market in 2024. This prominence is driven by the sector’s critical need for stringent data security, regulatory compliance, fraud detection, and efficient data handling capabilities.

BFSI organizations manage vast amounts of sensitive customer data and financial information, requiring robust EIM systems to ensure data accuracy, privacy, and accessibility without compromising security. Regulatory frameworks such as GDPR, Basel III, and others add layers of complexity that make EIM solutions indispensable for BFSI firms.

In addition, digital transformation across BFSI is accelerating through customer-centric innovations, real-time analytics, and automated workflows, all powered by sophisticated information management systems. EIM solutions enable BFSI companies to enhance customer experience by providing faster processing times and accurate insights while maintaining compliance standards.

Key Market Segments

By Solution

Enterprise Information Management Software

Enterprise Content Management (ECM)

Business Process Management (BPM)

Customer Experience Management (CEM)

Others

Services

Implementation & Integration Services

Consulting & Training Services

Support & Maintenance Services

By Deployment

By Enterprise Size

Large Enterprises

SME’s

By Industry

Retail

Healthcare

Industrial Manufacturing

Banking, Financial Services, and Insurance (BFSI)

IT & Telecom

Others

Regional Analysis and Coverage

North America

Europe

Germany

France

The UK

Spain

Italy

Russia

Netherlands

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Singapore

Thailand

Vietnam

Rest of Latin America

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

South Africa

Saudi Arabia

UAE

Rest of MEA

Driver Analysis

Rising Data Volume and Digital Transformation

The rapid growth in the amount of data generated by organizations worldwide is a primary driver for the Enterprise Information Management (EIM) solution market. As companies handle vast volumes of both structured and unstructured data, they require efficient systems to store, manage, and derive meaningful insights.

EIM solutions help in streamlining data processes, supporting better decision-making and operational efficiency. With data creation expected to escalate dramatically, businesses are compelled to adopt robust EIM platforms to maintain competitive advantage and agility in data handling.

Another factor fueling demand for EIM solutions is the ongoing digital transformation across industries. Organizations shifting their operations towards digital platforms and cloud environments seek flexible, scalable tools to manage their information assets effectively. This shift not only improves operational capabilities but also enhances compliance with data security regulations.

Restraint Analysis

High Implementation Cost and Complexity

One significant restraint in the Enterprise Information Management market is the high cost and complexity of implementing EIM solutions. Many small and medium enterprises (SMEs) find it challenging to afford the upfront expenses associated with software licenses, infrastructure, and employee training.

This barrier limits the adoption rate among smaller organizations, despite their increasing need for effective information management. In addition, the complexity involved in integrating EIM systems with existing legacy IT infrastructure can prolong deployment timelines and incur additional costs.

Furthermore, the need for specialized personnel to manage EIM platforms adds to operational expenses and deters organizations from adopting or fully utilizing these technologies. The intricate architecture of EIM solutions sometimes results in slower implementation across companies that lack skilled resources.

Opportunity Analysis

Cloud Adoption and AI Integration

The growing adoption of cloud technology presents a significant opportunity for the Enterprise Information Management market. Cloud-based EIM solutions offer businesses enhanced scalability, flexibility, and cost efficiency compared to traditional on-premises systems.

As more organizations migrate to cloud platforms, the demand for cloud EIM solutions increases, enabling providers to capture new market segments, especially in developing regions where digital infrastructure is expanding rapidly.

Additionally, the integration of artificial intelligence (AI) and machine learning (ML) technologies into EIM platforms offers vast potential. AI and ML can automate data categorization, improve data quality analysis, and provide predictive insights, greatly enhancing the value and effectiveness of EIM systems.

Businesses that embrace these advanced capabilities can improve decision-making processes and create competitive advantages. The rise of remote and hybrid work setups also drives demand for cloud-enabled EIM systems that support secure data access from anywhere, opening further avenues for growth.

Challenge Analysis

Data Privacy and Security Concerns

Data privacy and security remain critical challenges for enterprises adopting EIM solutions. As companies store and process large volumes of sensitive information, concerns about data breaches and unauthorized access increase, particularly when data is hosted in cloud environments.

Ensuring compliance with stringent regulations such as GDPR and CCPA adds complexity and risk to EIM deployment strategies. Moreover, the reliance on third-party cloud service providers can introduce vulnerabilities linked to supply chain and vendor dependencies.

Organizations must implement robust cybersecurity controls and maintain rigorous auditing processes to mitigate these risks. Failure to adequately protect sensitive data could result in severe legal penalties, financial losses, and reputational damage, posing a significant barrier for companies navigating the evolving data governance landscape.

Competitive Analysis

The Enterprise Information Management Solution market is shaped by leading players such as KMS Lighthouse, Aezion, Inc., T/DG, and Hyland Software, Inc. These companies focus on delivering platforms that improve knowledge sharing, automate workflows, and support document management. Their solutions are widely adopted by enterprises seeking to modernize operations and manage complex data efficiently, making them key drivers of growth in this market.

Important contributors like Open Text Corporation, IQVIA Inc., Acquia, Inc., and Virtusa Corp. strengthen the market with advanced information management systems tailored for industries such as healthcare, finance, and government. Their offerings support regulatory compliance, data governance, and analytics-driven insights. By aligning with sector-specific needs, these companies enhance enterprise efficiency while ensuring secure and compliant data usage.

Other participants including EIM Solutions, Swajyot Technologies, XBP Global, Function4, Atlas UP, Inc., Macro 4 Limited, Industrial Software Solutions, Kalypso, Xtensible Solutions, and Fink IT-Solutions GmbH & Co. KG contribute through integration services and specialized enterprise content platforms. Their focus on scalability and domain-specific solutions fosters strong competition and continuous innovation.

Top Key Players in the Market

KMS Lighthouse

Aezion, Inc.

T/DG

Hyland Software, Inc.

Open Text Corporation

IQVIA Inc.

Acquia, Inc.

Virtusa Corp.

EIM Solutions

Swajyot Technologies

XBP Global

Function4

Atlas UP, Inc.

Macro 4 Limited

Industrial Software Solutions

Kalypso: A Rockwell Automation Business

Xtensible Solutions, LLC

Fink IT-Solutions GmbH & Co. KG

Others

Recent Developments

In 2025, Aezion positioned itself as a leading custom enterprise data integration and information management partner. It focuses on enabling organizations to unify data across complex systems, facilitate analytics readiness, and implement AI-augmented data pipelines.

Hewlett Packard Enterprise (HPE) completed a landmark $14 billion acquisition of Juniper Networks in July 2025. This deal significantly boosts HPE’s AI-driven networking and cloud-native solutions, marking a major step in scaling its enterprise technology offerings.

Report Scope