Report Overview

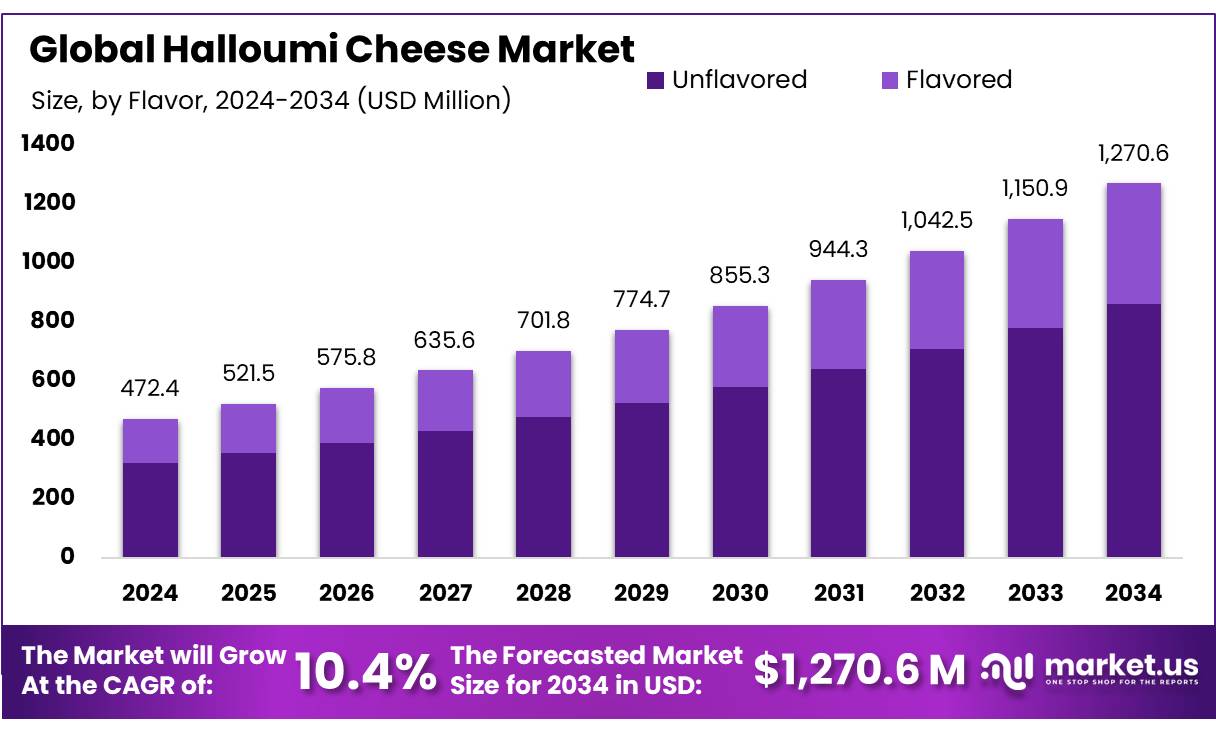

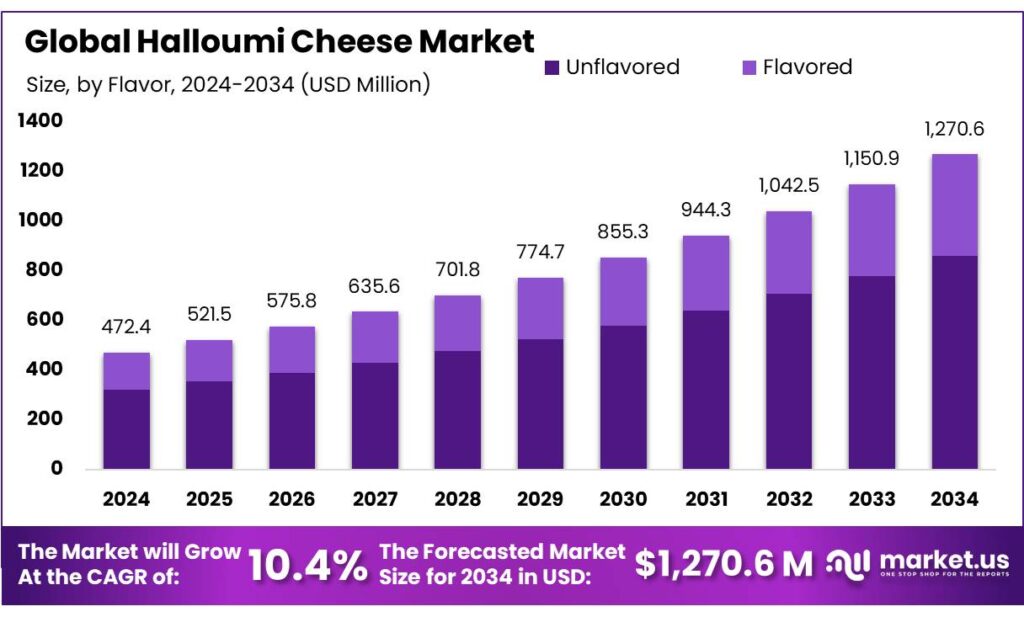

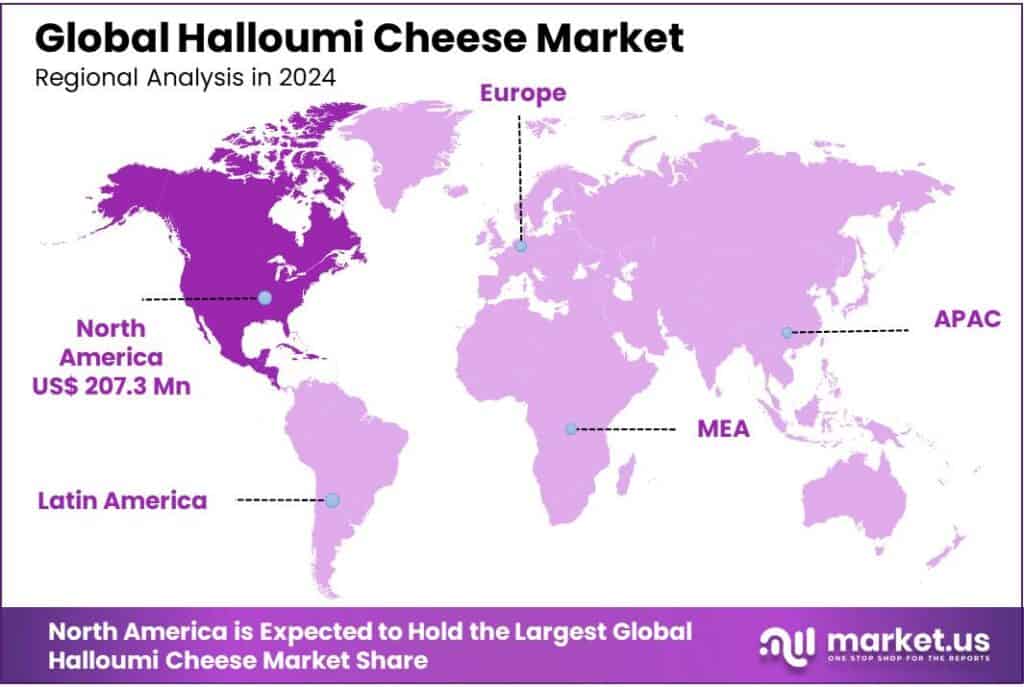

The Global Halloumi Cheese Market size is expected to be worth around USD 1270.6 Million by 2034, from USD 472.4 Million in 2024, growing at a CAGR of 10.4% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 43.9% share, holding USD 207.3 Million in revenue.

Halloumi cheese, a traditional Cypriot dairy product, has evolved from a regional delicacy to a globally recognized specialty. Originating from Cyprus, it is traditionally made from a blend of sheep and goat milk, although cow’s milk is increasingly used due to supply considerations. Notably, in 2021, Halloumi was granted Protected Designation of Origin (PDO) status by the European Union, ensuring that only cheeses produced in Cyprus can be marketed as Halloumi within the EU.

The Cypriot dairy industry processes approximately 210 million liters of milk annually, with Halloumi cheese production accounting for about 40,000 metric tons per year. In 2024, Cyprus exported over 42,000 metric tons of Halloumi cheese, generating approximately €324 million in revenue, marking an 8.6% increase in volume and a 2.67% rise in value compared to the previous year. This robust export performance underscores Halloumi’s significance as a key agricultural export, representing about 13.4% of Cyprus’s total exports of domestically produced goods.

Several factors contribute to the growing demand for Halloumi cheese. Its unique grilling properties, allowing it to retain shape when cooked, make it a popular choice among consumers seeking versatile and protein-rich alternatives. Additionally, the increasing global inclination towards Mediterranean diets, known for their health benefits, has further propelled Halloumi’s popularity. The product’s PDO status has also enhanced its appeal, ensuring authenticity and quality.

The Halloumi cheese industry faces both opportunities and challenges. The global market for Halloumi is projected to continue its upward trajectory, driven by sustained consumer interest in Mediterranean cuisine and plant-based protein sources. However, the industry must address supply chain constraints, particularly the seasonal availability of sheep and goat milk, which are essential for PDO-compliant production. Efforts to increase the proportion of these milks in Halloumi production are ongoing, with the Cypriot government mandating a gradual increase to 19% by 2024, though this has sparked debates within the industry regarding feasibility and impact on production capacity.

Key Takeaways

Halloumi Cheese Market size is expected to be worth around USD 1270.6 Million by 2034, from USD 472.4 Million in 2024, growing at a CAGR of 10.4%.

Unflavored halloumi cheese maintained a dominant position in the global market, capturing more than 67.9% of the total market share.

Conventional halloumi cheese maintained a dominant position in the global market, capturing more than 88.2% of the total market share.

Sliced halloumi cheese held a dominant position in the global market, capturing more than 59.4% of the total market share.

Food service sector emerged as the leading end-use segment in the global halloumi cheese market, capturing more than 49.7% of the total market share.

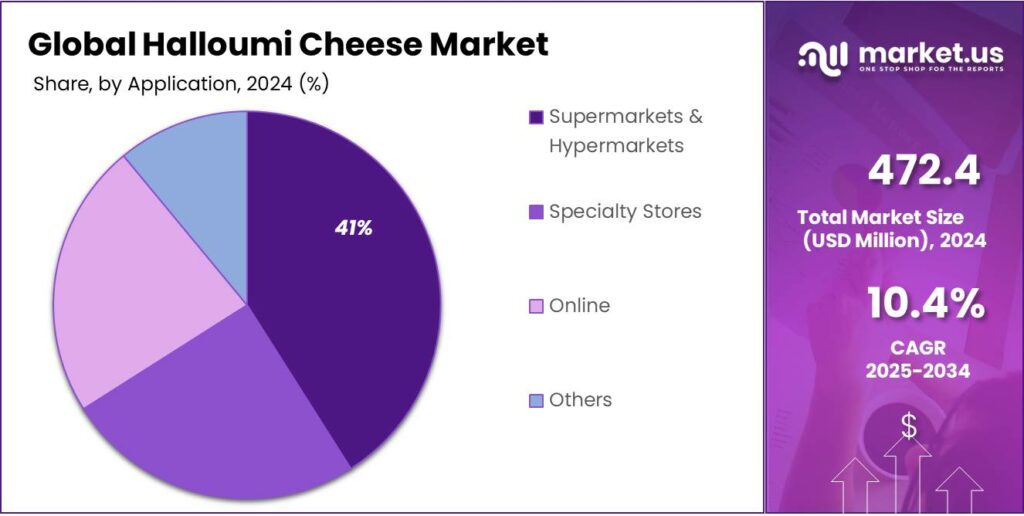

Supermarkets and hypermarkets captured a dominant 41.8% share of the global halloumi cheese market.

North America emerged as the dominant region in the global halloumi cheese market, capturing a substantial 43.9% share, valued at approximately USD 207.3 million.

By Flavor Analysis

Unflavored Halloumi Cheese Dominates with 67.9% Market Share in 2024

In 2024, unflavored halloumi cheese maintained a dominant position in the global market, capturing more than 67.9% of the total market share. This variant, cherished for its authentic taste and versatility, continues to be a staple in Mediterranean and Middle Eastern cuisines.

The unflavored segment’s growth is attributed to its adaptability in various culinary applications, from grilling to incorporation into salads and sandwiches. Its high melting point and unique texture make it a preferred choice among chefs and home cooks alike. Moreover, the increasing consumer preference for traditional and natural flavors has further bolstered the demand for unflavored halloumi.

By Nature Analysis

Conventional Halloumi Cheese Maintains Dominance with 88.2% Market Share in 2024

In 2024, conventional halloumi cheese maintained a dominant position in the global market, capturing more than 88.2% of the total market share. This variant, characterized by its traditional production methods and consistent quality, continues to be a staple in Mediterranean and Middle Eastern cuisines.

The conventional segment’s growth is attributed to its established production processes, which ensure a steady supply to meet the increasing global demand. The use of cow’s milk, which is more readily available and less seasonal than sheep and goat milk, has contributed to the scalability and cost-effectiveness of conventional halloumi production. This approach allows producers to maintain consistent product availability and pricing, appealing to both domestic and international markets.

By Form Analysis

Sliced Halloumi Cheese Captures 59.4% Market Share in 2024

In 2024, sliced halloumi cheese held a dominant position in the global market, capturing more than 59.4% of the total market share. This format’s popularity is primarily driven by its convenience and versatility, catering to the fast-paced lifestyles of modern consumers. Sliced halloumi is particularly favored in the food service sector, where quick preparation and consistent portioning are essential. Its ability to retain shape during grilling or frying makes it an ideal choice for sandwiches, burgers, and salads.

The growth of the sliced halloumi segment is also attributed to the increasing consumer demand for ready-to-eat and easy-to-prepare food options. Retailers and food service providers are responding to this trend by offering pre-sliced halloumi, which reduces preparation time and enhances the overall dining experience. This convenience factor has made sliced halloumi a preferred option among both professional chefs and home cooks.

By End Use Analysis

Food Service Sector Leads Halloumi Cheese Market with 49.7% Share in 2024

In 2024, the food service sector emerged as the leading end-use segment in the global halloumi cheese market, capturing more than 49.7% of the total market share. This dominance underscores the pivotal role of restaurants, cafes, and catering services in driving the demand for halloumi cheese. The unique properties of halloumi, particularly its high melting point, make it a preferred choice for grilling and frying, aligning well with the culinary needs of the food service industry.

The growth trajectory of the food service segment is closely linked to the rising popularity of Mediterranean and Middle Eastern cuisines, where halloumi plays a central role. As consumers increasingly seek diverse and authentic dining experiences, establishments are incorporating halloumi into their menus to cater to these preferences. Additionally, the shift towards plant-based diets and the growing trend of flexitarianism have further fueled the demand for halloumi as a versatile vegetarian protein source.

By Distribution Channel Analysis

Supermarkets & Hypermarkets Lead Halloumi Cheese Distribution with 41.8% Share in 2024

In 2024, supermarkets and hypermarkets captured a dominant 41.8% share of the global halloumi cheese market. This retail channel’s prominence is attributed to its extensive reach, offering consumers convenient access to a wide variety of halloumi products. These outlets provide both branded and private-label options, catering to diverse consumer preferences and budgets. The strategic placement of halloumi cheese in high-traffic areas within these stores enhances visibility and encourages impulse purchases.

The growth of this segment is further supported by the increasing consumer demand for Mediterranean and Middle Eastern cuisines, where halloumi plays a central role. As health-conscious consumers seek protein-rich, vegetarian-friendly alternatives, halloumi’s unique grilling properties make it an attractive option. Supermarkets and hypermarkets are capitalizing on this trend by expanding their product offerings and introducing innovative packaging solutions to meet consumer needs.

Key Market Segments

By Flavor

By Nature

By Form

By End Use

Household

Food Service

Retail

By Distribution Channel

Supermarkets & Hypermarkets

Specialty Stores

Online

Others

Emerging Trends

Surge in PDO-Compliant Halloumi Exports

In recent years, Cyprus’s Halloumi cheese industry has experienced a significant transformation, largely due to the implementation of the Protected Designation of Origin (PDO) status. This certification, granted by the European Union, mandates that authentic Halloumi must be produced in Cyprus using traditional methods, with a specific blend of sheep, goat, and cow milk.

The impact of PDO certification on Halloumi exports has been profound. In 2024, Cyprus exported over 42,000 tonnes of Halloumi, valued at approximately €324 million, marking an 8.6% increase in volume and a 2.67% rise in value compared to 2023. This growth underscores the global recognition and demand for PDO-compliant Halloumi.

The PDO status has not only enhanced the product’s authenticity but also opened new markets. For instance, exports to the United States reached €9.6 million in 2024, accounting for about 3% of Cyprus’s total Halloumi exports. Such figures indicate a growing interest in Halloumi beyond traditional markets.

To support this expansion, the Cypriot government has introduced measures to ensure the sustainability of PDO-compliant Halloumi production. In July 2024, the Ministry of Agriculture announced a decree to increase the proportion of sheep and goat milk in Halloumi production to 30% by the end of August 2025.

Drivers

Protected Designation of Origin (PDO) Status

One of the most significant drivers behind the global success of Halloumi cheese is its Protected Designation of Origin (PDO) status granted by the European Union in 2021. This certification ensures that only cheese produced in Cyprus, using traditional methods, can be marketed as “Halloumi” within the EU. The PDO status not only protects the authenticity of the product but also enhances its appeal in international markets by guaranteeing quality and origin.

Following the award of PDO status, Cyprus has witnessed a substantial increase in Halloumi exports. In 2024, the country exported over 42,000 tonnes of Halloumi, generating approximately €324 million in revenue. This marks an 8.6% increase in volume and a 2.67% rise in value compared to 2023. Notably, Halloumi exports accounted for 13.4% of Cyprus’s total exports of domestically produced goods, underscoring its economic significance.

The PDO status has also led to increased investments in the Halloumi sector. For instance, Greek dairy company Omiros Dairy invested €30 million in 2024 to establish a state-of-the-art dairy plant in Cyprus, aiming to produce 12,000 tonnes of Halloumi annually. This expansion not only boosts production capacity but also strengthens Cyprus’s position in the global dairy market.

However, the implementation of the PDO specifications has not been without challenges. The EU’s requirement to gradually increase the proportion of ewe and goat milk in Halloumi production to 19% by 2024 has sparked debates within the industry. Some stakeholders argue that the seasonal availability of ewe and goat milk could impact production capacity and export volumes. In response, the Cypriot government has committed to safeguarding Halloumi’s PDO status and is engaging with industry representatives to address these concerns.

Restraints

Limited Availability of Sheep and Goat Milk

A significant challenge facing the Halloumi cheese industry in Cyprus is the limited availability of sheep and goat milk, which is essential for producing the cheese under its Protected Designation of Origin (PDO) status. This limitation has become more pronounced due to economic pressures and changing agricultural practices.

In 2024, a survey of one of Cyprus’s largest Halloumi brands revealed that the sheep and goat milk content in their product was as low as 5%, well below the required 10% for PDO compliance during the low production season. This discrepancy highlights the challenges producers face in sourcing sufficient quantities of the traditional milks needed for authentic Halloumi production.

The Cypriot government has recognized this issue and, in 2025, introduced a new subsidy scheme to encourage increased milk production from sheep and goats. Under this scheme, farms producing at least 230 liters of milk per female animal per year are eligible for €19 per animal, up from €9 previously. However, this initiative has faced criticism from farmers who argue that the criteria are unrealistic and do not adequately address the underlying issues affecting milk supply.

Further complicating the situation, many sheep and goat breeders in Cyprus are selling off their livestock to foreign buyers, attracted by higher prices and fewer regulatory constraints. In July 2025, it was reported that approximately 1,500 sheep and goats were being exported to Libya, with more expected to follow. This mass exportation reduces the local breeding stock, exacerbating the milk supply shortage and threatening the sustainability of PDO Halloumi production.

Opportunity

Expansion into New International Markets

Cyprus’s Halloumi cheese industry stands at a pivotal juncture, with significant opportunities to expand its presence in international markets. In 2024, Halloumi exports reached over 42,000 tonnes, valued at approximately €324 million, marking an 8.6% increase in volume and a 2.67% rise in value compared to the previous year. This growth underscores the product’s rising popularity and the potential for further market penetration.

The United Kingdom remains the largest importer of Cypriot Halloumi, accounting for about 44% of exports. However, other markets such as Germany, Sweden, and Australia have also shown promising demand. For instance, Sweden imported over 3,200 tonnes valued at more than €25 million, while Australia imported approximately 2,000 tonnes worth €15.6 million. These figures indicate a growing interest in Halloumi beyond traditional markets.

To capitalize on this momentum, the Cypriot government has launched initiatives aimed at boosting Halloumi exports. In 2022, a two-year action plan was introduced to enhance the recognition of Halloumi as a distinct Cypriot product. This plan included the creation of a dedicated website, halloumi.cy, available in multiple languages, to promote the cheese’s heritage and PDO status

Additionally, the government has committed to safeguarding Halloumi’s PDO status and maintaining its position as Cyprus’s leading export product. In June 2024, President Nikos Christodoulides met with stakeholders from various sectors to discuss strategies for preserving and expanding Halloumi exports

Regional Insights

North America Leads Halloumi Cheese Market with 43.9% Share in 2024

In 2024, North America emerged as the dominant region in the global halloumi cheese market, capturing a substantial 43.9% share, valued at approximately USD 207.3 million. This robust market presence is primarily driven by the United States, which accounted for a significant portion of the regional revenue.

The increasing popularity of Mediterranean and Middle Eastern cuisines, coupled with a growing consumer inclination towards protein-rich vegetarian options, has significantly contributed to the surge in halloumi cheese consumption across North America. Halloumi’s unique grilling properties and versatility in various culinary applications have further bolstered its demand in both household and food service sectors.

Key Regions and Countries Insights

North America

Europe

Germany

France

The UK

Spain

Italy

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Rest of APAC

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

GCC

South Africa

Rest of MEA

Key Players Analysis

Established in 1990, Petrou Bros is a leading Cypriot dairy producer renowned for its Alambra-branded Halloumi cheese. Operating from Aradippou, the company processes approximately 250 tonnes of milk daily and exports to over 40 countries. Their Halloumi is PDO-certified, ensuring authenticity and quality.

Arla Foods is a global dairy company headquartered in Denmark, producing a range of dairy products, including Halloumi cheese under the Puck brand. Their Halloumi is known for its grilling quality and is available in various markets.

Top Key Players Outlook

Petrou Bros Dairy Products

Zita Dairies

Uhrenholt

Hadjipieris

Arla Foods

Dafni Dairy

Nordex Food

Achnagal Dairies

Lefkonitziatis Dairy Products

Olympus Cheese

Almarai

Recent Industry Developments

In January 2024, Arla announced the acquisition of a 50% stake in Petrou Bros, a renowned Cypriot halloumi producer, marking a strategic move to enhance its presence in the Mediterranean cheese market.

In 2024 Petrou Bros Dairy Products Ltd, achieved an annual production exceeding 6,500 tonnes of Halloumi, representing over 30% of Cyprus’s total Halloumi exports.

Report Scope