Report Overview

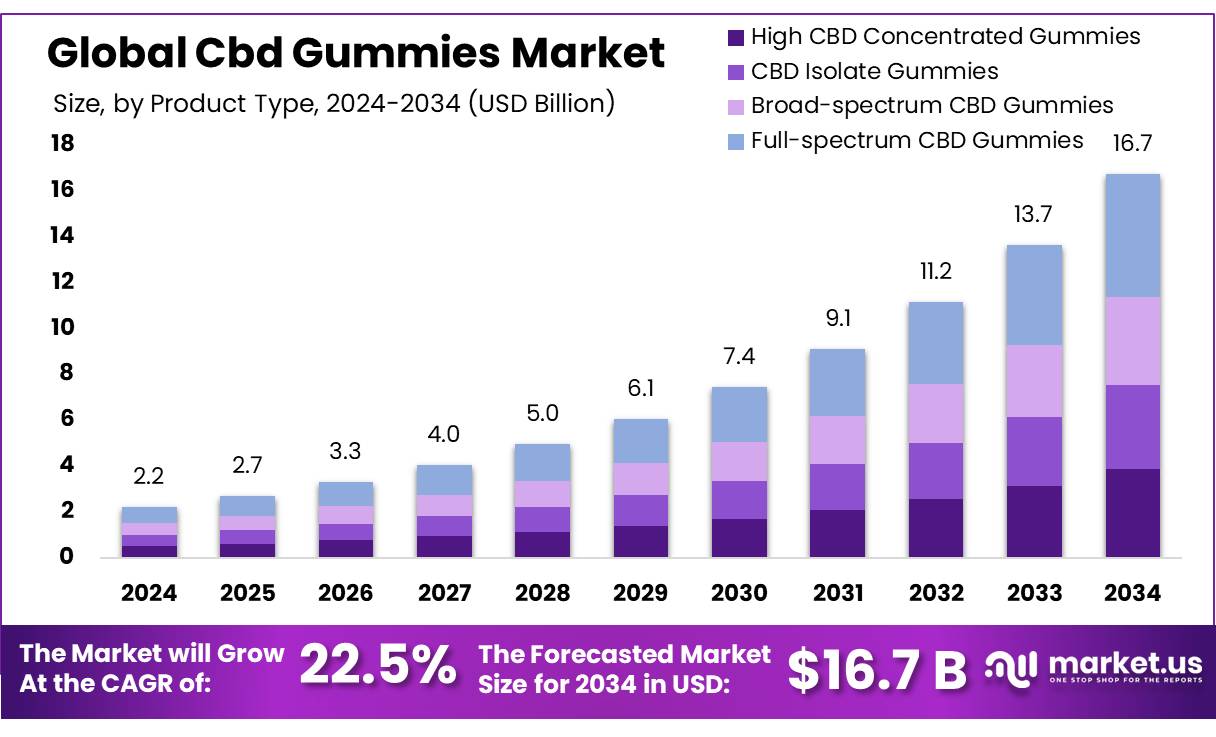

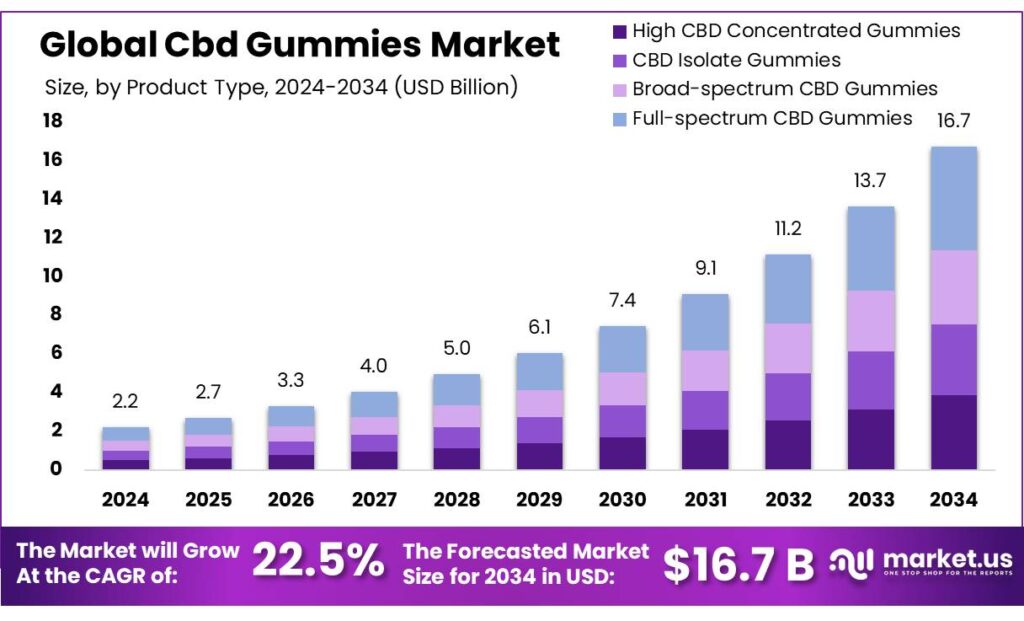

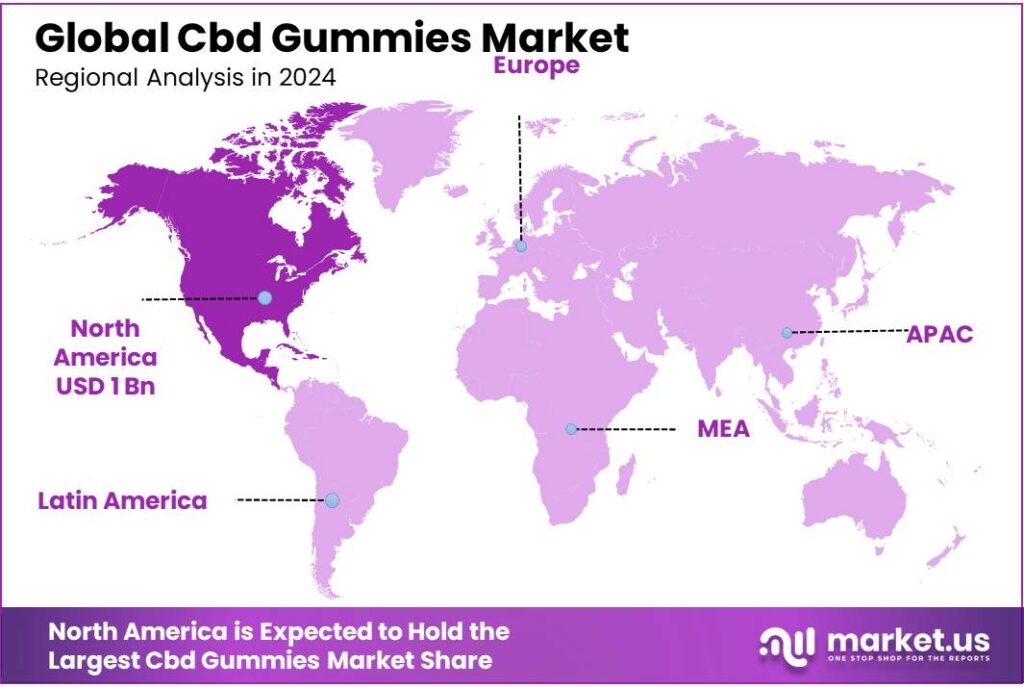

The Global Cbd Gummies Market size is expected to be worth around USD 16.7 Billion by 2034, from USD 2.2 Billion in 2024, growing at a CAGR of 22.5% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 47.8% share.

The demand for CBD gummies is also influenced by the growing prevalence of stress, anxiety, and sleep disorders among the Indian population. As consumers seek natural alternatives to manage these conditions, CBD gummies offer a convenient and appealing option. The market is characterized by a diverse range of products catering to various consumer preferences, including vegan and low-sugar options.

Government initiatives have also played a pivotal role in shaping the market. In the United States, the 2018 Farm Bill legalized the cultivation of hemp and the production of hemp-derived CBD products, provided they contain less than 0.3% THC. This legislative change has facilitated the growth of the CBD industry by providing a clearer regulatory framework and encouraging investment in CBD product development. However, the Food and Drug Administration (FDA) has expressed concerns regarding the safety and efficacy of CBD products, particularly in food and dietary supplements, due to insufficient evidence.

However, the U.S. Food and Drug Administration (FDA) has not approved CBD for use in food or dietary supplements due to safety concerns, including potential liver damage and interactions with other medications. This regulatory uncertainty has led to calls for clearer guidelines to ensure consumer safety and product quality. Despite these regulatory challenges, the market has seen substantial growth, with the U.S. CBD market expanding from an estimated $108 million in 2014 to approximately $1.9 billion in 2022.

Several factors contribute to the upward trajectory of the CBD gummies market. The rising prevalence of mental health issues, such as anxiety and depression, has heightened demand for alternative therapeutic options. For instance, the Anxiety and Depression Association of America reports that anxiety affects approximately 40 million adults in the United States, a statistic that underscores the increasing interest in CBD products as potential remedies. Additionally, the non-psychoactive nature of CBD, particularly in gummies, appeals to consumers seeking therapeutic benefits without the intoxicating effects associated with other cannabis derivatives.

Key Takeaways

Cbd Gummies Market size is expected to be worth around USD 16.7 Billion by 2034, from USD 2.2 Billion in 2024, growing at a CAGR of 22.5%.

Full-spectrum CBD gummies held a dominant market position, capturing more than a 31.4% share of the CBD gummies market.

Chocolate-flavored CBD gummies secured a dominant position in the Indian market, capturing over 34.8% of the total market share.

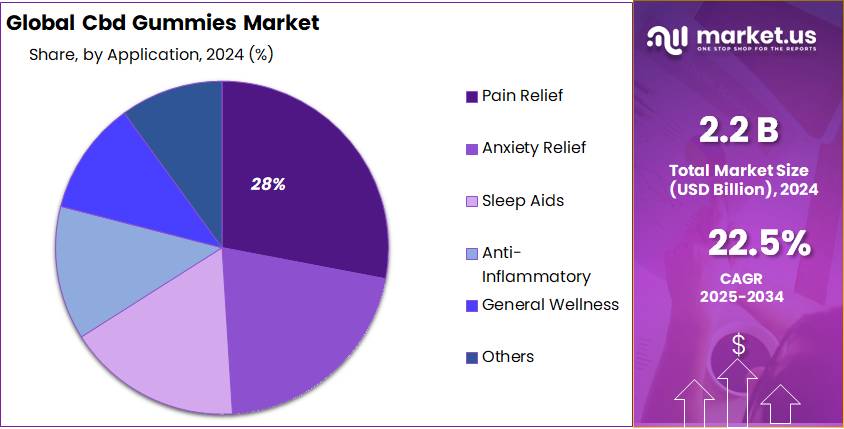

Pain relief application segment held a significant position in the CBD gummies market, capturing over 28.6% of the total market share.

Supermarket/Hypermarket distribution channel held a dominant position in the CBD gummies market, capturing more than a 42.2% share.

North America emerged as the dominant region in the global CBD gummies market, capturing approximately 47.8% of the total market share.

By Product Type Analysis

Full-Spectrum CBD Gummies Dominate with 31.4% Market Share in 2024

In 2024, full-spectrum CBD gummies held a dominant market position, capturing more than a 31.4% share of the CBD gummies market in India. This segment’s growth is attributed to the increasing consumer preference for products that offer a holistic approach to wellness, leveraging the entourage effect of multiple cannabinoids and terpenes present in full-spectrum formulations.

The popularity of full-spectrum CBD gummies is further bolstered by the growing awareness of their potential benefits in managing stress, anxiety, and sleep disorders. As consumers seek natural alternatives to pharmaceutical interventions, full-spectrum CBD gummies have emerged as a preferred choice due to their perceived efficacy and minimal side effects.

By Flavor Analysis

Chocolate Flavor CBD Gummies Lead with 34.8% Market Share in 2024

In 2024, chocolate-flavored CBD gummies secured a dominant position in the Indian market, capturing over 34.8% of the total market share. This preference is largely attributed to the rich, indulgent taste of chocolate, which appeals to a broad consumer base seeking a pleasurable way to consume wellness products.

The popularity of chocolate-flavored CBD gummies has been bolstered by the increasing consumer demand for functional edibles that offer both taste and therapeutic benefits. As consumers become more health-conscious, there is a growing inclination towards products that combine the enjoyment of traditional confections with the potential health benefits of CBD.

By Application Analysis

Pain Relief Application Leads CBD Gummies Market with 28.6% Share in 2024

In 2024, the pain relief application segment held a significant position in the CBD gummies market, capturing over 28.6% of the total market share. This dominance is attributed to the growing consumer preference for natural alternatives to manage chronic pain conditions such as arthritis, neuropathy, and fibromyalgia. CBD’s anti-inflammatory and analgesic properties have contributed to its increasing popularity among individuals seeking non-addictive pain management solutions.

The demand for CBD gummies in pain relief applications is further supported by the rise in awareness regarding the potential benefits of cannabidiol. Consumers are increasingly turning to CBD-infused products as part of their wellness routines, favoring the convenience and precise dosing that gummies offer. This trend aligns with the broader shift towards holistic health approaches and the desire for products that integrate seamlessly into daily life.

By Distribution Channel Analysis

Supermarket/Hypermarket Distribution Channel Leads CBD Gummies Market with 42.2% Share in 2024

In 2024, the Supermarket/Hypermarket distribution channel held a dominant position in the CBD gummies market, capturing more than a 42.2% share. This preference is attributed to the convenience and accessibility these retail formats offer to consumers. Supermarkets and hypermarkets provide a wide range of products under one roof, allowing consumers to compare different brands and formulations of CBD gummies easily. The physical presence of these stores also enables consumers to seek assistance from staff, enhancing their shopping experience.

The strong performance of the Supermarket/Hypermarket segment is further supported by the increasing consumer trust in established retail chains. Consumers often perceive products sold in these outlets as more reliable and authentic, which is crucial in the wellness product sector. Additionally, the strategic placement of CBD gummies alongside other health and wellness products in these stores increases their visibility and impulse purchase potential.

Key Market Segments

By Product Type

High CBD Concentrated Gummies

CBD Isolate Gummies

Broad-spectrum CBD Gummies

Full-spectrum CBD Gummies

By Flavor

Fruity

Mint

Chocolate

Sour

Mixed Berry

Others

By Application

Pain Relief

Anxiety Relief

Sleep Aids

Anti-Inflammatory

General Wellness

Others

By Distribution Channel

Conventional

Supermarket/Hypermarket

Local Health Stores

Online Retailing

Others

Emerging Trends

Personalized CBD Gummies: Tailoring Wellness to Individual Needs

One of the most significant trends shaping the CBD gummies market in 2025 is the move towards personalized wellness solutions. Consumers are increasingly seeking products that cater to their specific health needs and preferences, and CBD gummies are evolving to meet this demand.

A pivotal factor driving this trend is the growing consumer interest in customized health products. A survey conducted in 2023 revealed that 70% of consumers are willing to pay more for products tailored to their individual health requirements. This shift towards personalization is not just a passing fad but a reflection of a broader movement towards individualized wellness. Consumers are no longer satisfied with one-size-fits-all solutions; they want products that are specifically designed to address their unique health concerns.

In response to this demand, CBD gummy manufacturers are innovating by developing products that combine CBD with other functional ingredients aimed at specific health benefits. For instance, some gummies are formulated with melatonin to support sleep, while others include turmeric for its anti-inflammatory properties. These enhanced formulations not only cater to the growing demand for personalized wellness products but also position CBD gummies as versatile solutions for a range of health concerns.

Drivers

Therapeutic Benefits and Consumer Demand

The growing interest in CBD gummies is largely driven by their perceived therapeutic benefits and the increasing consumer preference for natural wellness products. CBD, or cannabidiol, is a non-psychoactive compound found in cannabis plants, and its potential health benefits have garnered significant attention.

In particular, CBD is believed to aid in alleviating symptoms associated with anxiety, chronic pain, and sleep disorders. According to a survey conducted by the Wellness Institute, 79% of consumers indicate that they are trying to incorporate more natural elements into their diets, reflecting a significant lifestyle shift towards health-conscious choices.

This shift is evident in the market dynamics, with CBD gummies emerging as a popular choice among consumers seeking convenient and discreet methods of consumption. The gummies offer a palatable alternative to traditional CBD oils and tinctures, making them particularly appealing to individuals new to CBD products. The ease of use and consistent dosing provided by gummies contribute to their growing popularity in the wellness sector.

Furthermore, the therapeutic versatility of CBD gummies enhances their appeal. They are not only used for stress relief and sleep improvement but also for managing chronic pain and inflammation. This broad range of applications positions CBD gummies as a multifunctional wellness product, catering to a diverse consumer base.

Restraints

Regulatory Uncertainty and Legal Restrictions

A significant challenge facing the CBD gummies market is the complex and evolving regulatory landscape, which varies widely across regions and often lacks clarity. This uncertainty can deter manufacturers and consumers alike, hindering market growth.

In the United States, the Food and Drug Administration (FDA) has not approved CBD for use in food or dietary supplements. In January 2023, the FDA stated that existing regulatory frameworks are not suitable for CBD, citing insufficient data on safety and efficacy. The agency has issued multiple warning letters to companies illegally marketing CBD products, including gummies, as dietary supplements or foods, emphasizing the need for clearer regulations.

Similarly, in India, the Food Safety and Standards Authority of India (FSSAI) has set stringent guidelines for hemp seed-based products. According to FSSAI regulations, the total THC content in any food product consisting of hemp seed or seed products shall not exceed 5 mg/kg, and the level of cannabidiol (CBD) shall not exceed 75 mg/kg. Moreover, such products must not be marketed with claims of psychoactive effects or health benefits related to CBD.

These regulatory constraints create a challenging environment for CBD gummies to be marketed and sold legally. Manufacturers must navigate a patchwork of regulations, which can vary not only between countries but also within regions of a single country. The lack of standardized regulations leads to confusion among consumers and businesses, potentially limiting the market’s expansion.

Opportunity

Expansion into Functional Wellness Products

One of the most promising growth opportunities for the CBD gummies market lies in their integration into the broader functional wellness sector. As consumers increasingly seek natural and holistic approaches to health, CBD gummies are evolving from niche products to mainstream wellness solutions. This shift is driven by several factors, including the growing demand for plant-based supplements, advancements in product formulations, and expanding distribution channels.

In response to this demand, manufacturers are innovating by developing CBD gummies that cater to specific health needs. For instance, some companies are formulating gummies that combine CBD with other functional ingredients such as melatonin for sleep support, turmeric for anti-inflammatory benefits, and vitamins for immune health. These enhanced formulations not only appeal to health-conscious consumers but also position CBD gummies as versatile wellness products.

Government initiatives are also playing a crucial role in supporting the growth of the CBD gummies market. In the United States, the 2018 Farm Bill legalized hemp-derived CBD products containing less than 0.3% THC, providing a clear regulatory framework that has encouraged investment and innovation in the sector. Similarly, countries like Canada and several European nations have implemented regulations that facilitate the legal sale of CBD products, further expanding market opportunities.

Regional Insights

North America Leads CBD Gummies Market with 47.8% Share in 2024

In 2024, North America emerged as the dominant region in the global CBD gummies market, capturing approximately 47.8% of the total market share. This dominance is primarily attributed to the widespread legalization of cannabis products, including CBD-infused edibles, across the United States and Canada. The U.S. market alone accounted for a significant portion of this share, driven by increasing consumer awareness and acceptance of CBD’s potential health benefits.

The regulatory landscape in North America has played a pivotal role in shaping the market dynamics. For instance, the U.S. Farm Bill of 2018 legalized the cultivation of hemp-derived CBD products, provided they contain less than 0.3% THC. This legislation has facilitated the growth of the CBD gummies market by ensuring a steady supply of raw materials and providing a clear legal framework for manufacturers and consumers alike.

Key Regions and Countries Insights

North America

Europe

Germany

France

The UK

Spain

Italy

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Rest of APAC

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

GCC

South Africa

Rest of MEA

Key Players Analysis

CV Sciences is a prominent wellness company specializing in hemp-derived CBD products. Under its +PlusCBD™ brand, the company offers a range of products, including gummies, capsules, and topicals. Their products are known for their high-quality standards, with each batch undergoing third-party testing to ensure purity and potency. CV Sciences emphasizes transparency and consumer trust, making it a recognized name in the CBD industry.

BellRock Brands is a multi-state cannabis operator with a diverse portfolio of brands, including Mary’s Medicinals and Dixie. The company offers a wide range of cannabis-infused products, such as edibles, topicals, and tinctures. BellRock focuses on innovation and quality, aiming to provide consumers with effective and enjoyable cannabis experiences.

Sunday Scaries is a California-based wellness brand known for its CBD products designed to alleviate stress and anxiety. Their product line includes gummies, tinctures, and energy shots, all formulated with full-spectrum CBD and additional ingredients like vitamins B12 and D3. The brand emphasizes transparency and customer satisfaction, offering a money-back guarantee on their products.

Top Key Players Outlook

CV Sciences, Inc.

BellRock Brands

Sunday Scaries

Green Roads

Medix CBD

NextEvo Naturals

Purekana LLC

Diamond CBD

PJ Marketing LLC

Charlotte’s Web, Inc.

Recent Industry Developments

In 2024, Medix CBD reported an estimated annual revenue of approximately $15 million, reflecting its strong position in the competitive CBD market.

In 2024 Green Roads, reported annual revenues of approximately $50 million, with a significant portion derived from its CBD gummies line.

Report Scope