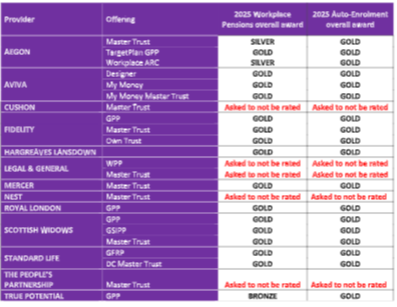

Seven providers, including Aviva, Royal London, and Standard Life, have achieved “overall gold” awards in Benefits Guru’s annual workplace pensions and auto enrolment ratings.

This year’s ratings, which mark the 11th edition, included nine providers and 18 different propositions and demonstrated the industry’s growth within the pensions market as providers are evolving their offerings to meet member needs.

The ratings also revealed that Standard Life achieved a clean sweep of overall gold awards, and gold in all subcategories across both workplace pension and auto enrolment ratings.

© Benefits Guru

Benefits Guru chief commercial officer, Jason Green, said: “This year‘s results are particularly interesting with some workplace pension providers really standing out for delivering some exceptional innovation

“Standard Life is a great case in point having achieved gold awards in the new Member AI Tools & Operating Efficiencies section.

“They have deployed a number of new AI based services, both internally to improve business processes and externally to support members and advisers.”

Green added that this includes using technology to assist with data validation during payroll processing, and the use of AI in call centres to help with live transcripts and flag potentially vulnerable customers.

He specified that this includes AI-powered guidance to deliver personalised prompts to members to help with understanding next best actions, nudges to increase contributions and personalised video content to members.

“It’s tremendous to see the lengths the real innovators in workplace pensions are going to in order to deliver an outstanding customer experience,” Green concluded.

This year, as well as benchmarking the existing criteria, such as member app and portals and support services functionality, Benefits Guru included new areas.

This included member AI tools and operating efficiencies which explores how providers are using AI internally to improve infrastructures and core services, as well as externally to support members and advisers.

It also included value for money & member outcomes, which looks at levels of member interaction and engagement.

tom.dunstan@ft.com

What’s your view?

Have your say in the comments section below or email us: ftadviser.newsdesk@ft.com