Image © European Central Bank

It could be worth positioning yourself for a stronger pound vs. euro through the ECB decision.

The Euro enters the European Central Bank’s (ECB) September policy decision as one of the top-performing currencies of 2025, but tactically, it could be worth looking for some weakness to result.

“We see slightly negative EUR risks around the ECB’s September meeting, with our economists expecting a slightly dovish press conference, also given ECB market pricing,” says a preview not from Bank of America.

The central bank will leave interest rates unchanged and tell listeners that it will continue to monitor the data when considering further action, which will surprise nobody.

Get More From Your GBP/EUR Transfer

Get More From Your GBP/EUR Transfer

Pound Sterling Live consistently delivers stronger rates than major UK banks.

In July, you could have saved up to €1,720 on a £50,000 transfer thanks to our competitive pricing.

Based on average GBP/EUR rates observed in July.

So on the face of it, we have a central bank that has completed the cutting cycle and is happy to sit and watch things play out. That should offer the euro support; after all, a good portion of the single currency’s outperformance this year is linked to the view that the ECB has completed the rate cutting cycle.

But currencies move on forward-looking expectations, and for traders, the ECB must convince that it truly is at the end of the interest rate cutting cycle.

This means there is some space for the market to build expectations for a couple more cuts in the coming months, a complication for the euro ‘bulls’.

“We lean bearish on EUR vs GBP, AUD, and the Scandies,” say strategists at Bank of America.

GBP/EUR Investment Bank Consensus Forecasts Cut

GBP/EUR Investment Bank Consensus Forecasts Cut

The median and mean forecasts, that provide a consensus forecast for GBP/EUR, have fallen.

Make smarter timing decisionsGet more euros for your poundsStay ahead of market moves

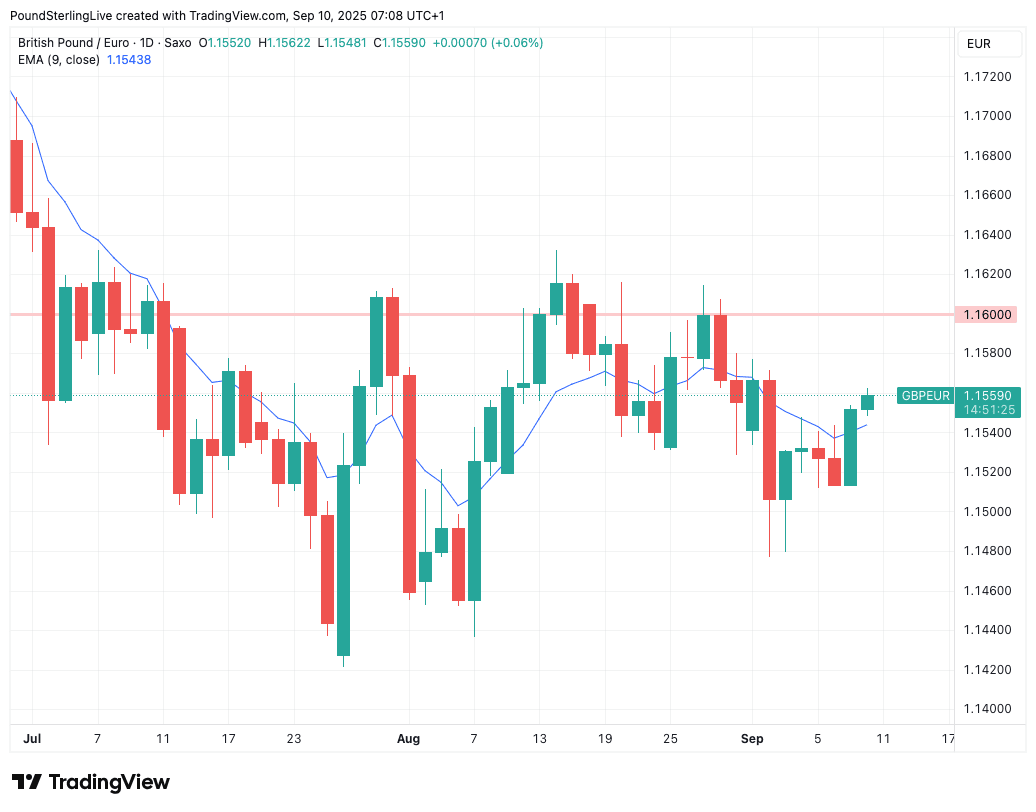

Ahead of the Thursday event, the pound to euro exchange rate grinds up to 1.1550, putting it at its highest level in more than a week. It’s recovery from last Tuesday’s sharp drop has been slow but Thursday’s ECB could help the pair extend gains towards 1.16, where notable resistance lies.

Those with payment requirements can consider booking an order at these levels to capture any advantageous move.

To be sure, fireworks are unlikely to be let off by the notoriously guarded ECB President Christine Lagarde, but there are some areas of potential vulnerabilities:

“We find it increasingly difficult to expect a hawkish press conference. While the discussion around the outlook is likely to be quite similar to that in July, the assumptions in the forecasts are quickly “growing stale”, given the move in real rates that will represent a major headwind if it persists,” says Bank of America.

A record-high trade-weighted exchange rate is also expected to add to “a dovish flavour”.

Above: The GBP/EUR is grinding higher in the post-July range. The move above the nine-day EMA, if combined with a supportive ECB event, opens the door to 1.16.

Bank of America thinks disinflationary forces are alive in the Eurozone and this will give the ECB scope to cut again in the future. The economy is also noted to have a “negative output gap, below-trend growth, and an inflation undershoot that is about to start and will likely become persistent.”

“That means rates would need to go lower eventually. But they won’t cut next week, just because they don’t want to,” says Bank of America.

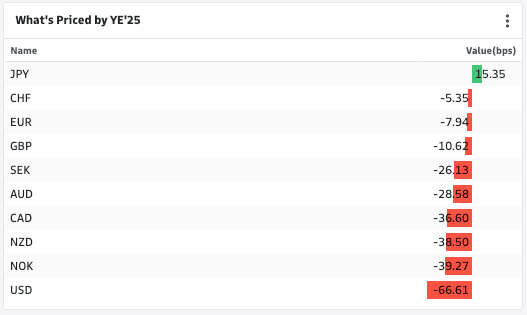

Analysts think the ECB can cut twice more, once in December and again in March. For context, the market sees no further cuts this year, meaning there is a route to the build up in rate cut bets which would crimp the euro’s advance.

“The three main reasons the ECB is not cutting today are a resilient economy, inflation on target, and well-anchored expectations. All three will be called into question from here,” says Bank of America.

Image shows the market expects no further cuts from ECB this year. Source: Goldman Sachs.

This, and how the Bank of England proceeds, will have a bearing on the pound to euro rate: should the ECB cut again and the Bank of England leave rates unchanged, the monetary policy outlook suddenly becomes more supportive of the pound.

In fact, economists at HSBC think the Bank of England could leave interest rates unchanged until March, a particularly bullish development for Pound Sterling.

Of course, there is the small matter of the UK budget in November to consider, which will keep concerns about the UK’s fiscal outlook on investors’ minds.

But when it comes to interest rates alone, the pound could have the support of Bank of England policy in its corner just as the ECB entertains a couple more cuts.

“BoE minutes demonstrated that inflation is still present, and cutting rates will not be a simple decision for the BoE. The magnitude of rate cuts may disappoint markets and result in more support for the GBP relative to the EUR in the near term,” says a research note from Standard Chartered.