Four O’Connor brothers were jailed in Stockholm in 2021 following a massive police investigation

Four O’Connor brothers from Carrick-on-Suir, Co Tipperary, were jailed in Stockholm in 2021 following a massive police investigation into a €4 million tax dodge.

Other family members, who were not part of the criminal case, were targeted by CAB which had been called in to assist Swedish police in 2020.

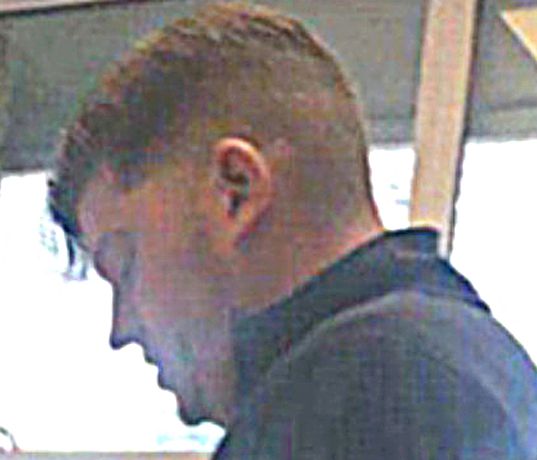

James O’Connor

John Jr, along with his brothers Edward, Mark and James Darren O’Connor, were sentenced to three years and eight months in prison.

Last month, the High Court heard how agreements had been reached with several members of the family in a Proceeds of Crime case.

John O’Connor Jnr

News in 90 Seconds – Monday, November 10th

Register

In one agreement Margaret (Tina) O’Connor confirmed she is the registered owner and Mark O’Connor agreed he is the beneficial owner of a house in Kilkenny.

The property, No1 Belline Vale at Piltown, Co Kilkenny, sold for €82,500 in 2016, according to the Property Price Register.

Mark O’Connor also agreed to pay more than €125,000 to CAB.

Edward O’Connor agreed to surrender 92 Main Street, Carrick-on-Suir to the Bureau along with €10,611 in an AIB account.

Under the agreement, he is to get back 20 per cent from the sale of the property which, according to an online property website, sold for €85,000 in 2020.

Edward O’Connor

In his agreement with the Bureau, Thomas O’Connor is to hand over 6 New Street, Carrick-on-Suir and will get 25 per cent of the proceeds back after it is sold.

James Griffin, another named respondent in the CAB case, is to keep €4,500 from frozen bank accounts with €24,500 going to CAB.

Brothers John O’Connor jnr and Jonathan have also sealed agreements with CAB, it was heard at a previous court hearing.

Their father, John O’Connor snr, is another respondent in the Bureau’s case and no agreement had been finalised, it was heard.

A fourth property, 55 O’Connell Street in Waterford, is listed among the properties and bank accounts being targeted by CAB.

When the case was first mentioned in court last March, it was heard that there are eight respondents – John snr, Margaret, Thomas, John jnr, Edward, Mark, Jonathan O’Connor and James Griffin.

John jnr and Jonathan O’Connor were the only two to appear in court and were deemed as being served notice of the proceedings at that stage.

John Jnr (left) and Jonathan O’Connor at court

Counsel for CAB said the others were in Canada and the US at the time, had been contacted, and agreed to served notice of the proceedings by email.

John O’Connor jnr, who was described as “the boss” in the Swedish criminal case, served more than three years in prison after being found guilty of dodging tax.

The brothers had run a paving and landscaping business and used false invoices and private bank accounts to funnel cash to Ireland instead of paying taxes.

CAB had been part of the international investigation into the O’Connor brothers following their arrest in October 2020.

Arrests

Europol revealed that €100,000 in cash was seized during searches, while CAB said 16 bank accounts and funds of €540,000 were frozen.

A series of raids and arrests were made in Sweden in October 2020 after authorities initiated an investigation into the transfer of large sums of money from Edward O’Connor’s bank account.

Darren O’Connor in high vis vest

The four brothers who were convicted have since served their sentences in Sweden and all except for John jnr, who had lived there for more than 10 years, are banned from the country.

In the criminal court judgement against them, the brothers were found to have deliberately transferred cash to avoid paying any tax in “an organised and systematic manner”.

Much of the cash paid by customers to the brothers ended up being transferred straight back to Ireland.

The written verdict at Stockholm District Court revealed how a large number of different bank accounts were used with dozens of transfers made between them.

Transfers

The brothers had opened new accounts when some bank officials began to ask questions about the large deposits and transfers.

Vehicle registered to Mark O’Connor

The court heard that when they were arrested there was almost no money left in any of their bank accounts, which had been transferred out of Sweden.

Prosecution documents in the case revealed how the police investigation included downloads of information taken from seized iPhones and a Macbook.

Payments

Hundreds of receipts, emails, texts and bank transactions were traced and used to show how the brothers operated.

Investigators also used photographs of the group at work and linked payments from customers to cash transfers to bank accounts controlled by the O’Connors.